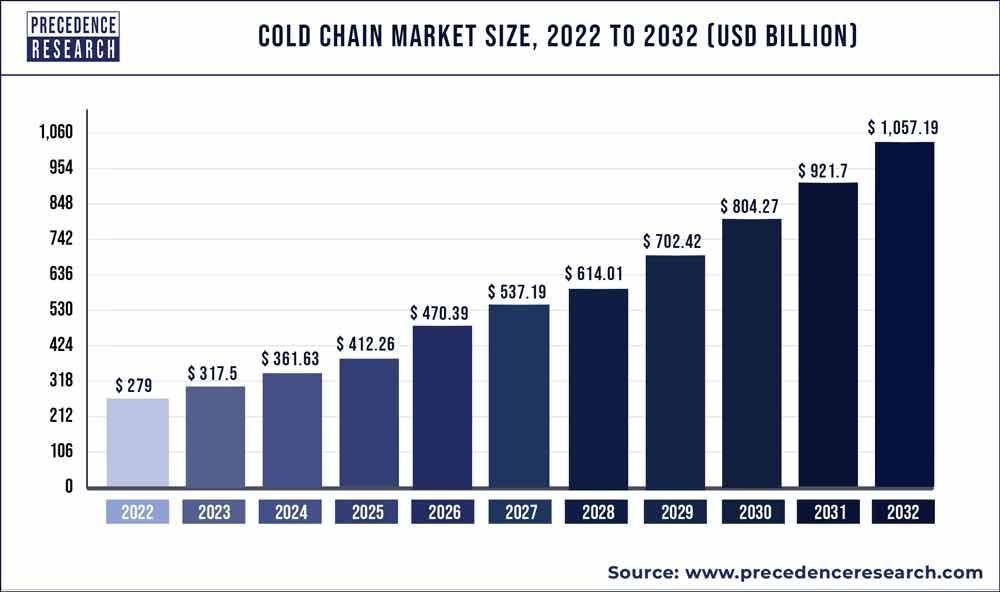

The global cold chain market size was valued at USD 317.5 billion in 2023 and is expected to reach over USD 1,057.19 billion by 2032, growing at a CAGR of 14.3% from 2023 to 2032.

Key Takeaway:

- By type, the storage segment has accounted highest revenue share of around 60% in 2022.

- By packaging, the product packaging segment has captured a revenue share of around 74% in 2022.

- By equipment, the storage equipment segment has contributed a revenue share of around 76% in 2022.

- By application, the fish, meat, and seafood segment accounted highest revenue share of around 24% in 2022.

- The North America market has garnered a revenue share of around 36% in 2022.

The cold chain market plays a crucial role in the transportation and storage of temperature-sensitive products, ensuring their quality and safety from production to consumption. It encompasses various industries such as food and beverage, pharmaceuticals, chemicals, and healthcare. The demand for cold chain solutions has been steadily increasing due to the globalization of food trade, growing pharmaceutical industry, and the need to maintain product integrity throughout the supply chain. This overview delves into the key factors driving the growth of the cold chain market, as well as the challenges and opportunities it presents across different regions.

Get a Sample: https://www.precedenceresearch.com/sample/1331

Growth Factors

Several factors contribute to the growth of the cold chain market. One significant factor is the increasing demand for perishable goods, including fresh produce, dairy products, and frozen foods, driven by changing consumer preferences and dietary habits. Moreover, the expansion of the pharmaceutical and healthcare sectors, coupled with stringent regulations regarding the transportation and storage of temperature-sensitive drugs and vaccines, has fueled the demand for advanced cold chain solutions. Additionally, technological advancements such as temperature monitoring systems, refrigeration equipment, and cold storage facilities have improved the efficiency and reliability of cold chain logistics, further driving market growth.

Scope of the Cold Chain Market Report

| Report Highlights | Details |

| Market Size In 2023 | USD 317.5 Billion |

| Market Size by 2032 | USD 1,057.19 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.3% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Type, Sector, Temperature Type, Packaging, Application, Region |

Cold Chain Market Dyanamic

Drivers

The primary drivers propelling the cold chain market forward include the rise in international trade of perishable goods, particularly fruits, vegetables, and seafood. Globalization has led to an increase in cross-border transportation of temperature-sensitive products, necessitating robust cold chain infrastructure to maintain product quality and safety. Furthermore, the growing awareness among consumers regarding food safety and hygiene has prompted manufacturers and retailers to invest in cold chain logistics to meet stringent regulatory requirements and ensure product integrity. Additionally, the expansion of the e-commerce sector has created new opportunities for cold chain providers, as online grocery shopping and meal kit delivery services require efficient refrigerated transportation and storage solutions.

Opportunities:

The cold chain market presents several opportunities for growth and innovation. With the increasing adoption of automation and digitization in supply chain management, there is a growing demand for advanced cold chain technologies, including IoT-enabled monitoring systems, blockchain-based traceability solutions, and predictive analytics for real-time temperature control. Moreover, the rising demand for organic and premium perishable products, coupled with the growing middle-class population in emerging economies, offers new avenues for cold chain expansion. Additionally, the development of integrated cold chain networks and multi-modal transportation solutions presents opportunities for cost optimization and improved efficiency in temperature-controlled logistics.

Challenges

Despite the promising growth prospects, the cold chain market also faces several challenges. One major challenge is the high initial investment required for establishing and maintaining cold storage facilities, refrigerated vehicles, and temperature monitoring systems. This poses a barrier to entry for small and medium-sized enterprises (SMEs) and can limit market growth, especially in developing regions with limited infrastructure and resources. Additionally, the lack of standardization and regulatory harmonization across different countries and regions poses challenges for cold chain operators, as they must navigate complex compliance requirements and ensure product safety and quality throughout the supply chain. Furthermore, the perishable nature of cold chain products makes them vulnerable to disruptions such as equipment failures, power outages, and natural disasters, highlighting the need for robust contingency planning and risk management strategies.

Read also: Shared Mobility Market Size to Hit USD 744.96 Bn by 2032

Region Insights

The growth of the cold chain market varies significantly across different regions, influenced by factors such as economic development, infrastructure investment, and regulatory environment. In North America, the United States dominates the cold chain market due to its advanced logistics infrastructure, stringent regulatory standards, and high consumer demand for perishable goods. The European cold chain market is characterized by a strong emphasis on food safety and sustainability, driving investments in cold chain technologies and renewable energy solutions. In Asia-Pacific, rapid urbanization, changing dietary patterns, and increasing healthcare spending are driving the demand for cold chain services, particularly in countries like China and India. Latin America and the Middle East & Africa regions are witnessing steady growth in the cold chain market, fueled by expanding food trade, pharmaceutical industry growth, and infrastructure development initiatives.

Key Companies Profiled

- Agro Merchant Group

- Nordic Logistics and Warehousing LLC

- Preferred Freezer Services LLC

- Cold Chain Technologies Inc.

- Cryopack Industries Inc.

- Creopack

- Cold Box Express Inc.

Segments Covered in the Report

By Type

- Storage

- Warehouses

- On-grid

- Off-grid

- Reefer Containers

- Warehouses

- Monitoring Components

- Hardware

- Software

- Transportation

- Road

- Sea

- Rail

- Air

By Sector

- Private

- Cooperative

- Public

By Temperature Type

- Frozen

- Chilled

By Packaging

- Product

- Crates

- Dairy

- Pharmaceuticals

- Fishery

- Horticulture

- Insulated Containers & Boxes

- Payload Size

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

- Type

- Cold Chain Bags/Vaccine Bags

- Corrugated Boxes

- Others

- Payload Size

- Cold Packs

- Labels

- Temperature-controlled Pallet Shippers

- Crates

- Materials

- Insulating Materials

- EPS

- PUR

- VIP

- Cryogenic Tanks

- Others (Insulating Pouches, Hard Cased Thermal Boxes, and Active Thermal Systems)

- Refrigerants

- Fluorocarbons

- Inorganics

- Ammonia

- CO2

- Hydrocarbons

- Fluorocarbons

- Insulating Materials

By Application

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Fish, Meat, and Seafood

- Processed Food

- Pharmaceuticals

- Vaccines

- Blood Banking

- Bakery & Confectionary

- Others (Ready-to-Cook, Poultry)

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/