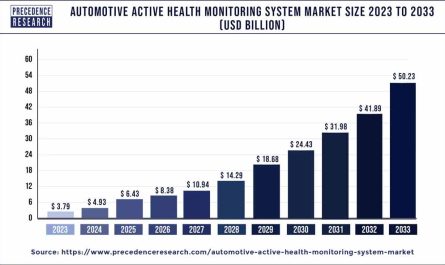

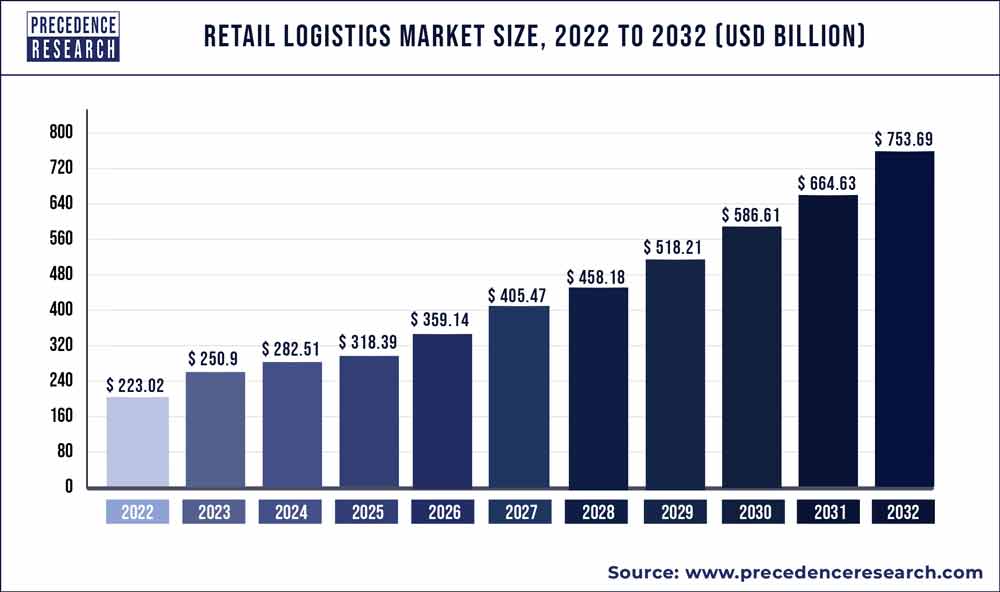

The retail logistics market size is poised to grow by $ 753.69 billion by 2032 from $ 223.02 Billion in 2022, exhibiting a CAGR of 13% during the forecast period 2023 to 2032.

Retail logistics involves a vital process that manages the movement of goods from their source of supply to the customers. The main objective of this system is to ensure a seamless delivery of products to customers by efficiently handling logistics. Additionally, it strives to guarantee that the right products are delivered to the right customers at the right time and place.

Get a Sample: https://www.precedenceresearch.com/sample/1263

Over the past few years, the retail industry has become a primary focus of digital innovation. Traditional retail methods and historical data have been largely replaced by new approaches in the evolving retail landscape. Since the early 2000s, the retail sector has experienced significant growth, expanding into markets worth hundreds of billions by 2020. This industry proves particularly susceptible to the integration of novel technologies such as data analytics, cognitive analytics, Internet of Things (IoT), among others.

Growth Factors in the Retail Logistics Market

The retail logistics market is expected to experience significant growth, driven by various factors in the coming years. One of the key drivers is the surge in global trade activities, particularly in developing nations. The continuous development and improvement of logistics infrastructure also play a vital role in fostering this growth.

According to a report by the World Trade Organization (WTO) in 2019, the service sector’s share in global trade is projected to rise by 50% by the year 2040. Moreover, if developing countries embrace digital technologies swiftly, their global share in retail services is expected to increase by 15% by 2040.

Another contributing factor to the growth of the retail logistics market is the increasing competitiveness of international retailers due to the rise of globalization. This has led to intensified competition among international retailers, resulting in a significant expansion of their retail stores, particularly in developing countries. Consequently, this expansion has positively impacted global trade activities, necessitating efficient transportation of raw materials and finished goods across various regions.

Report Highlights:

In the year 2020, the Asia Pacific region emerged as the dominant force in the global retail logistics market, experiencing significant growth throughout the forecast period. This growth was primarily fueled by the booming market for e-commerce and online shopping in the region.

North America also witnessed substantial growth during the projected years, largely due to the presence of numerous internationally operating players in the retail logistics industry.

Among the various types of retail logistics, the conventional segment took the lead in the global market in 2020, holding a significant revenue share of approximately 59%. This trend is expected to continue over the analysis period.

The e-commerce retail logistics segment displayed the most rapid growth in the coming years, driven by the increasing internet penetration that boosts online sales.

In 2020, the supply chain solution segment held the largest market share, thanks to the optimization of omnichannel operations and the timely delivery of goods.

The reverse logistics & liquidation segment is anticipated to experience considerable growth in the upcoming years, owing to the surge in e-commerce businesses.

Among transportation mediums, roadways transportation accounted for the majority of revenue share, surpassing 52% in 2020. This can be attributed to the rising demand for road vehicles for long-distance transportation.

Regional Overview:

In the global retail logistics market, the Asia Pacific stands as the leading region, securing a significant revenue share of approximately 26% in 2020. This dominance is expected to persist in the upcoming period due to the rapid growth of e-commerce and online shopping within the region. The surge in e-commerce business is the primary driving force behind the thriving market for retail logistics in this part of the world.

Notably, the Asia Pacific’s e-commerce market reached an impressive value of US$ 1.4 trillion in 2020 and is projected to continue its substantial expansion in the years ahead, largely fueled by the increasing number of digital buyers. China leads the pack with a substantial share of approximately 63% of the region’s total digital buyers, followed by India and Japan, which hold shares of 10.4% and 9.4%, respectively.

Meanwhile, North America and Europe also hold significant positions in the global retail logistics market. In 2019, these regions captured considerable market revenue shares, thanks to the presence of top globally renowned logistics players operating within their borders.

Key Players & Strategies

Key industry participants in the global retail logistics market are prominently engaged in service portfolio expansion, merger & acquisition, partnership, and various other inorganic growth strategies in order to expand their consumer base. For instance, in April 2020, FedEx entered into a partnership agreement with BigCommerce Pty. Ltd. that is open Software as a Service (SaaS) e-commerce platform. Under the partnership agreement the two companies agreed to help small and medium enterprises to sell their product online and stay connected to their delivers.

Segments Covered in the Report

By Type

- E-Commerce Retail Logistics

- Conventional Retail Logistics

By Solution Type

- Supply Chain Solutions

- Commerce Enablement

- Transportation Management

- Reverse logistics & liquidation

- Others

By Mode of Transport Type

- Airways

- Railways

- Waterways

- Roadways

By Regional Type

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

Asia Pacific

- China

- India

- Japan

- South Korea

Rest of the World

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333