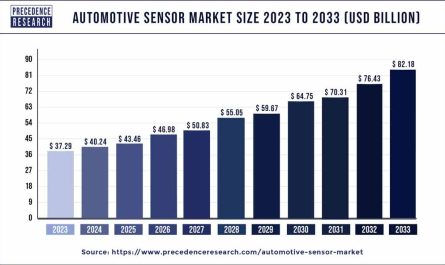

The global plug-in hybrid electric vehicles (PHEV) market size was valued at USD 132.74 billion in 2023 and is expected to hit around USD 295.5 billion by 2032 with a remarkable CAGR of 9.3% from 2023 to 2032.

Key Points

- By power source, the stored electricity segment accounted highest revenue share of over 71% in 2022.

- By vehicle type, the passenger vehicle segment held 84% of the total revenue share in 2022.

- The India plug-in hybrid electric vehicles market is registering growth at a CAGR of 7.4% from 2023 to 2032.

- The U.S. has hold 74 to 76% of the North America market share in 2022.

The plug-in hybrid electric vehicles (PHEV) market has emerged as a significant segment within the broader electric vehicle industry, offering consumers a balance between electric propulsion and the convenience of internal combustion engines. PHEVs combine an electric motor and a conventional engine, along with a battery pack that can be charged through external power sources. This hybrid architecture allows PHEVs to operate in electric-only mode for shorter distances while offering extended range through the internal combustion engine, addressing concerns related to range anxiety and charging infrastructure. The market for PHEVs has witnessed steady growth in recent years, driven by increasing environmental awareness, government incentives, technological advancements, and evolving consumer preferences for more sustainable transportation options.

Get a Sample: https://www.precedenceresearch.com/sample/2240

Growth Factors:

Several key factors contribute to the growth of the plug-in hybrid electric vehicles market. Firstly, the transition towards electrified transportation driven by environmental concerns and efforts to reduce greenhouse gas emissions has led to increased demand for PHEVs as a bridge between traditional internal combustion engine vehicles and fully electric vehicles. PHEVs offer consumers the flexibility to drive in electric mode for short commutes or urban driving while providing the convenience of longer range and refueling options offered by internal combustion engines. Additionally, government incentives, such as tax credits, subsidies, and access to preferential lanes, have incentivized consumers to purchase PHEVs, making them more attractive compared to conventional vehicles. Technological advancements in battery technology, electric drivetrains, and vehicle integration have also improved the performance, efficiency, and affordability of PHEVs, further driving market growth.

Region Insights:

The market for plug-in hybrid electric vehicles exhibits regional variations in terms of adoption rates, regulatory frameworks, infrastructure development, and consumer preferences. In regions such as Europe and China, stringent emissions regulations, urban congestion, and government incentives have accelerated the adoption of PHEVs. European countries, in particular, have implemented policies to promote low-emission vehicles, including PHEVs, through subsidies, tax incentives, and emission standards. China, as a major market for electric vehicles, has also witnessed significant growth in PHEV adoption, supported by government initiatives to reduce air pollution and promote electric mobility. North America, while lagging behind Europe and China in PHEV adoption, is witnessing steady growth driven by similar factors, including government incentives, technological advancements, and increasing consumer interest in sustainable transportation solutions.

Trends:

Several trends are shaping the plug-in hybrid electric vehicles market. One prominent trend is the expansion of PHEV offerings across various vehicle segments, including sedans, SUVs, and crossover vehicles, catering to diverse consumer preferences and driving needs. Automakers are increasingly integrating advanced features and technologies into PHEVs, such as regenerative braking systems, predictive energy management, and connected services, to enhance performance, efficiency, and overall driving experience. Moreover, collaborations and partnerships between automakers, battery manufacturers, and technology companies are driving innovation in PHEV technology, leading to improvements in battery efficiency, range, and charging capabilities. Another notable trend is the integration of renewable energy sources, such as solar panels, into PHEVs to extend electric range and reduce reliance on grid electricity, offering consumers greater sustainability and energy independence.

Plug-in Hybrid Electric Vehicles Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 132.74 Billion |

| Market Size by 2032 | USD 295.5 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.3% |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Power Source, Powertrain, Vehicle Type and Geography |

Drivers:

Several factors drive the adoption of plug-in hybrid electric vehicles worldwide. Firstly, the dual propulsion system of PHEVs, combining electric and internal combustion engines, offers consumers the flexibility to switch between power sources based on driving conditions, range requirements, and charging availability. This flexibility addresses concerns related to range anxiety and charging infrastructure limitations, making PHEVs a practical choice for consumers transitioning from traditional vehicles to electrified transportation. Government incentives and regulatory policies, including tax credits, rebates, and emissions standards, play a crucial role in incentivizing consumers to purchase PHEVs by reducing upfront costs and operating expenses. Additionally, technological advancements in battery technology, electric drivetrains, and vehicle integration have improved the performance, efficiency, and affordability of PHEVs, making them more competitive with traditional vehicles and fully electric alternatives.

Opportunities:

The plug-in hybrid electric vehicles market presents several opportunities for stakeholders across the value chain. Automakers have the opportunity to expand their PHEV offerings and develop innovative features and technologies to differentiate their products in a competitive market. Battery manufacturers can leverage advancements in battery technology to improve the energy density, longevity, and cost-effectiveness of PHEV batteries, enhancing the performance and affordability of PHEVs. Charging infrastructure providers have the opportunity to expand and diversify their charging networks to support the growing fleet of PHEVs, including home charging solutions, workplace charging stations, and public charging infrastructure. Moreover, governments and regulatory bodies can seize the opportunity to implement supportive policies and incentives to accelerate the adoption of PHEVs, including subsidies, tax incentives, and investment in charging infrastructure, to promote sustainable transportation and reduce greenhouse gas emissions.

Challenges:

Despite the growth potential, several challenges exist in the plug-in hybrid electric vehicles market. One of the primary challenges is consumer awareness and education regarding the benefits and capabilities of PHEVs compared to traditional vehicles and fully electric alternatives. Many consumers may still perceive PHEVs as a transitional technology or may be unaware of the potential cost savings and environmental benefits associated with PHEV ownership. Moreover, the upfront cost of PHEVs, although declining, remains a barrier for some consumers, especially in emerging markets where affordability is a significant consideration. Additionally, concerns about battery life, durability, and maintenance costs could impact consumer confidence in PHEVs, highlighting the need for continued advancements in battery technology and reliability. Addressing these challenges will require collaboration among automakers, governments, infrastructure providers, and other stakeholders to raise awareness, improve affordability, and enhance the overall value proposition of plug-in hybrid electric vehicles.

Read Also: Advanced Lead Acid Battery Market Size, Growth, Report By 2032

Recent Developments

- In June 2022, Honda Motor (China) Investment Co., Ltd., a completely-owned Honda subsidiary in China, announced that GAC Honda Automobile Co., Ltd. (GAC Honda), a Honda automobile production and sales joint venture in China, began construction of its new EV plant.

- In March 2022, Honda Motor (China) Investment Co., Ltd., a completely-owned Honda subsidiary in China, announced that GAC Honda Automobile Co., Ltd. (GAC Honda), a Honda automobile production and sales joint venture in China, began construction of its new EV plant.

- In May 2022, Nissan announced its partnership with British adventurer, Chris Ramsey, to undertake the world’s-first all-electric driving adventure from the magnetic North Pole to the South Pole.

- In 2021, FedEx Corp. announced that it has received its first 150 electric delivery vehicles from BrightDrop, the technology startup from General Motors decarbonizing last-mile delivery. This marks a critical milestone for FedEx as the company plans to transform its entire parcel pickup and delivery (PUD) fleet to all-electric, zero tailpipe emissions by 2040 and comes just months after BrightDrop’s commercialization of the Zevo 600 as the fastest vehicle to market in GM’s history.

- In May 2020, the e-NV200 is cementing its reputation as the ideal vehicle for urban deliveries where operators and residents appreciate its near-silent and zero-emission operation.

- In March 2020, Nissan concluded 31 agreements with local governments and companies on EV use during and after natural disasters. The agreements make electric cars available for local communities and citizens to use as power sources at evacuation centers and welfare facilities in the event of outages caused by natural disasters. This includes vehicles owned by local governments as well as ones used for car-sharing services and test drives at Nissan dealerships.

- In March 2019, Tesla announced its fully electric Model Y, which holds the capability of carrying seven passengers along with their cargo.

- In May 2019, Volkswagen launched pre-booking in Europe for the first model of its new full-electric ID.3. The first special edition was kept highly limited to just 30,000 vehicles.

Plug-in Hybrid Electric Vehicles (PHEV) Market Companies

- Nissan Motor Co., Ltd

- Mercedes-Benz Group AG

- General Motors

- Volkswagen AG

- Renault Group

- Ford Motor Company

- BMW Group

- Honda Motor Co., Ltd

- MITSUBISHI HEAVY INDUSTRIES, LTD

- TOYOTA MOTOR CORPORATION

Segments Covered in The Report

By Power Source

- Stored Electricity

- On-board Electric Generator

By Powertrain

- Series Hybrid

- Parallel Hybrid

- Combined Hybrid

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/