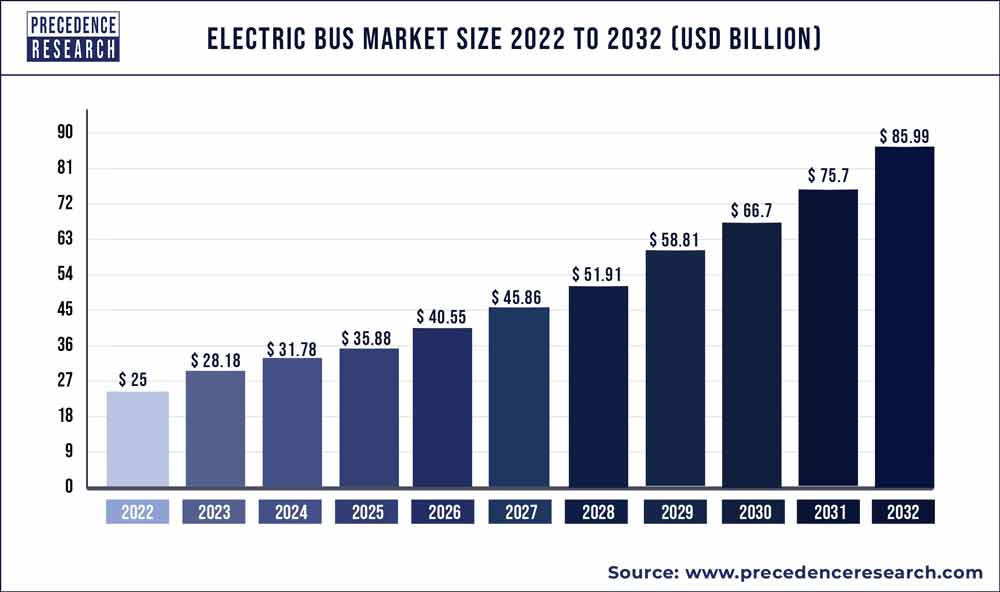

The global electric bus market size reached USD 28.18 billion in 2023 and is projected to hit around USD 85.99 billion by 2032, growing at a CAGR of 13.20% from 2023 to 2032.

Key Points

- By vehicle, the BEV segment has captured revenue share of 60.8% in 2022.

- The FCEV segment is expected to register a lucrative CAGR of 15.1% in terms of volume over the forecast period.

- By application, the intracity segment has held revenue share of 86% in 2022.

- The intercity segment is expanding at a CAGR of 15.6% between 2023 to 2032.

- By end-use, the public segment has held revenue share of around 81% in 2022.

- The private segment is growing at a CAGR of 11.8% from 2023 to 2032.

- By battery, the lithium iron phosphate battery segment has accounted revenue share of 90.5% in 2022.

- The lithium nickel manganese cobalt oxide segment is pooised to grow at a CAGR of 14.7% over the forecast period.

- Asia Pacific market has accounted Highest revenue share of 85.7% in 2022.

The electric bus market is experiencing significant growth as the world shifts towards sustainable transportation solutions. Electric buses, powered by batteries or other renewable energy sources, are gaining popularity due to their environmental benefits and cost savings over time. This market encompasses the production, distribution, and utilization of electric buses across various regions globally.

Get a Sample: https://www.precedenceresearch.com/sample/1622

Growth Factors:

Several factors are driving the growth of the electric bus market. Increasing concerns about air pollution and greenhouse gas emissions have led governments and organizations to prioritize the adoption of clean transportation alternatives. Additionally, advancements in battery technology have improved the performance and range of electric buses, making them more viable for widespread deployment. Moreover, rising fuel prices and government incentives for electric vehicle adoption further stimulate market growth.

Region Insights:

The electric bus market exhibits regional variations influenced by factors such as government policies, infrastructure development, and market demand. Regions like Europe and China have emerged as leaders in electric bus adoption, driven by ambitious environmental goals and substantial investments in public transportation infrastructure. Other regions, including North America and Asia-Pacific, are also experiencing rapid growth as governments implement initiatives to reduce emissions and promote sustainable mobility solutions.

Report Scope of the Electric Bus Market

| Report Coverage | Details |

| Market Size by 2032 | USD 85.99 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.20% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Propulsion, Consumer Segment, Application, Length of Bus Type, Vehicle Range, Battery Capacity, Power Output, Battery Type, Component, Seating Capacity, Level of Autonomy, Geography |

Drivers:

Several key drivers propel the growth of the electric bus market. Government regulations aimed at reducing emissions from public transportation fleets incentivize the adoption of electric buses. Moreover, cost savings associated with lower fuel and maintenance expenses make electric buses an attractive option for transit agencies and fleet operators. Furthermore, advancements in charging infrastructure and battery technology alleviate concerns about range anxiety, further accelerating market growth.

Opportunities:

The electric bus market presents various opportunities for stakeholders across the value chain. Manufacturers have the opportunity to innovate and develop new electric bus models with improved efficiency and performance. Additionally, infrastructure developers can capitalize on the growing demand for charging stations and related infrastructure. Moreover, governments and organizations can leverage public-private partnerships to invest in sustainable transportation projects and foster market growth.

Challenges:

Despite its rapid growth, the electric bus market faces several challenges. High upfront costs remain a barrier to adoption for some transit agencies and fleet operators, particularly in regions with limited financial resources. Additionally, concerns about the availability of charging infrastructure and grid capacity constraints may hinder widespread adoption. Furthermore, the lifespan and recyclability of batteries raise environmental and logistical challenges that require innovative solutions.

Read Also: Lithium-ion Battery Market Size to Reach USD 387.05 Bn by 2032

Competitive Landscape:

The electric bus market is characterized by intense competition among established manufacturers and emerging players. Leading manufacturers continually invest in research and development to enhance their product offerings and maintain a competitive edge. Additionally, partnerships and collaborations between manufacturers, technology companies, and government agencies drive innovation and market expansion. Furthermore, market consolidation and mergers and acquisitions contribute to the evolving competitive landscape of the electric bus market.

Key Developments

- Volvo buses began offering its usable energy commitment as a commercial solution in July 2021, ensuring electric bus accessibility and reliability. This means that Volvo buses guarantees the operation’s capacity for a set quantity of energy for the duration of the agreement.

- Alexander Dennis Ltd and BYD UK declared a deal with the National Transport Authority of Ireland for the supply of up to 200 zero emission battery electric buses that is manufactured by BYD UK in July 2021.

- Meritor and Daimler announced a partnership in December 2021 to supply powertrain for electric buses. The agreement is expected to start in January 2024.

- Arrival, a commercial electric vehicle firm, declared in July 2021 that it would build an electric bus for Anaheim utilizing its artificial intelligence enabled production facility in California.

- Olectra Greentech Ltd. stated in November 2021 that it would invest in a fully automated production facility in India with a capacity of 10,000 electric bus models per year.

Some of the prominent players in the global electric bus market include:

- Tata Motors

- Daimler AG

- Geely Automobiles Holdings Ltd.

- Man SE

- Scania

- AB Volvo

- Workhorse

- BYD Company Ltd.

- Dongfeng Motor Company

- Paccar Inc.

Segments Covered in the Report

By Propulsion

- Battery Electric bus

- Hybrid Electric bus

- Plug-in Hybrid Electric bus

- Fuel Cell Electric bus

By Consumer Segment

- Private

- Government

By Application

- Intercity

- Intracity

By Length of Bus Type

- less than 9 m

- 9−14 m

- Above 14 m

By Vehicle Range

- Less than 200 miles

- Above 200 miles

By Battery Capacity

- Upto 400 kWh

- Above 400 kWh

By Power Output

- Upto 250 kW

- Above 250 kW

By Battery Type

- Lithium- Nickel- Manganese- Cobalt-Oxide

- Lithium- Iron- Phosphate

- Others

By Component

- Motor

- Battery

- Fuel Cell Stack

- Battery Management System

- Battery Cooling System

- EV Connectors

By Seating Capacity

- Up to 40 seats

- 40-70 seats

- Above 70 seats

By Level of Autonomy

- Semi-autonomous

- Autonomous

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/