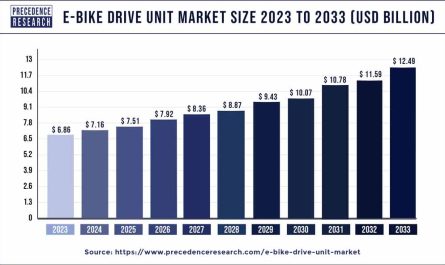

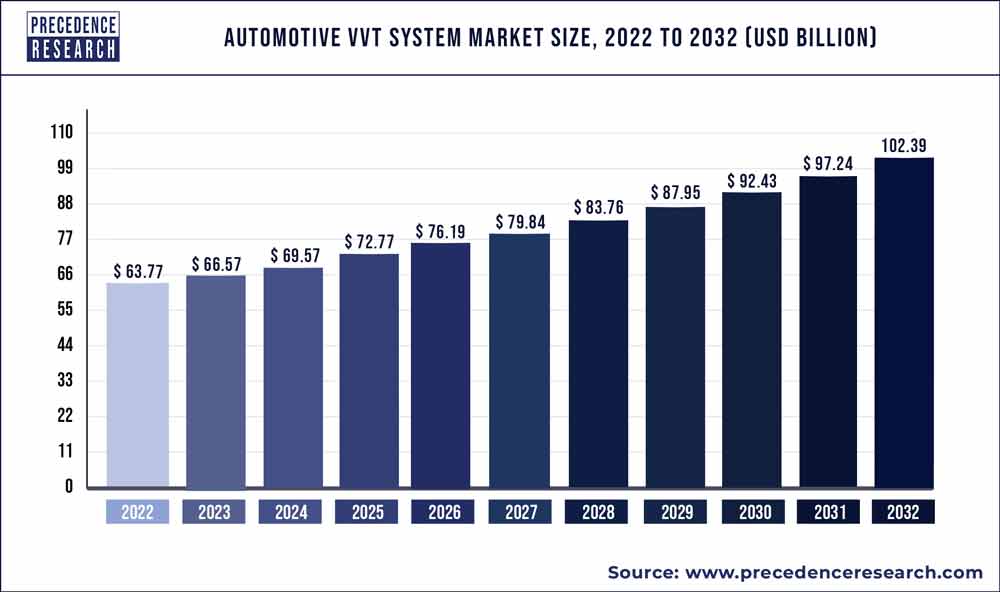

The global automotive VVT system market size reached USD 66.57 billion in 2023 and is projected to hit around USD 102.39 billion by 2032, with a CAGR of 4.9% from 2023 to 2032.

Key Points

- Asia Pacific led the market with the biggest market share in 2022.

- By Valve Train, the Double Overhead Cam(DOHC) segment has held the largest market share in 2022.

- By Vehicle Type, the Passenger vehicle segment generated over 65% of revenue share in 2022.

The Automotive Variable Valve Timing (VVT) System Market refers to the segment of the automotive industry that deals with the production and sale of VVT systems. These systems are critical for improving engine efficiency, performance, and emissions control by optimizing the timing of valve operations. By adjusting the timing of the intake and exhaust valves, VVT systems enhance fuel economy and power output while reducing harmful emissions. The market includes various types of VVT systems, such as hydraulic, electronic, and cam-phasing systems, and is driven by the increasing demand for fuel-efficient and environmentally friendly vehicles.

Get a Sample: https://www.precedenceresearch.com/sample/1052

Growth Factors

Several factors are contributing to the growth of the Automotive VVT System Market. Firstly, stringent government regulations on vehicle emissions are pushing manufacturers to adopt advanced technologies like VVT to meet these standards. Secondly, the rising consumer demand for fuel-efficient vehicles is driving the adoption of VVT systems. Additionally, advancements in automotive technology and the integration of VVT systems in hybrid and electric vehicles are further propelling market growth. The increasing production of automobiles, particularly in emerging markets, also contributes to the expanding market.

Region Insights

The Automotive VVT System Market is segmented regionally into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific holds the largest market share, driven by the high production and sales of automobiles in countries like China, Japan, and India. The presence of major automotive manufacturers and the growing adoption of advanced technologies in these regions support market growth. North America and Europe are also significant markets due to stringent emission regulations and the demand for high-performance vehicles. Meanwhile, the Rest of the World, including regions like Latin America and the Middle East, is witnessing gradual growth with increasing automotive investments and infrastructure development.

Automotive VVT System Market Scope

| Report Highlights | Details |

| Market Size by 2032 | USD 102.39 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.9% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Fuel Type, Methods, System, Number of Valves, Valve Train, Technology, Vehicle Type, Actuation Type, End-use, Regional Outlook |

Drivers

Key drivers of the Automotive VVT System Market include the need for improved fuel efficiency and reduced emissions, which are critical due to tightening environmental regulations worldwide. The continuous advancements in automotive technologies and the increasing production of hybrid and electric vehicles also drive market growth. Additionally, the consumer preference for enhanced vehicle performance and the growing automotive industry in emerging economies contribute significantly to the market expansion.

Opportunities

The Automotive VVT System Market presents several opportunities for growth. The increasing focus on developing advanced and cost-effective VVT systems can drive market expansion. Innovations in electric and hybrid vehicle technologies present opportunities for integrating VVT systems, enhancing their performance and efficiency. Moreover, the expansion of automotive manufacturing in emerging economies offers substantial market opportunities, as manufacturers look to capitalize on the growing demand for vehicles.

Challenges

Despite its growth prospects, the Automotive VVT System Market faces certain challenges. High development and manufacturing costs of VVT systems can be a barrier for market entry and expansion, particularly for smaller players. The complexity of VVT systems and the need for skilled labor for installation and maintenance also pose challenges. Additionally, fluctuations in raw material prices and the ongoing impact of global economic uncertainties, such as those caused by the COVID-19 pandemic, can hinder market growth.

Read Also: Smart Fleet Management Market Size to Reach US$ 814.37 bn by 2032

Some of the prominent players in the automotive VVT system market include

- Mikuni American Corporation

- Johnson Controls, Inc.

- Federal-Mogul LLC

- Camcraft, Inc.

- Aisin Seiki Co. Ltd.

- BorgWarner Inc.

- Eaton Corporation

- Mitsubishi Electric Corporation

- DENSO Corporation

- Robert Bosch GmbH

- Schaeffler AG

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

Segments Covered in the Report

By Fuel Type

- Diesel

- Gasoline

By Methods

- Cam Changing

- Cam Phasing

- Variable Valve

- Cam Phasing & Changing

By System

- Continuous

- Discrete

By Number of Valves

- More than 24

- Between 17 to 23

- 16

- Less Than 12

By Valve Train

- Over Head Valve(OHV)

- Double Overhead Cam(DOHC)

- Single Overhead Cam (SOHC)

By Technology

- Dual VVT-I

- VVT-I

- VVT-iW

- VVT-iE

By Vehicle Type

- Passenger Vehicles

- Electrical Vehicles

- Commercial Vehicles

By Actuation Type

- Type V

- Type IV

- Type III

- Type II

- Type I

By End-use

- Aftermarket

- OEMs

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/