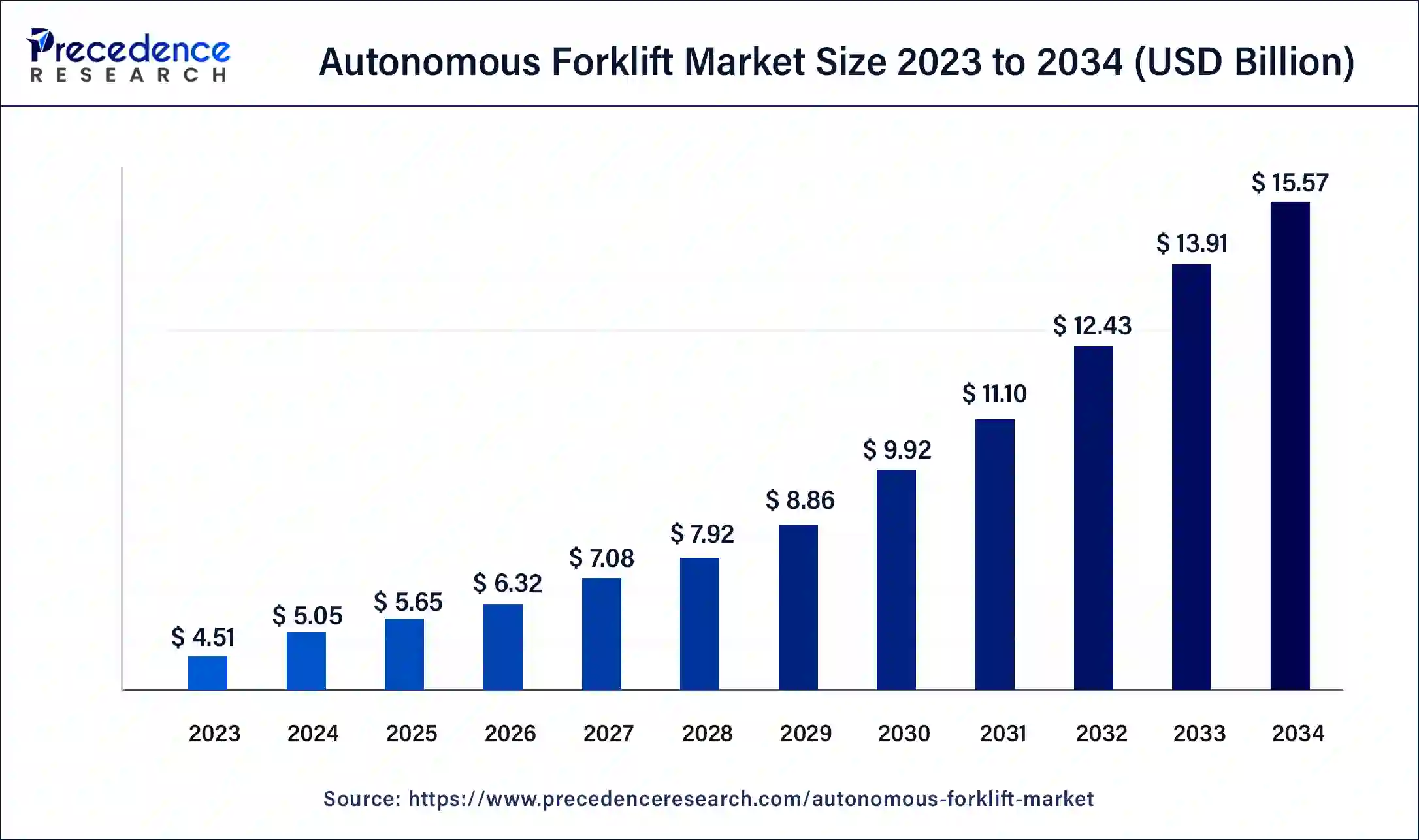

The global autonomous forklift market size surpassed USD 4.51 billion in 2023 and is projected to reach around USD 13.91 billion by 2033 with a remarkable CAGR of 11.92% from 2024 to 2033.

The Autonomous Forklift market has been rapidly evolving with advancements in artificial intelligence and automation technologies. Autonomous forklifts, also known as self-driving or driverless forklifts, represent a significant shift in warehouse and logistics operations, promising increased efficiency, reduced operational costs, and enhanced safety. These forklifts are equipped with sensors, cameras, and navigation systems that enable them to operate independently, navigating through warehouses, loading docks, and storage areas without human intervention. The market for autonomous forklifts is driven by the growing demand for automation in material handling processes across industries such as manufacturing, logistics, and retail.

Get a Sample: https://www.precedenceresearch.com/sample/4363

Autonomous Forklift Market Key Points

- Asia Pacific dominated the autonomous forklift market in 2023.

- North America is expected to show significant growth in the market over the forecast period.

- By tonnage, the above 10 tonnes segment dominated the market in 2023.

- By tonnage, the below 5-10 segment is expected to grow at the fastest rate in the market during the forecast period.

- By navigation technology, the laser segment dominated the market in 2023.

- By navigation technology, the vision segment is expected to grow at a notable rate in the market over the forecast period.

- By end use, the retail & wholesale segments dominated the market in 2023.

- By end use, the logistics segment is expected to grow rapidly in the market over the forecast period.

- By application, the indoor segment dominated the market in 2023.

Regional Insights

Asia Pacific dominated the autonomous forklift market in 2023. Asia Pacific emerges as a rapidly growing market for autonomous forklifts, fueled by extensive industrialization and the expansion of e-commerce logistics networks. Countries such as China, Japan, and South Korea are witnessing increased investments in smart manufacturing and logistics automation, boosting market demand. Additionally, rising labor costs in these countries drive the adoption of autonomous solutions to enhance operational efficiency and reduce dependency on manual labor. Latin America shows promising growth opportunities for autonomous forklifts, particularly in countries like Brazil and Mexico. The adoption is driven by the modernization of supply chain infrastructure and the need for efficiency improvements in manufacturing and retail sectors. Government initiatives promoting industrial automation and logistics efficiency further support market expansion in the region.

- The Asia Pacific autonomous forklift market size was estimated at USD 1.85 billion in 2023 and is predicted to be worth around USD 5.77 billion by 2033 with a CAGR of 12.04% from 2024 to 2033.

- The North America autonomous forklift market size was calculated at USD 1.31 billion in 2023 and is projected to expand around USD 4.10 billion by 2033, poised to grow at a CAGR of 12.08% from 2024 to 2033.

Autonomous Forklift Market Trends

Integration of AI and Machine Learning

One of the prominent trends in the autonomous forklift market is the integration of artificial intelligence (AI) and machine learning algorithms. These technologies enable forklifts to learn from their environment, optimize routes, and make real-time decisions based on changing warehouse conditions. AI-powered forklifts can predict maintenance needs, improve energy efficiency, and enhance overall operational performance.

Fleet Management Software

The adoption of fleet management software is rising among companies operating autonomous forklift fleets. These software solutions provide centralized control, monitoring, and optimization of multiple forklifts within a warehouse or across facilities. Features such as route planning, task scheduling, and performance analytics help in maximizing fleet efficiency and productivity.

Safety Enhancements

Safety remains a critical focus in the development of autonomous forklifts. Manufacturers are integrating advanced safety technologies such as collision avoidance systems, emergency braking, and obstacle detection sensors. These features mitigate risks associated with human-machine interactions and ensure compliance with stringent safety regulations in industrial environments.

Hybrid Power Systems

Hybrid power systems combining electric and alternative fuels are gaining traction in the autonomous forklift market. These systems offer operational flexibility, reduce carbon footprint, and enhance energy efficiency compared to traditional diesel-powered forklifts. Manufacturers are exploring innovations in battery technology and fuel cells to extend operating hours and minimize downtime.

Customization and Scalability

There is a growing trend towards customizable autonomous forklift solutions tailored to specific warehouse layouts and operational requirements. Manufacturers are offering modular designs and scalable platforms that can be easily integrated with existing automation systems. Customization options include payload capacity, lifting height, and specialized attachments for handling different types of goods.

Autonomous Forklift Market Scope

| Report Coverage | Details |

| Autonomous Forklift Market Size in 2023 | USD 4.51 Billion |

| Autonomous Forklift Market Size in 2024 | USD 5.05 Billion |

| Autonomous Forklift Market Size by 2033 | USD 13.91 Billion |

| Autonomous Forklift Market Growth Rate | CAGR of 11.92% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Tonnes, Navigation Technology, End-use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Autonomous Forklift Market Dynamics

Drivers

Demand for Operational Efficiency

The primary driver for adopting autonomous forklifts is the quest for operational efficiency. These forklifts enable continuous operation without breaks, minimize idle time, and optimize material handling processes. By automating repetitive tasks such as pallet movement and loading/unloading, businesses can achieve higher throughput and reduced cycle times in warehouse operations.

Labor Shortages and Rising Wages

Labor shortages and increasing wages in traditional manual handling roles are compelling companies to invest in automation solutions like autonomous forklifts. These technologies help mitigate the impact of workforce challenges by reducing reliance on labor-intensive tasks and improving overall productivity without compromising on safety or accuracy.

E-commerce Growth

The exponential growth of e-commerce has significantly boosted the demand for autonomous forklifts. Online retail giants and fulfillment centers require efficient, scalable logistics solutions to handle the influx of orders and meet customer expectations for fast delivery. Autonomous forklifts play a crucial role in streamlining order fulfillment processes and optimizing warehouse operations in e-commerce logistics.

Regulatory Support for Automation

Supportive regulatory frameworks and incentives promoting automation adoption in logistics and manufacturing sectors act as catalysts for market growth. Governments worldwide are encouraging investments in smart technologies to enhance industrial productivity, reduce environmental impact, and ensure workplace safety, thereby fostering the deployment of autonomous forklifts.

Opportunities

Emerging Markets

Emerging markets present significant growth opportunities for autonomous forklift manufacturers. Rapid industrialization, urbanization, and infrastructure development in regions like Asia Pacific, Latin America, and Africa create a conducive environment for expanding market presence and establishing strategic partnerships with local stakeholders.

Technological Advancements

Continuous advancements in sensor technology, connectivity solutions, and artificial intelligence offer opportunities for innovation in autonomous forklift design and functionality. Manufacturers can differentiate their products by integrating cutting-edge technologies that enhance performance, reliability, and operational flexibility in diverse warehouse environments.

Rental and Leasing Models

The adoption of rental and leasing models for autonomous forklifts is gaining traction among businesses seeking cost-effective solutions without upfront capital investments. Rental services enable companies to access state-of-the-art automation technologies, scale operations as per seasonal demand fluctuations, and benefit from maintenance and support services provided by equipment providers.

Challenges

Initial Investment Costs

High initial investment costs associated with purchasing and deploying autonomous forklifts pose a challenge for small and medium-sized enterprises (SMEs) and businesses operating on tight budgets. The cost includes not only the acquisition of autonomous vehicles but also infrastructure upgrades, training programs, and integration with existing warehouse management systems.

Technological Integration Complexity

Integrating autonomous forklifts with existing warehouse infrastructure and automation systems can be complex and time-consuming. Compatibility issues, data synchronization challenges, and the need for specialized IT expertise may hinder seamless deployment and operational efficiency, requiring thorough planning and collaboration between stakeholders.

Safety Concerns and Regulations

Ensuring safe operation of autonomous forklifts in dynamic warehouse environments remains a critical challenge. Safety standards, regulations, and guidelines for autonomous vehicles continue to evolve, requiring manufacturers to adhere to stringent compliance measures and invest in robust safety features to prevent accidents and ensure worker protection.

Skills Gap and Training

The deployment of autonomous forklifts necessitates upskilling and training warehouse personnel to interact effectively with automated systems and manage supervisory roles. Addressing the skills gap and providing comprehensive training programs are essential to maximize the benefits of automation, minimize downtime, and optimize overall operational performance.

Market Competition and Differentiation

Intensifying competition among autonomous forklift manufacturers and technology providers compels companies to innovate continuously and differentiate their offerings. Product differentiation strategies, customer-centric solutions, and strategic partnerships play a crucial role in gaining a competitive edge and capturing market share amidst evolving industry dynamics.

Read Also: Automotive Cabin Air Filter Market Size, Share, Report by 2033

Autonomous Forklift Market Recent Developments

- In February 2024, Seegrid Corporation announced the launch of an autonomous lift truck, the Palion Lift CR1 model, to address evolving challenges in autonomous material handling for warehousing, manufacturing, and logistics customers. The Palion Lift CR1 boasts an impressive 15’ lift height and a robust 4,000lb payload capacity. Further, the company stated that the new model is equipped with its own proprietary state-of-the-art navigation technology.

- In August 2023, Cyngn Inc., a developer of AI-powered autonomous driving solutions for industrial applications, announced a paid pre-order agreement with Arauco, a global company of sustainable forestry products, pulp, and engineered wood that is a supplier to the furniture and construction industries, to supply 100 autonomous electric DriveMod-enabled forklifts. The agreement aims to enhance Arauco’s operations and drive efficiency in its material handling processes.

- In September 2022, Toyota Material Handling Japan (“TMHJ”), a branch of Toyota Industries Corporation, developed an autonomous lift truck with world-first*1AI-based technology that automatically recognizes truck and load location and position and produces automated travel paths to complete loading operations.

Autonomous Forklift Market Companies

- Toyota Industries Corporation

- Kion Group AG

- Mitsubishi Logisnext Co Ltd

- Jungheinrich AG

- Hyster-Yale Materials Handling

- Hangcha Group Co, Ltd

- Agilox Services GMBH

- Komatsu Ltd.

- Doosan Corporation

- Anhui Yufeng Equipment Co., Ltd.

- Anhui Heli Co., Ltd.

- Crown Equipment Corporation

- MLE B.V.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/