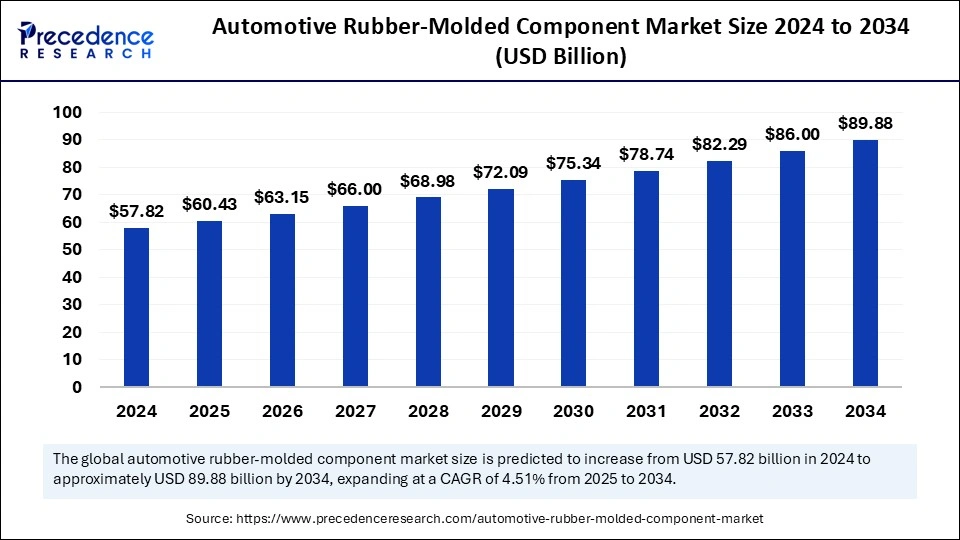

The global automotive rubber-molded component market size was valued at USD 57.82 billion in 2024 and is expected to attain around USD 89.88 billion by 2034, growing at a CAGR of 4.51% from 2025 to 2034.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/5738

Automotive Rubber-Molded Component Market Key Points

-

The Asia Pacific region commanded the highest share of the market in 2024.

-

North America is projected to show remarkable growth throughout the forecast period.

-

EPDM was the top material choice in 2024, leading in market share.

-

SBR is anticipated to gain traction and expand significantly in the near future.

-

Among components, seals dominated the market in 2024.

-

The gaskets segment is expected to witness accelerated growth in the coming years.

-

Passenger cars accounted for the largest share in 2024 by vehicle type.

-

The commercial vehicles category is projected to experience steady market expansion

AI’s Impact on the Future of the Automotive Rubber-Molded Component Market

-

AI helps in real-time monitoring of production lines, reducing downtime and maximizing output.

-

Predictive AI analytics assist in forecasting market trends, helping manufacturers make data-driven decisions.

-

AI-enhanced material science research accelerates the development of eco-friendly rubber compounds.

-

AI-powered autonomous systems ensure precise molding and reduce variations in product dimensions.

-

Smart AI-driven logistics improve supply chain efficiency, reducing delays and production bottlenecks.

Automotive Rubber-Molded Component Market Overview

The automotive rubber-molded component market is growing steadily, fueled by the increasing demand for high-performance sealing, insulation, and vibration-damping solutions in vehicles. As the automotive industry shifts towards electric and fuel-efficient vehicles, the need for lightweight and durable rubber components is also on the rise. Innovations in rubber formulation and processing technologies are further enhancing the performance of these components.

Also Read: Rail Glazing Market

Automotive Rubber-Molded Component Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 89.88 Billion |

| Market Size in 2025 | USD 60.43 Billion |

| Market Size in 2024 | USD 57.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.51% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Component Type, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The expansion of electric vehicle production is a significant driver of market growth. Government policies and regulations aimed at reducing vehicle emissions are also encouraging the use of advanced rubber materials. The growing demand for comfort and noise reduction in vehicles has led to increased adoption of high-quality rubber seals and gaskets. Additionally, advancements in automated production techniques have improved efficiency and reduced costs for manufacturers.

Opportunities

The rising focus on sustainability presents an opportunity for rubber manufacturers to develop eco-friendly alternatives. Research and development in bio-based rubber and recycled materials can offer long-term benefits for both manufacturers and consumers. Furthermore, the increasing demand for autonomous and connected vehicles is driving innovation in rubber-molded components designed for advanced automotive systems.

Challenges

One of the biggest challenges in the industry is ensuring compliance with strict environmental regulations regarding rubber production and disposal. Additionally, supply chain disruptions and raw material shortages can impact production timelines and costs. The market also faces competition from alternative materials, such as thermoplastics, which offer similar benefits but with lighter weight and greater recyclability.

Regional Insights

Asia Pacific leads the market due to its dominance in automotive manufacturing and increasing investment in electric vehicle production. North America is experiencing growth in demand for high-performance automotive components, driven by advancements in vehicle design and sustainability efforts. Europe remains a key player, with strict regulations pushing automakers to adopt high-quality, low-emission rubber components. Other regions, such as Latin America and Africa, are expected to see gradual growth as automotive infrastructure and manufacturing capabilities expand.

Recent Developments

- In December 2024, Pricol, an automotive components maker, announced its plan to acquire Sundaram Auto Components’ injection molding business for Rs 215 crore. The company stated that it is acquiring its wholly-owned subsidiary, Pricol Precision Products Pvt Ltd.

- In June 2024, Celanese announced the expansion of its portfolio of materials for automotive boots and bellows. New solutions include multiple sustainable materials and a new grade suitable for injection molding of these parts. New materials aimed at achieving performance requirements while reducing the carbon footprint.

Automotive Rubber-Molded Component Market Companies

- NOK Corporation

- Trelleborg AB

- AB SKF

- Continental AG

- Federal-Mogul Corporation

- ALP Group

- Bohra Rubber Pvt. Ltd

- Cooper-Standard Automotive

- DANA Holding Corporation

- Freudenberg and Co. Kg

- Hebei Shinda Seal Group

- Hutchinson SA

- Steele Rubber Products

- Sumitomo Riko Co. Ltd

- Jayem Auto Industries Pvt Ltd

- Bony Polymers Pvt Ltd

Segments Covered in the Report

By Material Type

- Ethylene Propylene Diene Monomer (EPDM)

- Natural Rubber (NR)

- Styrene-butadiene Rubber (SBR)

- Others

By Component Type

- Seals

- Gaskets

- Hoses

- Weather-strips

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)