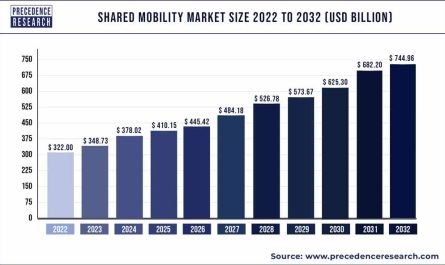

The global zero-emission aircraft market size reached USD 20.98 billion in 2022 and is projected to hit around USD 87.49 billion by 2032, growing at a CAGR of 15.40% between 2023 and 2032.

Key Takeaways

- By type, turbofan system segment is expected to hit remarkable growth between 20223 to 2032.

- By range type, the short haul segment has had largest market share in 2022.

- Europe region had highest share 47% in 2022.

- Asia-Pacific region will grow at a highest CAGR from 2023 to 203

Governments all over the world must exert significant pressure to transition from fuel properties to helium or rechargeable battery in aircraft. The airline infrastructures dependent on gas have been supported by laws and a blueprint developed by different authorities, which would be expected to decrease carbon dioxide emissions globally.

Get the Free Sample Copy of Report@ https://www.precedenceresearch.com/sample/2015

A Memorandum of Cooperation was approved on 22nd July 2010 by the U.S. Department of Energy and Defense department to direct aim of trying to direct efforts towards improving the country’s energy supplies and creating federal govt authority in transitioning to a reduced economic system. Producing and installing cutting-edge hydrogen fuel for auxiliary electricity in ground support systems at airlines as well as on DOD flights constituted one of Mourinho’s centerpieces.

Regional Snapshot

The Europe region hit highest market share 46% in 2021. Governments all around the world are preparing paths to limit pollution generated by jet fuel aviation to control rising levels of CO2 as well as other toxic pollutants by operating aviation. For example, nations including Germany, the United States, S. Korea, and France have created plans and strategies for the switch to aviation powered by electricity or gas.

Additionally, numerous businesses worldwide are developing airplanes powered by solar energy, helium, battery, or electric drivetrains. In just a few decades, seamless city transportation will be available thanks to systems like a jet (for example, CityHawk from Urban Aviation) or negligible airplanes powered by these sources of energy. The introduction of these airplanes could pave the way for new sustainable alternative opportunities while reducing our reliance on fossil fuels throughout time.

Report Scope of the Zero-Emission Aircraft Market

| Report Coverage | Details |

| Market Size in 2023 | USD 24.11 Billion |

| Market Size by 2032 | USD 87.49 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 15.58% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Source, Range, Application, Type, Geography |

Read More: Automotive Motors Market Size, Share, Trends, Opportunities Analysis Report By 2032

Report Highlights

- United States Agency for Environmental Protection discovered in 2015 that certain kinds of airplane motors’ greenhouse gas emissions put the government’s health and well-being at risk and pollute the atmosphere.

- An emissions reduction plan that applies to both commercial and passenger aircraft in UN participating nations was finalized by the ICAO in 2016. Such a significant ruling opened the door again for the advancement of electric aviation as producers looked to environmentally friendly strategies to reduce carbon footprint.

- Market participants have begun engaging in electronic aircraft technology, and their efforts already had paid off with the successful development of prototypes as well as the production of light planes.

- Restrictions are now being developed in response to the advent of new technology to increase its economic potential. A plane’s goals essential architecture objectives are reinstated by standards like CS-23.

- As either a result, many new paths for the advancement of completely electric and combination engines have finally opened. With completing design standards to boosting customer protection & technology in airplanes, the emphasis has moved. Due to the lack of design constraints, the engineers have been to focus on completely rebuilding the airplane and making the required adjustments.

Market Dynamics

Drivers

Since the only consequence of hydrogen burning and hydrogen storage is Pure water, hydro aviation has the biggest benefit of not producing any carbon pollution (water). Around 915 million tonnes of Carbon were released into the atmosphere as a result of aircraft worldwide, according to Air Travel Activist Group, accounting for 2% of any pollution due to human activity and 13% of pollutants from all methods of travel. Many nations, especially those inside the European Union (EU), including France, German, the United Kingdom, and others, are making attempts to reduce emissions and therefore are subtly encouraging the utilization of helium airplanes for travel. This is demonstrated by instances like the grants awarded by the UK government towards the H2GEAR initiative. The H2GEAR effort, led by large businesses like Gmbh Aviation, hopes to develop tiny hydrogen-powered airplanes for industrial use.

Restraints

The mass of the battery and also the length of time required to refill these are the main drawbacks of electric and hybrid. For example, at this moment, it takes forever for adapters to complete a battery charge. Even atomic planes have some limits. Though keeping gasoline as gas pressure has concerns with aviation mass and size, fluid hydrogen is now among the best practical options. To overcome the challenges of the negligible airplanes, though, all main airline companies and countless companies are realizing the power to create, create, and explore novel technology. By 2030–40, according to various companies, comprehensive airplanes will be launched commercially.

Opportunities

It is anticipated that advancements in hydrogen-based fuel cell technology will make it feasible to use them in the aircraft industry. The governmental and business industries are placing more and more emphasis on the advancement of liquid fuels. For instance, Events 38, The manufacturer of imaging drones, said in Mid – June that one of the company’s E400 UAVs adapted to function on proton cells had completed a flawless test launch. This is the beginning stage of implementing a new system, which is more environmentally friendly and cost-effective than gasoline or battery energy.

The advancement of fuel cells using hydrogen has gotten more and more attention. For example, Airbus, a significant aerospace firm, previously teamed alongside ElringKlinger, a business including over a decade of knowledge as a fuel cell technology and element provider. Airbus expects to deliver its operational hydrocarbons jet by 2035. This partnership’s goal is really to concentrate on advancements in hydrogen-based fuel cells

Challenges

Currently, hydrogen fuel devices’ size and weight are just too large, which reduces automobile endurance. Relatively long traditional airplanes require elements and materials which allow small, inexpensive gasoline storage solutions. Most hydrogen fuel strategies have a hurdle in terms of energy consumption. Inorganic hydrogen retention that regenerates the waste offboard presents a problem for cumulative energy management. Additionally, again for compacted and hydrogen techniques, all energy needed for both compressing and stabilization must be taken into account. Methods for storing helium are not durable enough. To create hydrogen energy storage with such a lifespan of 1,500 rotations, specific elements and materials were required.

The amount of time needed to refuel is excessive. Over the program’s lifespan, it is necessary to create gasoline storage technologies with refueling durations of under 3 minutes. Especially when compared to traditional storage devices for crude oil, the price of aboard proton storage technologies is excessively expensive. Hydrogen fuel devices require reduced materials and products, in addition to limited, elevated production methods. Even now in developed nations like the US, the necessary codes and guidelines for helium storage technologies associated with infrastructure needs are yet to be developed, despite expectations that they will speed up adoption and commercial and guarantee the security of the community.

Key Market Developments

- 18 March 2021, the initial in-flight pollution investigation of broad industrial passenger jetsbroad industrial passenger jets utilizing only sustainability jet fuel has been started by a group of aviation experts. Together, Siemens and German research center Rolls-Royce, DLR, and SAF manufacturer Neste have launched the ground-breaking “Emissionsth and Environmental Effect of Alternative Energy sources” (ECLIF3) research, which examines how 100percentage SAF impacts airplane pollutants & productivity.

- This one will allow the firm to develop chances in commercial and collaboration with facilities, aircraft producers, and aircraft, inside the Netherland & larger European Union. With this new invention, ZeroAvia can further the advancement of fuel cells with hydrogen rocket technology.

- Rolls-Royce will launch some all aircraft with a record-breaking goal performance of 300+ MPH On April 19, 2021.

- Opportunities for both existing companies as well as those looking to break into the sector have been addressed by Visiongain.

- Airbus Helicopters flew a comprehensive prototype of its electrified aircraft in July 2021. The cross design of CityAirbus includes four ducting elevated motor engines. To provide a minimal sound impact, its 8 shafts are propelled by electric engines rotating at about 950 rpm.

- Beta Technologies accomplished the 205-mile-long highest manned test launch of their Alia jet in Jul 2021. (330 kilometers). Merely 3 of Alia’s 5 rechargeable batteries were being used when the device was in airplane mode.

Key market players

- AeroDelft

- Airbus S.A.S.

- Blue Origin Federation, LLC

- Boeing Aerospace NYSE: BA

- Bye Aerospace

- Eviation Aircraft

- HES Energy Systems

- Joby Aviation

- Lilium

- Lockheed Martin Corporation NYSE: LMT

- Northrop Grumman Corporation NYSE: NOC

- Pipistrel d.o.o

- Reaction Engines

- Rolls-Royce Holdings PLC

- SpaceX Aerospace Company

- Thales SA

- Wright Electric

- ZeroAvia, Inc.

Segments are covered in the report

By Source

- Hydrogen

- Electric

- Solar

By Range

- Short-Haul

- Medium-Haul

- Long-Haul

By Application

- Passenger Aircraft

- Cargo Aircraft

By Type

- Turboprop Rear Bulkhead

- Turbofan System

- Blended Wing Body

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Table of Content:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Zero-Emission Aircraft Market

5.1. COVID-19 Landscape: Zero-Emission Aircraft Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Zero-Emission Aircraft Market, By Source

8.1. Zero-Emission Aircraft Market, by Source, 2023 2032

8.1.1. Hydrogen

8.1.1.1. Market Revenue and Forecast (2020 2032)

8.1.2. Electric

8.1.2.1. Market Revenue and Forecast (2020 2032)

8.1.3. Solar

8.1.3.1. Market Revenue and Forecast (2020 2032)

Chapter 9. Global Zero-Emission Aircraft Market, By Range

9.1. Zero-Emission Aircraft Market, by Range e, 2023 2032

9.1.1. Short-Haul

9.1.1.1. Market Revenue and Forecast (2020 2032)

9.1.2. Medium-Haul

9.1.2.1. Market Revenue and Forecast (2020 2032)

9.1.3. Long-Haul

9.1.3.1. Market Revenue and Forecast (2020 2032)

Chapter 10. Global Zero-Emission Aircraft Market, By Application

10.1. Zero-Emission Aircraft Market, by Application, 2023 2032

10.1.1. Passenger Aircraft

10.1.1.1. Market Revenue and Forecast (2020 2032)

10.1.2. Cargo Aircraft

10.1.2.1. Market Revenue and Forecast (2020 2032)

Chapter 11. Global Zero-Emission Aircraft Market, By Type

11.1. Zero-Emission Aircraft Market, by Type, 2023 2032

11.1.1. Turboprop Rear Bulkhead

11.1.1.1. Market Revenue and Forecast (2020 2032)

11.1.2. Turbofan System

11.1.2.1. Market Revenue and Forecast (2020 2032)

11.1.3. Blended Wing Body

11.1.3.1. Market Revenue and Forecast (2020 2032)

Chapter 12. Global Zero-Emission Aircraft Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Source (2020 2032)

12.1.2. Market Revenue and Forecast, by Range (2020 2032)

12.1.3. Market Revenue and Forecast, by Application (2020 2032)

12.1.4. Market Revenue and Forecast, by Type (2020 2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Source (2020 2032)

12.1.5.2. Market Revenue and Forecast, by Range (2020 2032)

12.1.5.3. Market Revenue and Forecast, by Application (2020 2032)

12.1.5.4. Market Revenue and Forecast, by Type (2020 2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Source (2020 2032)

12.1.6.2. Market Revenue and Forecast, by Range (2020 2032)

12.1.6.3. Market Revenue and Forecast, by Application (2020 2032)

12.1.6.4. Market Revenue and Forecast, by Type (2020 2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Source (2020 2032)

12.2.2. Market Revenue and Forecast, by Range (2020 2032)

12.2.3. Market Revenue and Forecast, by Application (2020 2032)

12.2.4. Market Revenue and Forecast, by Type (2020 2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Source (2020 2032)

12.2.5.2. Market Revenue and Forecast, by Range (2020 2032)

12.2.5.3. Market Revenue and Forecast, by Application (2020 2032)

12.2.5.4. Market Revenue and Forecast, by Type (2020 2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Source (2020 2032)

12.2.6.2. Market Revenue and Forecast, by Range (2020 2032)

12.2.6.3. Market Revenue and Forecast, by Application (2020 2032)

12.2.6.4. Market Revenue and Forecast, by Type (2020 2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Source (2020 2032)

12.2.7.2. Market Revenue and Forecast, by Range (2020 2032)

12.2.7.3. Market Revenue and Forecast, by Application (2020 2032)

12.2.7.4. Market Revenue and Forecast, by Type (2020 2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Source (2020 2032)

12.2.8.2. Market Revenue and Forecast, by Range (2020 2032)

12.2.8.3. Market Revenue and Forecast, by Application (2020 2032)

12.2.8.4. Market Revenue and Forecast, by Type (2020 2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Source (2020 2032)

12.3.2. Market Revenue and Forecast, by Range (2020 2032)

12.3.3. Market Revenue and Forecast, by Application (2020 2032)

12.3.4. Market Revenue and Forecast, by Type (2020 2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Source (2020 2032)

12.3.5.2. Market Revenue and Forecast, by Range (2020 2032)

12.3.5.3. Market Revenue and Forecast, by Application (2020 2032)

12.3.5.4. Market Revenue and Forecast, by Type (2020 2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Source (2020 2032)

12.3.6.2. Market Revenue and Forecast, by Range (2020 2032)

12.3.6.3. Market Revenue and Forecast, by Application (2020 2032)

12.3.6.4. Market Revenue and Forecast, by Type (2020 2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Source (2020 2032)

12.3.7.2. Market Revenue and Forecast, by Range (2020 2032)

12.3.7.3. Market Revenue and Forecast, by Application (2020 2032)

12.3.7.4. Market Revenue and Forecast, by Type (2020 2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Source (2020 2032)

12.3.8.2. Market Revenue and Forecast, by Range (2020 2032)

12.3.8.3. Market Revenue and Forecast, by Application (2020 2032)

12.3.8.4. Market Revenue and Forecast, by Type (2020 2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Source (2020 2032)

12.4.2. Market Revenue and Forecast, by Range (2020 2032)

12.4.3. Market Revenue and Forecast, by Application (2020 2032)

12.4.4. Market Revenue and Forecast, by Type (2020 2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Source (2020 2032)

12.4.5.2. Market Revenue and Forecast, by Range (2020 2032)

12.4.5.3. Market Revenue and Forecast, by Application (2020 2032)

12.4.5.4. Market Revenue and Forecast, by Type (2020 2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Source (2020 2032)

12.4.6.2. Market Revenue and Forecast, by Range (2020 2032)

12.4.6.3. Market Revenue and Forecast, by Application (2020 2032)

12.4.6.4. Market Revenue and Forecast, by Type (2020 2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Source (2020 2032)

12.4.7.2. Market Revenue and Forecast, by Range (2020 2032)

12.4.7.3. Market Revenue and Forecast, by Application (2020 2032)

12.4.7.4. Market Revenue and Forecast, by Type (2020 2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Source (2020 2032)

12.4.8.2. Market Revenue and Forecast, by Range (2020 2032)

12.4.8.3. Market Revenue and Forecast, by Application (2020 2032)

12.4.8.4. Market Revenue and Forecast, by Type (2020 2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Source (2020 2032)

12.5.2. Market Revenue and Forecast, by Range (2020 2032)

12.5.3. Market Revenue and Forecast, by Application (2020 2032)

12.5.4. Market Revenue and Forecast, by Type (2020 2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Source (2020 2032)

12.5.5.2. Market Revenue and Forecast, by Range (2020 2032)

12.5.5.3. Market Revenue and Forecast, by Application (2020 2032)

12.5.5.4. Market Revenue and Forecast, by Type (2020 2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Source (2020 2032)

12.5.6.2. Market Revenue and Forecast, by Range (2020 2032)

12.5.6.3. Market Revenue and Forecast, by Application (2020 2032)

12.5.6.4. Market Revenue and Forecast, by Type (2020 2032)

Chapter 13. Company Profiles

13.1. AeroDelft

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Airbus S.A.S.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Blue Origin Federation, LLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Boeing Aerospace NYSE: BA

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Bye Aerospace

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Eviation Aircraft

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. HES Energy Systems

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Joby Aviation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Lilium

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Lockheed Martin Corporation NYSE: LMT

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms