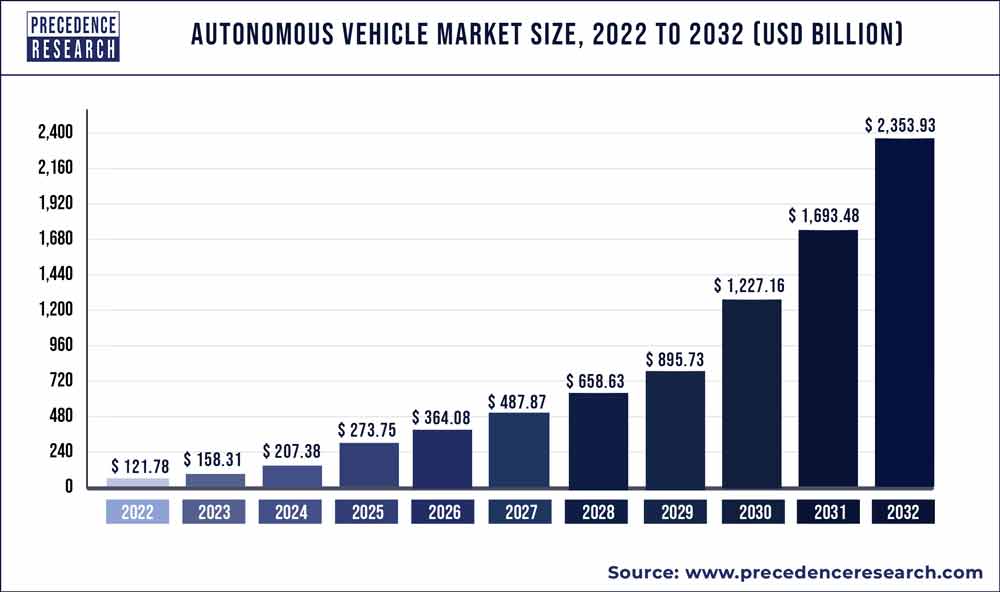

The global autonomous vehicle market size was valued at USD 121.78 billion in 2022 and is projected to hit around USD 2,353.93 billion by 2032 with a CAGR of 35% from 2023 to 2032

Key Takeaway

- North America reached at highest revenue share of over 40.15% in 2022.

- Application, the transportation segment accounted largest revenue share of 93.74% in 2022.

- The Asia-Pacific region is expected to hit at a CAGR of 35.6% from 2023 to 2032.

- By vehicle type, the passenger segment accounted for 74.15% of revenue share in 2022.

- By propulsion type, the semi-autonomous vehicle segment accounted for 95.06% of revenue share in 2022.

Vehicles that sense its environment and operate without human involvement are termed as autonomous cars. An autonomous vehicle utilizes a completely automated driving system that allows the vehicle to respond accordingly to the external conditions as a human driver would manage.

The Society of Automotive Engineers (SAE) outlines 6 stages of automation that ranges from Level 0 to Level 5. Level 0 means zero automation or completely manual and level 5 means complete or full automation. In other terms, these levels of automation are defined as the degree of human intervention required in a vehicle.

Get the Sample Pages of the Report for More Understanding@ https://www.precedenceresearch.com/sample/1074

Growth Factors

Autonomous vehicle was the most awaited technology in the field of automobile due to everyday increasing road accidents and increasing need for driver assistance technologies. Government initiatives influencing the adoption of these vehicles in compliance with their plan to reduce the harmful gas emission from vehicles significantly drives the market growth for autonomous vehicles. The government of some regions such as Europe and North America also offer incentives to the public for the purchase of electric and hybrid vehicles. Hybrid and electric vehicles are the most important example of autonomous cars. Furthermore, significant investments for the transportation infrastructure development along with rising disposable income in the developing regions are positively influencing the rising demand for autonomous vehicles in the coming years. However, the high cost of components for the autonomous vehicles may restrict the market growth in the under developed or developing nations.

Report Scope of the Autonomous Vehicle Market

| Report Highlights | Details |

| Market Size in 2023 | USD 158.31 Billion |

| Market Size by 2032 | USD 2,353.93 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 35% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Application, Level of Automation, Propulsion, Vehicle, Region |

Regional Snapshots

North America is the most promising region and the market leader in the global autonomous vehicle market in 2019. Prior acceptor of advanced technologies and vehicle advancement are the prime factors contributing significantly towards the regional growth. In addition, the rising volume for semi-autonomous cars in the region especially in USA and Canada are likely to boost the market growth. Moreover, increasing investment from technology innovators such as Microsoft, Google, and Delphi automotive are likely to project the region as the prime adopter of autonomous vehicles followed by Europe and Asia Pacific.

Report Highlights

- North America dominated the global autonomous vehicle market with significant revenue share in 2019 and projected to grow at an explicit growth rate during the forecast period. This is attributed to significant amendments made by the governing bodies in the traffic regulations to support the autonomous vehicle on public road.

- Europe predicted to encounter the most lucrative growth rate for autonomous car market in the coming years owing to shifting consumer preference towards automated product along with rising adoption of autonomous vehicles. For instance, in 2018, UK government announced a jurisdiction to permit autonomous vehicles on any public road without the requirement of extra insurance or permits.

- The Asia Pacific expected to flourish rapidly in the autonomous vehicles market during the analysis period owing to fast adoption of green mobility, as well as rising trend of mobility as a service in the region. China, India, Japan, and other ASEAN countries are significantly adopting the advanced mobility solution that helps government in their plan for reduced carbon emission and healthy environment in the near future.

- By application, the global autonomous vehicles market is dominated prominently by the transportation segment owing to rapid adoption of advanced vehicles for personal and commercial applications. Furthermore, government initiative for promoting shared mobility and battery powered vehicle adoption drives the growth of the segment. However, defense segment also seeks lucrative growth over the analysis period due to rising adoption of autonomous technology in defense vehicles.

Key Players & Strategies

The global autonomous vehicle market is highly competitive and offers numerous opportunities for the industry participants to upscale their market performance and position. In addition, the market also provides lucrative growth prospects for the new entrants. Implementation of smart and advanced electronic products along with sensors in various parts of the automobile transforms it into autonomous vehicles. Furthermore, upcoming technologies such as Artificial Intelligence (AI), Machine Learning (ML), and other advanced technologies upgrade the performance of the vehicles. Thus startup players grab significant opportunity to provide services and core technologies to the automotive giants for automobile application. Product enhancement, upgradation, and innovation are the prime growth aspects for the active market players. In addition, they also focus towards merger, collaboration, and partnership with technology providers to enhance their product features and performance.

Read Also: Automotive Electronic Control Unit Market Size Worth US$ 120.8 Bn by 2032

Some of the prominent players in the autonomous vehicle market include:

- BMW AG

- Audi AG

- Ford Motor Company

- Daimler AG

- Google LLC

- General Motors Company

- Nissan Motor Company

- Honda Motor Co., Ltd.

- Toyota Motor Corporation

- Tesla

- Volvo Car Corporation

- Uber Technologies, Inc.

- Volkswagen AG

Segments Covered in the Report

By Application

- Defense

- Transportation

- Commercial transportation

- Industrial transportation

By Level of Automation

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Propulsion Type

- Semi-autonomous

- Fully Autonomous

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Autonomous Vehicle Market

5.1. COVID-19 Landscape: Autonomous Vehicle Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Autonomous Vehicle Market, By Application

8.1. Autonomous Vehicle Market, by Application, 2023-2032

8.1.1. Defense

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Transportation

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Autonomous Vehicle Market, By Level of Automation

9.1. Autonomous Vehicle Market, by Level of Automation, 2023-2032

9.1.1. Level 1

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Level 2

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Level 3

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Level 4

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Level 5

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Autonomous Vehicle Market, By Propulsion Type

10.1. Autonomous Vehicle Market, by Propulsion Type, 2023-2032

10.1.1. Semi-autonomous

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Fully Autonomous

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Autonomous Vehicle Market, By Vehicle Type

11.1. Autonomous Vehicle Market, by Vehicle Type, 2023-2032

11.1.1. Passenger Car

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Commercial Vehicle

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Autonomous Vehicle Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Application (2020-2032)

12.1.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.1.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.1.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Application (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Application (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Application (2020-2032)

12.2.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.2.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Application (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Application (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Application (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Application (2020-2032)

12.3.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.3.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Application (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Application (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Application (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Application (2020-2032)

12.4.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.4.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Application (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Application (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Application (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Application (2020-2032)

12.5.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Application (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Application (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Level of Automation (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

Chapter 13. Company Profiles

13.1. BMW AG

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Audi AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Ford Motor Company

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Daimler AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Google LLC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. General Motors Company

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Nissan Motor Company

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Honda Motor Co., Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Toyota Motor Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Tesla

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com