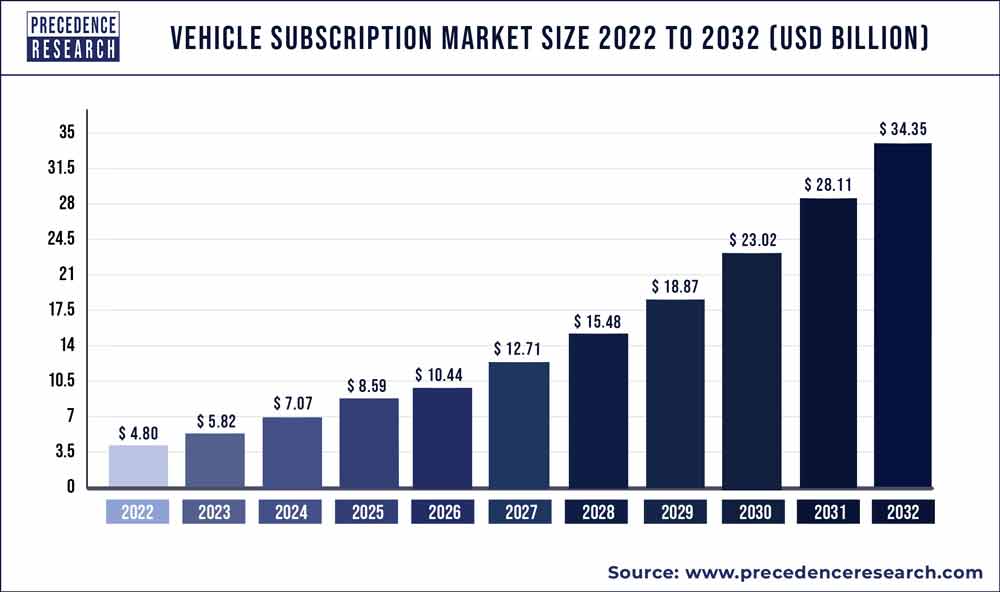

The global vehicle subscription market size reached USD 4.1 billion in 2020 and is predicted to attain over USD 31.73 billion by 2030, at a CAGR of 22.8% from 2021 to 2030.

Vehicle Subscription is a type of service offered in which the customer by paying the service charge obtain the right to use one or more vehicles during the subscription period. In 2020, the vehicle subscription market size was valued at US$ 4.1 billion and it is expected grow at a CAGR of 22.8% during the forecast period. Some of the subscriptions offer insurance and maintenance as a part of their service; other subscriptions offer the subscriber to switch between different vehicles during their subscription period.

Read More: https://www.precedenceresearch.com/sample/1328

Crucial factors accountable for market growth are:

- Easy user access and cost-effectiveness foster the market demand of vehicle subscription market.

- Increase in customer disposable income.

- Rapid urbanization and industrialization in developing countries.

- The benefits of subscribing vehicles compared with leasing the vehicles.

Vehicle Subscription Market Scope

| Report Highlights | Details |

| Market Size | USD 31.73 Billion by 2030 |

| Growth Rate | CAGR of 22.8% From 2021 to 2030 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Vehicle, Subscription Period, Service Providers, End Use, Region |

| Companies Mentioned | Fair Financial Corp., Clutch Technologies, LLC, CarNext, FlexDrive, Cluno GmbH, DriveMyCar Rentals Pty Ltd, BMW AG, Daimler AG, General Motors, Hyundai Motor India, Tata Motors, Tesla, Volkswagen, Volvo Car Corporation, ZoomCar, Cox Automotive |

Read More: Shared Mobility Market Size To Attain USD 945.83 Billion By 2030

Regional Snapshots

Asia Pacific is anticipated to grow significantly during the forecast period and with a CAGR of more than 28% of the market share due to the presence of developing countries engaged in activities such as rapid urbanization and industrialization. Also, the presence of huge population in this region fosters the growth of Vehicle Subscription market. For instance, On 15th December 2020, Hyundai Motor India announced that its vehicle subscription services has seen increasing demand specially among the millennials and tech savvy individuals.

Report Highlights

- The IC powered vehicle segment is expected to lead the market contributing more than 71% of the revenue share in the upcoming years.

- The corporate end use segment of the Vehicle Subscription Market is estimated to lead the market with a market share of more than 60% in 2020.

- By Geography, Asia Pacificis expected to grow significantly with a CAGR of 28% during the forecast period because of the surge in urbanization, industrialization and massive population present in this region.

Vehicle Subscription Market Dynamics

Driver –

Due to the cost-effectiveness and easy user access to vehicles the vehicle subscription market is growing significantly. Also, the rapid increase in the consumers disposable income in the developing countries are estimated to drive the market growth. For instance, On 4th October 2021, Fair Financial Corp announced that they are relaunching the app for offering subscriptions to its inventory of used cars. In the first quarter of 2022, Fair has planned to roll out subscriptions on leases for used cars provided by third-party vendors — with the larger goal of transforming into a central hub for all automotive retail.

Restraint –

The major restraining factor that will negatively impact the growth of the Vehicle Subscription Market includes the well-established vehicle leasing, rental, sharing market, and the design of more flexible leasing models and improved ride-hailing features offered by service providers.

Opportunity –

The rapid technological developments and the shift of customers towards vehicle subscription services when compared with car ownership are anticipated to offer huge opportunities in the growth of the vehicle subscription market.For instance, On 18th July 2021, Zoomcar, a self-drive car rental firm, planned to increase the number of electric cars fleet from the current 2 to 5 per cent to 30-35 per cent in the upcoming years.

Challenges –

The prevalent vehicle leasing, rental, and sharing market and the introduction of more flexible leasing models are expected to be a major challenge in the growth of the vehicle subscription market.

Recent Developments

- On 14th October 2021, Constellation Automotive Group is Europe’s largest vertically integrated digital used car marketplace, announced the acquisition of CarNext which is the leading B2B and B2C digital used car sales marketplace present across 22 European nations. The partnership between CarNext and Constellation creates Europe’s largest digital used car marketplace, selling more than 2.5 million cars annually for a GMV of €21bn.

- On 21st February 2021, Cazoo, the UK-based online used-car retailer, announced that it has acquired Cluno, Germany’s leader in car subscription services. This acquisition is an important step in its expansion into Europe.

- On 7th October 2021, General Motors announced that it expects to generate nearly $2 billion in revenue this in its car subscription services and is expected to reach$25 billion by the end of the 2030especially because of the launch of its Ultifi software platform in 2023 that will enable an enhanced subscriptions platform and over-the-air software updates for its customers.

Segments Covered in the Report

By Vehicle Type

- IC Powered Vehicle

- Electric Vehicle

By Subscription Period

- 1 to 6 Months

- 6 to 12 Months

- More than 12 Months

By Service providers

- OEMs & Captives

- Independent/Third Party Service Provider

By End Use

- Private

- Corporate

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Vehicle Subscription Market, By Vehicle

7.1. Vehicle Subscription Market, by Vehicle Type, 2021-2030

7.1.1. IC Powered Vehicle

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Electric Vehicle

7.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Vehicle Subscription Market, By Subscription Period

8.1. Vehicle Subscription Market, by Subscription Period, 2021-2030

8.1.1. 1 to 6 Months

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. 6 to 12 Months

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. More than 12 Months

8.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Vehicle Subscription Market, By Service Providers

9.1. Vehicle Subscription Market, by Service Providers, 2021-2030

9.1.1. OEMs & Captives

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Independent/Third Party Service Provider

9.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Vehicle Subscription Market, By End Use

10.1. Vehicle Subscription Market, by End Use, 2021-2030

10.1.1. Private

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Corporate

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Vehicle Subscription Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.1.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.1.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.1.4. Market Revenue and Forecast, by End Use (2019-2030)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.1.5.4. Market Revenue and Forecast, by End Use (2019-2030)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.1.6.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.1.6.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.1.6.4. Market Revenue and Forecast, by End Use (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.2.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.2.4. Market Revenue and Forecast, by End Use (2019-2030)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.2.5.4. Market Revenue and Forecast, by End Use (2019-2030)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.2.6.4. Market Revenue and Forecast, by End Use (2019-2030)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.2.7.4. Market Revenue and Forecast, by End Use (2019-2030)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.2.8.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.2.8.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.2.8.4. Market Revenue and Forecast, by End Use (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.3.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.3.4. Market Revenue and Forecast, by End Use (2019-2030)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.3.5.4. Market Revenue and Forecast, by End Use (2019-2030)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.3.6.4. Market Revenue and Forecast, by End Use (2019-2030)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.3.7.4. Market Revenue and Forecast, by End Use (2019-2030)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.3.8.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.3.8.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.3.8.4. Market Revenue and Forecast, by End Use (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.4.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.4.4. Market Revenue and Forecast, by End Use (2019-2030)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.4.5.4. Market Revenue and Forecast, by End Use (2019-2030)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.4.6.4. Market Revenue and Forecast, by End Use (2019-2030)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.4.7.4. Market Revenue and Forecast, by End Use (2019-2030)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.4.8.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.4.8.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.4.8.4. Market Revenue and Forecast, by End Use (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.5.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.5.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.5.4. Market Revenue and Forecast, by End Use (2019-2030)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.5.5.4. Market Revenue and Forecast, by End Use (2019-2030)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Vehicle (2019-2030)

11.5.6.2. Market Revenue and Forecast, by Subscription Period (2019-2030)

11.5.6.3. Market Revenue and Forecast, by Service Providers (2019-2030)

11.5.6.4. Market Revenue and Forecast, by End Use (2019-2030)

Chapter 12. Company Profiles

12.1. Fair Financial Corp.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Clutch Technologies, LLC

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. CarNext

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. FlexDrive

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cluno GmbH

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. DriveMyCar Rentals Pty Ltd

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. BMW AG

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Daimler AG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. General Motors

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Hyundai Motor India

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. Tata Motors

12.11.1. Company Overview

12.11.2. Product Offerings

12.11.3. Financial Performance

12.11.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333