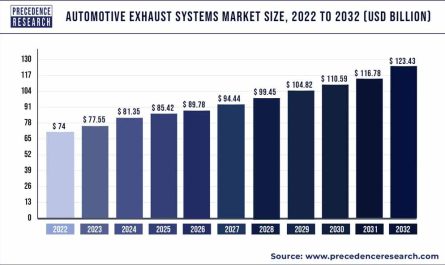

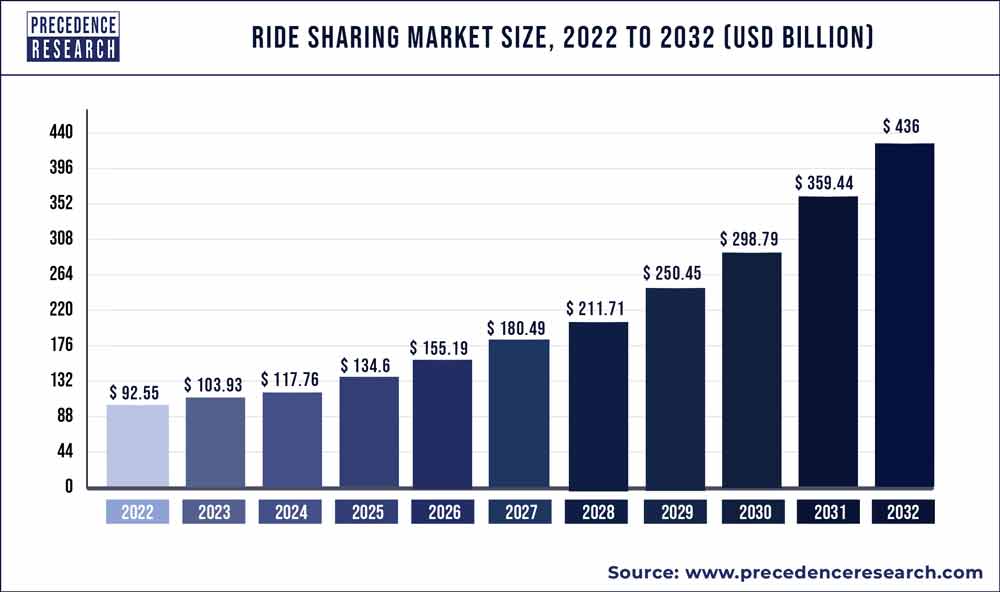

The global ride sharing market size is expected to be worth around USD 436 billion by 2032 from USD 436 billion in 2022, growing at a CAGR of 17.3% from 2022 to 2032.

Stringent emission regulations imposed by governments of various countries across the globe in order to control the alarming rate of rise in global pollution likely to propel the adoption of shared mobility and thus the trend for ride sharing in the coming years. Furthermore, overcrowded public transportations cause high level of discomfort that in turn triggers the demand for more comfortable intercity ride models. Hence, increasing rush in the public transportation favors the growth of ride sharing.

Increase in the number of private car ownerships coupled with rise in traffic congestion are some of the other important factors that drive the market growth for ride sharing during the near future. Populated countries and cities have insufficient network of roads that leads to increase the traffic congestion. As per the Federal Highway Administration, increased traffic congestion takes more than 37% of total travelling time for the daily commuters in the United States. Furthermore, rising purchasing power of consumer in the developing countries also ignites the rising sale of passenger vehicles that in turn likely to trigger the traffic congestion and hence prospers the growth of ride sharing in the regions.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1282

Ride Sharing Market Report Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 103.93 Billion |

| Market Size by 2032 | USD 436 Billion |

| Growth Rate from 2023 and 2032 | CAGR of 17.3% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Service Type, Vehicle Type, Membership Type |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

| Companies Mentioned | DIDI Chuxing, UBER Technologies Inc., GETT, GRAB, LYFT Inc., ANI Technologies Pvt. Ltd., INTEL, BLABLACAR, TOMTOM International BV, Denso Corporation, APTIV, WAYMO, General Motors, Ford Motor Company, IBM International |

However, technology development in the construction and infrastructure field has overcome the concern for traffic congestion and thus challenges the market growth for ride sharing. Nonetheless, advancement in the vehicle technology and road infrastructure compel users to invest in the new car models and upcoming vehicles that propels the growth in sale of passenger cars and thus prospers the market growth for ride sharing in the coming years.

The rapid spread of COVID-19 in the early 2020 has disrupted the operation of various industries including automotive. Ride sharing is the main trend that gets most affected by the COVID-19 pandemic. Lockdown situation and social distancing norms were the major factors that hampered the market growth for ride sharing. Even currently, the market is still struggling hard with the consumer’s perspective to adopt individual vehicles rather than shared vehicles owing to increased health concern and awareness from the spread of COVID-19 virus.

Report Highlights

- Based on service type, the market is segmented into e-hailing, car rental, car sharing, and station-based mobility. In 2020, the e-hailing segment hit the largest revenue share in the global market due to comfort for passenger, increasing traffic blockages, ease of booking and rising government activities. E-hailing is generally use for a small distance, and rides for about 10 to 15 km on average.

- Based on membership type, the corporate ride sharing services are emerging rapidly in the existing market and providing alluring opportunities to the industry participants. Rapid growth in industrialization in the emerging nations has also created a challenge for the commutation service for the employees. Hence, multinational companies are more tilted towards ride sharing services in order to favor the green mobility solution for their employees as well as also to promote the healthier mode of transportation among the common public. These multinational companies tie up with some ride sharing service to avail the facility of ride sharing for daily of their employees. In 2019, MoveInSync, an office commute platform introduced GetToWork, a subscription-based service for business to consumer ride sharing app for daily office commute.

- By geography, North America is the front-runner in the global ride sharing market in terms of revenue share due to large concentration of market vendors in the United States. In addition, North America is the largest technology investor as well as innovator across the globe that favors the mart growth of ride sharing within the region. Further, the region is an industrial hub that proliferates the adoption of corporate model of ride sharing in the region.

Key Players Analysis

The global ride sharing market is highly fragmented owing to the presence of large number of market players and thus the rate of competition among the market vendors is also very high particularly among the major industry participants. The market is also highly vulnerable for the new market entrants and thus triggers the rate of competition within the global market. In addition, these market players are significantly concentrated towards the new service launch that favors the prominent growth of the market.

Some of the prominent players covered under the global ride sharing market report include DIDI Chuxing, UBER Technologies Inc., GETT, GRAB, LYFT Inc., ANI Technologies Pvt. Ltd., INTEL, BLABLACAR, TOMTOM International BV, Denso Corporation, APTIV, WAYMO, General Motors, Ford Motor Company, IBM International, CABIFY, CAR2GO, DAIMLER, and EASY Taxiamong others.

Ride Sharing Market Segments:

By Service Type

- E-hailing

- Car Rental

- Car Sharing

- Station-based Mobility

By Membership Type

- Fixed Ridesharing

- Corporate Ridesharing

- Dynamic Ridesharing

By Vehicle Type

- Electric Vehicle Mobility

- CNG/LPG Vehicle

- ICE Vehicle Mobility

- Micro-mobility

By Regional Outlook

- North America

- US

- Rest of North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Service Typeing Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Ride Sharing Market, By Service Type

7.1. Ride Sharing Market, by Service Type, 2021-2030

7.1.1. E-hailing

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Car Rental

7.1.2.1. Market Revenue and Forecast (2017-2030)

7.1.3. Car Sharing

7.1.3.1. Market Revenue and Forecast (2017-2030)

7.1.4. Station-based Mobility

7.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global Ride Sharing Market, By Membership Type

8.1. Ride Sharing Market, by Membership Type, 2021-2030

8.1.1. Fixed Ridesharing

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Corporate Ridesharing

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Dynamic Ridesharing

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Ride Sharing Market, By Vehicle Type

9.1. Ride Sharing Market, by Vehicle Type, 2021-2030

9.1.1. Electric Vehicle Mobility

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. CNG/LPG Vehicle

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. ICE Vehicle Mobility

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Micro-mobility

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Ride Sharing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.1.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.1.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.1.4.3. Market Revenue and Forecast, by Vehicle Type(2017-2030)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.1.5.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.1.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.2.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.2.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.2.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.2.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.2.6.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.2.7.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.2.7.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.3.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.3.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.3.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.3.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.3.6.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.3.7.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.3.7.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.4.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.4.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.4.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.4.6.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.4.7.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.4.7.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.5.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.5.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Service Type (2017-2030)

10.5.5.2. Market Revenue and Forecast, by Membership Type (2017-2030)

10.5.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

Chapter 11. Company Profiles

11.1. DIDI Chuxing

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. UBER Technologies Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. GETT

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. GRAB

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. LYFT Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ANI Technologies Pvt. Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. INTEL

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. BLABLACAR

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. TOMTOM International BV

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Denso Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

11.11. APTIV

11.11.1. Company Overview

11.11.2. Product Offerings

11.11.3. Financial Performance

11.11.4. Recent Initiatives

11.12. WAYMO

11.12.1. Company Overview

11.12.2. Product Offerings

11.12.3. Financial Performance

11.12.4. Recent Initiatives

11.13. General Motors

11.13.1. Company Overview

11.13.2. Product Offerings

11.13.3. Financial Performance

11.13.4. Recent Initiatives

11.14. Ford Motor Company

11.14.1. Company Overview

11.14.2. Product Offerings

11.14.3. Financial Performance

11.14.4. Recent Initiatives

11.15. IBM International

11.15.1. Company Overview

11.15.2. Product Offerings

11.15.3. Financial Performance

11.15.4. Recent Initiatives

11.16. CABIFY

11.16.1. Company Overview

11.16.2. Product Offerings

11.16.3. Financial Performance

11.16.4. Recent Initiatives

11.17. CAR2GO

11.17.1. Company Overview

11.17.2. Product Offerings

11.17.3. Financial Performance

11.17.4. Recent Initiatives

11.18. DAIMLER

11.18.1. Company Overview

11.18.2. Product Offerings

11.18.3. Financial Performance

11.18.4. Recent Initiatives

11.19. EASY Taxi

11.19.1. Company Overview

11.19.2. Product Offerings

11.19.3. Financial Performance

11.19.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms