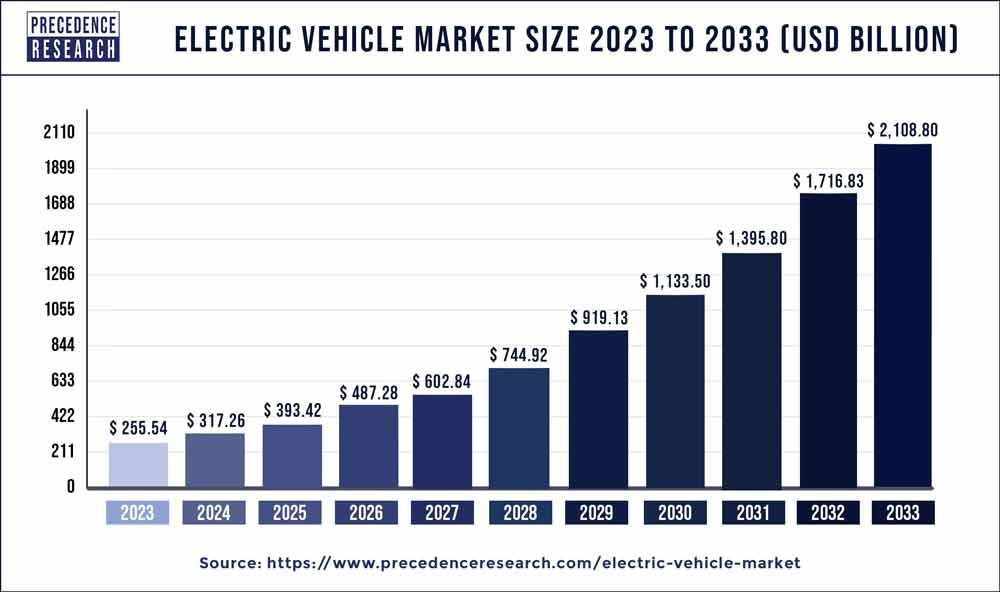

The global electric vehicle market size surpassed USD 255.54 billion in 2023 and is estimated to reach around USD 2,108.80 billion by 2033 with a noteworthy CAGR of 23.42% from 2024 to 2033.

Key Points

- Asia Pacific has dominated the market with a 42.14% revenue share in 2023.

- The Asia Pacific EV market was valued at USD 107.68 billion in 2023.

- By propulsion type, BEV accounted largest revenue share 67.7% in 2023.

- By vehicle type, the passenger car segment accounted for 62.4% of revenue share in 2023.

- EV sales increased by 80% in the United States in 2019.

- By 2040, Europe is expected to achieve 40% greenhouse gas reduction and net zero by 2050.

- In Europe, Norway and Iceland have newly registered 86% and 64% electric cars in 2021 respectively.

- The hybrid electric vehicle segment is expected to reach USD 301.67 billion by 2030 valued at USD 77,581.7 million in 2021.

- The plug-in hybrid EV segment is expected to hit revenue of USD 385,617 million from 2022 to 2030.

- The passenger car electric vehicle market was valued at USD 127,394 million in 2021 and is projected to hit USD 598,735 million by 2030.

- The commercial vehicle EV market was valued at USD 47,351.9 million in 2021.

- The luxury EV market is projected to reach USD 441,273 million by 2030 valued at USD 104,380 million in 2021.

The electric vehicle (EV) market has experienced exponential growth in recent years, driven by increasing environmental awareness, advancements in technology, and government incentives promoting sustainable transportation solutions. As concerns about climate change and air pollution intensify, consumers and businesses alike are shifting towards electric vehicles as a cleaner and more sustainable alternative to traditional internal combustion engine vehicles. This paradigm shift has sparked significant investment and innovation within the EV industry, leading to rapid expansion and evolution of the market landscape.

Get a Sample: https://www.precedenceresearch.com/sample/1009

Table of Contents

ToggleGrowth Factors

Several key factors have contributed to the remarkable growth of the electric vehicle market. Firstly, advancements in battery technology have significantly improved the performance and affordability of electric vehicles, effectively addressing concerns related to range anxiety and charging infrastructure. Additionally, government initiatives aimed at reducing carbon emissions and promoting clean energy have spurred widespread adoption of electric vehicles through subsidies, tax incentives, and infrastructure development programs. Moreover, growing consumer awareness about the environmental impact of fossil fuel consumption has fueled demand for electric vehicles, driving automakers to invest heavily in electrification and expand their EV product offerings.

Trends:

Several notable trends are shaping the electric vehicle market. One prominent trend is the increasing popularity of electric SUVs and crossover vehicles, as consumers seek larger and more versatile electric options to meet their diverse transportation needs. Another trend is the emergence of electric vehicle subscription and ride-sharing services, offering consumers flexible and convenient alternatives to traditional car ownership. Furthermore, the integration of smart connectivity features and autonomous driving technology into electric vehicles is expected to enhance user experience and drive future market growth.

Electric Vehicle Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 255.54 Billion |

| Market Size by 2033 | USD 2,108.80 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 23.42% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe and North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Propulsion Type, Components, Vehicle Type, Vehicle Class, Top Speed, Vehicle Drive, EV Charging Point Type, V2G, Region |

SWOT Analysis:

Strengths: The electric vehicle market benefits from growing environmental consciousness, technological innovation, and government support, driving strong demand and investment in the sector. Additionally, electric vehicles offer numerous advantages over internal combustion engine vehicles, including lower operating costs, reduced emissions, and superior performance. Furthermore, the expanding charging infrastructure and improving battery technology are enhancing the viability and appeal of electric vehicles to consumers.

Weaknesses: Despite significant progress, electric vehicles still face challenges such as limited range, longer charging times, and higher upfront costs compared to conventional vehicles. Additionally, concerns about battery life, recycling, and supply chain constraints pose potential obstacles to widespread adoption. Moreover, the dependence on rare earth minerals for battery production raises sustainability concerns and supply chain risks for the electric vehicle industry.

Opportunities: The electric vehicle market presents vast opportunities for growth and innovation, driven by technological advancements, regulatory incentives, and shifting consumer preferences. The electrification of commercial fleets, expansion of charging infrastructure, and development of new battery technologies are poised to accelerate market penetration and adoption. Furthermore, partnerships between automakers, energy companies, and technology firms offer opportunities for collaboration and synergistic innovation in areas such as vehicle-to-grid integration and renewable energy storage solutions.

Threats: Despite the positive outlook, the electric vehicle market faces several potential threats, including regulatory uncertainty, geopolitical tensions affecting the supply chain, and competition from established automakers and emerging electric vehicle startups. Additionally, fluctuations in commodity prices, trade disputes, and macroeconomic factors could impact the cost and availability of key components such as batteries and electric vehicle components. Moreover, concerns about cybersecurity and data privacy in connected electric vehicles pose risks to consumer trust and adoption.

Read Also: Vehicle Roadside Assistance Market Size To Hit USD 41.76 Bn by 2033

Competitive Landscape:

The electric vehicle market is characterized by intense competition among established automakers, emerging startups, and technology firms vying for market share and dominance. Traditional automakers such as Tesla, Nissan, and General Motors have been at the forefront of electric vehicle innovation, leveraging their expertise in manufacturing, branding, and distribution to gain a competitive edge. Meanwhile, new entrants such as Rivian, Lucid Motors, and NIO are challenging incumbents with innovative electric vehicle designs, advanced technology features, and compelling value propositions.

In conclusion, the electric vehicle market is experiencing rapid growth and transformation, driven by a convergence of technological, environmental, and regulatory factors. While challenges and uncertainties remain, the electrification of transportation represents a paradigm shift towards a more sustainable and environmentally responsible future. As the market continues to evolve, stakeholders must adapt to changing dynamics, embrace innovation, and collaborate to capitalize on emerging opportunities in the electric vehicle ecosystem.

Key Developments

-

- In January 2023, the UK government achieved its goal of converting over a quarter of all of its automobiles (25.5%) to ultra-low emission vehicles, and is now moving forward with decarbonizing its central car fleet (ULEV).

- In January 2023, MG unveiled new small electric car concept at the biennial Auto Expo in India.

- In January 2023, the UK government achieved its goal of converting over a quarter of all of its automobiles (25.5%) to ultra-low emission vehicles, and is now moving forward with decarbonizing its central car fleet (ULEV).

- In January 2023, MG unveiled new small electric car concept at the biennial Auto Expo in India.

BMW will debut its new i4 electric vehicle in November 2021, with a range of 300-367 miles. In just four seconds, the car can reach 100 km/h. It has an automatic transmission and is equipped with linked car capabilities.

- In April 2021, the key player named Toyota introduced the new Mirai & LS models in the city japan which come with the technology of advanced driving assessment.

- In April 2021, the key player named BYD introduced four new electric vehicle models which were equipped with Blade batteries in Chongqing. The new vehicle models, Qin plus EV, E2 2021 Tang EV, and Song plus EV came with the advanced feature of battery safety.

- In April 2021, the key player named Volkswagen reviled the 7 seater ID.6 X and EV ID.6 Crozz manufactured along with SAIC and FAW in China. Furthermore, these vehicles be sold in China only. Also, it comprises of 2 versions of battery, as 77 kWh & 58 kWh and comes in four powertrain configurations.

- Tesla, Inc. declared the acquisition of Maxwell Technologies, Inc. in March 2019. The purchase was made with the goal of improving Tesla’s batteries and lowering overall costs in order to obtain a competitive edge in the market.

- The Nissan Motor Company has surpassed 180,000 consumers, which is the most significant milestone in the LEAF’s launch. The latest vehicle from this business is the Ariya, an electric crossover coupe.

Electric Vehicle Market Companies

- Ampere Vehicles

- Benling India Energy and Technology Pvt Ltd

- BMW AG

- BYD Company Limited

- Chevrolet Motor Company

- Daimler AG

- Energica Motor Company S.p.A.

- Ford Motor Company

- General Motors

- Hero Electric

- Hyundai Motor Company

- Karma Automotive

- Kia Corporation

- Lucid Group, Inc.

- Mahindra Electric Mobility Limited

- NIO

- Nissan Motors Co., Ltd.

- Okinawa Autotech Pvt. Ltd.

- Rivain

- Tata Motors

- Tesla Inc.

- Toyota Motor Corporation

- Volkswagen AG

- WM Motor

- Xiaopeng Motors

Segments Covered in the Report

By Propulsion Type

- Hybrid Vehicles

- Pure Hybrid Vehicles

- Plug-in Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

By Components

- Battery Cells & Packs

- On-Board Charge

- Motor

- Reducer

- Fuel Stack

- Power Control Unit

- Battery Management System

- Fuel Processor

- Power Conditioner

- Air Compressor

- Humidifier

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- E-Scooters & Bikes

- Light Commercial Vehicles

- Others

By Vehicle Class

- Mid-priced

- Luxury

By Top Speed

- Less Than 100 MPH

- 100 to 125 MPH

- More Than 125 MPH

By Vehicle Drive

- Front-Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

By EV Charging Point Type

- Normal Charging

- Super Charging

By V2G

- V2B or V2H

- V2G

- V2V

- V2X

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/