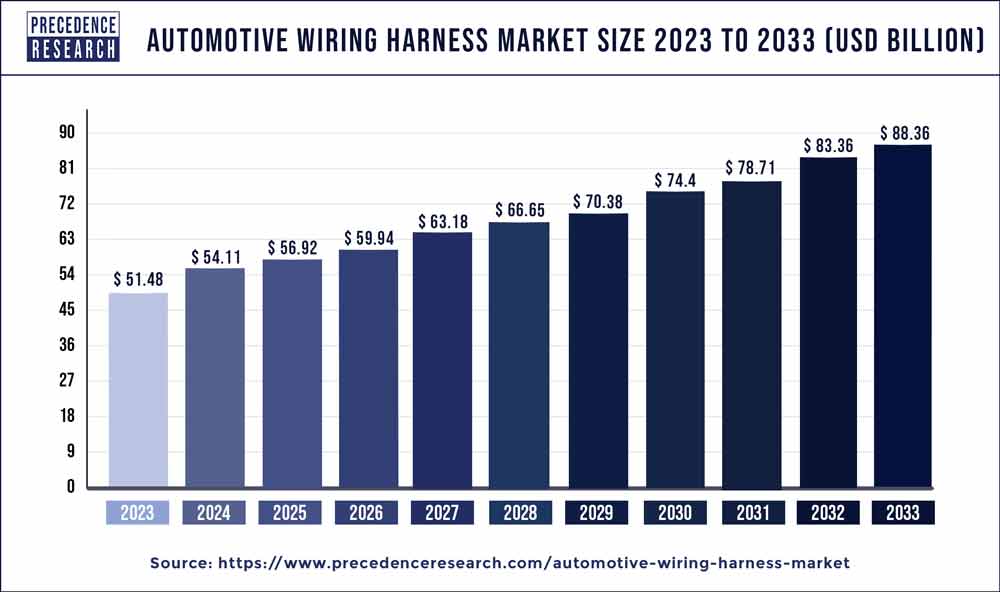

The global automotive wiring harness market size was valued at USD 51.48 billion in 2023 and is expected to hit over USD 88.36 billion by 2033 with a CAGR of 5.6% from the forecast period 2024 to 2033.

The Automotive Wiring Harness Market plays a pivotal role in the automotive industry, serving as a crucial component that facilitates the transmission of electrical signals and power within vehicles. Wiring harnesses consist of a collection of wires, connectors, terminals, and other components that are bundled together to ensure efficient and reliable electrical connectivity throughout the vehicle. As automotive technology continues to advance, with a focus on electrification, connectivity, and autonomous driving, the demand for sophisticated wiring harness solutions is witnessing significant growth. This surge in demand is driven by various factors, including technological advancements, regulatory standards, and shifting consumer preferences, shaping the landscape of the automotive wiring harness market.

Get a Sample: https://www.precedenceresearch.com/sample/1008

Table of Contents

ToggleGrowth Factors

- Vehicle Electrification: The rapid electrification of vehicles, including hybrid and electric vehicles (EVs), is one of the primary drivers fueling the growth of the automotive wiring harness market. As automakers strive to enhance fuel efficiency, reduce emissions, and meet stringent environmental regulations, the demand for complex wiring harnesses to support the electrification of powertrains and auxiliary systems continues to rise.

- Increasing Adoption of Advanced Electronics: Modern vehicles are equipped with an array of advanced electronic components and systems, such as infotainment systems, advanced driver assistance systems (ADAS), and telematics. This proliferation of electronic features necessitates sophisticated wiring harness solutions capable of supporting high-speed data transmission, power distribution, and integration of various sensors and control units.

- Focus on Lightweighting and Space Optimization: Automotive manufacturers are increasingly emphasizing lightweighting initiatives to improve fuel efficiency and enhance vehicle performance. Wiring harness suppliers are innovating to develop lightweight yet durable materials and streamlined harness designs that minimize space requirements within vehicles, thereby meeting the industry’s evolving demands for efficient packaging and design flexibility.

- Growing Demand in Emerging Markets: Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing robust growth in automotive production and sales. As disposable incomes rise and urbanization accelerates, there is a surging demand for passenger vehicles equipped with advanced features, driving the need for reliable and cost-effective wiring harness solutions in these regions.

Trends:

- Shift towards High-Voltage Wiring Harnesses: The proliferation of electric and hybrid vehicles has led to a growing demand for high-voltage wiring harnesses capable of safely transmitting power between the battery, electric motor, and various onboard systems. Manufacturers are investing in the development of specialized wiring harnesses with enhanced insulation and safety features to address the unique requirements of electrified powertrains.

- Integration of Data Communication Networks: With the rise of connected and autonomous vehicles, there is a trend towards integrating data communication networks, such as Controller Area Network (CAN), Ethernet, and FlexRay, into automotive wiring harnesses. This enables seamless communication between onboard systems, sensors, and external devices, supporting advanced functionalities such as vehicle-to-everything (V2X) communication and over-the-air updates.

- Adoption of Modular and Flexible Harness Designs: To accommodate the increasing complexity of vehicle electronics and facilitate easier assembly, automotive wiring harness suppliers are embracing modular and flexible design approaches. Modular harness architectures allow for standardized components and connectors, simplifying production processes and enhancing scalability across different vehicle platforms.

- Emphasis on Sustainability and Recyclability: In line with broader sustainability initiatives within the automotive industry, there is a growing emphasis on developing environmentally friendly wiring harness solutions. Manufacturers are exploring alternative materials, such as bio-based plastics and recyclable metals, to reduce the environmental footprint of harness production and disposal while ensuring compliance with regulatory requirements.

Automotive Wiring Harness Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 51.48 Billion |

| Market Size by 2033 | USD 88.36 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.6% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Material, Propulsion, Transmission, Vehicle, Sales Channel, Geography |

SWOT Analysis

- Strengths:

- Established Supply Chain: The automotive wiring harness industry benefits from a well-established supply chain comprising manufacturers, suppliers, and distributors with extensive experience and expertise in producing high-quality harness solutions.

- Technological Advancements: Continuous innovation in materials, manufacturing processes, and design methodologies enables wiring harness suppliers to deliver products with improved performance, reliability, and cost-effectiveness.

- Diversified Customer Base: Wiring harness manufacturers cater to a diverse customer base, including OEMs and aftermarket suppliers, providing resilience against fluctuations in demand within specific market segments.

- Weaknesses:

- Cost Pressures: Intense competition and cost pressures within the automotive industry pose challenges for wiring harness manufacturers to maintain profitability while meeting stringent quality and performance requirements.

- Dependency on Automotive OEMs: The automotive wiring harness market is highly dependent on the production volumes and product specifications of automotive OEMs, exposing suppliers to the risk of demand fluctuations and supply chain disruptions.

- Complexity of Regulatory Compliance: Compliance with evolving regulatory standards and certification requirements, particularly related to safety, emissions, and materials, adds complexity and costs to the development and production of wiring harnesses.

- Opportunities:

- Expansion in Electric Vehicle Segment: The rapid growth of the electric vehicle market presents significant opportunities for wiring harness suppliers to capitalize on the increasing demand for specialized high-voltage harnesses and related components.

- Penetration into Emerging Markets: Emerging economies offer untapped potential for market expansion, driven by rising automotive production, infrastructure development, and consumer purchasing power.

- Collaboration for Innovation: Collaborative partnerships between wiring harness manufacturers, automotive OEMs, and technology providers can foster innovation and accelerate the development of next-generation harness solutions tailored to evolving industry trends and customer requirements.

- Threats:

- Supply Chain Disruptions: Vulnerabilities in the global supply chain, including raw material shortages, geopolitical tensions, and transportation disruptions, pose threats to the timely procurement of components and production of wiring harnesses.

- Competitive Intensity: The automotive wiring harness market is characterized by intense competition among established players and new entrants, leading to pricing pressures, margin erosion, and challenges in maintaining market share.

- Regulatory Uncertainty: Uncertainties surrounding future regulatory frameworks, particularly related to emissions standards, safety regulations, and trade policies, could impact the demand for wiring harnesses and necessitate adjustments in manufacturing processes and product offerings.

Read Also: Electric Vehicle Market Size To Attain USD 2,108.80 Bn By 2033

Competitive Landscape:

The automotive wiring harness market is characterized by the presence of several key players, including major multinational corporations and regional suppliers, competing based on factors such as product quality, technological innovation, pricing, and geographic reach. Some of the prominent players in the market include Yazaki Corporation, Sumitomo Electric Industries, Ltd., Lear Corporation, Delphi Technologies, Furukawa Electric Co., Ltd., and Aptiv PLC. These companies leverage their extensive R&D capabilities, manufacturing expertise, and strategic partnerships to maintain a competitive edge and expand their market presence across different vehicle segments and regions. Additionally, the market witnesses a significant degree of vertical integration, with some manufacturers involved in the production of both wiring harnesses and related components, such as connectors, terminals, and insulation materials, to enhance supply chain efficiency and control costs. Overall, the competitive landscape of the automotive wiring harness market is dynamic and evolving, driven by technological advancements, shifting consumer preferences, and regulatory dynamics within the global automotive industry.

Automotive Wiring Harness Market Companies

- Sumitomo Electric Industries, Ltd.

- Delphi Automotive LLP

- Furukawa Electric Co. Ltd

- Lear Corporation

- THB Group

- Yura Corporation

- Leoni Ag

- SPARK MINDA

- Yazaki Corporation

- Fujikura Ltd.

- QINGDAO SANYUAN GROUP

- SamvardhanaMotherson Group

- NexansAutoelectric

- PKC Group

Segments Covered in the Report

By Type

- Engine Harness

- Dashboard/ Cabin Harness

- Battery Wiring Harness

- Chassis Wiring Harness

- Body & Lighting Harness

- HVAC Wiring Harness

- Seat Wiring Harness

- Door Wiring Harness

- Sunroof Wiring Harness

By Material

- Metallic

- Aluminum

- Copper

- Other Metals

- Optical Fiber

- Plastic Optical Fiber

- Glass Optical Fiber

By Propulsion

- IC Engine Vehicle

- Electric Vehicle

By Transmission

- Electric Wiring

- Data Transmission

- <150 Mbps

- 150 Mbps to 1 Gbp

- >1 Gbps

By Vehicle

- Commercial Vehicle

- Passenger Vehicle

By Voltage

- Low Voltage

- High Voltage

By Sales Channel

- OEM

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/