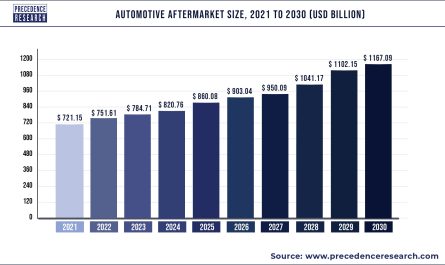

The global airless tires market size was valued at USD 54 million in 2022 and is expected to hit over USD 97.16 million by 2032 with a registered CAGR of 6.10% from 2023 to 2032.

The airless tires market has garnered significant attention in recent years due to its potential to revolutionize the automotive and transportation industries. Unlike traditional pneumatic tires filled with air, airless tires are designed to withstand punctures, eliminate the risk of flats, and require minimal maintenance. This innovative technology offers numerous advantages such as improved durability, enhanced safety, and reduced environmental impact, making it an attractive alternative to conventional tires. As the demand for sustainable and efficient transportation solutions continues to rise, the airless tires market is poised for substantial growth and innovation.

Get a Sample: https://www.precedenceresearch.com/sample/1486

Growth Factors:

Several key factors are driving the growth of the airless tires market. Firstly, the increasing emphasis on sustainability and environmental conservation has prompted automotive manufacturers and consumers alike to seek eco-friendly alternatives to traditional tires. Airless tires eliminate the need for air, reducing the use of rubber and other materials, and minimizing the environmental footprint associated with tire production and disposal.

Moreover, the superior durability and resilience of airless tires make them well-suited for a wide range of applications, including off-road vehicles, construction equipment, and industrial machinery. These tires are capable of withstanding rough terrain, extreme temperatures, and heavy loads, offering enhanced performance and reliability in challenging operating conditions.

Additionally, advancements in tire technology and materials science have led to the development of innovative airless tire designs that offer improved comfort, traction, and stability. Manufacturers are leveraging cutting-edge materials such as composite polymers, elastomers, and reinforced fibers to enhance the performance and longevity of airless tires, driving adoption across various industries.

Furthermore, the growing demand for autonomous and electric vehicles (EVs) is expected to fuel the demand for airless tires. As automakers invest in self-driving and electric mobility solutions, there is a need for tires that can support the unique requirements of these vehicles, such as increased durability, reduced rolling resistance, and enhanced energy efficiency. Airless tires offer a compelling solution to these challenges, making them well-suited for next-generation transportation technologies.

Region Insights:

The adoption of airless tires varies across regions, influenced by factors such as infrastructure development, regulatory policies, and consumer preferences. In developed markets such as North America and Europe, where there is a strong emphasis on innovation and sustainability, airless tires have gained traction in niche segments such as off-road vehicles, military applications, and industrial machinery. Companies based in these regions are investing in research and development to further improve airless tire technology and expand their market presence.

In emerging markets such as Asia Pacific and Latin America, where rapid industrialization and urbanization are driving demand for transportation and infrastructure development, there is growing interest in airless tires as a cost-effective and reliable alternative to traditional tires. Governments in these regions are increasingly focusing on infrastructure modernization and sustainable transportation solutions, creating opportunities for airless tire manufacturers to expand their business operations and partnerships.

In regions with harsh climates and rugged terrain, such as the Middle East, Africa, and parts of South America, airless tires offer significant advantages in terms of durability, performance, and safety. These regions have traditionally relied on pneumatic tires for their transportation and logistics needs, but the vulnerability of traditional tires to punctures and blowouts in extreme conditions has led to growing interest in airless tire technology as a more resilient and reliable solution.

Scope of the Airless Tires Market

| Report Coverage | Details |

| Market Size in 2023 | USD 57.02 Million |

| Growth Rate from 2023 to 2032 | 6.10% |

| Revenue Projection by 2032 | USD 97.16 Million |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

Drivers:

Several drivers are propelling the growth of the airless tires market. One of the primary drivers is the need for enhanced safety and reliability in transportation and mobility solutions. Traditional pneumatic tires are susceptible to punctures, blowouts, and underinflation, posing safety risks to drivers, passengers, and pedestrians. Airless tires eliminate these risks by utilizing innovative designs and materials that provide superior durability and resilience, thereby enhancing vehicle safety and performance.

Moreover, the growing demand for off-road vehicles, construction equipment, and agricultural machinery is driving the adoption of airless tires in industries where reliability and ruggedness are paramount. These tires offer significant advantages over pneumatic tires in terms of puncture resistance, load-bearing capacity, and longevity, making them ideal for use in challenging operating environments.

Furthermore, the rise of electric mobility and autonomous vehicles is creating new opportunities for airless tire manufacturers. Electric vehicles require tires that minimize rolling resistance and maximize energy efficiency to optimize battery range and performance. Airless tires, with their unique design and construction, offer reduced rolling resistance and improved fuel efficiency compared to pneumatic tires, making them well-suited for electric and autonomous vehicle applications.

Additionally, the increasing focus on sustainability and environmental conservation is driving demand for eco-friendly transportation solutions, including airless tires. Traditional tire manufacturing processes consume significant amounts of natural resources and energy, and generate emissions and waste. Airless tires, by eliminating the need for air and reducing material usage, offer a more sustainable alternative that aligns with the goals of circular economy and resource efficiency.

Opportunities:

The airless tires market presents numerous opportunities for innovation, collaboration, and market expansion. One of the key opportunities lies in the development of new materials and manufacturing processes to further improve the performance, durability, and cost-effectiveness of airless tires. Companies are investing in research and development to explore advanced materials such as nanocomposites, graphene, and bio-based polymers, which offer superior mechanical properties and environmental benefits compared to traditional tire materials.

Moreover, there is significant potential for partnerships and collaborations between airless tire manufacturers, automotive OEMs, and technology providers to accelerate the commercialization and adoption of airless tire technology. Collaborative efforts can help streamline product development, address technical challenges, and expand market reach, ultimately driving innovation and market growth.

Furthermore, the diversification of applications and end-use industries represents a promising opportunity for airless tire manufacturers to expand their market presence and revenue streams. In addition to traditional automotive and transportation applications, airless tires can be utilized in sectors such as agriculture, construction, mining, and logistics, where reliability, durability, and safety are critical considerations.

Additionally, the rise of e-commerce and last-mile delivery services is creating demand for innovative tire solutions that can withstand the rigors of urban environments and frequent stop-and-go driving conditions. Airless tires offer advantages such as reduced maintenance requirements, extended tread life, and enhanced puncture resistance, making them well-suited for delivery vehicles and urban mobility solutions.

Moreover, advancements in additive manufacturing and 3D printing technologies present opportunities for on-demand manufacturing and customization of airless tires to meet the unique requirements of different vehicle platforms and operating conditions. By leveraging digital design tools and flexible manufacturing processes, manufacturers can offer personalized tire solutions tailored to specific customer needs, thereby enhancing customer satisfaction and market competitiveness.

Challenges:

Despite the promising growth prospects, the airless tires market faces several challenges that must be addressed to realize its full potential. One of the primary challenges is the scalability and cost-effectiveness of airless tire manufacturing processes. While advancements in materials science and production techniques have led to significant improvements in airless tire technology, the cost of manufacturing remains higher than traditional pneumatic tires, limiting mass adoption and market penetration.

Moreover, the performance and ride comfort of airless tires may not fully match that of pneumatic tires, particularly in terms of noise, vibration, and handling characteristics. Consumers are accustomed to the ride quality and performance of traditional tires, and may be hesitant to adopt airless tire technology if it compromises vehicle comfort or driving experience. Therefore, manufacturers must continue to refine and optimize airless tire designs to achieve a balance between durability, performance, and comfort.

Read Also: Automotive Suspension Market Size, Share, Report By 2032

Some of the prominent players in the global airless tires market include:

- Trelleborg

- Continental AG

- Michelin

- Toyo Tire Corporation

- Hankook Tire & Technology Co. Ltd

- Sumitomo Rubber Industries Ltd.

- The Goodyear Tire & Rubber Company

- The Yokohama Rubber Co. Ltd

- Bridgestone Corporation

- Ameritire Corporation

Segments Covered in the Report

By Product

- Radial

- Bias

By Vehicle

- Military Vehicle

- Passenger Vehicle

- Commercial Vehicle

- Terrain Vehicle

- Utility Vehicle

- Two-wheelers

By Material

- Rubber

- Plastic

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/