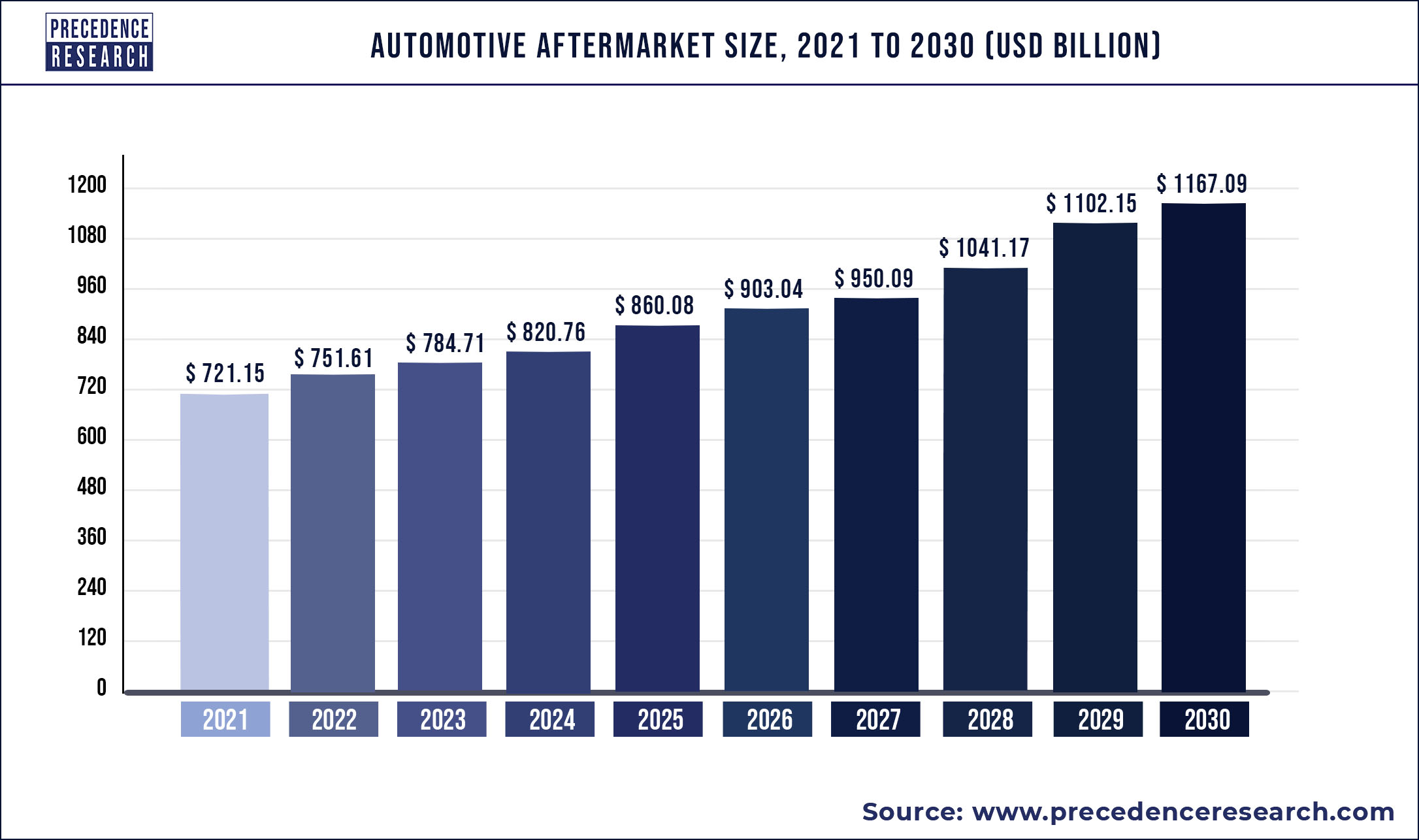

The global automotive aftermarket size reached USD 751.61 billion in 2022 and is expected to expand around USD 1167.09 billion by 2030, growing at a CAGR of 5.49% from 2022 to 2030.

Automotive aftermarket includes post-sales replacement of vehicle parts or components to maintain the efficiency and its mobility affordable throughout the life of a vehicle. There are chain of operators in the automotive aftermarket that include multi-brand repairers, providers of technical information, parts distributors, tools manufacturers, parts manufacturers, and roadside rescue service providers.

Automotive Aftermarket Growth Factors

- Increasing sales of pre-owned and new vehicles

- Ageing of vehicles

- Poor road conditions

- Rising adoption of electric vehicle and safety technologies

- Integration of advanced technologies

Regional Snapshots

The North America region has the largest market share of 35.50% over the period 2016 to 2027. This is attributed to the rising sale and production of both passenger and commercial vehicles in the region. The Europe region has accounted market share of 24.15% over the period 2016 to 2027. The APAC region has expected to hit 22.03% market share over the period 2016 to 2027. The LATAM region is expected to surpass 10.79% market share and MEA 7.54%.

COVID -19 Impact

This situation due to COVID -19 has led to the uncertainty around its impact on various industries. The majorly affected sectors include airlines, automotive, manufacturing sector, construction sites, pharmaceuticals, medical, food & beverages and tourism. The automotive industry was standstill for some period of time which has caused some losses to these companies and thus, has affected the Automotive Aftermarket sector. The demand towards addressing Covid-19 situation was more than others consumer goods sector. This has reduced the demand and inclination of the Automotive Aftermarket and other operations resulting in decreased spending. The car sales and services industry has also witnessed huge losses owing to the suspended manufacturing process, low demand from end users. The labor issue has impacted these companies largely.

The Overall Automotive market has been affected. Various governments are pumping money into the economy, for instance US Fed have taken an initiative to pump $1.5 trillion into the financial system similar initiatives have been taken by various governments, which is expected to reduce the negative impact on the economy. Such initiatives may help to decrease the severity of the impact on these industries.

The outbreak of COVID-19 has brought massive slowing of the supply chain; uncertainty in the stock market; falling business confidence, and growing panic among the population. Despite the growing uncertainty and panic, technology suppliers must continue to focus on their long-term investments, maintain engagement with partners and prospects, and look to specific markets for stability. Emerging technologies like Smart Transportation, Industry 4.0, the Internet of Things and innovation in the high performance material will be fundamental to an overall recovery by the car manufacturing & modification sector.

Read More: Monorail System Market Size to Record US$ 9.27 Billion by 2032

Market Drivers

- Rise in technological advancement

The demand for aftermarket parts such as catalytic converters and electronic chips to increase fuel economy on older vehicles has risen in response to the demand for environmentally sustainable vehicles. Owners are particularly interested in adding new features to their older cars which serves as a key driver for the market growth of automotive aftermarket industry.

- Government regulations aid in market growth

In many countries the government has imposed strict car emission regulations, putting pressure on product manufacturers to produce environmentally friendly and high-efficiency automobile parts for both domestic and international markets that enhances the demand of automotive aftermarket and estimated to pace at increasing rate in the coming years.

Market Restraints

- Ratification of vehicles safety technologies

With the growing technological changes, the vehicles are well equipped with sensors which leads to excellent driving behavior and thereby lessens the wear tear of brakes and other component in vehicles. This factor hinders the replacement of components and hampers the market growth of automotive aftermarket.

- High Operational Cost

The cost of vehicle modification is high for most of the population. The parts of vehicles are sold as a premium option to the comparatively upper-class consumers who choose to pay a premium price for them. However, if this becomes more widely used, the price would have to come down so that the common people can afford. Therefore, it hinders the market expansion of automotive aftermarket

Market Opportunities

- Increasing in older vehicles and their age –

The average age of vehicles continues to rise with passenger cars and the light truck segment, average age stands at 11.3 years. The older vehicles become; the more parts require remaining on the road. There has been a 14% increase in the age of automobiles from the past six years which serves as a positive sign for the development of the market.

- E-commerce changed the automotive aftermarket

The digitalization which is digital influence has transformed the way a consumer makes a purchase. Aftermarket customers read everything possible, including reviews and videos. Year after year, consumers are besieged with online advertising, both on desktops and smartphones. Wheel and the tire websites and aftermarket touch-up paint websites are two fastest growing segments in the industry. Thus, the aftermarket industry is catching up the rest of the world by using smartphone e-commerce technologies.

Report Highlights

- The North America led the automotive aftermarket in terms of revenue in 2020 and analyzed to witness prominent growth over the forecast period. In this region, the growing demand of consumers for vehicle modification for improved performance and resale value has widened the market of automotive industry. The trend of sales of pre-owned vehicles is rising and creating a huge demand for automotive aftermarket in the forecasting period. Also, the vehicles or components of vehicle demand replacement after certain years of usage which serves as the key factors in expanding the market in U.S.

- Europe is anticipated to dominate the global automotive aftermarket mainly due to the increasing disposable income and consumer preferences for replacement products to improve vehicle performance. Changes in lifestyle with changing trends and easy customization, consumers use their aftermarket products to replace original equipment as they are lightweight, robust and versatile in terms of customization. Increasing sales through major online platforms like amazon.com, ebay, Rakuten and Oscaro will multiply the growth of the Europe Automotive Aftermarket.

- Asia Pacific is witnessing significant growth owing to growing automotive production and by the increase of automotive manufacturers to increase and improve their performance in terms of appearance, speed, sound and other aspects. Growing automobile manufacturing industry especially in countries like China, India and Korea the requirement for large number of automotive parts and components is increasing which is one of major factor leading to market growth in Asia.

- In terms of revenue, tire dominated the global automotive aftermarket with US$ 202.04 billion by 2027 at 5.47% CAGR and anticipated to continue its dominance over the forecast period due to small replacement cycle compared to its counterparts.

- On the basis of distribution channel, retailer segment projected to hit revenue US$ 720.17 billion by 2027 with CAGR of 4.74%, whereas wholesale and distribution segment witness the fastest growth over the projected years.

- By technology, genuine parts are expected to dominate the automotive aftermarket with a CAGR of 4.63% over forecast period 2021 to 2027. Genuine Parts are manufactured by the manufacturers and also by the OEMs. As genuine parts are manufactured by manufacturers themselves, they have greater assurance of quality, are diverse, easy to find, and also include warranty. Genuine parts are more expensive when compared with certified and uncertified parts.

Segments Covered in the Report

By Product

- Battery

- Tire

- Filters

- Brake Parts

- Turbochargers

- Lighting & Electronic Components

- Body Parts

- Exhaust Components

- Wheels

- Others

By Application

- DIFM (Do it for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEM’s)

By Distribution Channel

- Wholesalers & Distributors

- Retailers

- OEMs

- Repair Shops

By Certification

- Certified Parts

- Genuine Parts

- Uncertified Parts

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333