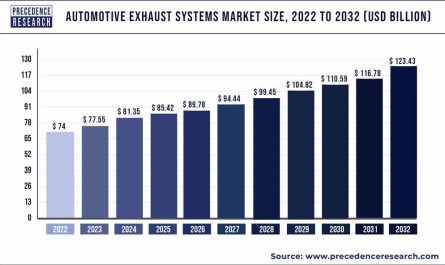

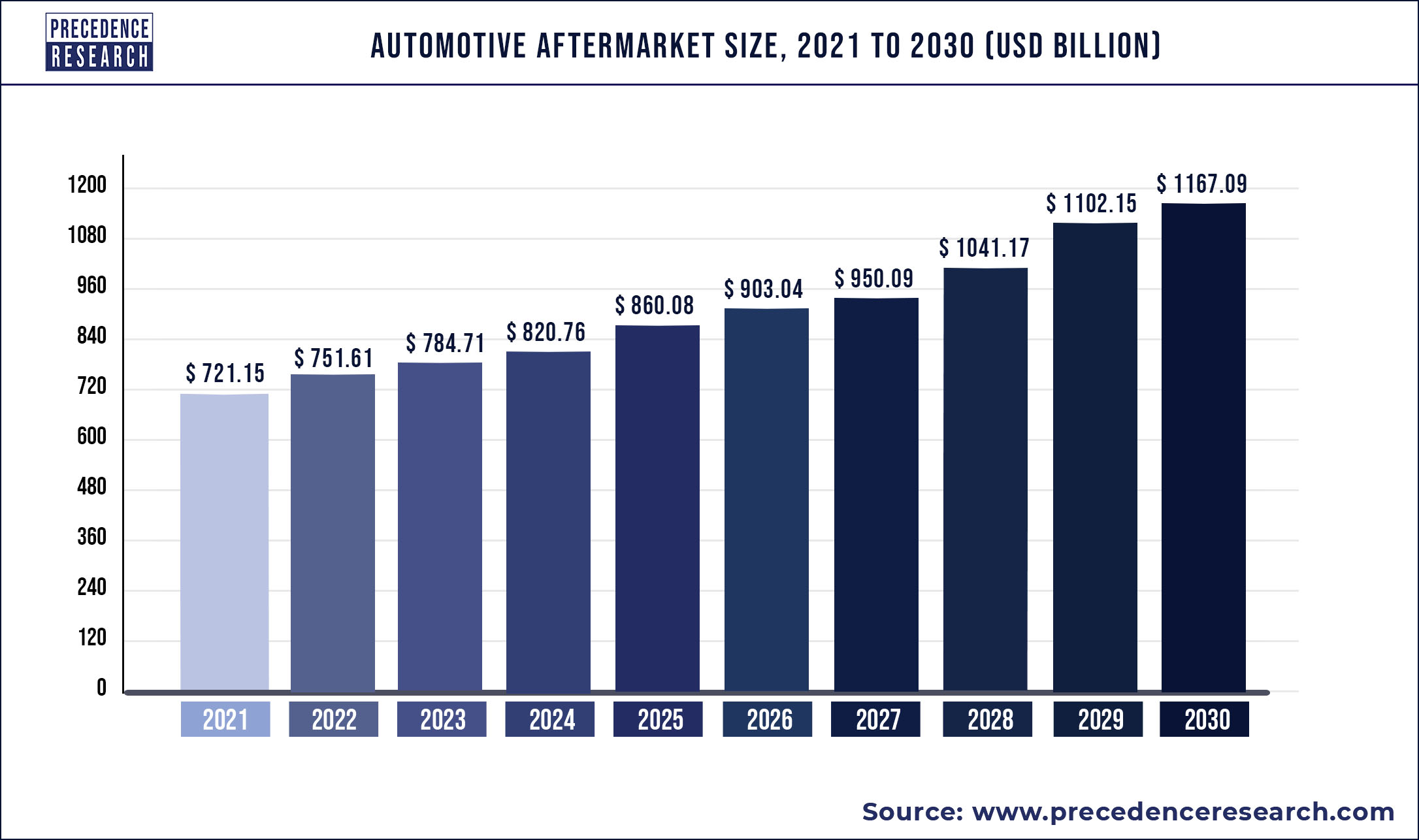

The global automotive aftermarket size is expected to hit US$ 1167.09 billion by 2030 from at US$ 751.61 billion in 2022 with a registered CAGR of 5.49% from 2022 to 2030.

After the original equipment manufacturer (OEM) sells the vehicle to the consumer, the automotive aftermarket is responsible for the manufacturing, distribution and sales, and installation of automobile parts, equipment, and accessories. The original equipment manufacturer (OEM) may or may not manufacture the accessories and components for sale. The global automotive aftermarket is being driven by key factors such as increased internet penetration combined with improvements in the telematics industry. These variables encourage online sales of automobile parts, resulting in more frequent purchases.

The growing demand for automobile in emerging markets is expected to boost market growth. Due to numerous environmental requirements, technological advancements, and the adoption of various eco-friendly practices in automobile production are expected to increase demand for alternative automotive parts.

Getba Sample: https://www.precedenceresearch.com/sample/1111

Regional Snapshot

North America region accounted largest revenue share in the automotive aftermarket in 2020. Due to the presence of major manufacturers, the North America has become a major automobile parts and accessories aftermarket production hub. The market in this region is predicted to grow rapidly, due to growing fabrication industry in Mexico.

Asia-Pacific region is the fastest growing region in the automotive aftermarket. In expanding markets such as India, China, and Japan, the market in Asia-Pacific is characterized by rising vehicle sales of commercial and passenger vehicles. In addition, there has been a rise in mergers and acquisitions among the key market players, as a result of new regulatory frameworks related to tax. These factors are expected to propel Asia-Pacific automotive aftermarket.

Europe is anticipated to dominate the global automotive aftermarket mainly due to the increasing disposable income and consumer preferences for replacement products to improve vehicle performance. Changes in lifestyle with changing trends and easy customization, consumers use their aftermarket products to replace original equipment as they are lightweight, robust and versatile in terms of customization. Increasing sales through major online platforms like amazon.com, ebay, Rakuten and Oscaro will multiply the growth of the Europe Automotive Aftermarket.

Market Dynamics

Drivers

Surge in demand for electric vehicles

Electric vehicle demand and production have risen significantly in recent years, owing to their numerous advantages over gasoline-powered vehicles. Oil and air filters, fan belts, timing belts, head caskets, and spark plugs do not need to be replaced, making fuel-powered vehicles more cost-effective and efficient. As a result, electric vehicles are becoming the preferred mode of transportation, limiting the growth of the gasoline-powered vehicle industry. Furthermore, as a result of improved vehicle dynamics and traction control, automobile manufacturers are focusing on the development of electric vehicles equipped with cutting-edge technology. This necessitates the use of high-quality equipment and accessories. As a result, increased production of electric vehicles is expected to drive the growth of the automotive aftermarket.

Restraints

Adoption of vehicle safety technologies

The sensors in automobiles allow for reduced wear and tear on automobiles, especially tires and brakes, which are subjected to tough driving conditions on a daily basis. This element lowers the need for replacement parts, which could stifle industry growth. In addition, continual research and development for new raw materials to prevent automobile parts and accessories deterioration restricts the product penetration. As a result, the adoption of vehicle safety technologies hinders the growth of automotive aftermarket during the forecast period.

Opportunities

Rising demand for replacement parts

The rising demand for maintenance and services as a result of poor road conditions and degradation of vehicle will benefit the aftermarket components. The low production costs and an increase in the number of road accidents is all contributing to the market’s growth. As a result, the rising demand for replacement parts is creating lucrative opportunities for the growth of automotive aftermarket during the forecast period.

Challenges

High R&D expenditures

The research and development refer the actions that businesses engage in order to innovate and create new products and services. It is frequently the initial stage of the development process. The goal is usually to bring innovative products and services to market while also increasing the company’s profit. The development of new and innovative products requires research and development. The top market players of the automotive aftermarket are highly investing on the new product development. The research and development require lot of resources for the introduction of new products in the market. Thus, the high research and development expenditures is a huge challenge for the growth of automotive aftermarket during the forecast period.

Read Also: Automotive Transmission Market Size to Hit USD 259.88 Bn By 2032

Report Highlights

- In terms of revenue, tire dominated the global automotive aftermarket with US$ 202.04 billion by 2027 at 5.47% CAGR and anticipated to continue its dominance over the forecast period due to small replacement cycle compared to its counterparts. As tires have a shorter replacement cycle as compared to other component counterparts, it is projected to remain the leading segment.

- On the basis of end user, retailer segment projected to hit revenue US$ 720.17 billion by 2027 with CAGR of 4.74%, whereas wholesale and distribution segment witness the fastest growth over the projected years.

- Based on the certification, genuine parts segment is estimated to be the most opportunistic segment during the forecast period. Original equipment manufacturers (OEMs) often known as subcontractors, manufactures genuine parts. The genuine replacement parts have a higher level of quality assurance, are more diverse, are easier to locate, and come with a warranty.

Few of the prominent players in the automotive aftermarket include:

- p.A.

- 3M Company

- Continental AG

- Robert Bosch GmbH

- Federal-Mogul Corporation

- Denso Corporation

Segments Covered in the Report

By Product

- Battery

- Tire

- Filters

- Brake Parts

- Turbochargers

- Lighting & Electronic Components

- Body Parts

- Exhaust Components

- Wheels

- Others

By Application

- DIFM (Do it for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEM’s)

By Distribution Channel

- Wholesalers & Distributors

- Retailers

- OEMs

- Repair Shops

By Certification

- Certified Parts

- Genuine Parts

- Uncertified Parts

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the Worl

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/