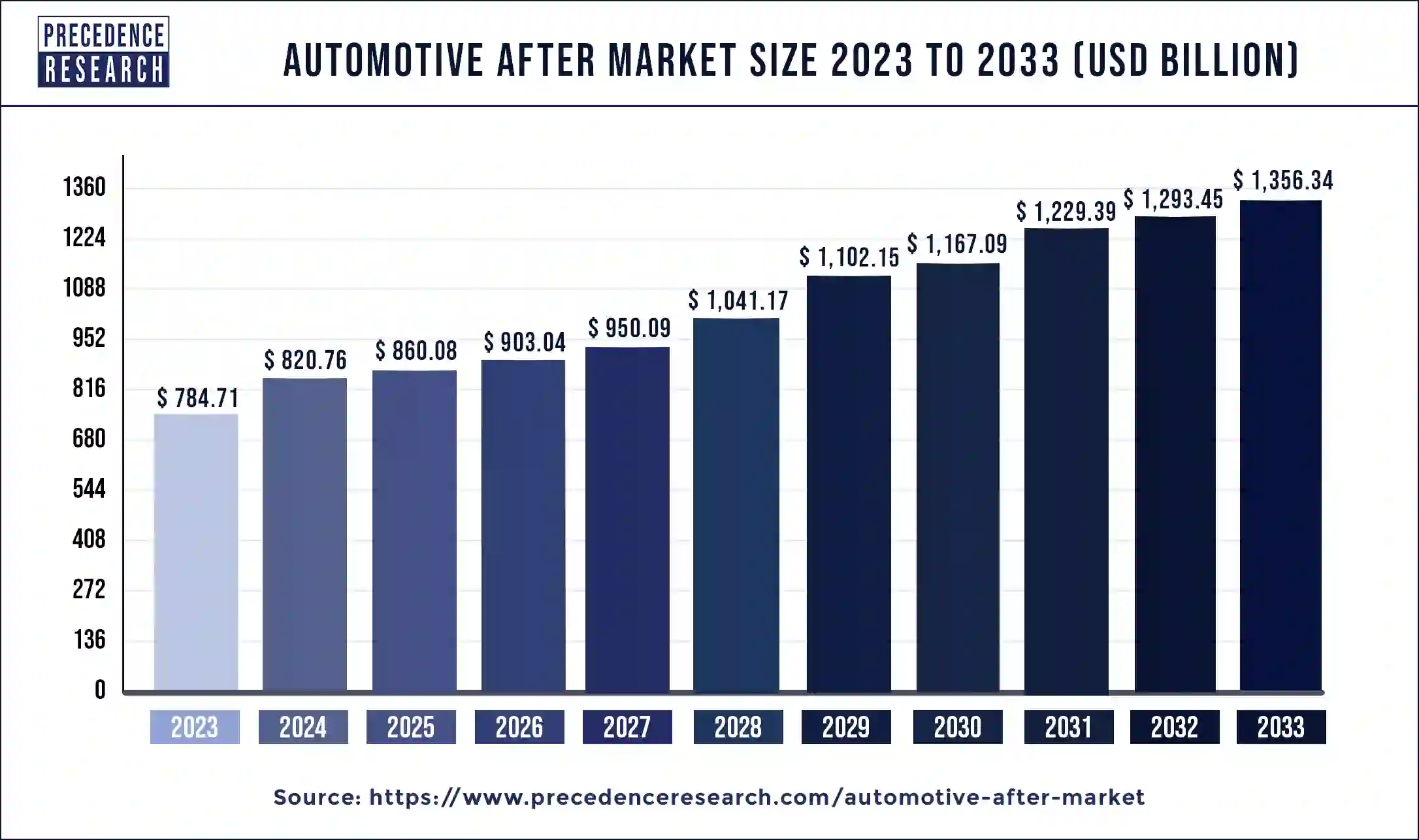

The global automotive aftermarket size is projected to attain around USD 1,356.34 billion by 2033 and it is anticipated to grow at a CAGR of 5.74% from 2024 to 2033.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1111

Key Highlights

- With a market share of 34.95%, North America was the top regional contributor in 2023.

- The tire segment maintained its position as the top-selling product in 2023.

- The DIFM (Do it for Me) segment led the application category with the highest revenue in 2023.

- The retailers segment emerged as the leading distribution channel in 2023.

- By technology, the genuine parts segment secured the highest market share in 2023.

Drivers

One of the key drivers of the automotive aftermarket is the rising number of aging vehicles on the road, leading to increased demand for replacement parts and repairs. The growing adoption of advanced automotive technologies, including telematics and diagnostic systems, is also influencing the market.

Additionally, consumers are increasingly opting for Do-It-For-Me (DIFM) services, where professional technicians handle vehicle repairs and maintenance. The expansion of e-commerce platforms has further boosted market accessibility, allowing customers to compare prices and find quality aftermarket products easily.

Opportunities

The market presents significant growth opportunities with the rise of electric vehicles (EVs), which require specialized aftermarket solutions. Additionally, the increasing popularity of digital marketplaces and mobile apps is transforming how consumers purchase and install aftermarket parts.

Sustainable and eco-friendly aftermarket solutions, such as remanufactured parts, are also gaining traction as environmental concerns grow. Developing markets, particularly in Asia Pacific and Latin America, offer lucrative opportunities due to rising vehicle ownership and improving infrastructure.

Challenges

Despite the growth prospects, the industry faces challenges such as counterfeit products and concerns over product quality and safety. The increasing complexity of modern vehicles, especially those equipped with advanced driver-assistance systems (ADAS), makes aftermarket repairs more difficult.

Furthermore, supply chain disruptions and fluctuating raw material prices impact production and distribution costs, posing hurdles for manufacturers and suppliers.

Regional Insights

North America and Europe are leading the automotive aftermarket, driven by high vehicle ownership rates and established service networks. The Asia Pacific region is experiencing rapid growth, supported by rising disposable incomes, expanding automotive fleets, and an increasing preference for aftermarket customization.

Latin America and the Middle East are also emerging as key markets, fueled by growing demand for vehicle maintenance and repair services.

Automotive Aftermarket Companies

- p.A.

- 3M Company

- Continental AG

- Robert Bosch GmbH

- Federal-Mogul Corporation

- Denso Corporation

Segments Covered in the Report

By Product

- Battery

- Tire

- Filters

- Brake Parts

- Turbochargers

- Lighting & Electronic Components

- Body Parts

- Exhaust Components

- Wheels

- Others

By Application

- DIFM (Do it for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEM’s)

By Distribution Channel

- Wholesalers & Distributors

- Retailers

- OEMs

- Repair Shops

By Certification

- Certified Parts

- Genuine Parts

- Uncertified Parts

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com