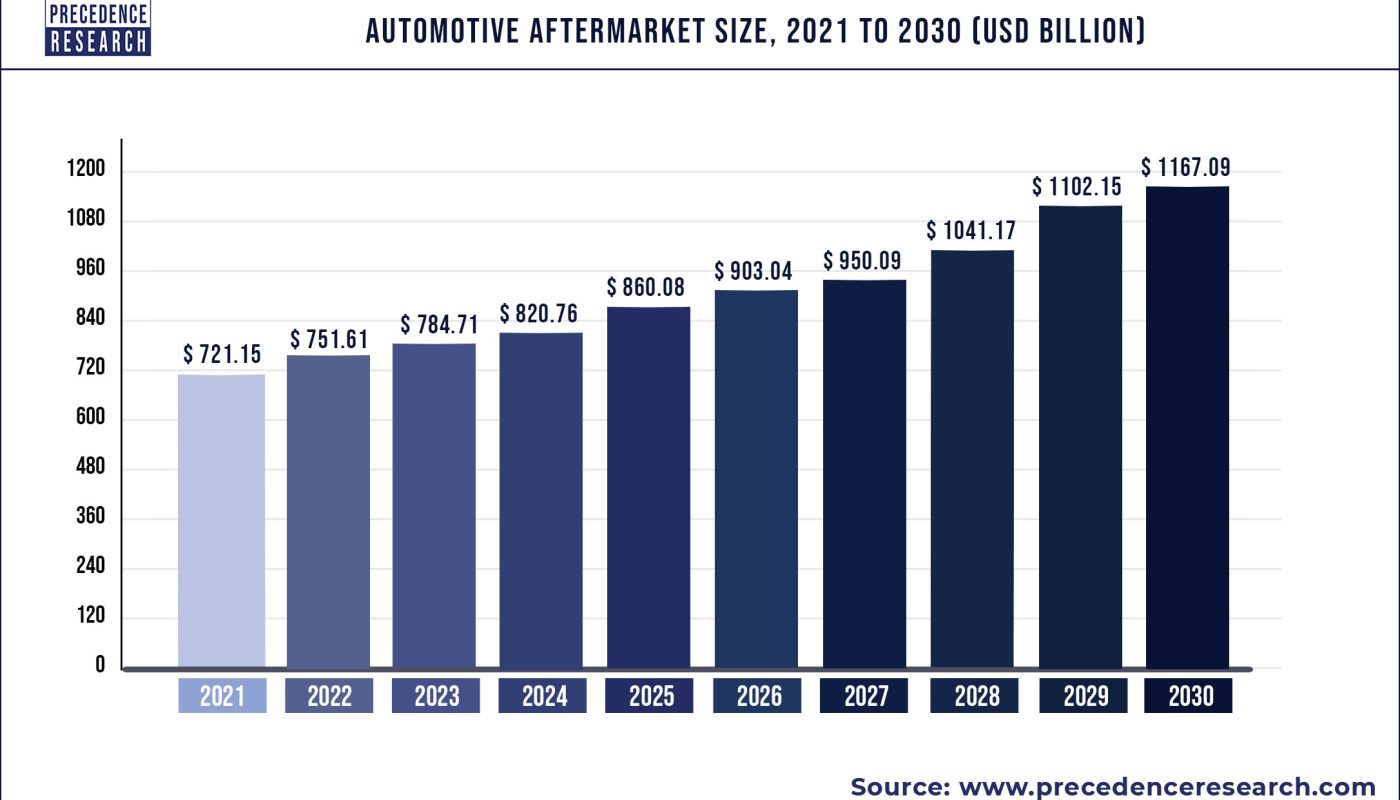

The global automotive aftermarket size was valued at USD 751.61 billion in 2022 and is predicted to hit around USD 1167.09 billion by 2030, poised to grow at a noteworthy CAGR of 5.49% from 2022 to 2030.

The automotive aftermarket refers to the secondary market of the automotive industry, encompassing the sale of parts, accessories, and services for vehicles after their initial purchase from the original equipment manufacturer (OEM). This sector plays a crucial role in the automotive ecosystem, offering a wide range of products and services to vehicle owners, repair shops, and fleet operators. The aftermarket includes both OEM-branded and aftermarket-branded components, catering to various needs and preferences of consumers. With the increasing age of vehicles on the road and the growing demand for customization and performance upgrades, the automotive aftermarket has witnessed significant growth and evolution in recent years.

Get a Smple: https://www.precedenceresearch.com/sample/1111

Table of Contents

ToggleGrowth Factors

Several factors contribute to the growth of the automotive aftermarket industry. Firstly, the increasing average age of vehicles on the road is a significant driver of aftermarket demand. As vehicles age, the need for maintenance, repairs, and replacement parts rises, thereby fueling the aftermarket sector. Additionally, technological advancements in automotive components and accessories have expanded the range of products available in the aftermarket, including performance upgrades, connected car solutions, and advanced safety features. Moreover, the rising consumer preference for customization and personalization has spurred demand for aftermarket accessories and styling products, driving further growth in the sector. Furthermore, the proliferation of e-commerce platforms has made aftermarket products more accessible to consumers, facilitating easy comparison shopping and purchase convenience.

Region:

The automotive aftermarket is a global industry, with significant regional variations in market dynamics and consumer preferences. North America, Europe, Asia-Pacific, and Latin America are among the key regions contributing to the aftermarket’s growth. North America and Europe boast mature aftermarket ecosystems, characterized by a well-established network of distributors, retailers, and service providers. In contrast, the Asia-Pacific region, particularly countries like China and India, presents immense growth opportunities due to the expanding vehicle parc and rising disposable incomes. Moreover, emerging economies in Latin America and Africa are witnessing increasing aftermarket activity driven by urbanization, rising vehicle ownership, and infrastructure development.

Scope of the Automotive Aftermarket

| Report Highlights | Details |

| Market Size | USD 1167.09 Billion by 2030 |

| Growth Rate | CAGR of 5.49% from 2022 to 2030 |

| Base Year | 2021 |

| Historic Data | 2017 to 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Replacement Part, Service Channel, Distribution Channel, Certification, Regional Outlook |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

SWOT Analysis

Strengths: The automotive aftermarket benefits from a diverse product portfolio catering to various vehicle makes and models, providing consumers with a wide range of choices. Moreover, the aftermarket’s flexibility and agility enable rapid adaptation to changing consumer preferences and market trends. Additionally, the aftermarket sector fosters competition, driving innovation and product development to meet evolving customer needs.

Weaknesses: One of the challenges facing the automotive aftermarket is the prevalence of counterfeit and low-quality products, which can undermine consumer trust and pose safety risks. Moreover, the aftermarket’s reliance on the OEM supply chain for parts and components can lead to pricing pressures and supply chain disruptions, impacting profitability and operational efficiency.

Opportunities: The increasing adoption of electric and hybrid vehicles presents a significant opportunity for the aftermarket sector, as these vehicles require specialized components and services. Furthermore, advancements in vehicle connectivity and data analytics open up new avenues for aftermarket players to offer value-added services such as predictive maintenance and remote diagnostics. Moreover, the growing trend of vehicle subscription services and shared mobility platforms creates a demand for flexible aftermarket solutions tailored to the needs of fleet operators and mobility service providers.

Threats: Regulatory changes and compliance requirements pose a potential threat to the aftermarket industry, particularly concerning emissions standards, safety regulations, and intellectual property rights. Additionally, the proliferation of ride-sharing and autonomous vehicles could disrupt traditional vehicle ownership patterns, impacting aftermarket demand. Furthermore, geopolitical uncertainties and trade tensions may affect global supply chains and trade flows, posing risks to aftermarket players reliant on international sourcing and distribution networks.

Read Also: Automotive Logistics Market Size to Cross USD 636.26 bn by 2032

Competitive Landscape:

The automotive aftermarket is characterized by intense competition among a diverse range of players, including OEMs, independent aftermarket suppliers, distributors, retailers, and service providers. OEMs often have a significant presence in the aftermarket segment, leveraging their brand reputation, technical expertise, and extensive dealer networks to capture aftermarket sales. Independent aftermarket suppliers, on the other hand, compete based on factors such as product quality, pricing, and distribution reach. Distributors and retailers play a crucial role in the aftermarket value chain, serving as intermediaries between manufacturers and end consumers. Additionally, service providers such as repair shops, garages, and online platforms offer installation, maintenance, and repair services, contributing to the overall aftermarket ecosystem. Overall, the competitive landscape of the automotive aftermarket is dynamic and continually evolving, driven by innovation, market consolidation, and changing consumer preferences.

Few of the prominent players in the automotive aftermarket include:

- p.A.

- 3M Company

- Continental AG

- Robert Bosch GmbH

- Federal-Mogul Corporation

- Denso Corporation

Segments Covered in the Report

By Product

- Battery

- Tire

- Filters

- Brake Parts

- Turbochargers

- Lighting & Electronic Components

- Body Parts

- Exhaust Components

- Wheels

- Others

By Application

- DIFM (Do it for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEM’s)

By Distribution Channel

- Wholesalers & Distributors

- Retailers

- OEMs

- Repair Shops

By Certification

- Certified Parts

- Genuine Parts

- Uncertified Parts

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/