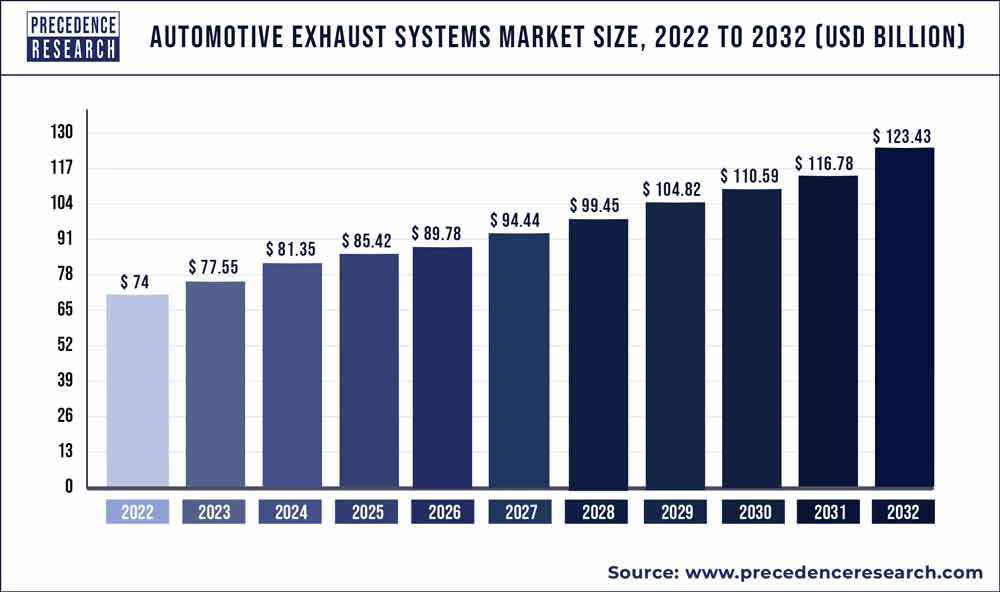

The global automotive exhaust systems market size was estimated at USD 77.55 billion in 2023 and is projected to reach around USD 123.43 billion by 2032, at a CAGR of 5.3% from 2023 to 2032.

Key Takeaways

- By component, the exhaust manifold segment dominated the market with a revenue share of around 40% in 2022.

- The muffler component segment is expected to grow at a CAGR of 7.2% from 2023 to 2032.

- By fuel type, the gasoline segment hit a revenue share of over 82% in 2022.

- By vehicle, the passenger car segment has garnered a 71% market share in 2022 with a CAGR of 5.6%.

- The commercial vehicles segment is anticipated to grow at a CAGR of 8.3% between 2023 to 2032.

- In 2022, Asia Pacific region has captured 62% revenue share 2022 and is expected to grow at a CAGR of 7.1% from 2023 to 2032.

- The Latin American region is expected to grow at a CAGR of 6.9% from 2023 to 2032.

The automotive exhaust systems market is a significant segment within the automotive industry, involving the design, production, and distribution of exhaust systems for various types of vehicles. These systems play a crucial role in managing emissions, reducing noise, and improving engine performance and fuel efficiency. As environmental regulations tighten worldwide, the demand for advanced exhaust systems has been increasing. The market includes various components such as catalytic converters, mufflers, resonators, and tailpipes.

Get a Sample: https://www.precedenceresearch.com/sample/2102

Growth Factors

The growth of the automotive exhaust systems market is driven by several factors. Firstly, increasing environmental awareness and stringent emissions regulations have led to the development of more efficient and cleaner exhaust systems. This trend is further fueled by the rise of electric and hybrid vehicles, which often require specialized exhaust systems. Additionally, the growing demand for vehicles in emerging economies contributes to market growth. Advances in technology, such as lightweight materials and innovative designs, also play a role in the market’s expansion.

Region Insights

Regionally, the market is most prominent in North America, Europe, and Asia-Pacific. North America and Europe have strict emissions standards and a high adoption rate of advanced exhaust systems. In contrast, the Asia-Pacific region is expected to witness the highest growth due to the rapid industrialization and increase in vehicle ownership, particularly in countries like China and India. Emerging economies in Latin America and the Middle East are also likely to see growth in the automotive exhaust systems market due to infrastructure development and urbanization.

Automotive Exhaust Systems Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 77.55 Billion |

| Market Size by 2032 | USD 123.43 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.3% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Vehicle Type, Fuel Type, After-treatment Device, Component, Technology, and Geography |

Drivers

The primary drivers of the automotive exhaust systems market include the increasing adoption of emission control regulations globally, the growth in vehicle production, and the demand for better fuel efficiency. The push towards electrification and hybridization of vehicles also drives innovation in exhaust systems, as these systems must adapt to the changing automotive landscape.

Opportunities

Opportunities in the market lie in the development of advanced exhaust systems, including those that cater to electric and hybrid vehicles. Companies can capitalize on the demand for lightweight, efficient, and cost-effective exhaust systems. Moreover, there is potential for growth in emerging markets with rising disposable incomes and increased vehicle sales. Investing in research and development to create innovative exhaust solutions will offer competitive advantages.

Challenges

The market faces challenges such as fluctuating raw material prices and the shift towards electric vehicles, which may reduce demand for traditional exhaust systems. The complexity of regulatory compliance across different regions can also pose challenges for manufacturers. Additionally, intense competition in the market can lead to price wars and impact profitability. Overcoming these challenges will require companies to be agile, invest in innovation, and stay ahead of regulatory changes.

Read Also: On-Board Diagnostics (OBD) Aftermarket Size, Share, Report By 2032

Recent Developments:

- Futaba Industrial Co., Ltd. declared in May 2021 that it would show its goods at the Department Of mechanical engineering Exhibition 2021 Online. The business will provide emissions and systems in the body elements that will lessen the release of pollutants, increase fuel economy, and lighten vehicles for the Sustainable Development Goals.

- In 2021 Apr, Faurecia revealed that the manufacturing hub for its Clean Transportation Department, the Koriyama Factory in Koriyama Municipal, Fukushima Prefecture, will begin operations in the second quarter of 2021. The Koriyama Factory was supposed to begin operation about Sept 2020; however, it was delayed because the automaker to which it supplied components temporarily reduced output as a result of the coronavirus outbreak (COVID-19).

- Eberspaecher declared in March 2021 that the series manufacture of tunnels mixing for exhaust-emission conversions in commercial vehicles and passenger vehicles had begun. The mixer makes sure that the watery urea solutions and exhaust gas are mixed and evaporated as efficiently as possible.

- To create a comprehensive effluent temperature control system that would permit producers of commercial vehicles & lightweight cars to comply with forthcoming pollution rules, Tenneco’s Air Quality trade organization partnered together Eaton’s Vehicles Department in Mar 2021.

- A partnership agreement for a 50:50 ownership split was struck in Feb 2019 by Eberspaecher and Sharda Motors Manufacturing Ltd. To meet the strictest emissions targets, Bharat Stage VI, the new partnership will design, build, and market emissions after-treatment devices for Indian commercial car manufacturers.

Automotive Exhaust Systems Market Scope

- BASF SE

- Benteler International AG

- Bosal International N.V.

- Continental AG

- Eberspacher Climate Control Systems GmbH & Co. KG

- Faurecia S.A.

- Friedrich Boysen GmbH & Co. KG

- Futaba Industrial Co. Ltd.

- Harbin Airui Automotive Exhaust Systems Co. Ltd.

- Johnson Matthey

- Klarius Products Ltd

- Sango Co., Ltd.

- Sejong Industrial Co., Ltd.

- Tenneco, Inc.

- Umicore

- Yutaka Giken Company Limited

Segments covered in the report:

By Vehicle Type

- Passenger Cars

- Commercial Vehicle

By Fuel Type

- Gasoline

- Diesel

By After-treatment Device

- LNT

- GPF

By Component

- Exhaust Manifold

- Muffler

- Catalytic Converter

- Oxygen Sensor

- Exhaust Pipes

By Technology

- Diesel Oxidation Catalyst (DOC)

- Diesel Particulate Filter (DPF)

- Selective catalytic reduction (SCR)

- Exhaust gas recirculation (EGR)

- Gasoline Particulate Filter (GPF)

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/