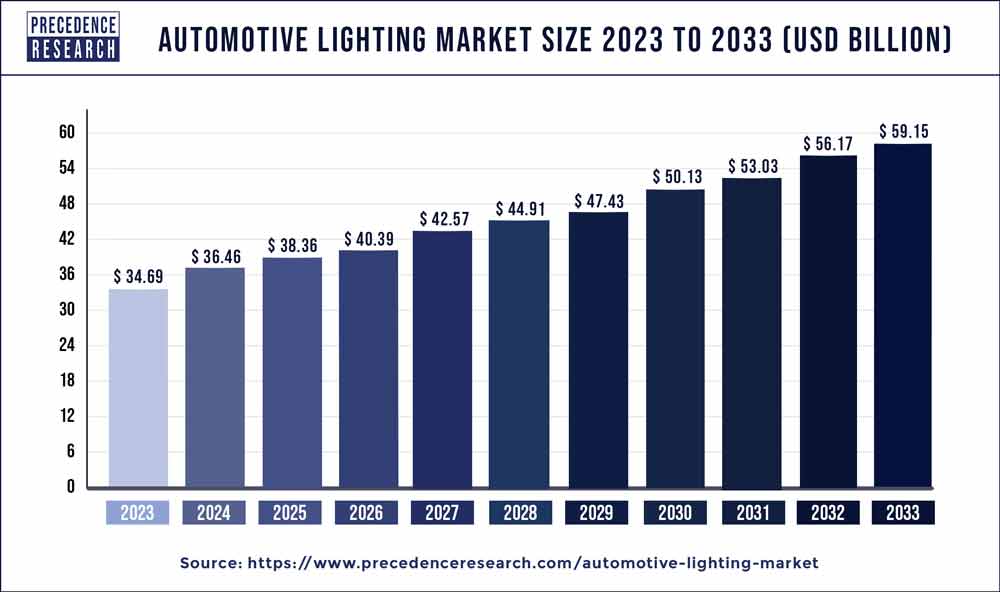

The global automotive lighting market size reached USD 34.69 Billion in 2023 and is projected to reach USD 59.15 Billion by 2033, with a CAGR of 5.52% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the biggest market share of 40.11% in 2023.

- By Technology, the halogen segment registered the maximum market share in 2023.

- By Technology, the Light Emitting Diode (LED) segment is expected to expand at the fastest CAGR over the projected period.

- By Application, the front/headlamps segment is expected to expand at the fastest CAGR over the projected period.

The automotive lighting market has been experiencing significant growth in recent years, driven by a combination of technological advancements, increasing vehicle production, and stringent regulations regarding vehicle safety and energy efficiency. This sector plays a crucial role in enhancing road safety, providing visibility for drivers, and enhancing the aesthetic appeal of vehicles. In this overview, we’ll delve into the growth factors, regional insights, drivers, opportunities, and restraints shaping the automotive lighting market.

Get a Sample: https://www.precedenceresearch.com/sample/1079

Growth Factors

The automotive lighting market is propelled by various growth factors. One of the primary drivers is the increasing adoption of advanced lighting technologies such as LED (Light Emitting Diode) and OLED (Organic Light Emitting Diode). These technologies offer superior energy efficiency, longer lifespan, and enhanced design flexibility compared to traditional halogen and xenon lighting systems. Moreover, the rising demand for premium vehicles equipped with advanced lighting features such as adaptive headlights, ambient lighting, and dynamic turn signals is driving market growth.

Furthermore, stringent government regulations mandating the use of energy-efficient lighting systems and advanced safety features in vehicles are driving the adoption of LED and OLED lighting solutions. Regulations such as the European Union’s directive on Daytime Running Lights (DRLs) and the United States’ Federal Motor Vehicle Safety Standards (FMVSS) for automotive lighting are encouraging automakers to invest in advanced lighting technologies to comply with regulatory requirements.

Region Insights

The automotive lighting market exhibits varying dynamics across different regions. In mature markets such as North America and Europe, the demand for advanced lighting technologies is driven by factors such as consumer preference for safety features, stringent regulations, and the presence of leading automotive manufacturers. North America, particularly the United States, is witnessing increased adoption of LED lighting systems in vehicles, driven by regulations such as the National Highway Traffic Safety Administration’s (NHTSA) Federal Motor Vehicle Safety Standards (FMVSS) and consumer demand for energy-efficient lighting solutions.

In Europe, the automotive lighting market is characterized by a strong emphasis on design aesthetics, safety, and sustainability. Leading automotive lighting manufacturers such as Hella, Osram, and Valeo are headquartered in Europe and play a significant role in driving innovation and technology adoption in the region. Additionally, emerging markets in Asia Pacific, particularly China and India, are experiencing rapid growth in the automotive lighting market due to increasing vehicle production, rising disposable incomes, and government initiatives to promote road safety and vehicle electrification.

Automotive Lighting Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 34.69 Billion |

| Market Size by 2033 | USD 59.15 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.52% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, Product, Vehicle, Application, Region |

Automotive Lighting Market Dynamic

Drivers

Several drivers are fueling the growth of the automotive lighting market globally. One of the primary drivers is the growing demand for vehicle safety features and advanced driver assistance systems (ADAS). Automotive lighting plays a critical role in enhancing visibility and reducing the risk of accidents, especially during nighttime driving and adverse weather conditions. As consumers prioritize safety features when purchasing vehicles, automakers are incorporating advanced lighting technologies such as adaptive headlights, automatic high beam control, and pedestrian detection systems to improve vehicle safety ratings and enhance driver confidence.

Moreover, the growing trend towards vehicle customization and personalization is driving demand for innovative lighting solutions that can enhance the aesthetic appeal of vehicles. LED and OLED lighting systems offer design flexibility, allowing automakers to create unique lighting signatures, illuminated logos, and interior ambient lighting effects that differentiate their vehicles in the market.

Opportunities:

The automotive lighting market presents significant opportunities for manufacturers and suppliers to capitalize on emerging trends and technologies. One such opportunity lies in the integration of smart lighting systems and connectivity features in vehicles. With the advent of connected and autonomous vehicles, there is a growing demand for intelligent lighting solutions that can communicate with other vehicle systems, adjust lighting intensity based on driving conditions, and provide real-time feedback to drivers.

Additionally, the shift towards electric and autonomous vehicles is driving demand for lightweight and energy-efficient lighting solutions that can extend the range of electric vehicles and enhance overall efficiency. Manufacturers are investing in research and development to develop innovative lighting materials, such as organic LEDs (OLEDs) and micro-LEDs, that offer improved energy efficiency and design flexibility while meeting the stringent requirements of electric and autonomous vehicles.

Restraints:

Despite the positive growth outlook, the automotive lighting market faces several challenges and restraints. One of the key restraints is the high cost associated with advanced lighting technologies such as LED and OLED. While these technologies offer long-term cost savings in terms of energy efficiency and durability, the initial upfront costs can be prohibitive for some consumers, particularly in emerging markets where price sensitivity is high.

Furthermore, supply chain disruptions and raw material shortages can impact the production and availability of automotive lighting components, leading to delays and increased costs for manufacturers. The global semiconductor shortage, exacerbated by factors such as the COVID-19 pandemic and geopolitical tensions, has affected the production of automotive lighting components, highlighting the vulnerability of the supply chain to external disruptions.

Read Also: Autonomous Vehicle Market Size to Reach USD 2,353.93 BN by 2032

Automotive Lighting Market Companies

- DENSO Corporation

- HellaKGaAHueck& Co.

- Hyundai Mobis

- Valeo

- Koito Manufacturing Co. Ltd.

- OsramLicht AG

- Koninklijke Philips N.V.

- Stanley Electric Co. Ltd.

- ROBERT BOSCH GmbH

- ZizalaLichtsysteme GmbH

Segments Covered in the Report

This research study comprises complete valuation of the market revenue with the help of widespread quantitative and qualitative insights, and prognoses of the market. This report presents breakdown of market into forthcoming and niche segments. Additionally, this research study gauges market revenue growth and its drift at global, regional, and country from 2021 to 2033. This report includes market division and its revenue assessment by categorizing it depending on technology, product sale, vehicle type, application, and region:

By Technology

- LED

- Halogen

- Xenon/HID

By Product Sale

- Aftermarket Products

- Original Equipment Manufacturers (OEMs)

By Vehicle Type

- ICE

- Commercial Vehicle

- Passenger Vehicle

- Electric Vehicle

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Application

- Front/Headlamps

- Side

- Rear Lighting

- Interior Lighting

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/