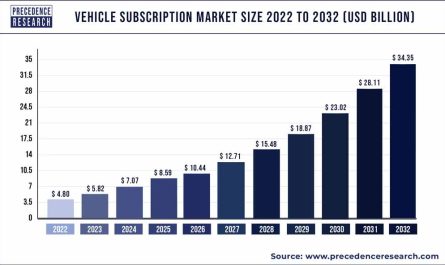

The global automotive lightweight materials market was valued at USD 65.38 billion in 2019 and is expected to reach USD 115.37 billion by 2027 and is poised to grow at a CAGR of 7.4% from 2020 to 2027.

Automotive lightweight materials are prominently used in automotive industry to boost their speed and fuel efficiency by reducing their weight. These lightweight materials are an appropriate replacement for heavy generic materials that were previously used to build the outer frame of vehicles owing to the advantages that include improved handling, enhanced strength, less material consumption, and low corrosion rate. Carbon fiber is one those lightweight materials that is extensively used by automobile manufacturers worldwide, as it notably reduces the weight of the vehicle while preserving the strength.

Growth Factors

Shifting trend towards new powertrain technologies coupled with higher emphasis on fuel economy standards are the key forces that drives the adoption of lightweight materials over the analysis period. The product demand is positively impacted by the increasing inclination towards battery-powered electric vehicles, as they carry an additional weight due to the components that include electric motors and batteries, and consequently require lightweight materials to improve the vehicle efficiency. Reduced weight provides multiple benefits that include improved vehicle performance & handling along with controlled vibration & noise.

However, high cost of lightweight materials, limited infrastructure availability, and supply chain volatility may hinder the growth of automotive lightweight materials market over the study timeframe.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1087

Report Scope of the Automotive Lightweight Materials Market

| Report Highlights | Details |

| Market Size | USD 115.37 Billion by 2027 |

| Growth Rate | CAGR of 7.4% from 2021 to 2027 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2021 |

| Forecast Period | 2021 to 2027 |

| Segments Covered | Vehicle, Material, Application, Region |

Report Highlights

- The Asia Pacific was projected as the front-runner in terms of consumption for the year 2019 owing to rapid growth in the adoption of electric and hybrid electric vehicles in the region

- Europe and North America are the prominent revenue contributors in the global market due to availability of advanced transportation infrastructure as well as large R&D investment

- Based on vehicle, passenger vehicle witness high demand for lightweight materials compared to other types of vehicles owing to high sales percentage across the globe

- Light commercial vehicles exhibit lucrative growth during the forecast period because of escalating trend of e-commerce and online shopping

- Metals alloys held the significant value share in the global automotive lightweight materials market in the year 2019 and estimated to be maintain its dominance by 2027

- High-strength Steel [HSS] is a type of metal that encounters prominent demand after aluminum

- Powertrain application expected to be the fastest growing segment over the forecast period due to its significant contribution of more than 27% in the vehicle’s weight

Regional Snapshots

In 2019, the Asia Pacific emerged as the dominant market for the automotive lightweight materials. This is mainly attributed to the on-going green revolution in various countries of Asia. For instance, China has announced its plan to convert its public transportation sector with green mobility by the end of 2025. In the wake of same, the country is significantly investing in the upgradation of transport infrastructure in support of the electric and advanced vehicle technology. Similarly, other countries such as Singapore, India, Malaysia, Japan, and Korea are also following the same path and supporting the electric vehicle adoption across the country.

On the other side, Europe being an automotive hub contributes prominently towards the value gain in the global automotive lightweight materials market. The region is a home for several OEMs that include Audi, Mercedes, Porsche, BMW, Ferrari, Alfa Romeo, Bentley, Aston Martin, Jaguar, and many more, this also positively influence the market growth of lightweight materials in the region. In addition, the government in the region has issued stringent norms pertaining to carbon emission such as Euro 6 that will significantly reduce the pollutants that include carbon monoxide and nitrogen oxide, thereby improving the air quality along with the fuel efficiency of the vehicle.

Key Players & Strategies

The global automotive lightweight materials market is highly competitive in nature, as the market players are prominently involved in the inorganic growth strategies such as merger & acquisition, partnership, and joint venture. Furthermore, the industry participants also introduce novel approach for identifying the supply and demand gaps by delivering materials with multiple benefits. For instance, in May 2018, SABIC developed new materials for autonomous, connected, and electric vehicles. Technical expertise in chassis and crash solutions aids the development and design of light reinforcement parts for improving vehicle crash worthiness.

In addition, these industry players also focus prominently on new product development and enhancement. For instance, in March 2018, LyondellBasell introduced its new materials to advance surfaces at the Plastics in the Automotive Engineering technical conference that was organized by the Association of German Engineers (VDI) in Germany.

Some of the prominent players in the automotive lightweight materials market include:

- Henkel AG & Co.

- DuPont

- NovaCentrix

- KGaA

- Intrinsiq Materials, Inc.

- Creative Materials Inc.

- Vorbeck Materials Corporation, Inc

- Johnson Matthey PLC

- Heraeus Holding GmbH

- Applied Ink Solutions

Segments Covered in the Report

By Vehicle

- Passenger Vehicles

- Heavy Commercial Vehicles [HCVs]

- Light Commercial Vehicles [LCVs]

By Material

- High-strength Steel [HSS]

- Metal Alloys

- Polymers

- Composites

By Application

- Exterior

- Interior

- Powertrain

- Structural

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automotive Lightweight Material Market, By Vehicle

7.1. Automotive Lightweight Material Market, by Vehicle Type, 2020-2027

7.1.1. Passenger Vehicles

7.1.1.1. Market Revenue and Forecast (2016-2027)

7.1.2. Heavy Commercial Vehicles [HCVs]

7.1.2.1. Market Revenue and Forecast (2016-2027)

7.1.3. Light Commercial Vehicles [LCVs]

7.1.3.1. Market Revenue and Forecast (2016-2027)

Chapter 8. Global Automotive Lightweight Material Market, By Application

8.1. Automotive Lightweight Material Market, by Application, 2020-2027

8.1.1. High-strength Steel [HSS]

8.1.1.1. Market Revenue and Forecast (2016-2027)

8.1.2. Metal Alloys

8.1.2.1. Market Revenue and Forecast (2016-2027)

8.1.3. Polymers

8.1.3.1. Market Revenue and Forecast (2016-2027)

8.1.4. Composites

8.1.4.1. Market Revenue and Forecast (2016-2027)

Chapter 9. Global Automotive Lightweight Material Market, By Material

9.1. Automotive Lightweight Material Market, by Material, 2020-2027

9.1.1. Exterior

9.1.1.1. Market Revenue and Forecast (2016-2027)

9.1.2. Interior

9.1.2.1. Market Revenue and Forecast (2016-2027)

9.1.3. Powertrain

9.1.3.1. Market Revenue and Forecast (2016-2027)

9.1.4. Structural

9.1.4.1. Market Revenue and Forecast (2016-2027)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2016-2027)

Chapter 10. Global Automotive Lightweight Material Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.1.2. Market Revenue and Forecast, by Application (2016-2027)

10.1.3. Market Revenue and Forecast, by Material (2016-2027)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.1.4.2. Market Revenue and Forecast, by Application (2016-2027)

10.1.4.3. Market Revenue and Forecast, by Material (2016-2027)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.1.5.2. Market Revenue and Forecast, by Application (2016-2027)

10.1.5.3. Market Revenue and Forecast, by Material (2016-2027)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.2.2. Market Revenue and Forecast, by Application (2016-2027)

10.2.3. Market Revenue and Forecast, by Material (2016-2027)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.2.4.2. Market Revenue and Forecast, by Application (2016-2027)

10.2.4.3. Market Revenue and Forecast, by Material (2016-2027)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.2.5.2. Market Revenue and Forecast, by Application (2016-2027)

10.2.5.3. Market Revenue and Forecast, by Material (2016-2027)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.2.6.2. Market Revenue and Forecast, by Application (2016-2027)

10.2.6.3. Market Revenue and Forecast, by Material (2016-2027)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.2.7.2. Market Revenue and Forecast, by Application (2016-2027)

10.2.7.3. Market Revenue and Forecast, by Material (2016-2027)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.3.2. Market Revenue and Forecast, by Application (2016-2027)

10.3.3. Market Revenue and Forecast, by Material (2016-2027)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.3.4.2. Market Revenue and Forecast, by Application (2016-2027)

10.3.4.3. Market Revenue and Forecast, by Material (2016-2027)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.3.5.2. Market Revenue and Forecast, by Application (2016-2027)

10.3.5.3. Market Revenue and Forecast, by Material (2016-2027)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.3.6.2. Market Revenue and Forecast, by Application (2016-2027)

10.3.6.3. Market Revenue and Forecast, by Material (2016-2027)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.3.7.2. Market Revenue and Forecast, by Application (2016-2027)

10.3.7.3. Market Revenue and Forecast, by Material (2016-2027)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.4.2. Market Revenue and Forecast, by Application (2016-2027)

10.4.3. Market Revenue and Forecast, by Material (2016-2027)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.4.4.2. Market Revenue and Forecast, by Application (2016-2027)

10.4.4.3. Market Revenue and Forecast, by Material (2016-2027)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.4.5.2. Market Revenue and Forecast, by Application (2016-2027)

10.4.5.3. Market Revenue and Forecast, by Material (2016-2027)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.4.6.2. Market Revenue and Forecast, by Application (2016-2027)

10.4.6.3. Market Revenue and Forecast, by Material (2016-2027)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.4.7.2. Market Revenue and Forecast, by Application (2016-2027)

10.4.7.3. Market Revenue and Forecast, by Material (2016-2027)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.5.2. Market Revenue and Forecast, by Application (2016-2027)

10.5.3. Market Revenue and Forecast, by Material (2016-2027)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.5.4.2. Market Revenue and Forecast, by Application (2016-2027)

10.5.4.3. Market Revenue and Forecast, by Material (2016-2027)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Vehicle (2016-2027)

10.5.5.2. Market Revenue and Forecast, by Application (2016-2027)

10.5.5.3. Market Revenue and Forecast, by Material (2016-2027)

Chapter 11. Company Profiles

11.1. Henkel AG & Co.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. DuPont

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. NovaCentrix

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. KGaA

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Intrinsiq Materials, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Creative Materials Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Vorbeck Materials Corporation, Inc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Johnson Matthey PLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Heraeus Holding GmbH

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Applied Ink Solutions

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/