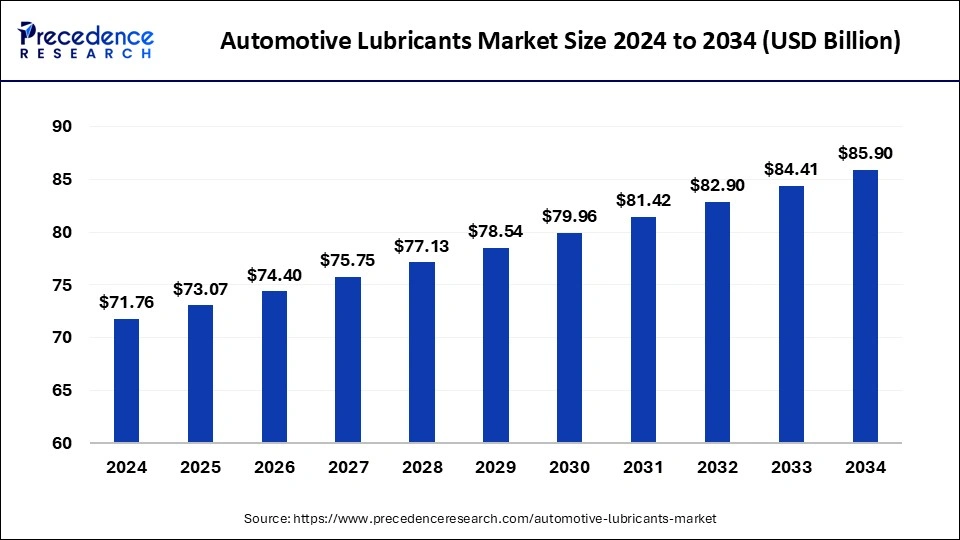

The global automotive lubricants market size is estimated at USD 71.76 billion in 2024 and is projected to cross around USD 84.41 billion by 2033, growing at a CAGR of 1.82% from 2024 to 2033.

The Automotive Lubricants Market is a vital segment within the broader automotive industry, encompassing various lubrication products essential for the smooth functioning and longevity of vehicles. These lubricants are crucial for reducing friction between moving parts, preventing wear and tear, dissipating heat, and enhancing overall performance. The market is driven by the increasing production and sales of automobiles globally, coupled with rising consumer awareness regarding the importance of regular maintenance to extend vehicle lifespan.

Get a Sample: https://www.precedenceresearch.com/sample/4635

Automotive Lubricants Market Key Points

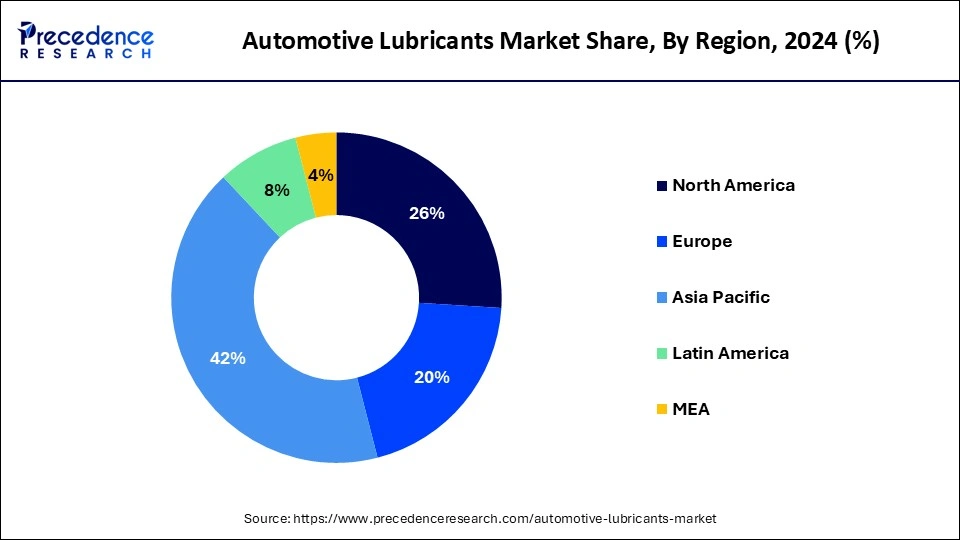

- Asia Pacific dominated the automotive lubricants market with the largest revenue share of 42% in 2023.

- By product type, the engine oil segment dominated the global market in 2023.

- By product type, the gear oil segment is projected to gain a notable share of the market over the forecast period.

- By oil type, the conventional segment accounted for the largest revenue share of 54% in 2023.

- By oil type, the synthetic segment is expected to witness considerable growth in the global market over the studied period.

Regional Insights

- The Asia Pacific automotive lubricants market size was exhibited at USD 29.60 billion in 2023 and is projected to be worth around USD 35.87 billion by 2033, poised to grow at a CAGR of 1.93% from 2024 to 2033.

In the Asia-Pacific region, the Automotive Lubricants Market is experiencing substantial growth propelled by several key factors. The region boasts the largest automotive market globally, led by China and India, which are witnessing rapid urbanization and industrialization. Increasing disposable incomes and a growing middle-class population are driving higher vehicle ownership rates, thereby boosting demand for automotive lubricants.

Additionally, stringent emissions regulations are encouraging the adoption of advanced lubrication technologies that enhance fuel efficiency and reduce environmental impact. As automotive manufacturing continues to expand across Southeast Asia, countries like Thailand, Indonesia, and Vietnam are emerging as significant contributors to regional market growth. Overall, Asia-Pacific remains a pivotal region in the global Automotive Lubricants Market, characterized by robust growth opportunities and evolving regulatory landscapes.

Automotive Lubricants Market Trends

- Shift towards Synthetic Lubricants: There is a growing preference for synthetic lubricants due to their superior performance in terms of longevity, thermal stability, and resistance to oxidation compared to conventional lubricants. This shift is particularly driven by the increasing demand for high-performance vehicles and stringent emissions regulations.

- Rising Demand for Bio-based Lubricants: Environmental concerns and sustainability initiatives are prompting the automotive industry to adopt bio-based lubricants derived from renewable sources such as vegetable oils and animal fats. These lubricants offer biodegradability and reduced environmental impact compared to petroleum-based counterparts.

- Focus on Fuel Efficiency: Automakers and consumers alike are prioritizing fuel efficiency improvements. Lubricants play a crucial role in reducing friction and improving engine efficiency, thereby contributing to lower fuel consumption and reduced emissions. This trend is particularly important in light of stricter fuel economy standards globally.

- Technological Advancements: Advancements in lubricant technology, including additives and base oils, are enhancing the performance and durability of lubricants. Innovations such as nanotechnology in lubricant formulations are enabling better wear protection and thermal stability, catering to the demanding requirements of modern engines

Scope of Automotive Lubricants Market

| Report Coverage | Details |

| Market Size by 2033 | USD 84.41 Billion |

| Market Size in 2023 | USD 70.48 Billion |

| Market Size in 2024 | USD 71.76 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 1.82% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Oil Type, Product Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Oil Type Insights

The Automotive Lubricants Market is characterized by a variety of oil types, each tailored to meet specific performance and operational needs of modern vehicles. Mineral oils, derived from crude oil through refining processes, remain widely used due to their cost-effectiveness and general applicability across standard engine operations. However, synthetic oils have gained prominence for their superior performance attributes. These oils are chemically engineered to offer enhanced viscosity stability across extreme temperature ranges, ensuring optimal engine protection and longevity. Semi-synthetic oils, blending mineral and synthetic components, strike a balance between performance benefits and affordability, making them popular for a range of vehicle types. Each oil type within this market segment plays a critical role in reducing friction, cooling vital engine components, and extending overall engine life.

Product Type Insights

Within the Automotive Lubricants Market, diverse product types cater to specific automotive applications, ensuring efficient operation and prolonged component life. Engine oils constitute the largest segment, designed to lubricate internal combustion engines and mitigate friction-induced wear. These oils vary in viscosity grades to accommodate different engine designs and operational conditions, ensuring optimal performance across diverse automotive applications. Transmission fluids are critical for lubricating and cooling transmission systems, facilitating smooth gear shifts and protecting against wear. Gear oils, formulated to withstand high pressures and temperatures, maintain gearbox integrity and efficiency in various vehicles. Hydraulic fluids power hydraulic systems such as steering and braking, ensuring reliable operation and component longevity. Specialty lubricants, including greases and penetrating oils, address specific automotive needs, enhancing performance and durability of components like bearings and joints. Each product type in this market segment contributes to efficient vehicle operation, meeting stringent performance standards and regulatory requirements while supporting the evolving demands of automotive technology.

Read Also: Automotive Motors Market Size to Hit USD 45.92 Bn by 2033

Recent Developments

- In October 2022, Total Energies signed an agreement with MG Motor to develop a new range of lubricants in Chile. The new product is expected to be MG Oil, the first MG Motor oil specially formulated for automobiles. This new product is expected to be manufactured entirely in Chile, which will likely help Total Energies strengthen its geographical presence there.

- In January 2023, McLaren Automotive, a luxury supercar company, announced the renewal of its partnership with Gulf Oil International as its official lubricant and fuel partner for 2023.

- In June 2022, Shell introduced a used oil management service as part of a new attempt to organize India’s waste oil disposal infrastructure and enhance re-refining rates. To start collecting and re-refining used oil across India, Shell partnered with used oil refiners. These partners share the objective of advancing the lubricants industry’s circular economy.

Automotive Lubricants Market Companies

- Exxon Mobil

- Castrol

- Shell

- Repsol

- LUKOIL

- Sasol

- Indian Oil Corporation Ltd

- HP Lubricants

- Philipps 66

- Fuchs

- Cepsa

Automotive Lubricants Market Dynamics

One of the primary drivers of growth in the Automotive Lubricants Market is the expanding automotive aftermarket. As vehicles age, there is a continuous demand for lubricants for maintenance and repair purposes, thereby sustaining market growth. Moreover, advancements in lubricant technology, such as the development of synthetic and semi-synthetic lubricants, are further boosting market expansion. These advanced lubricants offer superior performance under extreme conditions, contributing to their adoption across various vehicle types, including passenger cars, commercial vehicles, and off-highway vehicles.

The Automotive Lubricants Market presents several opportunities for manufacturers and suppliers. With the automotive industry’s increasing shift towards electric vehicles (EVs), there is a growing demand for specialized lubricants tailored to the unique requirements of EV components such as electric motors and battery systems. Additionally, the rising trend towards lightweight vehicles and stringent environmental regulations promoting fuel efficiency are driving the need for lubricants that reduce frictional losses and improve overall vehicle efficiency. Manufacturers focusing on eco-friendly and bio-based lubricants are poised to capitalize on these evolving trends and consumer preferences.

However, the market also faces certain challenges. Fluctuating crude oil prices, which directly impact the cost of base oils used in lubricant formulations, pose a significant challenge for market players in maintaining profitability and competitive pricing. Moreover, regulatory complexities related to environmental standards and emissions regulations necessitate continuous innovation and compliance efforts from lubricant manufacturers. The competitive landscape is intense, with numerous global and regional players vying for market share, leading to price wars and margin pressures.