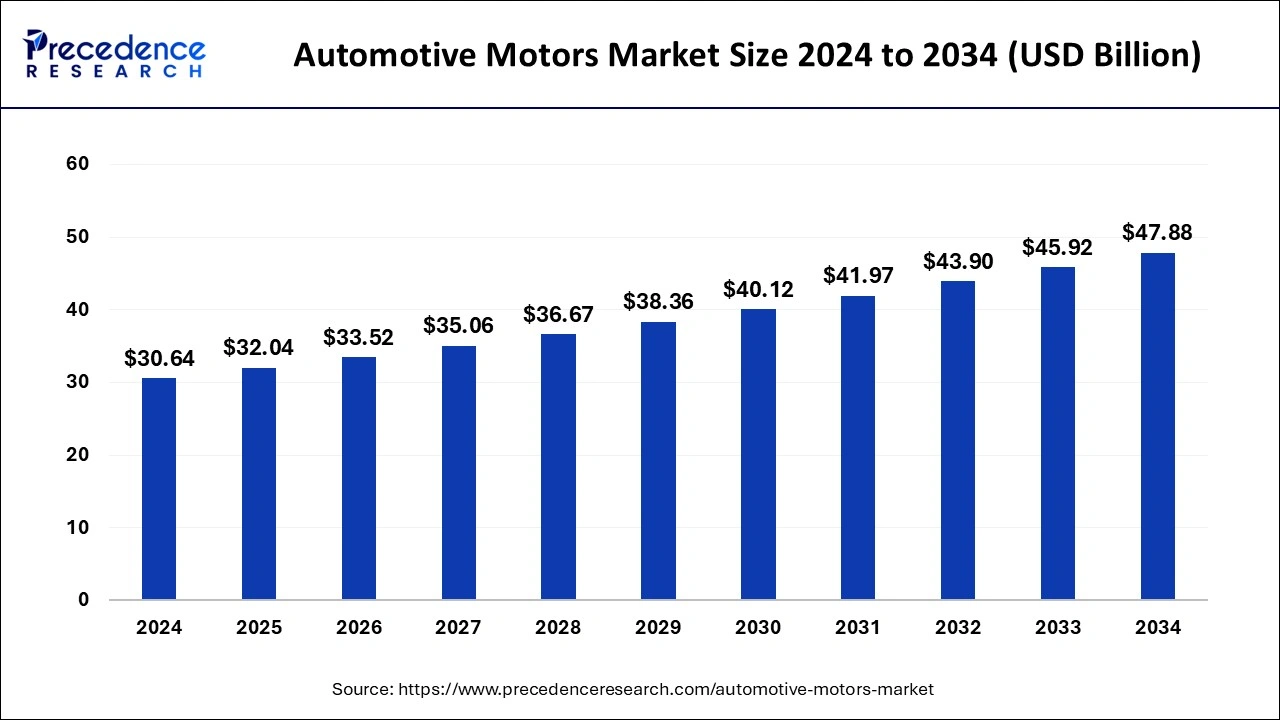

The global automotive motors market size is estimated at USD 30.64 billion in 2024 and is projected to cross around USD 45.92 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

The automotive motors market is a crucial segment within the automotive industry, encompassing a diverse range of motor types used in vehicles worldwide. These motors play integral roles in various applications, including powertrain, chassis systems, and HVAC systems, among others. Key types of automotive motors include DC motors, AC motors, and stepper motors, each tailored for specific functions within vehicles.

Get a Sample: https://www.precedenceresearch.com/sample/2078

Automotive Motors Market Key Points

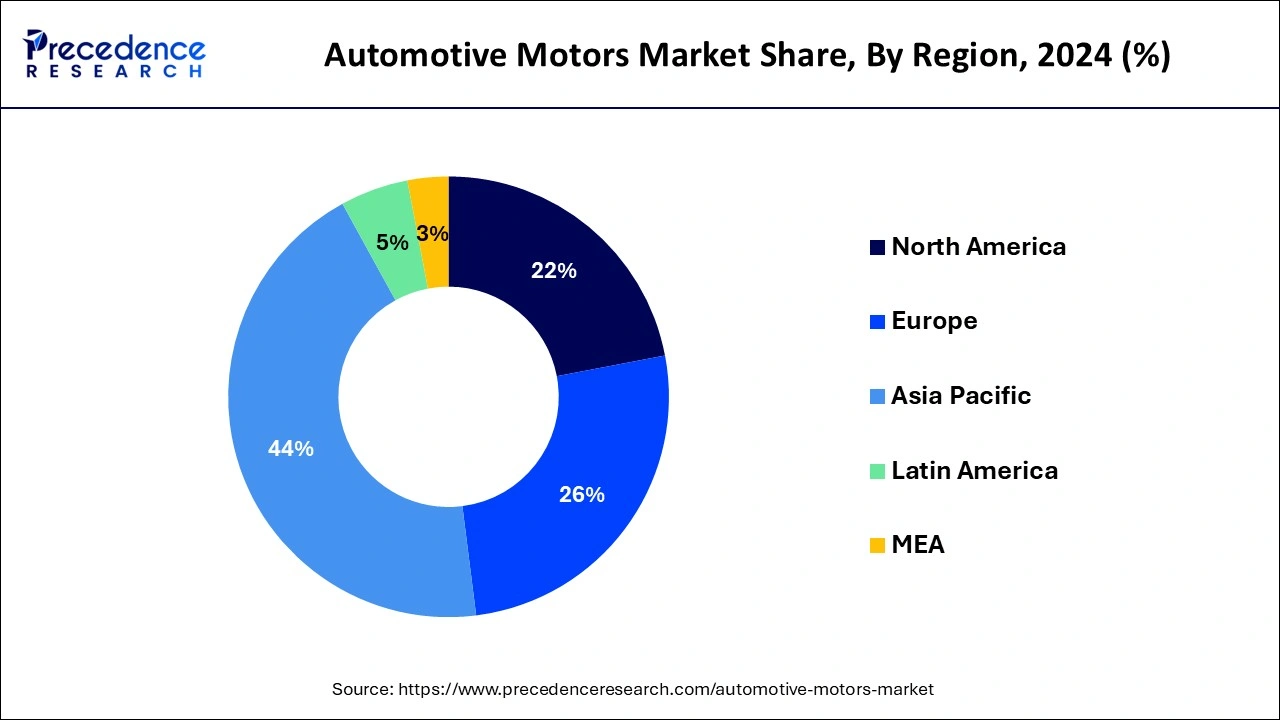

- Asia-Pacific region contributed a revenue share of over 43.14% in 2023.

- By type, the DC brushed motors segment contributed the highest revenue share of over 44% in 2023.

- By vehicle type, the passenger cars segment hit 39% revenue share in 2023.

- By function, the comfort & convenience segment held 54% revenue share in 2023.

Regional Insights

- The Asia Pacific automotive motors market size was valued at USD 12.63 billion in 2023 and is expected to be worth around USD 20.43 billion by 2033, at a CAGR of 4.9% from 2024 to 2033.

In the Automotive Motors Market, the Asia-Pacific region stands out as a dominant force. This region leads in both production and consumption of automotive motors, driven by key automotive manufacturing hubs in countries such as China, Japan, South Korea, and India. Factors contributing to Asia-Pacific’s dominance include a large consumer base, rapid urbanization, increasing disposable incomes, and supportive government policies promoting electric vehicles (EVs) and other fuel-efficient technologies. Moreover, advancements in automotive technology and infrastructure development further bolster the region’s position as a leader in the global automotive motors market. As automotive industries in Asia-Pacific continue to expand, fueled by both domestic demand and exports, the region is expected to maintain its prominent role in shaping the future of automotive mobility worldwide.

Automotive Motors Market Trends

- Electrification: With the global shift towards electric vehicles (EVs), demand for electric motors has surged. Electric motors are crucial components in EV drivetrains, powering everything from propulsion to auxiliary systems like HVAC and power steering.

- Efficiency and Lightweighting: There is a strong emphasis on improving motor efficiency to extend range in EVs and enhance fuel efficiency in internal combustion engine (ICE) vehicles. Lightweight materials and advanced manufacturing techniques are being employed to reduce the weight of motors while maintaining or improving performance.

- Integration of Advanced Features: Automotive motors are increasingly integrating advanced features such as sensors, controllers, and software for better performance, safety, and autonomous driving capabilities.

- Permanent Magnet Motors: Permanent magnet motors, particularly rare-earth magnet-based designs, are gaining popularity due to their high efficiency and power density, making them suitable for electric and hybrid vehicles.

- Regulatory Standards: Stricter emission norms globally are pushing automakers to adopt electric and hybrid technologies, thereby boosting the demand for automotive motors that support cleaner propulsion systems.

Automotive Motors Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 29.29 Billion |

| Market Size in 2024 | USD 30.64 Billion |

| Market Size by 2033 | USD 45.92 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Application, Vehicle Type, Technology, Function, and Motor Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Application Insights

Automotive motors play a critical role across various applications within vehicles, contributing to both performance and comfort. In the powertrain segment, motors are pivotal in electric and hybrid vehicles, delivering efficient propulsion by converting electrical energy into mechanical power. They provide torque for acceleration and steady-state operation, significantly influencing vehicle dynamics and efficiency. Moreover, motors are essential in safety and comfort systems, powering components like power windows, seat adjustment mechanisms, and mirrors. These motors enhance driver and passenger convenience while ensuring optimal vehicle ergonomics.

Vehicle Type Insights

Vehicle type diversity further drives the automotive motors market, spanning passenger cars, commercial vehicles, two-wheelers, and off-road vehicles. In passenger cars, motors support a wide range of functionalities, from basic power accessories to advanced electric propulsion systems in electric vehicles (EVs). Commercial vehicles utilize motors for both powertrain components and auxiliary systems, enhancing operational efficiency. Additionally, electric motorcycles and scooters rely on motors for propulsion, contributing to the growing trend of electric mobility.

Technology Insights

Technological advancements are pivotal in shaping the automotive motors landscape. The shift towards electric vehicles has spurred innovations in electric motor technology, aimed at improving efficiency and performance. Brushless DC motors (BLDC) have gained prominence due to their higher efficiency, reduced maintenance requirements, and quieter operation compared to traditional brushed motors. Stepper motors are utilized for precise control in applications such as instrument clusters and HVAC systems, enhancing vehicle control and comfort. Permanent magnet motors, incorporating rare-earth magnets, offer enhanced efficiency and power density, supporting the transition towards sustainable mobility solutions.

Function Insights

Functionally, automotive motors serve diverse roles ranging from propulsion and actuation to control and auxiliary systems support. In propulsion, electric motors are pivotal in driving EVs and hybrid vehicles, providing the necessary torque for acceleration and continuous operation. Actuation motors control various mechanical components, including valve actuators in engine management and throttle actuators, optimizing engine performance and efficiency. Control motors are integral to automated systems, enabling functionalities like autonomous driving features and adaptive cruise control, enhancing vehicle safety and driving experience. Additionally, motors power auxiliary systems such as pumps for fluid circulation, maintaining optimal vehicle performance across different operating conditions.

Motor Type Insights

Motor types cater to specific automotive applications, each offering distinct advantages. AC motors are prevalent in electric vehicle propulsion systems, delivering high power outputs required for efficient electric propulsion. DC motors are widely used across automotive applications due to their simplicity and controllability, supporting functions like power windows and seat adjustments. Induction motors find application in EVs for their robustness and reliability in traction applications, ensuring consistent performance over extended operational periods. Synchronous motors are employed where precise speed control and efficiency are critical, such as electric power steering systems, enhancing vehicle handling and energy efficiency.

Automotive Motors Market Dynamics

Drivers

Several factors drive growth in the automotive motors market. One primary driver is the increasing demand for electric and hybrid vehicles, which rely heavily on electric motors for propulsion and energy efficiency. Government regulations aimed at reducing vehicle emissions have accelerated the adoption of electric vehicles (EVs), thereby boosting the demand for automotive motors. Additionally, advancements in motor technologies, such as improved efficiency and compact designs, contribute to their widespread adoption across various automotive applications.

Opportunities

The automotive motors market presents several opportunities for growth and innovation. As automakers continue to invest in electrification, there is a growing opportunity for motor manufacturers to develop high-performance motors that meet stringent efficiency and durability standards. Moreover, the expansion of autonomous driving technology creates new avenues for motor applications in advanced driver-assistance systems (ADAS) and self-driving vehicles. Furthermore, the increasing focus on lightweight and energy-efficient motors opens doors for materials innovation and cost-effective manufacturing processes.

Challenges

Despite promising growth prospects, the automotive motors market faces several challenges. One significant challenge is the high cost associated with electric motor production, which can hinder mass adoption, particularly in price-sensitive markets. Additionally, the complexity of integrating electric motors into existing vehicle platforms poses engineering challenges for automakers. Moreover, the reliance on rare earth materials in motor production raises concerns about supply chain vulnerabilities and environmental sustainability.

Read Also: Commercial Telematics Market Size to Hit USD 357.12 Bn by 2033

Recent Development

- In September 2020, BorgWarner disclosed its decision to manufacture a power iDM for the electric Ford Mustang.

Life Sciences BPO Market Companies

- Continental AG (Germany)

- Nidec Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Johnson Electric Holdings Ltd. (Hong Kong)

- Denso Corporation (Japan)

- Mitsubishi Electric Corporation (Japan). Siemens AG (Germany)

- Borgwarner Inc. (U.S.)

- Mitsuba Corporation (Japan)

- Magna International (Canada)

- Valeo S.A. (France)

- Mahle Group (Germany)

- REIL Electricals India Limited (India)

- PMP Auto Components Pvt. Ltd. (India)

- SAIC Motor Corporation Limited (China)