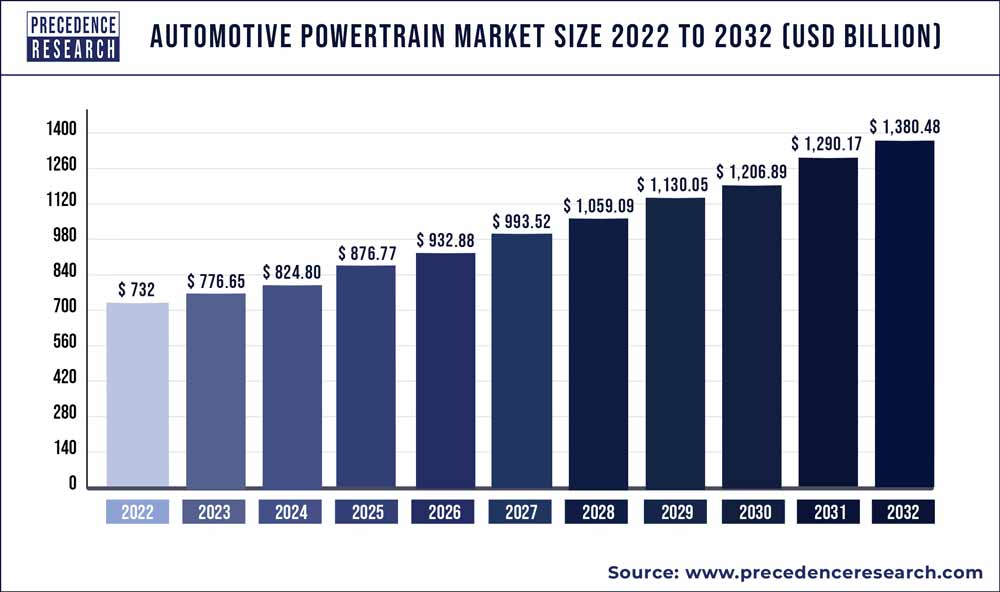

The global automotive powertrain market size reached USD 732 billion in 2022 and is projected to grow USD 1,380.48 billion by 2032, growing at a CAGR of 6.6% between 2023 and 2032.

Key Points

- Asia Pacific led the global market with the highest market share in 2022.

- By Position, the all-wheel drive (AWD) segment has held the largest market share in 2022.

- By Engine Type, the gasoline engines segment has held the biggest revenue share in 2022.

The automotive powertrain market encompasses a vital aspect of vehicle engineering, focusing on the mechanisms responsible for generating and transmitting power to propel automobiles. It constitutes a complex assembly of components including the engine, transmission, drivetrain, and associated control systems, all working in tandem to deliver the required performance, efficiency, and driving experience. As the automotive industry undergoes rapid technological advancements and regulatory shifts towards sustainability, the powertrain segment plays a pivotal role in shaping the future landscape of transportation.

Get a Sample: https://www.precedenceresearch.com/sample/1276

Growth Factors:

- Technological Innovations: Ongoing advancements in powertrain technologies, such as electrification, hybridization, and lightweight materials, are driving significant growth in the market. Manufacturers are continuously investing in research and development to enhance the efficiency and performance of powertrain systems while meeting stringent emissions standards.

- Stringent Emission Regulations: Global initiatives aimed at reducing greenhouse gas emissions and improving fuel economy are compelling automakers to develop cleaner and more efficient powertrain solutions. Regulations such as Euro 7 standards in Europe and Corporate Average Fuel Economy (CAFE) standards in the United States are pushing manufacturers to adopt alternative powertrain technologies to comply with emission targets.

- Consumer Demand for Fuel Efficiency: Rising environmental consciousness among consumers, coupled with volatile fuel prices, is increasing the demand for vehicles with fuel-efficient powertrains. This demand is driving automakers to introduce hybrid, electric, and other eco-friendly powertrain options across various vehicle segments.

- Urbanization and Congestion Concerns: With the rapid urbanization of cities worldwide, concerns regarding air quality, congestion, and noise pollution have intensified. Governments and municipalities are incentivizing the adoption of electric and hybrid vehicles by implementing policies such as zero-emission zones and subsidies for electric vehicle purchases, thereby bolstering the growth of the automotive powertrain market.

Region Insights:

North America: The North American automotive powertrain market is characterized by a significant focus on hybrid and electric vehicle technologies, driven by stringent emission regulations and consumer demand for fuel-efficient vehicles. Major automakers in the region are investing heavily in electrification to meet emission targets and gain a competitive edge in the market.

Europe: Europe leads the global automotive powertrain market, driven by stringent emission standards set by the European Union. The region has witnessed a rapid adoption of electric vehicles, supported by government incentives and infrastructure development for electric mobility. Additionally, European automakers are increasingly collaborating with technology companies to develop advanced powertrain solutions.

Asia Pacific: The Asia Pacific region is witnessing rapid growth in the automotive powertrain market, fueled by the expansion of the automotive industry in countries like China, India, and Japan. Government initiatives promoting electric mobility, coupled with the presence of major automotive manufacturers and suppliers, are driving the adoption of electric and hybrid powertrains in the region.

Trends:

- Electrification: The shift towards electrification is a dominant trend in the automotive powertrain market, with increasing investments in electric vehicle (EV) technology by both established automakers and new entrants. Advancements in battery technology, along with government incentives and infrastructure development, are accelerating the adoption of electric powertrains globally.

- Vehicle Lightweighting: Automotive manufacturers are focusing on lightweighting strategies to improve fuel efficiency and reduce emissions. Advanced materials such as carbon fiber reinforced polymers (CFRP) and aluminum alloys are being increasingly used in powertrain components to achieve weight reduction without compromising strength and durability.

- Integration of Connectivity and Automation: The integration of connectivity and automation technologies is reshaping the automotive powertrain landscape. Connected powertrains enable real-time monitoring and optimization of performance, while autonomous driving features such as predictive shifting algorithms enhance driving efficiency and comfort.

Automotive Powertrain Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 732 Billion |

| Market Size by 2032 | USD 1,380.48 Billion |

| Growth Rate from 2023 and 2032 | CAGR of 6.6% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Position, Engine, Vehicle |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

SWOT Analysis:

Strengths:

- Established expertise and infrastructure in traditional powertrain technologies.

- Strong partnerships and collaborations between automakers and technology providers.

- Growing consumer awareness and acceptance of electric and hybrid vehicles.

Weaknesses:

- High initial costs associated with electric and hybrid powertrain technologies.

- Limited charging infrastructure for electric vehicles in certain regions.

- Potential challenges in recycling and disposal of electric vehicle batteries.

Opportunities:

- Expansion of electric vehicle market in emerging economies.

- Technological advancements leading to improved performance and cost-effectiveness of electric powertrains.

- Collaboration opportunities in research and development of advanced powertrain solutions.

Threats:

- Disruption of traditional automotive supply chains due to rapid electrification.

- Regulatory uncertainties and changes in emission standards.

- Competition from non-traditional players entering the automotive industry with innovative powertrain solutions.

Read Also: Electric Vehicle Supply Equipment Market Size to Reach $ 364.94 Bn by 2032

Competitive Landscape

Some of the prominent players covered under the global automotive powertrain market report include Aisin Seiki Co. Ltd., Ford Motor Company, Borgwarner Inc., General Motors Company, Hyundai Motor Company, GKN PLC, Jtekt Corporation, Volkswagen AG, Toyota Motor Corporation, and ZF Friedrichshafen AG among others.

The global automotive powertrain market research report classifies the market as follows:

By Position

- All-wheel Drive (AWD)

- Rear-wheel Drive (RWD)

- Front-wheel Drive (FWD)

By Engine Type

- Diesel

- Gasoline

- Others

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Regional Outlook

- North America

- US

- Rest of North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/