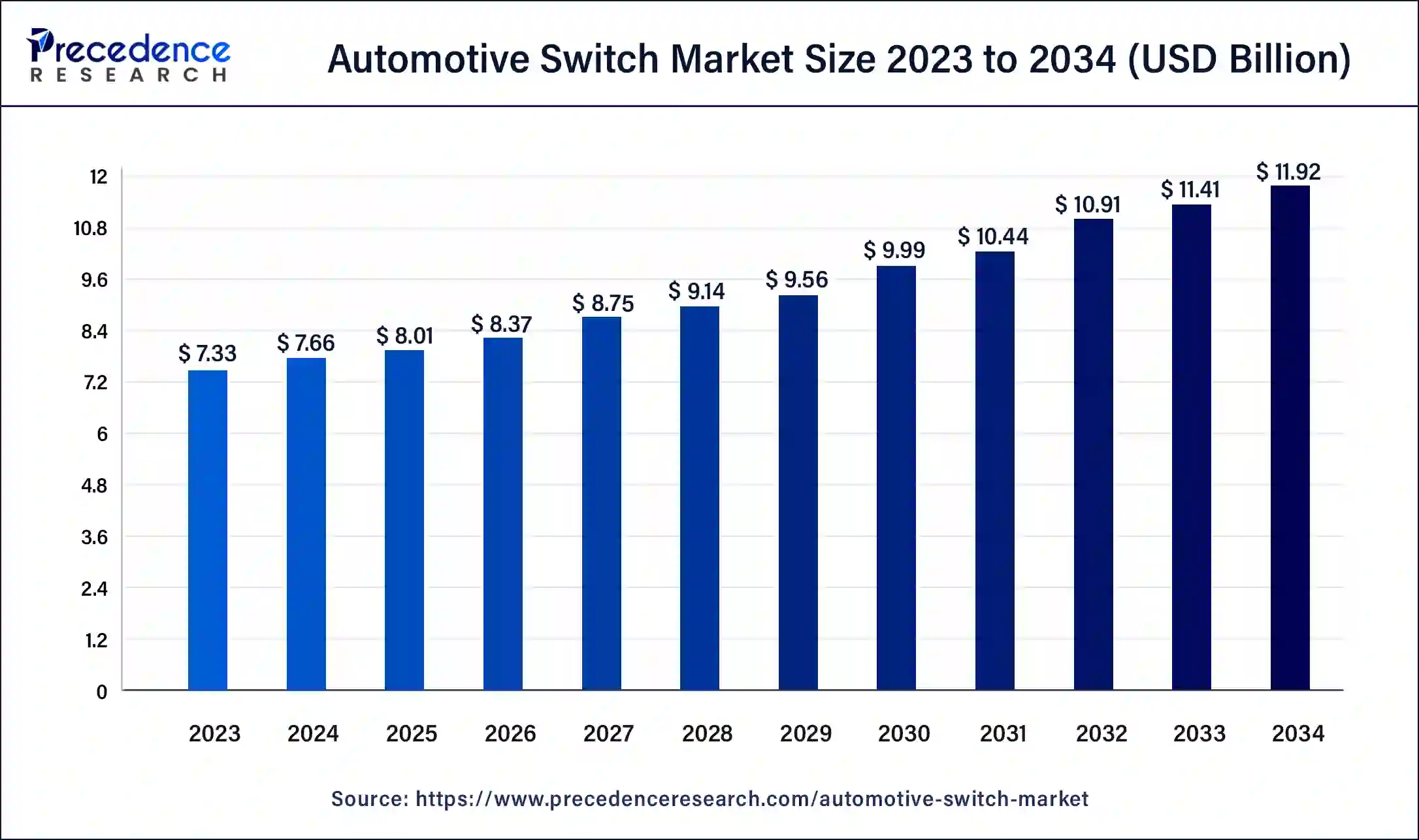

The global automotive switch market size was valued at USD 7.33 billion in 2023 and is expected to reach around USD 11.92 billion by 2034. The market is slated to expand at 4.52% CAGR from 2024 to 2034.

This growth is driven by the increasing demand for advanced vehicle features, particularly in electric and autonomous vehicles. The transition from traditional mechanical switches to electronic and touch-based switches is contributing to this growth. Innovations in automotive technology, including the integration of smart systems and improved user interfaces, are also playing a vital role. Additionally, the rise of connected vehicles and the growing trend towards vehicle electrification are expected to significantly influence market dynamics in the coming years.

Automotive Switch Market Key Takeaways

- Asia Pacific accounted for the largest share of the automotive switch market in 2023.

- North America will register significant growth in the market over the forecast period.

- By type, the HVAC segment registered for the largest share of the market in 2023.

- By vehicle type, in 2023, the HCVs segment dominated the global market.

- By sales channel, the OEM segment accounted for the largest market share in 2023.

- By sales channel, the aftermarket segment will grow notably in the market over the forecast period.

Get a Sample: https://www.precedenceresearch.com/sample/5075

Market Dynamics

The automotive switch market is influenced by several dynamics, including technological advancements, consumer preferences, and regulatory factors. Key drivers include the increasing integration of electronic components in vehicles, with estimates suggesting that over 70% of new vehicles will feature advanced electronic systems by 2025. The shift towards electric vehicles (EVs) is another crucial factor; global EV sales are projected to surpass 20 million units annually by 2025, substantially driving the demand for sophisticated switch technologies. However, the market faces challenges such as high manufacturing costs, which can account for nearly 30% of the total production cost, and the complexity of integrating advanced switch technologies into existing vehicle designs. Regulatory standards aimed at improving vehicle safety and emissions are also influencing the market, as manufacturers must comply with these regulations while innovating their product offerings. Moreover, growing competition among automotive manufacturers and suppliers is prompting continuous improvements in switch technology to meet consumer demands for enhanced features and reliability.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.92 Billion |

| Market Size in 2024 | USD 7.66 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.52% |

| Largest Market | Asia Pacific |

| Base Year | 2024 to 2034 |

| Forecast Period | 2023 |

| Segments Covered | Type, Vehicle Type, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Regional Insights

The automotive switch market exhibits varied dynamics across different regions. North America and Europe are significant markets, with North America projected to account for over 25% of the global market share by 2030. This growth is primarily driven by the presence of major automotive manufacturers and increasing consumer demand for advanced vehicle features. The Asia-Pacific region, particularly countries like China and Japan, is witnessing rapid growth, with the region expected to register the highest CAGR of 6.1% during the forecast period due to rising vehicle production, increased disposable income, and the growing adoption of electric vehicles. The shift towards smart transportation solutions and connected vehicles in these regions further boosts market prospects. Additionally, emerging economies in Latin America and the Middle East are expected to see steady growth in automotive switch adoption as vehicle ownership rises, with forecasts indicating a CAGR of approximately 4.5% in these regions.

Read Also: Automotive Seat Market Size to Attain USD 133.05 Bn by 2033

Import and Export Data

Import and export trends in the automotive switch market reflect the global supply chain’s complexity and interdependencies. Major exporting countries, including Germany, Japan, and the United States, dominate the market, supplying advanced switch technologies to various regions. For instance, Germany alone exported around USD 3 billion worth of automotive switches in 2022. In contrast, countries in the Asia-Pacific region, particularly China, are significant importers of automotive components, including switches, with imports reaching approximately USD 2.5 billion in the same year as they ramp up local vehicle production. Trade agreements and tariffs significantly influence these dynamics, impacting the cost and availability of automotive switches across different markets. Understanding these import and export trends is essential for manufacturers and suppliers looking to navigate the competitive landscape and capitalize on growth opportunities in the global automotive switch market.

Automotive Switch Market Companies

- Delphi Technologies

- Leopold Kostal GmbH & Co. KG

- Panasonic Automotive Systems Co.

- Valeo

- ZF Friedrichshafen AG

- TRW Automotive US LLC

- Marquardt GmbH

- Preh GmbH

- Ark-Les Connectors

- D&R Technology

- LLC

- Diamond Electric Manufacturing Corporation

- E-Switch Inc

- Honeywell Inc.

Recent Developments

- In January 2024, ZF Friedrichshafen AG announced that ZF Passive Safety Systems offers its belt tensioner with multiple switchable load limiters (MSLL), which helps further reduce the consequences of accidents.

- in April 2024, Switch Mobility, the electric vehicle division of Ashok Leyland launch the IeV 4, its first electric light commercial vehicle, from its Hosur facility. This introduction marks the commencement of manufacturing for Switch Mobility’s IeV series of electric light commercial vehicles (e-LCVs).

- In September 2023, Continental and Ethernovia collaborated to create a high-bandwidth, low-latency switch in a 7nm process for software-defined vehicles (SDVs) to move data efficiently and securely.