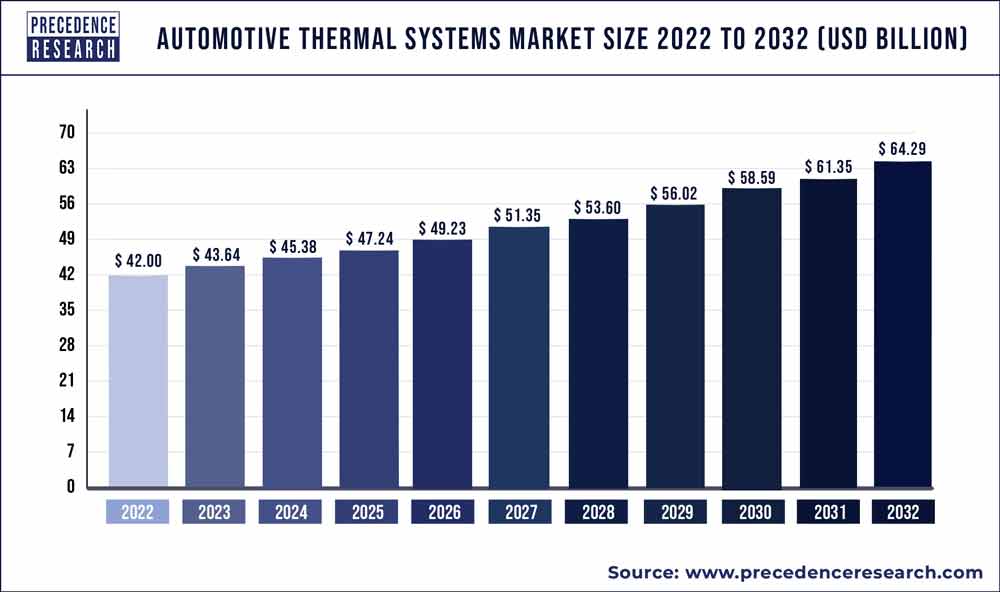

The global automotive thermal systems market size is expected to hit over US$ 64.29 billion by 2032 from 42 billion in 2022 and expand growth at a CAGR of 4.40% from 2023 to 2032.

The market for automotive thermal system is expected to increase significantly during the forecast period. Several factors, including strict pollution restrictions and emission norms, as well as rising global warming, have contributed to the increase in demand for automotive thermal system in the market.

Get the Sample Copy of Report@ https://www.precedenceresearch.com/sample/1520

One of the primary drivers driving the automotive thermal system market expansion is the growing demand to reduce carbon emissions produced by internal combustion engines in automobiles, as well as rigorous emission regulatory frameworks enforced by government agencies in developing regions. Aside from that, the automotive thermal system industry is being boosted by the increasing use of innovative Heating Ventilation Air Conditioning (HVAC) systems that are less harmful to the environment.

Report Highlights

- Based on the vehicle type, the passenger vehicle segment dominated the global automotive thermal system market in 2020 with highest market share. The increased per capita income and higher standard of living are two significant reasons driving passenger vehicle sales in many countries. The automotive thermal system market is also likely to be driven by a growing desire for luxury and comfort, as well as demand for advanced amenities such as rear A/C, ventilated seats, and heated steering.

Report Highlights

- Based on the vehicle type, the passenger vehicle segment dominated the global automotive thermal system market in 2020 with highest market share. The increased per capita income and higher standard of living are two significant reasons driving passenger vehicle sales in many countries. The automotive thermal system market is also likely to be driven by a growing desire for luxury and comfort, as well as demand for advanced amenities such as rear A/C, ventilated seats, and heated steering.

Scope of the Automotive Thermal Systems Market

| Report Coverage | Details |

| Market Size | US$ 64.29 Billion by 2032 |

| Growth Rate | CAGR of 4.40% from 2023 to 2032 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Component, Vehicle, Application, Region |

| Companies Mentioned | Denso Corporation, Mahle GmbH, Gentherm Inc., Valeo, Grayson Thermal Systems, Borgwarner Inc., General Motors Company, Lennox International Inc., Modine Manufacturing Company Inc., Visteon Corporation |

Read More: Automotive Interior Market Size to Worth Around US$ 184.97 Bn by 2032

Market Dynamics

Drivers

Surge in demand for electric vehicles

The major market players have been compelled to provide electric vehicles all over the world due to the factors such as rising demand for low-emission commuting and governments supporting long-range, zero emission vehicles through subsidies and tax rebates. As a result, there is an increasing demand for electric vehicles in the market. The cost of batteries is predicted to decrease as the demand for electric vehicles is expected to grow. This is driving the growth of the battery electric vehicles in the market. The battery electric vehicles require power electronics, battery cooling, and electric motor cooling. By successfully utilizing waste heat, thermal system plays a vital role in boosting driving time and performance. As a result, the surge in demand for electric vehicles is driving the growth of the global automotive thermal system market.

Restraints

Lack of standardization and high cost of manufacturing

The local or regional market players must adhere to the regulating body’s emission regulations. However, because emission regulations differ by region, a lack of standardization can make it difficult to export thermal systems. The manufacturers are unable to get raw materials or inventory due to lack of standardization, which hampered the export sector. This also leads to the high cost of manufacturing. As a result, the lack of standardization and high cost of manufacturing is restricting the growth of global automotive thermal system market during the forecast period.

Opportunities

Increasing government regulations

Controlling greenhouse gas emissions from automobiles has become a serious concern as the global vehicle fleet grows. The government regulatory frameworks have controlled gasoline Sulphur content limits and required fuel economy standards to combat the exponential consequence of emissions. By utilizing waste heat and controlling the vehicle’s heating and cooling systems properly, advancements in automotive thermal system technology can minimize carbon dioxide reduction and enhance automobile efficiency. Thus, the increasing government regulations against toxic gases emissions are creating lucrative opportunities for the growth of the automotive thermal system market during the forecast period.

Challenges

High cost of technology

The original equipment manufacturers (OEMs) have implemented innovative and advanced technology to attain to intended outcomes as a result of the establishment of rigorous pollution. In addition, the rising demand for in-vehicle comfort characteristics on interior comfort thermal systems. The cost of thermal system can be compared to overall amount of carbon dioxide reduction accomplished by these technologies to determine its performance. The cost for upgradation and modification of automotive thermal systems required high capital investments. Thus, the high cost of technology is a major challenge for the growth of the automotive thermal system market during the forecast period.

Some of the prominent players in the global automotive thermal systems market include:

- Denso Corporation

- Mahle GmbH

- Gentherm Inc.

- Valeo

- Grayson Thermal Systems

- Borgwarner Inc.

- General Motors Company

- Lennox International Inc.

- Modine Manufacturing Company Inc.

- Visteon Corporation

Segments Covered in the Report

By Component

- Compressor

- Heating Ventilation Air Conditioning (HVAC)

- Powertrain Cooling

- Fluid Transport

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Application

- Front and Rear A/C

- Engine and transmission

- Seat

- Battery

- Motor

- Waste Heat Recovery

- Power Electronics

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- spain

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Table of Content:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Thermal Systems Market

5.1. COVID-19 Landscape: Automotive Thermal Systems Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Thermal Systems Market, By Component

8.1. Automotive Thermal Systems Market, by Component Type, 2023-2032

8.1.1. Compressor

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Heating Ventilation Air Conditioning (HVAC)

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Powertrain Cooling

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Fluid Transport

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Automotive Thermal Systems Market, By Application

9.1. Automotive Thermal Systems Market, by Application, 2023-2032

9.1.1. Front and Rear A/C

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Engine and transmission

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Seat

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Battery

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Motor

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Waste Heat Recovery

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Power Electronics

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Automotive Thermal Systems Market, By Vehicle

10.1. Automotive Thermal Systems Market, by Vehicle, 2023-2032

10.1.1. Passenger Vehicles

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Commercial Vehicles

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Automotive Thermal Systems Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Vehicle (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Vehicle (2020-2032)

Chapter 12. Company Profiles

12.1. Denso Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Mahle GmbH

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Gentherm Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Valeo

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Grayson Thermal Systems

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Borgwarner Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. General Motors Company

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Lennox International Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Modine Manufacturing Company Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Visteon Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308