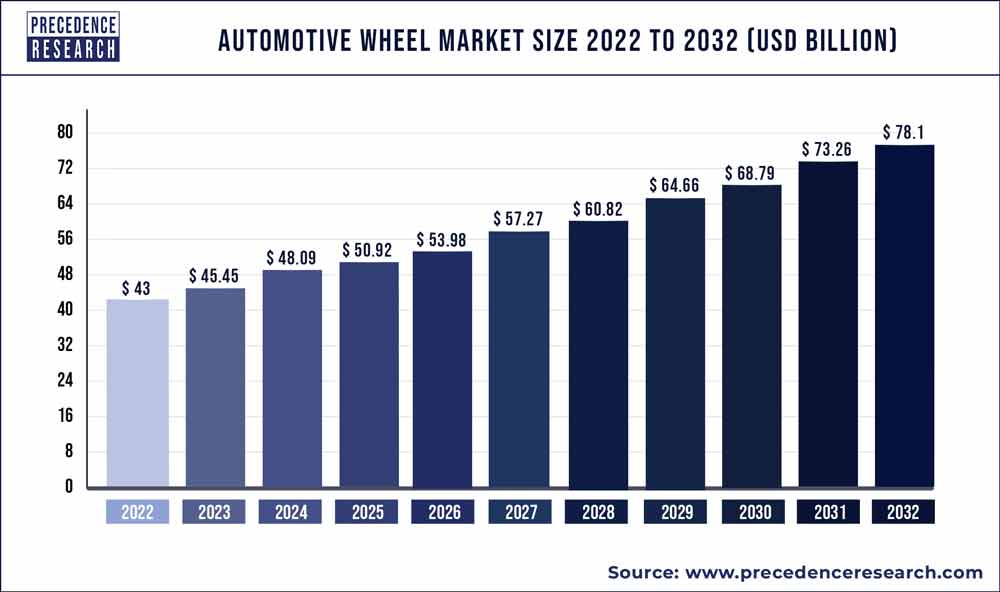

The global automotive wheel market size is expected to reach over US$ 78.10 billion by 2032 from US$ 43 billion in 2022 and is expanding growth at a noteworthy CAGR of 6.20% from 2023 to 2032.

Due to the increased demand for passenger, sports, and luxury automobiles, the automotive wheel market has gained significant traction in recent years. The consumer preferences are evolving, resulting in a significant demand for performance-based vehicles. The rise in performance-based automobiles, such as luxury vehicles, is driving the demand for automotive wheel. The wheels also play an important role in vehicle performance analysis, which is expected to boost the automotive wheel market growth during the forecast period.

Moreover, due to government enforced standards, automobile manufacturers are adopting more carbon-based and aluminum wheels. Furthermore, the new material requires far less energy to manufacture and create perfectly shaped wheel with better-defined and sharper body lines, making component replacements easier. On the other hand, alloy wheels have the largest market share in the automotive wheel market due to its properties such as ductility, density, and corrosion resistant. In addition, as hybrid electric vehicle models become more common, the need for unique wheels for these vehicles has grown.

Get the Report Sample Copy @ https://www.precedenceresearch.com/sample/1473

Regional Snapshot

Asia-Pacific is the largest segment for automotive wheel market in terms of region. The high urbanization rates, combined with the rising consumer buying power in markets such as Japan, China, Thailand, India, and South Korea, are expected to boost the automotive wheel market growth in the Asia-Pacific region. The automotive wheel demand is being fueled by the availability of low cost of labor in the Asia-Pacific’s countries.

Europe region is the fastest growing region in the automotive wheel market. The factors such as infrastructural development, consumer’s buying power, and shift in consumer’s lifestyle are driving the automobile and automotive demand, which, in turn, is driving demand for automotive wheel. The automotive industry makes a significant contribution to the GDP.

Report Highlights

- Based on the material type, the aluminum segment dominated the global automotive wheel market in 2020 with highest market share. This is attributed to an increase in demand for light weight automobiles to improve vehicle fuel efficiency. The usage of aluminum wheels by major automobile manufacturers to improve vehicle dynamics is expected to drive the global automotive wheel market.

- Based on the vehicle type, passenger vehicle segment is estimated to be the most opportunistic segment during the forecast period. The demand for luxury passenger automobiles that provide comfort is growing as people’s disposable income and spending power rises around the world.

Scope of the Automotive Wheel Market

| Report Coverage | Details |

| Market Size | USD 78.10 Billion by 2032 |

| Growth Rate | CAGR of 6.20% from 2023 to 2032 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Material, Vehicle, Region |

| Companies Mentioned | Euromax Wheel, Prime Wheel Corporation, Aluminum Wheel Co. Ltd, Superior Industries International Inc., Foshan Nanhai Zhongnan, Enkei Corporation, Ronal Group, BBS GmbH, Center Motor Wheel of America Inc., Topy Industries Ltd. |

Read Also: Off-road tires Market Size to Worth Around US$ 907.04 Bn by 2032

Market Dynamics

Drivers

Rise in production of vehicles

The manufacturing businesses’ competitiveness has risen dramatically in the recent years, forcing automobile manufacturers to adopt new technologies. The increased production of passenger automobiles and commercial vehicles in developing and developed regions as a result of the expanding transportation industry is predicted to boost the worldwide revenue growth. As a result, the rise in production of vehicles is boosting the growth of automotive wheel market during the forecast period.

Restraints

Engineering and technological barriers

The technological limitations, such as the difficulty of shaping alloys and magnesium to meet a specific purpose, have also hampered the expansion of the automotive wheel market. The magnesium is a lighter alternative to aluminum or steel. It is a third of the weight of aluminum and quarter of the weight of steel. The magnesium alloys, on the other hand, are currently utilized in small amounts in automobiles and are restricted for the utilization in the variety of purposes. Joining different metals also poses technological obstacles. Thus, these factors are restricting the growth of automotive wheel market.

Opportunities

Surge in demand for light weight vehicles

The surge in demand for light weight materials in the automobile industry, as well as a greater focus on fuel economy, has boosted the demand for light weight vehicles all over the world. Due to rising urbanization and consumer’s purchasing power, the automotive wheel market is expected to rise at a fastest rate throughout the forecast period. As a result, the surge in demand for light weight vehicles is creating lucrative opportunities for the growth of automotive wheel market during the forecast period.

Challenges

Volatility in raw material prices

The cost of raw materials has a considerable impact on the final product’s price. Any changes in raw material prices as a result of socioeconomic or political factors can affect the component prices, which in turn, affect final product prices. The aluminum, steel, and magnesium are used to manufacture automotive wheel. Thus, the volatility in raw material prices is the biggest challenge for the growth of the automotive wheel market during the forecast period.

Some of the prominent players in the global automotive wheel market include:

- Euromax Wheel

- Prime Wheel Corporation

- Aluminum Wheel Co. Ltd

- Superior Industries International Inc.

- Foshan Nanhai Zhongnan

- Enkei Corporation

- Ronal Group

- BBS GmbH

- Center Motor Wheel of America Inc.

- Topy Industries Ltd.

Segments Covered in the Report

By Material Type

- Alloy

- Steel

- Aluminum

- Carbon Fiber

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By End User

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/