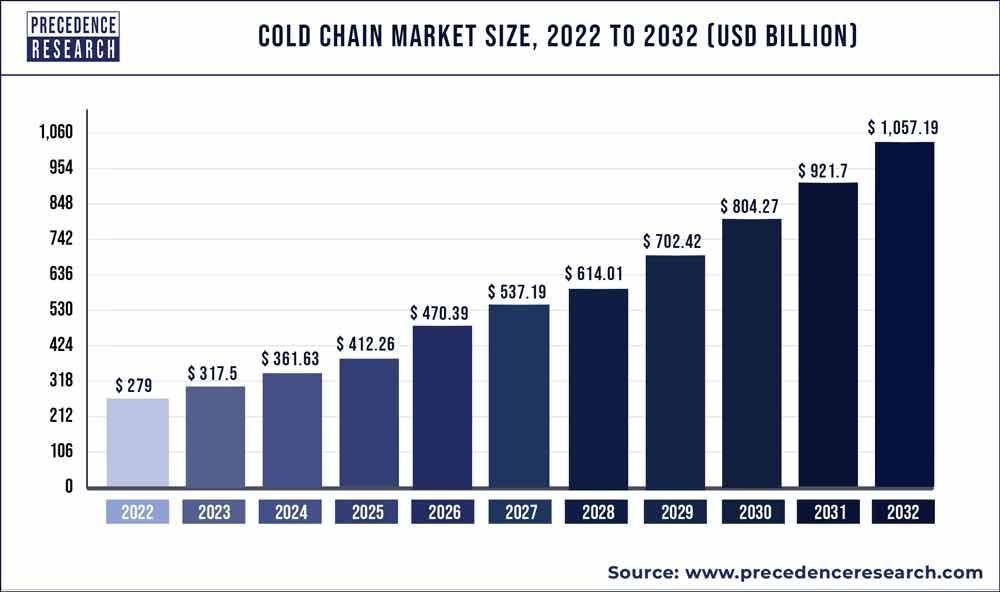

The global cold chain market size is projected to surpass around US$ 583.1 billion by 2030 and is growing at a CAGR of 15.1% from 2022 to 2030.

Key Takeaway:

- By type, the storage segment has accounted highest revenue share of around 60% in 2021.

- By packaging, the product packaging segment has captured revenue share of around 74% in 2021.

- By equipment, the storage equipment segment has contributed revenue share of around 76% in 2021.

- By application, the fish, meat, and seafood segment accounted highest revenue share of around 24% in 2021.

- The North America market has garnered revenue share of around 36% in 2021.

A cold chain is the temperature-controlled supply chain that is used in the storage, transportation and distribution of temperature sensitive products that needs to be preserved in a definite temperature range in order to prevent them from getting rotten. The cold chain providers monitor the temperature of their facility on a regular basis so as to prevent the products from getting decayed.

Get a Sample: https://www.precedenceresearch.com/sample/1331

Some of the temperature sensitive products include fruits, vegetables, medicines, meats and any others. The manufacturersof the sensitive products strictly monitor the temperature at every point of transit from the manufacturing unit till it gets delivered to the consumers. With the development of technology, the manufacturers of the sensitive food products are installing the remote monitoring system for the cold chain units so that the real time temperature can be administered.

Crucial factors accountable for market growth are:

- The rise in retail stores across the world.

- The rising demand for refrigerated transport vehicles in order to deliver the perishable products to retail stores.

- Increased demand for ready to eat and perishable products in the market.

- Increased demand for cold chain systems in the pharmaceutical industry.

- The surge in demand for cold storages to preserve the fruits and vegetable.

Cold Chain Market Scope

| Report Highlights | Details |

| Market Size In 2030 | USD 948.24 Billion |

| Growth Rate | CAGR of 15.1% From 2022 to 2030 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Type, Sector, Temperature Type, Packaging, Application, Region |

Regional Snapshots

North America is expected to hold the largest revenue share contributing more than 37% market share in 2021 and is expected to remain in dominant position during the forecast period. The significant growth in this region is due to the presence of major market players continuously involved in developing new technologies to produce an energy efficient cold chain system. Furthermore, the increasing demand for the perishable food products in the North American market contributes significantly towards the growth of the cold chain market.

Asia Pacific region is anticipated to be the fastest growing region owing to the rise in Government investments in order to develop advanced logistics infrastructure. In this region, China is expected to hold a significant share owing to the rise in demand for technological advancements in food processing, packaging and storage of seafoods. Moreover, the development in the pharmaceutical sector in India and China will fuel the growth of the cold chain market in this region.

Report Highlights

- In the commercial segment, the demand for cold storage systems in the retail stores, supermarkets and hypermarkets are estimated to contribute significantly towards the growth of the cold chain market.

- In the public sector, the Cold Chain Market is also expected to grow remarkably because of the increasing Government investments to develop advanced cold storage facilities.

- By Geography, North America leads the Cold Chain Market by revenues share because of its massive demand for the perishable food products.

Cold Chain Market Dynamics

Driver – The rising consumer demand for the perishable products, awareness about the importance of consuming the perishable products such as milk, meat, fruits and others are the primary attributes that is expected to drive the growth of the cold chain market, Moreover, the surge in demand for ready to eat and processed food products in the market across the globe will contribute significantly towards the growth of the cold chain market.

Restraint – The major restraining factors that is expected to hinder the growth of the cold chain market includes emission of greenhouse gases from the refrigeration units, production of carbon dioxide by the diesel powered transportation refrigeration units, food and packaging waste at each stage of supply chain, high power consumption and others.

Opportunity – The rapid surge in the development of retail chain, supermarket, hypermarkets and others will produce huge opportunities for the growth of the cold chain market. Also, in the developing countries such as China and India there has been an increase in demand for the processed food products and this is expected to produce huge opportunities forthe growth of cold chain market.

Challenges – Production of energy efficient and low greenhouse gas emissions refrigeration units is the major challenge faced by the cold chain markets. Furthermore, lack of proper food storage, poor cold chain logistics, lack of standardization are some of the challenges for the growth of the cold chain market.

Recent Developments

- On 30th March 2021 Cold chain Technologies announced that it has partnered with B Medical Systems to offer comprehensive thermal packaging and stationary refrigeration solutions for temperature critical medications.

- On 23rd September 2021 Cryopak, a leader in temperature assurance packaging and temperature monitoring devices has introduced “BOXEDin” a concept to ship high value biologics for longer-range profile duration.

Key Companies Profiled

- Agro Merchant Group

- Nordic Logistics and Warehousing LLC

- Preferred Freezer Services LLC

- Cold Chain Technologies Inc.

- Cryopack Industries Inc.

- Creopack

- Cold Box Express Inc.

Segments Covered in the Report

By Type

- Storage

- Warehouses

- On-grid

- Off-grid

- Reefer Containers

- Warehouses

- Monitoring Components

- Hardware

- Software

- Transportation

- Road

- Sea

- Rail

- Air

By Sector

- Private

- Cooperative

- Public

By Temperature Type

- Frozen

- Chilled

By Packaging

- Product

- Crates

- Dairy

- Pharmaceuticals

- Fishery

- Horticulture

- Insulated Containers & Boxes

- Payload Size

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

- Type

- Cold Chain Bags/Vaccine Bags

- Corrugated Boxes

- Others

- Payload Size

- Cold Packs

- Labels

- Temperature-controlled Pallet Shippers

- Crates

- Materials

- Insulating Materials

- EPS

- PUR

- VIP

- Cryogenic Tanks

- Others (Insulating Pouches, Hard Cased Thermal Boxes, and Active Thermal Systems)

- Refrigerants

- Fluorocarbons

- Inorganics

- Ammonia

- CO2

- Hydrocarbons

- Fluorocarbons

- Insulating Materials

By Application

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Fish, Meat, and Seafood

- Processed Food

- Pharmaceuticals

- Vaccines

- Blood Banking

- Bakery & Confectionary

- Others (Ready-to-Cook, Poultry)

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333