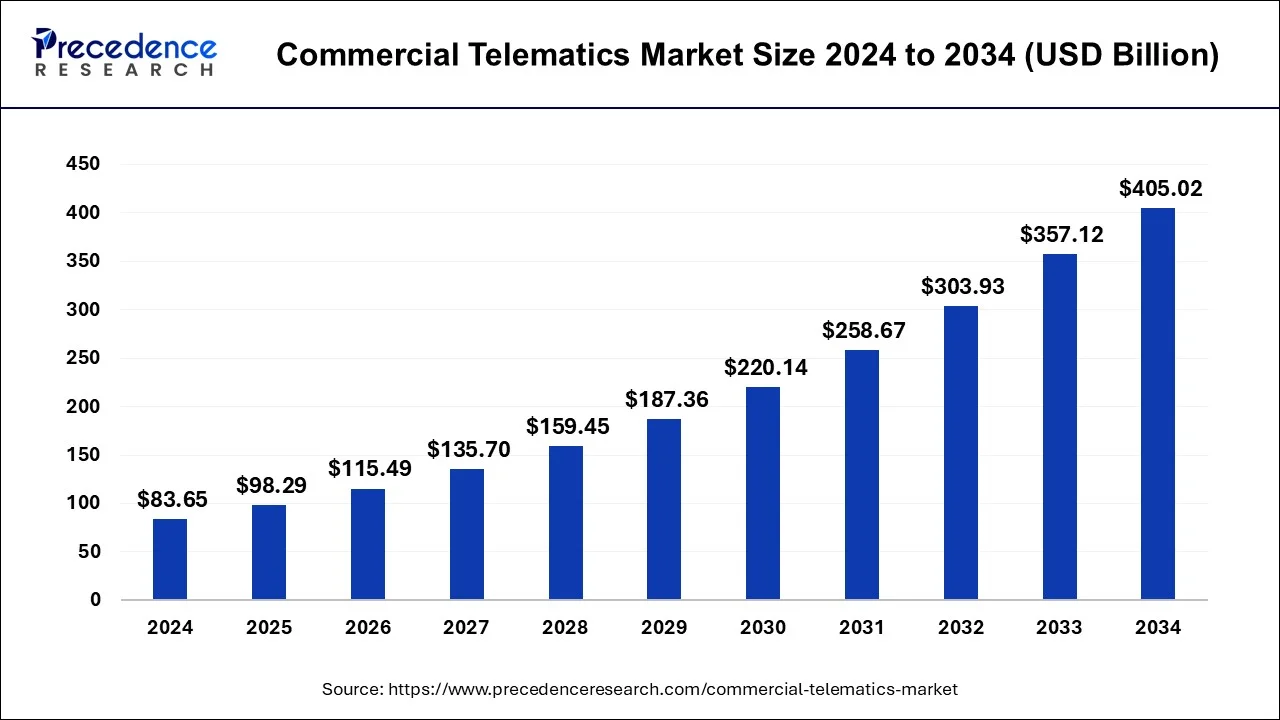

The global commercial telematics market size is estimated at USD 83.65 billion in 2024 and is projected to surpass around USD 357.12 billion by 2033 with a notable CAGR of 17.5% from 2024 to 2033.

The commercial telematics market has witnessed significant growth owing to advancements in technology and increasing adoption of connected vehicles across various industries. Telematics involves the use of telecommunications and informatics for transmitting data over long distances, primarily used in vehicles to monitor their performance, location, and driver behavior. It integrates GPS technology with onboard diagnostics to enable real-time tracking and management of fleets, enhancing operational efficiency and safety measures.

Get a Sample: https://www.precedenceresearch.com/sample/1878

Commercial Telematics Market Key Points

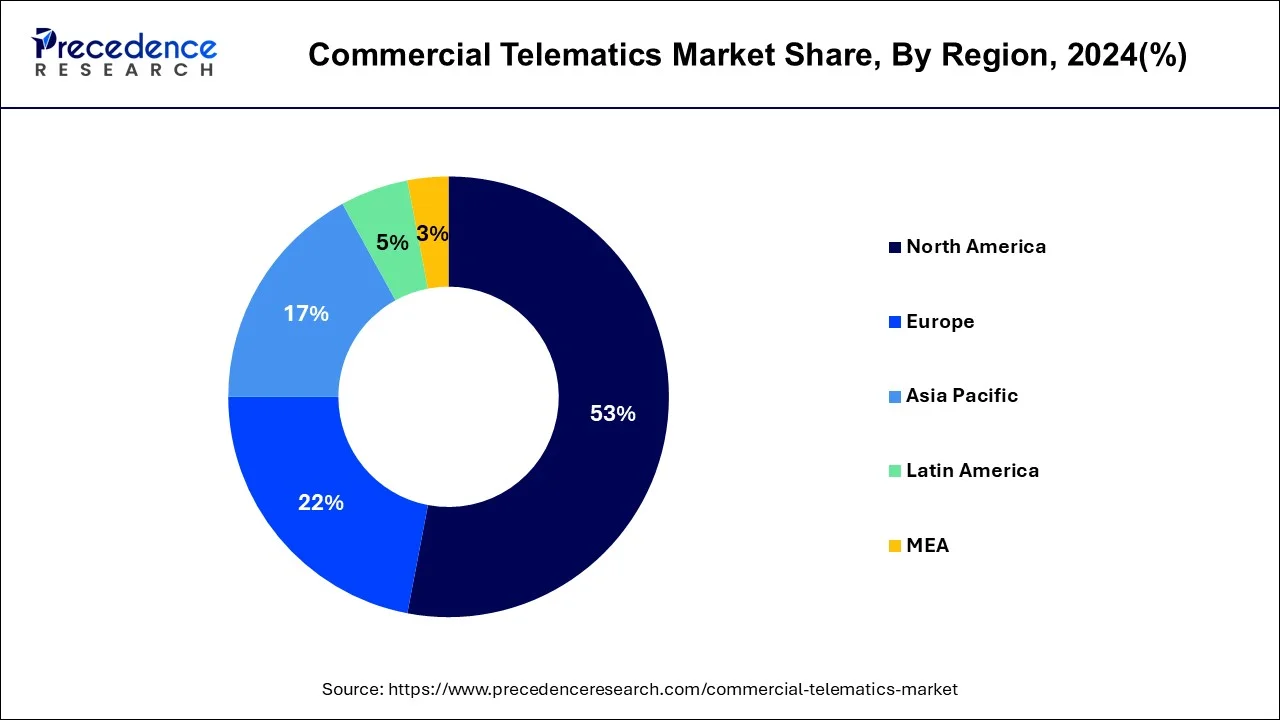

- North America represented the highest market share 52.14% in 2023.

- Asia Pacific is supposed to create at the speediest rate with a CAGR of 26.5% from 2024 to 2033.

- By application, the solution segment accounted market share of around 83% in 2023.

- By end user, the transportation and operations segment accounted for 32% market share in 2023.

- The OEM segment is expected to grow at a CAGR of 15.2% over the forecast timeframe from 2024 to 2033.

- The services segment is expected to reach a CAGR of 15.3% from 2024 to 2033.

Regional Insights

The Commercial Telematics Market is witnessing significant growth across various regions globally. North America holds a prominent share, driven by the early adoption of advanced telematics solutions in fleet management and logistics sectors. The region benefits from robust infrastructure and high penetration of connected vehicles, bolstering market expansion. In Europe, stringent regulations promoting vehicle safety and efficiency contribute to market growth, with increasing investments in smart transportation solutions.

Asia-Pacific emerges as a rapidly growing market, fueled by rising demand for fleet monitoring and management solutions in emerging economies like China and India. The region’s expanding automotive industry and government initiatives supporting smart city development further propel market opportunities. Latin America and the Middle East & Africa regions are also experiencing growth, driven by increasing commercial vehicle fleets and efforts towards enhancing transportation efficiency through telematics solutions.

Commercial Telematics Market Trends

- Integration of Advanced Technologies: Commercial telematics solutions are increasingly integrating advanced technologies such as AI (Artificial Intelligence) and IoT (Internet of Things) to provide more sophisticated fleet management, vehicle tracking, and driver behavior analysis.

- Focus on Driver Safety and Efficiency: There’s a growing emphasis on enhancing driver safety and operational efficiency through real-time monitoring of vehicle diagnostics, route optimization, and proactive maintenance scheduling.

- Demand for Connected Vehicles: The market is witnessing a rising demand for connected vehicles equipped with telematics systems that offer features like remote diagnostics, predictive maintenance, and emergency assistance.

- Expansion into New Industry Verticals: Beyond traditional logistics and transportation, commercial telematics solutions are expanding into new verticals such as construction, agriculture, and public transportation, offering tailored solutions to meet specific industry needs.

- Data Analytics for Business Insights: There’s an increasing adoption of data analytics tools that leverage the large volumes of data generated by telematics systems. This helps businesses gain actionable insights into fleet performance, fuel efficiency, and overall operational productivity.

Commercial Telematics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.5% |

| Market Size in 2023 | USD 71.19 Billion |

| Market Size in 2024 | USD 83.65 Billion |

| Market Size by 2033 | USD 357.12 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Application, By System Type, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Type Insights

Embedded telematics systems are directly integrated into vehicles during manufacturing, providing real-time data on diagnostics, location tracking, and driver behavior. These systems are crucial for automakers and large fleet operators aiming to optimize vehicle performance and maintenance schedules efficiently. Integrated telematics, on the other hand, involve aftermarket devices that can be retrofitted into vehicles, offering similar functionalities as embedded solutions but are more accessible to smaller fleets and commercial vehicle operators seeking cost-effective solutions. Tethered telematics rely on external devices like smartphones or tablets for accessing telematics features, providing flexibility and affordability for businesses leveraging existing mobile technology for fleet management and asset tracking.

Application Insights

Fleet and asset management applications of telematics help operators monitor vehicle location, fuel consumption, driver behavior, and maintenance schedules, thereby improving operational efficiency, reducing costs, and enhancing safety. Navigation and Location-Based Services (LBS) leverage telematics for precise GPS navigation, route optimization, and real-time traffic updates, benefiting logistics companies and emergency responders by ensuring efficient travel routes. Infotainment applications integrate multimedia, internet connectivity, and entertainment features into vehicles, enhancing driver and passenger experience with streaming music, hands-free calling, and voice-activated controls.

System Type Insights

Telematics systems rely on GPS/GNSS technology for accurate location tracking, geofencing, and route planning, crucial for logistics and transportation industries. Vehicle-to-Everything (V2X) systems facilitate communication between vehicles, infrastructure, and pedestrians, enhancing road safety through real-time data exchange on traffic conditions and hazards. Cellular telematics use cellular networks for continuous connectivity, enabling remote vehicle diagnostics, over-the-air updates, and real-time analytics for proactive maintenance and operational insights.

End-User Insights

Transportation and logistics sectors extensively use telematics for fleet management, route optimization, and cargo tracking, ensuring efficient operations and timely deliveries while minimizing costs. Automotive OEMs integrate telematics into vehicles to offer connected car services such as remote diagnostics, predictive maintenance, and enhanced driver assistance systems, enhancing customer satisfaction and loyalty. In the construction industry, telematics monitor heavy equipment and machinery, optimizing usage, scheduling maintenance, and improving safety on construction sites, thereby enhancing project efficiency and worker safety.

Commercial Telematics Market Dyanamic

Drivers

Several factors drive the growth of the commercial telematics market. One primary driver is the rising demand for fleet management solutions across industries such as logistics, transportation, and construction. Telematics systems offer businesses the ability to optimize route planning, monitor fuel consumption, and ensure compliance with regulatory standards, thereby reducing operational costs and improving overall productivity. Moreover, advancements in IoT (Internet of Things) technology and cloud computing have expanded the capabilities of telematics systems, enabling seamless data integration and analysis.

Opportunities

The commercial telematics market presents numerous opportunities for expansion. With the proliferation of smart cities and the increasing need for efficient transportation systems, there is a growing demand for telematics solutions that can support traffic management and vehicle-to-infrastructure communication. Additionally, the integration of artificial intelligence and machine learning algorithms into telematics platforms offers opportunities for predictive maintenance and enhanced decision-making capabilities. Furthermore, the adoption of telematics in emerging economies presents untapped markets where infrastructure development and digitization efforts are accelerating.

Challenges

Despite its growth prospects, the commercial telematics market faces several challenges. One significant challenge is concerns regarding data privacy and cybersecurity. As telematics systems collect and transmit sensitive information, ensuring robust security measures to protect against cyber threats and unauthorized access is crucial. Moreover, the complexity of integrating diverse data sources and legacy systems poses interoperability challenges for telematics service providers. Furthermore, high initial costs associated with deploying telematics solutions and resistance to change among traditional fleet operators can hinder market adoption and growth in certain regions.

Read Also: Traction Motor Market Size To Reach USD 29.66 Billion By 2032

Commercial Telematics Market Companies

- Zonar Systems, Inc.

- Trimble Inc.

- Verizon Telematics, Inc.

- Omnitracs LLC

- Inseego Corporation

Recent Developments

- Blend Telematics and Imperial Form Strategic Partnership on March 10, 2021 MiX Telematics, a main overall SaaS supplier of associated armada the executives frameworks, consented to an arrangement to turn into Imperial’s favored telematics provider. Royal is a main Africa-centered supplier of far reaching market access and planned operations arrangements. This essential coordinated effort empowers Imperial to orchestrate information and revealing. As per the new arrangement, MiX’s superior arrangements and administrations will be applied all through Imperial’s whole armada for their demonstrated gamble the board benefits.

- Portage Telematics is formally sent off on June 11, 2020 by Ford Commercial Solutions. Portage has formally divulged the Ford Telematics stage to help business vehicle clients in enhancing and expanding the effectiveness of their armadas. Passage Telematics is a membership based electronic programming stage that gives armada directors straightforward admittance to basic connected vehicle information.