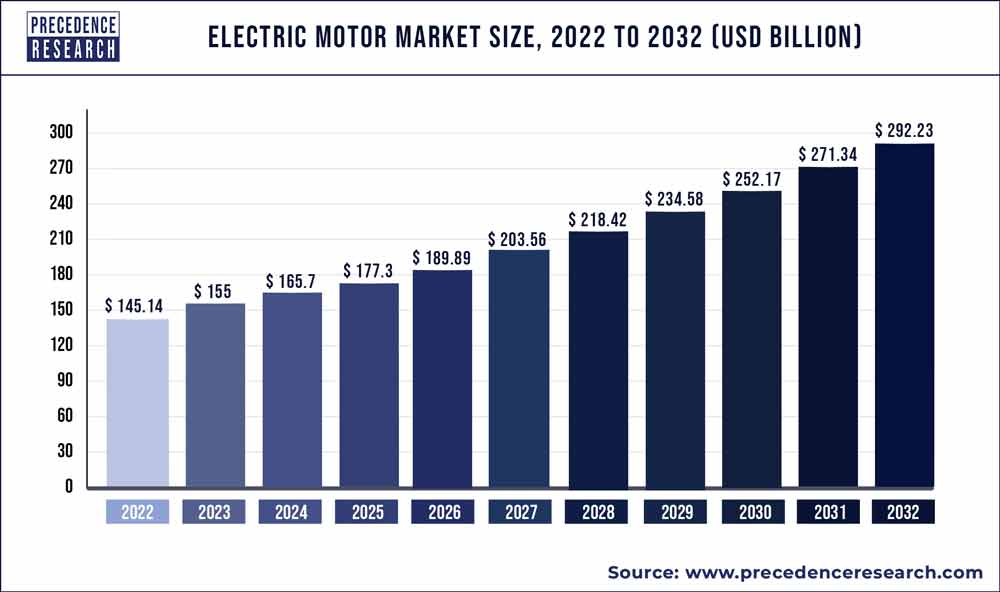

The electric motor market size reached USD 155 billion in 2023 and is expected to reach USD 292.23 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032.

Key Takeaways

- Asia Pacific led the global market with the highest market share of 38% in 2022.

- By Type, the AC electric motors segment has held the largest market share in 2022.

- By Output Power, the above 1 hp motors segment captured the biggest revenue share in 2022.

- By Rotor Type, the inner rotor segment is expected to grow at a remarkable CAGR during the forecast period.

- By End-User, the industrial segment is expected to expand at the fastest CAGR over the projected period.

The machine which converts electrical energy into mechanical energy is known as an electric motor. As compared to the traditional engines electric motors provides various advantages such as low initial cost with the same horsepower rating. It has the longer lifespan due to the less moving parts. The electrical motors are majorly used in industrial, residential, commercial, agriculture and transportation sector.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1293

Crucial factors accountable for market growth are:

- Penetration of robotics and automation in end use industries

- Investments in smart factory automation

- Increasing government spending on the waste water management

- The innovation and technological advancement

- The increasing R&D expenditure of the market leaders

Regional Snapshots

Asia Pacific dominated the global electric motor market in 2020 and projected to augment the market in the coming years. The prime factor attributed for its growth is the rapid industrialization; the countries in the Asia Pacific are progressing toward internet-based industrial operations in each sector.

Nidec Corporation said in February 2017 that it has completed the previously announced acquisition of Emerson Electric Co.’s electric power generation, motors, and drives division. The purchased company has a strong commercial foundation, a well-known brand, and a large client base, mostly in North America and Europe.These factors are expected to create a positive impact on the electric motors market in the near future.

Electric Motors Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 155 Billion |

| Market Size By 2032 | USD 292.23 Billion |

| Growth Rate From 2023 to 2032 | CAGR of 7.3% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

Report Highlights

- Based on the type, AC segment is the most dominating in the electric motor market due to its advantages such as less maintenance and longer life span.

- The above 1 hp motors is the major contributor in the electric motor market. The factors which are contributing the growth of the above 1 hp segment are their compactness, light weight, and low maintenance requirements.

- The inner rotor segment held the largest share in the electric motor market. These motors are used in robotics, CNC machines, automatic door openers, and metal cutting and forming machine applications in the manufacturing, automotive, and consumer electronics industries

- Based on the end user, the industrial segment held the prominent share in terms of revenue.

Market Dynamics

Driver

Electric motors are employed in infrastructure, major structures, and industries all around the world. Each year, almost 30 million motors are sold for industrial use alone. Electric motor makers have been inventing and challenging the worldwide marketplace as the focus has turned to pollution reduction. The business wants to completely rethink electric motor technology for usage in electric automobiles. Last year, Rolls-Royce, Siemens, and Airbus forged a cooperation with the goal of building a near-term flight demonstrator that will be a substantial step forward in commercial aircraft hybrid-electric propulsion.Thus, the innovation and technological advancement will lead to the growth of the electric motors market in the forecast period.

Restraint

A few Chinese manufacturers control the prices of raw materials such as permanent magnets, steel bars, copper wires, and precision thin metals such as specialty alloys, which are needed to create electric motors. There is little product differentiation, and the market dominance of specific providers is determined by the price of the product. The price changes that ensue must be absorbed by the market’s other manufacturers/suppliers. For example, when the price of rare-earth permanent magnets fluctuates during the manufacturing process, manufacturers and suppliers are unable to pass the price shift on to end-use customers.

Opportunities

Increasing government support in the form of tax exemptions and incentives to promote eco-friendly electric vehicles powered by electric motors is also providing chances for the electric motor market to flourish. Countries all throughout the world have set 2050 targets for reducing automobile emissions. They have begun to promote the production and sale of electric vehicles as well as related charging infrastructure. The US government, for example, spent $5 billion in 2017 to encourage electric vehicle infrastructure, such as charging stations.Electric vehicles with electric motors are becoming more popular in Europe as a result of aggressive actions done to decarbonize society.These factors are acting as an opportunity in the electric motors market.

Challenges

The market for electric motors is highly fragmented, with a significant number of domestic and international manufacturers. In this industry, product quality is a fundamental criterion for distinction. The regulated market mostly caters to industrial buyers and maintains high product quality, whereas the unorganized market provides low-cost options for tapping local markets. Such factors are the major challenges for the companies who are providing the quality electric motors.

Read Also: Automotive Powertrain Market Size to Rise USD 1,380.48 Bn by 2032

Recent Developments

- B&R, one of the major providers of machine and factory automation solutions, was acquired by ABB in 2017.

- For example, on January 24, 2019, Bosch acquired full ownership of EM-motive, one of Europe’s most successful electric motor producers.

- Nidec Corporation announced an outline for its new subsidiaries on August 3rd, 2021, after purchasing Mitsubishi Heavy Industries Machine Tool Co., Ltd.’s equity.

- Johnson Electric, for example, launched Low Voltage DC Motor Solutions for Smart Furniture on February 5, 2021. Actuators in smart recliners, height-adjustable desks, hospital beds, and other smart furniture products utilize LVDC motor solutions.

Electric Motor Market Players

- ABB Group

- General Electric

- ARC Systems, Inc.

- Asmo Co., Ltd.

- Nidec Motor Corporation

- DENSO

- WEG

- Emerson Electric

- Toshiba Corporation

- Hitachi

- Bosch

- Maxon Motors AG

- Regal Beloit Corporation

- Rockwell Automation, Inc.

- Siemens AG

- AMETEK.Inc.

- Johnson Electric Holdings Limited

Segments Covered in the Report

By Type

- Alternate Current (AC)

- Direct Current (DC)

By Output Power

- <1 HP

- >1 HP

By Rotor Type

- Outer Rotor

- Inner Rotor

By End-User

- Industrial

- Residential

- Commercial

- Agriculture

- Transportation

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/