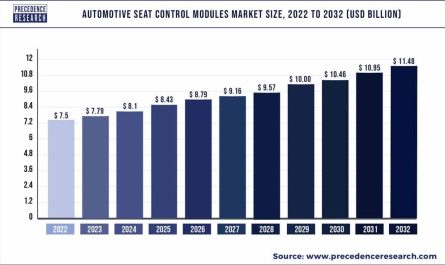

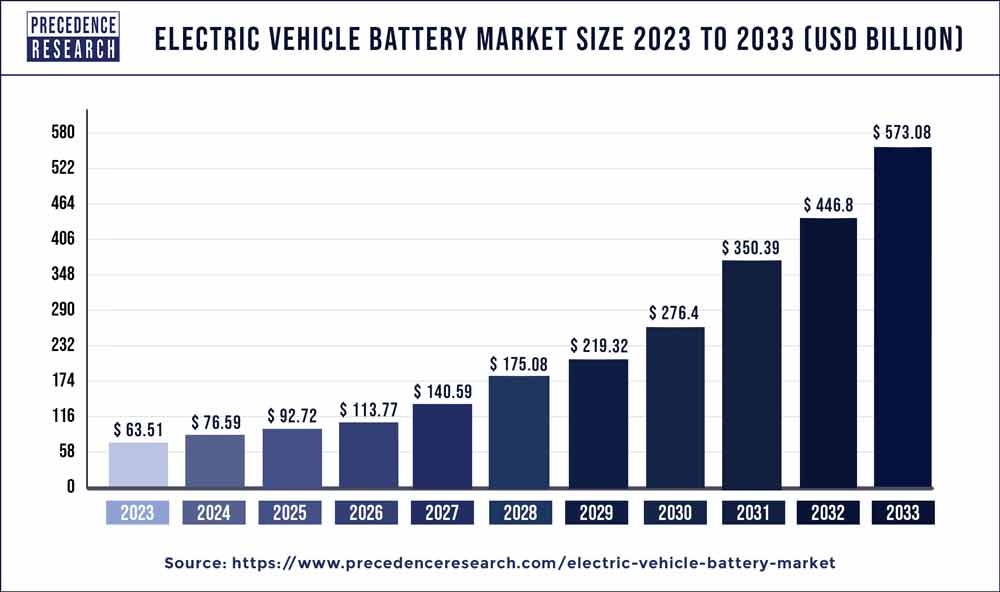

The global electric vehicle battery market size reached USD 53.08 billion in 2022 and it is expected to hit around USD 276.40 billion by 2030 with a CAGR of 22.9% from 2022 to 2030.

Key Takeaway

- APAC electric vehicle battery market was valued at USD 21.21 billion in 2022.

- Asia Pacific has held revenue share of around 39.96% in 2022.

- By battery type, lithium-ion battery segment has generated the highest revenue share of 64.67% in 2022.

- By li-ion battery component, seperator has captured 32.42% revenue share in 2022.

- By vehicle type, commercial vehicles has accounted for 56.18% revenue share in 2022.

- By propulsion, hybrid electric vehicle has exhibited revenue share of 34.55% in 2022.

- By capacity, 50-110 kWh segment hold 32.21% revenue share in 2022.

- By material, manganese segment hold 26% revenue share in 2022.

- By battery form, pouch segment has generated revenue share of over 42.91% in 2022.

The burgeoning sales of the electric vehicles across the globe are expected to significantly drive the growth of the EV battery market during the forecast period. Furthermore, the declining battery prices owing to the technological advancements and increasing research and development expenditure is another major factor behind the rising adoption of the EVs. The rising public-private partnerships to establish charging station infrastructure is a notable government initiative that is expected to fuel the growth of the global EV battery market.

Get the Sample Pages of Report@ https://www.precedenceresearch.com/sample/1626

There has been a significant upsurge in the popularity of the electric vehicles in the past few years. The rising government initiatives to shift towards electric vehicles and reduce carbon emission from vehicles have led to the regulatory reforms regarding the use of electricity powered commute solutions across the globe. In several countries, the government is offering subsidies to the consumers to purchase BEVs and PHEVs to boost the adoption of electric vehicles.

Report Highlights

- Based on battery type, the lithium-ion was the dominating segment in 2021. The lightweight of the lithium-ion batteries and its higher energy density are the two major properties that makes it suitable for use in electric vehicles. It is highly used in the BEVs and PHEVs across the globe, which led to the dominance of this segment.

- On the basis of Vehicle type, the commercial vehicle is expected to be the most opportunistic segment. The growing government initiatives to electrify the commercial vehicles and public transport medium are expected to drive the growth of this segment. The commercial vehicles are the major carbon emitting vehicles and hence its electrification is the priority of the government.

- Depending on the propulsion, the BEV segment dominated the market in 2021. The BEVs wholly depends on the batteries for power and hence the BEVs are the major consumers of the EV batteries, which led to the dominance of this segment in the EV battery market.

Regional Insights

Asia Pacific dominated the global EV battery market in 2021. With the rising urbanization and increasing purchasing power parity, the demand for the electric vehicles is rising in countries like China, India, and Japan, which is expected to augment the demand for the lithium-ion batteries. China is one of the leading markets for electric vehicles owing to its growing inclination towards clean energy. India is a top importer of the lithium-ion batteries and South Korea and China are the major trading partners for India for lithium-ion batteries. Asia Pacific is among the top producers and top consumers of the EVs and hence the demand for the EV batteries is high in Asia Pacific region. The government of India is emphasizing on the conversion of two and the three-wheelers segment into electric and wants to achieve 30% of automotive sales to e-mobility by the year 2030.

Europe is expected to exhibit the highest CAGR during the forecast period. The government initiatives to promote adoption of electric vehicles and EV batteries play the major role. The government provides subsidies and incentives to the consumers and the manufacturers as the EVs are very much expensive in Europe. The presence of top OEMs in Europe significantly contributes towards the growth of the electric vehicles and batteries market. The government in France is intended to encourage the electric commercial vehicles and is targeting to electrify the public transport solutions. Therefore, the rising government initiatives to promote EVs in various European countries are expected to drive the growth of the EV battery market in Europe in the forthcoming years.

Report Scope of the Electric Vehicle Battery Market

| Report Coverage | Details |

| Market Size by 2030 | USD 276.40 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 22.9% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2030 |

| Segments Covered | Battery Type, Vehicle Type, Propulsion, Li-ion Battery Component, Method, Capacity, Battery Form, Material Type, End User, Geography |

Market Dynamics

Driver

Rising penetration of the plug-in models

The leading manufacturers like Hyundai, Tata, Toyota, and Mercedes are heavily investing to enter into the EVs market owing to the surging demand for the EVs across the globe. Many of the auto manufacturers are partnering with the battery manufacturing companies to gain market share, strengthen their position, and exploit the market opportunities. Therefore, the rising production of the plug-in models is expected to drive the growth of the EV battery market during the forecast period.

Restraint

High costs of EVs

Electric vehicles are very expensive in the current scenario. The volume of low and middle income consumers is very high across the globe and their financial limitations may restrict them to shift to the electric vehicles. Therefore, the lower adoption of the electric vehicles among the low and middle income groups may hinder the growth of the EV battery market.

Opportunity

Growing popularity of the battery-as-a-service model

The major companies in the market are adopting battery-as-a-service model under which the consumers can swap or change the batteries after discharge. This model helps the user to save time that needs to be spent on charging the batteries and improve customer experience and customer satisfaction. The rising popularity of the battery-as-a-service model is expected to offer numerous growth opportunities to the market players in the foreseeable future.

Challenge

Battery safety concerns

EV batteries undergo various safety tests before it is put under use. The incidents like Chevy EV Bolts fire incidents pertaining to the batteries are a major doubt among the consumers regarding the battery safety. EV batteries involve the use of inflammable materials like plastics, manganese, and lithium. Lithium is highly reactive to water. Therefore, the rising concerns over battery safety are a major challenge for the market players.

Read Also: Hydrogen Aircraft Market Size Worth US$ 2,148.53 Mn By 2032

Key Market Developments

- In August 2020, CATL revealed the plan of building new EV batteries without the use of nickel and cobalt owing to the high costs associated with the cobalt.

- In November 2020, Samsung SDI decided to commercialize its li-ion battery to replace liquid electrolyte in batteries and improve the battery performance.

- In December 2019, Samsung SDI acquired additional stake of15% in the Samsung SDI-ARN Power Battery Co. Ltd. and became the major stakeholder with 65% of the company’s stake.

Some of the prominent players in the global EV battery market include:

- Hitachi, LTD.

- Sony Group Corporation

- ATLASBX Co. Ltd.

- Zhejiang Narada Power Sour

- BB Battery Co.

- Panasonic Energy Co., Ltd.

- Narada Power Source Co., Ltd.

- Robert Bosch LLC

- Crown Battery

- EnerSys, Inc.

- GS Yuasa Corporation

- TCL Corporation

- Huanyu New Energy Technology

- C&D Technologies, Inc.

- Duracell

- NEC Corporation

- North Star

- GS Yuasa Corp.

Segments Covered in the Report

(Note*: We offer report based on sub segments as well. Kindly, let us know if you are interested)

By Battery Type

- Lead-Acid Battery

- Lithium-ion Battery

- Sodium-ion Battery

- Nickel-Metal Hydride Battery

- Others

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Propulsion

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

By Li-ion Battery Component

- Positive Electrode

- Negative Electrode

- Electrolyte

- Separator

By Method

- Wire Bonding

- Laser Bonding

By Capacity

- <50 kWh

- 50-110 kWh

- 111-200 kWh

- 201-300 kWh

- >300 kWh

By Battery Form

- Prismatic

- Cyindrical

- Pouch

By Material Type

- Lithium

- Cobalt

- Manganese

- Natural Graphite

By End User

- Electric Vehicle OEMs

- Battery Swapping Stations

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/