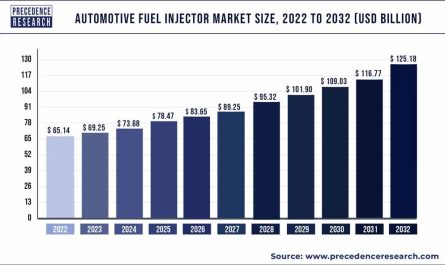

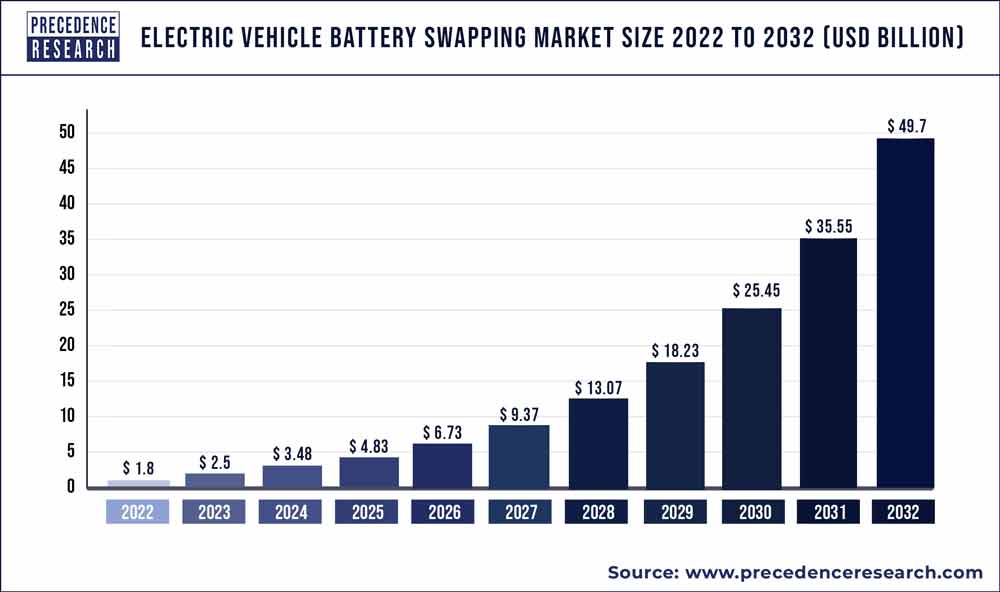

The global electric vehicle battery swapping market size was estimated at USD 2.5 billion in 2023 and is projected to hit around USD 49.70 billion by 2032 with a CAGR of 39.40% from 2023 to 2032.

Key Points

- Asia Pacific electric vehicle battery swapping market was valued at USD 72 million in 2022.

- By vehicle type, the two-wheeler segment garnered largest revenue share of 69% in 2022.

- In 2022, Asia pacific region accounted largest market share of around 44%.

- Europe will show good growth rate in near future.

- By service type, the subscription segment accounted 67% revenue share in 2022.

The Electric Vehicle (EV) Battery Swapping Market is a sector dedicated to providing a convenient solution for EV owners by allowing them to quickly replace their vehicle’s battery at specialized stations instead of waiting for it to charge. This market is gaining traction as it addresses one of the primary concerns for EV adoption: long charging times and range anxiety. It streamlines the process, offering a faster alternative for EV charging and enhancing the user experience.

Get a Sample: https://www.precedenceresearch.com/sample/1872

Growth Factors:

The growth of the Electric Vehicle Battery Swapping Market is driven by several factors. Increasing environmental concerns and stringent emissions regulations worldwide are prompting the shift towards electric vehicles. Additionally, the rapid advancement in battery technology and the proliferation of EV charging infrastructure are further boosting the market. Government incentives and subsidies for electric vehicles also play a significant role in encouraging EV adoption, thereby driving the need for battery swapping services.

Region Insights:

The market is growing at a rapid pace in regions such as Asia-Pacific, particularly in China and India, where EV adoption is on the rise due to government policies promoting cleaner transportation options. Europe is also experiencing growth in the EV battery swapping market, thanks to strict emission standards and a strong focus on sustainability. North America is expected to follow suit as electric vehicle adoption increases, particularly in urban areas with a high density of EVs.

Report Scope of the Electric Vehicle Battery Swapping Market

| Report Coverage | Details |

| Market Size by 2032 | USD 49.70 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 39.40% |

| Asia Pacific Market Share in 2022 | 44% |

| Subscription Segment Market Share in 2022 | 68% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Vehicle Type, Service Type, Geography |

Drivers:

Key drivers for the EV Battery Swapping Market include the need for rapid and efficient EV charging solutions, rising concerns over greenhouse gas emissions, and the desire for more convenient and user-friendly charging options. Additionally, the expansion of electric vehicle fleets, particularly in commercial and public transportation sectors, is creating demand for scalable battery swapping infrastructure.

Opportunities:

Opportunities in the EV Battery Swapping Market lie in the potential for innovative business models such as subscription-based battery swapping services and partnerships with electric vehicle manufacturers to integrate battery swapping technology into their products. There is also room for expansion in rural and remote areas where traditional charging infrastructure may be limited. Moreover, developing smart and efficient battery swapping systems and integrating renewable energy sources into the infrastructure present promising prospects.

Challenges:

The market faces challenges such as the high initial investment required for setting up battery swapping infrastructure and standardizing battery technology across different vehicle manufacturers. Battery safety and compatibility issues between various EV models can also be hurdles. Furthermore, the reluctance of some consumers to shift from conventional charging methods and the need for widespread education about the benefits of battery swapping could impede market growth.

Read Also: Autonomous Vehicle Chips Market Size, Report 2032

Recent Developments

- NIO and Sinopec together introduced the NIO Power Swap Station 2 which is located at Sinopec’s station. This project is situated in China. It is the first of its kind under this collaboration. It is also the second of its kind under this segment where battery swapping takes place. It mainly represents the introduction of NIO Power Swap Station 2. This event took place in April 2021.

- In June 2021, Ample and ENEOS landed into a collaboration in order to install the technology for battery swapping in Japan. The passenger companies and delivery services will be making use of them in the initial phase by the end of March 2022.

Key market players

- Numocity

- BAIC

- ChargeMyGaadi

- NIO

- KYMCO

- Amplify Mobility

- Gogoro

- Sun Mobility

- Lithion Power

- Ample

- ECHARGEUP

- Amara Raja

- Aulton New Energy Automotive Technology

- Others

Segments covered in the report

By Vehicle Type

- Two-Wheeler

- Three-Wheeler Passenger vehicle

- Three-Wheeler Light commercial vehicle

- Four Wheeler Light commercial vehicle

- Buses

- Others

By Service Type

- Subscription

- Pay Per Use

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/