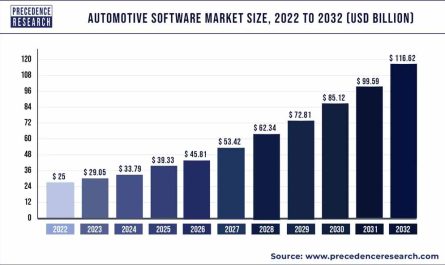

The global electric vehicle charging infrastructure market size is expected to reach around US$ 221.9 billion by 2030 from US$ 25.56 billion in 2022, growing at a CAGR of 31.02% during the forecast period 2023 to 2030.

Key Takeaway

- By type, U.S. electric vehicle charging infrastructure market was valued at USD 3.1 billion in 2021.

- Asia-Pacific region accounted highest revenue share of over 58% in 2021.

- The commercial segment has contributed highest revenue share in 2021.

- By application, the commercial segment was reached at US$ 17,406.4 million in 2021 and will grow at a 34.79% CAGR over the forecast period 2021 to 2027.

- The residential application segment was surpassed at US$ 2,107.5 million in 2021 and will reach at a 31.87% CAGR over the forecast period 2021 to 2027.

- China EV charging infrastructure market size was valued at 10462.2 million in 2021 and is projected to reach US$ 69,831.9 million 2027.

- Japan EV charging infrastructure market was valued at 442.5 million in 2021 and is predicted to reach US$ 2467.3 million 2027.

- South Korea EV charging infrastructure market size was estimated at 245.1 million in 2021 and is expected to surpass US$ 1435.5 million 2027.

- US EV charging infrastructure market was reached at 2,059.9 million in 2021 and expected to hit US$ 11,317.4 million 2027.

- Germany EV charging infrastructure market was estimated at 1275.0 million in 2021 and to reach valuation US$ 6,633.4 million 2027.

- UK EV charging infrastructure market was accounted at 858.3 million in 2021 and projected to surpass US$ 4155.8 million 2027.

- Netherlands EV charging infrastructure market was valued at 1587.9 million in 2021 and expected to reach US$ 7540.5 million 2027.

The transition of automotive industry from fuel based vehicles to electric mobility solutions promises widespread opportunities and is expected to help decarbonizing the transport sector. To achieve the maximum decarburization, accessible and robust availability of electric vehicle charging stations is very essential factor. Many of the government bodies across various countrieshave instituted various policies in order to promote innovation and development in the charging infrastructure. With growing demand for electric vehicles across the world need to customize charging infrastructure according to regional transport system is also growing.

Full Report is Ready | Get the sample copy of report@ https://www.precedenceresearch.com/sample/1461

A proper, full-fledged and contextual approach is needed to efficient and timely implementation of electric vehicle charging infrastructure stations, such as meeting requirements of local transport system optimally integrating it with the electricity supply and transport networks. Electric vehicles can be charged in various ways, depending upon the location and requirement of the vehicle and electricity supply hence charging stations for e-vehicles are of different types and specially designed for customized applications. Specifications and standards of e-vehicle charging stations differ country wise, based on available models and characteristics of the electricity grid.

Regional Snapshots

U.S., Europe, and China are among the leading regions in electric vehicle charging infrastructure market. China and Europe are expected to grow beyond the U.S. in plug based charging stations deployment by2025. This is attributed to the influence of macroeconomic factors and policies including average gas prices, policy incentives charging station production, growth in GDP, and consumption.

In Asia rapidly growing consumer base and increasing interest from government bodies to support e-vehicle industry contributed the growth of electric vehicle charging infrastructure market in Asia. Previously South Korea and Japan led the production of e-vehicles in Asia; however, China is now fastest-growing market. Factors such as high population, low oil production coupled with government involvement in the industry promises positive growth opportunities in the region. In North America and mainly in U.S., wide potential consumer base, increasing investments in R&D, shift in domestic automotive industry, and government support promises lucrative growth opportunities for electric vehicle charging infrastructure market. The U.S. government is supporting the e-vehicle industry by investing funds into domestic production and R&D facilities in order to create long term vision of strengthening the e-vehicle industry and reducing environmental impacts of fuel based vehicles. These investments and favorable environmental policies are expected to market growth in North America.

Scope of the EV Charging Infrastructure Market

| Report Coverage | Details |

| Market Size in 2022 | US$ 25.56 billion |

| Growth Rate from 2022 to 2030 | CAGR of 31.02% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2030 |

| Segments Covered | Charger Type, Connector Type, Application Type, Region |

Driver

Growing demand for fast-charging infrastructure is driving the market

Fast charging infrastructure is mainly focused at recharge e-vehicles’ batteries in minimum time period. With latest innovation in the charging infrastructures, the average time for rapid charging is around 20 minutes in which it charges up to 80% capacity. By using such rapid charging infrastructures, travelling distance of e-vehicles can be extended. With more number of such stations being implemented on public places in many countries, number of e-vehicles is also increasing. With rising number of e-vehicles on road, need for more advanced charging station is increasing and this factor is proving one of the major factors that is boosting the market growth of the electric vehicles charging infrastructure market.

Restraints

High cost of e-vehicles to restrict market growth during forecast time.

E-vehicles are considered beneficial when it comes to sustainable alterative for fuel vehicles, but while doing so its cost is much higher than the regular vehicles. The extra cost of electric vehicles is mainly attributed to the cost of battery charging, infrastructures to charge the battery, and other features that are incorporated to adhere with engine norms. The raw materials used in the batteries of e-vehicles are costlier than those batteries in fuel based vehicles, and process involved in production of these batteries is very expensive. With such costs making the e-vehicles costlier, customers of lower income group cannot afford these vehicles and hence these cars are only seen in urban areas mainly. This factor may act as a prime restraint for the growth of market in coming years.

Opportunity

Expansion of charging infrastructure in developing regions

As the e-vehicle industry and its revenue is mainly generated by urban cities, there lies an opportunity for the manufacturers to decreasing the price of e-vehicles and make it available in the price range that is affordable by middle and lower income group families. With increase in the number of e-vehicles, need for charging infrastructure will also increase which will offer lucrative growth opportunities for the market to grow. Innovative battery raw materials for batteries which will also offer high energy density could reduce the cost greatly and this can be a promising opportunities for established as well as new market players to strengthen their presence and expand in new markets. With e-vehicles market expanding in tier 2 and tier 2 cities in developing countries, opportunity lies in providing maximum number of charging infrastructures in such developing region for market players and new entrants to capture the market share and strengthen market position

Challenges

Disparity in rules and regulations regarding the charging infrastructure

With electric cars now widely available in various countries, need for specific type of charging infrastructures for various countries is also rising. The electric vehicles that are available in themarket today havea variety of charging technologies, which makes it complicated to install aunified charging network. Moreover the infrastructure and design module that can be used in Europe cannot be necessarily implemented in Asia, so market players need to change the design and dimensions according to the local needs. This process can increase the cost of overall infrastructure and costlier products are often neglected in developing countries. Such challenges may restrict market growth for some extent during the forecast period.

Read Also: Automated Guided Vehicle Market Size to Worth US$ 12.57 Bn by 2032

Report Highlights

- On the basis of charger type, during the forecast time period fast charger segment is expected to register prominent and highest CAGR. The fast charger segment accounted largest revenue share 93.2% in 2020. Rapid growth of DCFC segment is mainly because of the growing initiatives from government bodies and investments in fast-charging stations.

- By connector type, combined charging system segment accounted largest revenue share of around 37.2% in 2020. CCS charging sockets use shared communications pins to combine AC and DC inlets.

- In 2020 by vehicle type, the largest market share is captured by personal vehicles while commercial vehicles segment is expected to grow with rapid CAGR. This is mainly attributed to the shift of consumer behavior from fuel based vehicles towards battery powered electric vehicles. For personal use many customers are buying electric vehicles as they are cost efficient and are eco-friendly. Owing to increase in the government interest and investment in e-vehicle industry many local bodies are buying commercial vehicles as a mean of intercity transport and hence this segment demands more charging station in upcoming years.

Some of the prominent players in the global electric vehicle charging infrastructure market include:

- ABB

- BP Chargemaster

- ChargePoint, Inc.

- ClipperCreek, Inc.

- Eaton Corp.

- General Electric Company

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Schneider Electric

- Siemens AG

- Tesla, Inc.

- Webasto SE

Segments Covered in the Report:

By Charger Type

- Slow Charger

- Fast Charger

By Connector Type

- CHAdeMO

- Combined Charging System (CCS)

- Others

By Application

- Commercial

- Residential

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- LATAM

- MEA

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/