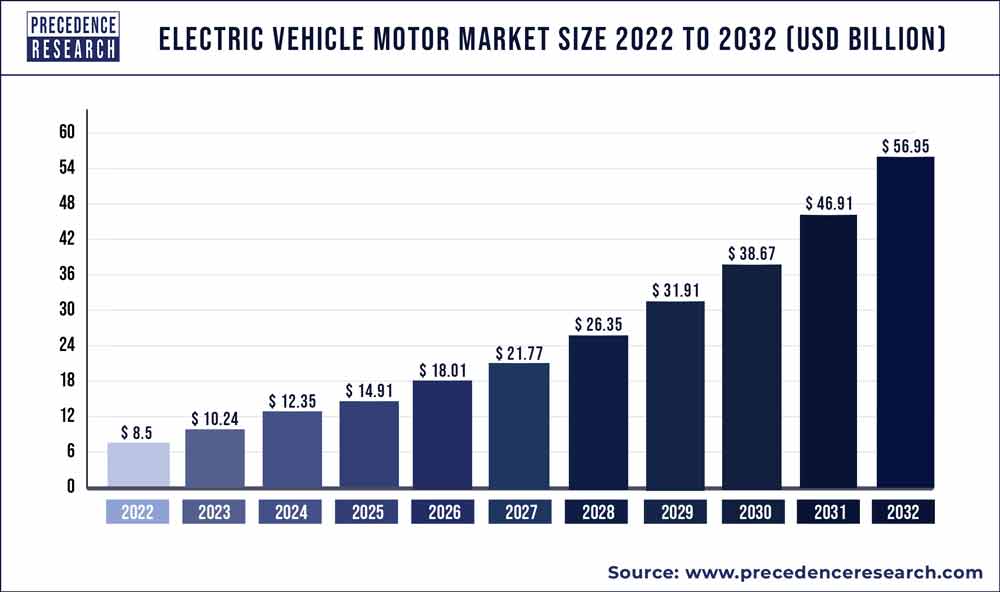

The global electric vehicle motor market was valued at USD 10.24 billion in 2023 and is predicted to reach around USD 56.95 billion by 2032, expanding growth at a CAGR of 21% from 2023 to 2032.

Key Points:

- AC motor type segment accounted 59% of revenue share in 2022.

- DC motor type segment garnered 43% revenue share in 2022.

- Asia Pacific region accounted market share of around 48% in 2022.

- Latin America and the Middle East and Africa are expected to grow at a remarkable CAGR from 2023 to 2032

The electric vehicle (EV) motor market has experienced significant growth in recent years due to increasing demand for electric vehicles globally. This market encompasses a variety of electric motors used in EVs, including induction motors, permanent magnet motors, and others. The market is poised for continued expansion as EV adoption rises, supported by advancements in motor technology and government incentives for cleaner transportation.

Get a Sample: https://www.precedenceresearch.com/sample/1860

Growth Factors:

Key growth factors in the EV motor market include the rising demand for eco-friendly transportation options, advancements in electric motor technology, and increased investment in electric vehicle infrastructure. Additionally, stricter emission regulations worldwide are pushing automakers to develop and produce more electric vehicles, thereby boosting the demand for EV motors.

Region Insights:

The EV motor market exhibits different growth patterns across various regions. In North America, the market is driven by government incentives and policies promoting electric vehicle adoption. In Europe, stringent emission standards and a strong focus on sustainability drive market growth. Asia-Pacific, particularly China, is a major hub for EV production and consumption, leading the market with high demand and manufacturing capabilities.

Report Scope of the Electric Vehicle Motor Market

| Report Coverage | Details |

| Market Size by 2032 | USD 56.95 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 21% |

| Asia Pacific Market Share in 2022 | 48% |

| AC motor Type Market Share in 2022 | 59% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Type, Vehicle Type, Motor Type, Power Rating, Application, Powertrain Type, Marketplace, End User, Geography |

Drivers:

The main drivers of the EV motor market include government policies promoting EV adoption, advancements in motor efficiency and performance, and growing consumer awareness of environmental issues. Additionally, the development of improved charging infrastructure and the declining cost of EV technology are key drivers that support market growth.

Opportunities:

Opportunities in the EV motor market include the development of more efficient and cost-effective motor technologies, expanding electric vehicle models across different vehicle types, and increased collaboration between automakers and technology companies. There is also potential for growth in emerging markets where EV adoption is still in its early stages.

Challenges:

Challenges in the EV motor market include high initial costs for EVs and their components, limited charging infrastructure in certain regions, and competition from traditional internal combustion engine vehicles. Additionally, the supply chain for critical materials, such as rare earth elements used in certain types of motors, can pose risks and uncertainties for manufacturers.

Read Also: Hybrid Electric Vehicle Market Size, Share , Report 2032

Key market developments

- Electric vehicles have turned into a fundamental part of the car business. It gives a way toward more noteworthy energy effectiveness, as well as lower outflows of toxins and other ozone depleting substances. The key components driving this ascent incorporate rising ecological worries, as well as gainful government endeavors. The yearly deals volume of electric traveler vehicles is assessed to surpass 5 million units toward the finish of 2025, and it is normal to represent 15 percent of complete vehicle deals toward the finish of 2026.

- Super Power Systems marked another coordinated effort manage Statcon Energiaa (SE), an India-based power hardware producing business, in April 2021. The understanding is supposed to expand two associations’ involvement with the examination, assembling, and showcasing of force hardware items for the energy, rail, and protection businesses.

- In February 2021, Johnson Electric presented another line of Low Voltage DC (LVDC) engines with highlights like little size, high power thickness, low working commotion, and high force. The new things are explicitly intended to give Smart Furniture like clinical beds, level flexible workstations, savvy chairs, and other buyer items a 17 percent longer life.

- Mabuchi Motors expressed in June 2021 that it will finish a 100% procurement of Electromag SA for a complete capital of about CHF 0.1 million or USD 0.11 million. Mabuchi’s portfolio will be extended with new brushless engines used in medical care offices like ventilators and dental therapy.

Electric Vehicle Motor Market Companies

- Shenzhen V&T Technologies Co. Ltd.

- Time High-Tech Co. Ltd.

- Shanghai E-drive Co. Ltd.

- Kelly Controls LLC

- BYD

- Zhuhai Enpower Electric Co. Ltd.

- Delta Electronics

- Profile

- Chroma ATE Inc.

- DEC Dongfeng Electric Machinery Co. Ltd.

- Canadian Electric Vehicles Ltd

- Fujian Fugong Power Technology Co. Ltd.

- Hunan CRRC Times Electric Vehicle Co. Ltd.

- Nidec (Beijing) Drive Technologies Co. Ltd.

- Jing-Jin Electric Technologies (Beijing) Co. Ltd.

- United Automotive Electronic Systems Co. Ltd. (UAES)

- Shenzhen Inovance Technology Co. Ltd.

- JEE Automation Equipment Co. Ltd.

- Shandong Deyang Electronics Technology Co. Ltd.

- Beijing Siemens Automotive E-Drive System Co. Ltd.

- Zhongshan Broad-Ocean Motor Co. Ltd.

- Parker

- Prestolite E-Propulsion Systems (Beijing) Limited

Segments covered in the report

By Type

- AC Motor

- Synchronous AC Motor

- Induction AC Motor

- DC Motor

- Brushed DC Motor

- Brushless DC Motor

By Vehicle Type

- Pure Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle (FCEV)

By Motor Type

- Induction Motor

- Synchronous Motor

- Switched Reluctance Motor

By Power Rating

- Up to 60 KW

- 60 to 90 KW

- Above 90 KW

By Application

- Electric Two-Wheeler

- Electric Three-Wheeler

- Electric Commercial Vehicles

- Electric Passenger Cars

By Powertrain Type

- Single Motor

- Dual Motor

- Triple Motor

- Four Motor

By Marketplace

- OEM

- Aftermarket

By End User

- Agribusiness

- Transportation

- Private

- Business

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/