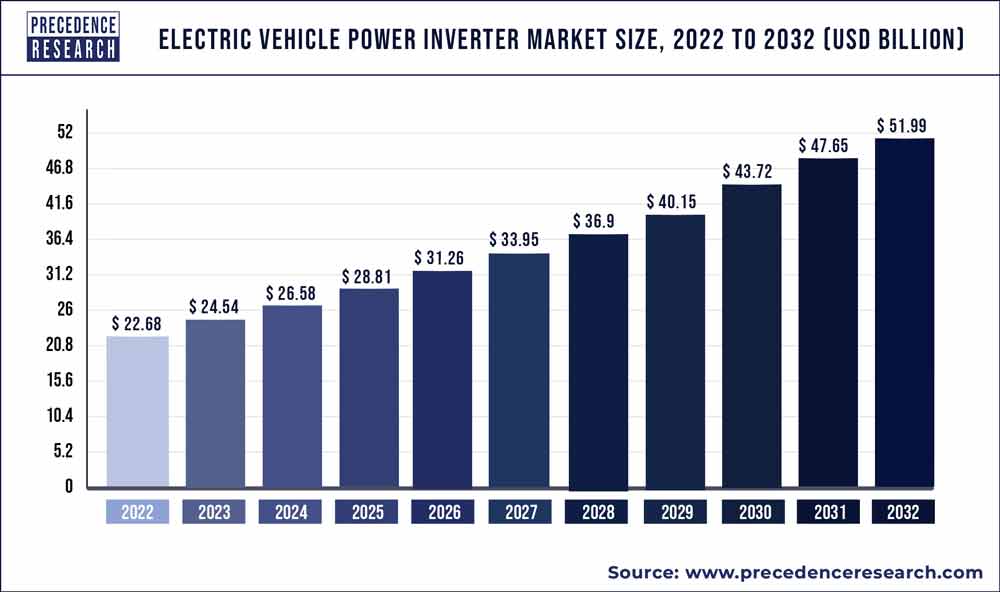

The global electric vehicle power inverter market size was valued at USD 22.68 billion in 2023 and it is predicted to grow around USD 51.99 billion by 2032, expanding at a remarkable CAGR of 8.7% from 2023 to 2032.

Key Points

- By propulsion, the Electric Vehicle Battery segment has registered a 59% revenue share in 2022.

- By inverter type, the traction inverter segment has led the market with a 55% revenue share in 2022.

- By vehicle type, the passenger vehicle segment has captured 87% revenue share in 2022.

- By distribution channel, the aftermarket segment has generated 79% market share in 2022.

- The Asia-Pacific made up 44% market share in 2022.

The electric vehicle power inverter market is a critical component of the electric vehicle ecosystem, responsible for converting direct current (DC) from the battery into alternating current (AC) to power the vehicle’s electric motor. As electric vehicles continue to gain traction worldwide, driven by environmental concerns and government initiatives to reduce emissions, the demand for efficient and reliable power inverters is on the rise. The market encompasses a wide range of power inverters, including onboard chargers, DC-DC converters, and traction inverters, catering to various vehicle types and applications. With advancements in semiconductor technology, power electronics, and vehicle electrification, the electric vehicle power inverter market is poised for significant growth in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/2224

Growth Factors:

Several key factors are driving the growth of the electric vehicle power inverter market. Firstly, the increasing adoption of electric vehicles, propelled by stringent emissions regulations, incentives for electric mobility, and advancements in battery technology, is fueling the demand for power inverters. As automakers invest in electrifying their vehicle fleets, the need for efficient power management solutions, including power inverters, becomes paramount. Additionally, advancements in power electronics, such as silicon carbide (SiC) and gallium nitride (GaN) semiconductors, enable power inverters to achieve higher efficiency, power density, and reliability, meeting the performance requirements of electric vehicles while minimizing energy losses. Moreover, the growing trend towards vehicle electrification across various transportation sectors, including passenger cars, commercial vehicles, and public transportation, further drives the demand for electric vehicle power inverters.

Region Insights:

The electric vehicle power inverter market exhibits regional variations in terms of adoption rates, regulatory frameworks, and technological capabilities. Regions leading in electric vehicle adoption, such as Europe, China, and North America, also drive demand for power inverters. Europe, with its ambitious targets for reducing greenhouse gas emissions and promoting electric mobility, is a key market for electric vehicle power inverters. The region’s robust automotive industry and supportive regulatory environment create opportunities for power inverter manufacturers to supply to leading automakers. China, the world’s largest electric vehicle market, presents significant opportunities for power inverter suppliers, fueled by government incentives, investment in charging infrastructure, and rapid electrification of the transportation sector. North America, with its mature automotive industry and strong focus on innovation, is another prominent market for electric vehicle power inverters, driven by consumer demand for electric vehicles and advancements in power electronics technology.

Trends:

Several trends are shaping the electric vehicle power inverter market. One notable trend is the integration of power electronics and electric vehicle systems to optimize efficiency, performance, and reliability. Power inverter manufacturers are collaborating with automakers and semiconductor companies to develop customized solutions tailored to specific vehicle platforms and applications. Moreover, the trend towards vehicle electrification across various segments, including passenger cars, commercial vehicles, and two-wheelers, is driving demand for power inverters with higher power ratings, compact form factors, and enhanced thermal management capabilities. Another trend is the transition towards wide-bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), which offer superior performance, efficiency, and reliability compared to traditional silicon-based power devices. As electric vehicle powertrain architectures evolve, power inverter manufacturers are innovating to meet the evolving requirements of next-generation electric vehicles, including higher voltages, faster switching speeds, and advanced control algorithms.

Electric Vehicle Power Inverter Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 24.54 Billion |

| Market Size by 2032 | USD 51.99 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.7% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Propulsion Type, Vehicle Type, Inverter Type, Level of Integration, Distribution Channel, and Geography |

Drivers:

Several drivers are propelling the growth of the electric vehicle power inverter market. Firstly, the increasing adoption of electric vehicles, driven by regulatory mandates, consumer demand, and advancements in battery technology, creates a robust demand for power inverters. Automakers are investing in electric vehicle platforms and expanding their electric vehicle lineup, driving the need for high-performance power inverters to meet the powertrain requirements of electric vehicles. Additionally, advancements in power electronics technology, including wide-bandgap semiconductors and advanced thermal management techniques, enable power inverter manufacturers to deliver compact, efficient, and reliable solutions for electric vehicles. Moreover, the growing focus on energy efficiency, sustainability, and reducing carbon emissions in the transportation sector further accelerates the demand for electric vehicle power inverters as a key enabler of electrification.

Opportunities:

The electric vehicle power inverter market presents numerous opportunities for stakeholders across the value chain. Power inverter manufacturers have the opportunity to differentiate their offerings through innovation in power electronics, thermal management, and control algorithms, catering to the diverse requirements of electric vehicle applications. Collaboration with automakers, semiconductor companies, and research institutions can drive technology development and accelerate time-to-market for next-generation power inverters. Moreover, expanding into emerging markets with nascent electric vehicle industries presents opportunities for power inverter suppliers to establish a foothold and capitalize on the growing demand for electric mobility. As the electric vehicle market continues to evolve, power inverter manufacturers can leverage their expertise to develop integrated solutions that optimize efficiency, performance, and reliability across the electric vehicle powertrain.

Challenges:

Despite the promising growth prospects, the electric vehicle power inverter market faces several challenges that could hinder its expansion. One challenge is the complexity of electric vehicle powertrain architectures, which require power inverters to meet stringent performance, efficiency, and reliability requirements while minimizing size, weight, and cost. Developing power inverters that can withstand harsh operating conditions, including high temperatures, vibration, and humidity, poses engineering challenges for manufacturers. Additionally, the rapid pace of technological innovation and evolving industry standards necessitate continuous investment in research and development to stay competitive in the market. Supply chain disruptions, including shortages of critical components and raw materials, could also impact the availability and cost of electric vehicle power inverters. Moreover, the lack of standardization in electric vehicle power electronics poses interoperability challenges for power inverter suppliers, automakers, and charging infrastructure providers, hindering seamless integration and interoperability across different electric vehicle platforms and charging networks.

Read Also: Long-distance General Freight Trucking Market Size,Share, Report 2032

Recent Developments

- In March 2022, Sony Group Corporation and Honda Motor Co., Ltd signed a memorandum of understanding indicating their aim to create a joint venture to work on the development and sale of high-value-added battery electric cars (EVs).

- A company called Robert Bosch introduced a new initiative in collaboration with the Fraunhofer IZM and Porsche in Berlin aimed at boosting the variety of electric cars (EVs) by improving the driving performance of the power inverters in cars in May 2021.

- Mitsubishi Electric Corp stated in August 2019 that the company has finished the structure of its new eight plant building located at Himeji Works in Hirohata. The business spent approx $63.6 million on the new factory, which produces motors, generator, and inverter for hybrid electric vehicles.

Segments Covered in the Report

By Propulsion Type

- Hybrid Vehicle

- Plug in Hybrid Vehicle

- Battery Electric Vehicle

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Inverter Type

- Traction Inverter

- Soft Switching Inverter

By Level of Integration

- Integrated Inverter System

- Separate Inverter System

- Mechatronic Integration System

By Distribution Channel

- OEM

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/