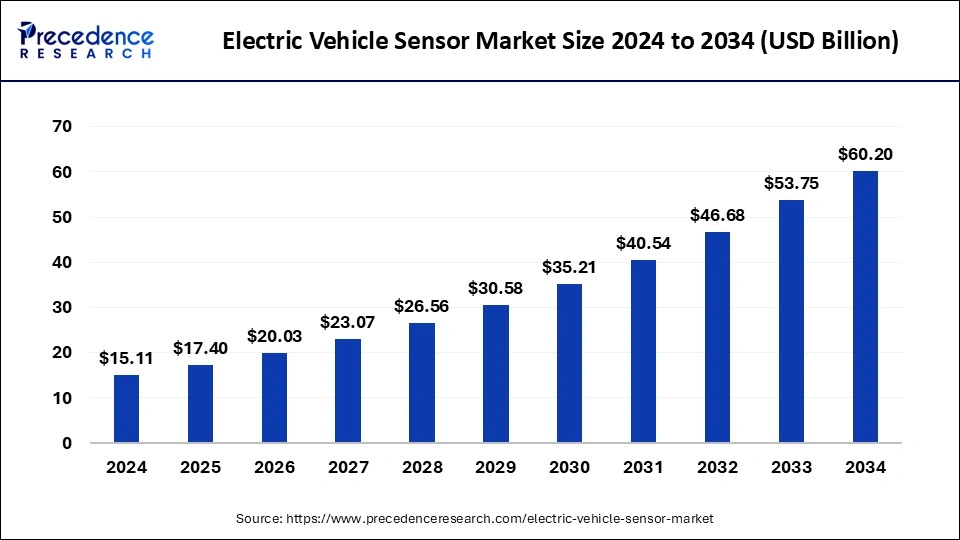

The global electric vehicle sensor market size is estimated at USD 15.11 billion in 2024 and is projected to reach around USD 53.75 billion by 2033 with a noteworthy CAGR of 15.14% from 2024 to 2033.

The Electric Vehicle (EV) sensor market is experiencing significant growth driven by the rapid adoption of electric vehicles worldwide. Sensors play a crucial role in EVs by monitoring various parameters such as battery temperature, electric motor performance, vehicle speed, and environmental conditions. These sensors enable efficient operation, ensure safety, and contribute to the overall performance optimization of electric vehicles. As the automotive industry shifts towards sustainable mobility solutions, the demand for advanced sensors tailored for electric vehicles continues to rise.

Get a Sample: https://www.precedenceresearch.com/sample/4605

Electric Vehicle Sensor Key Points

- Asia Pacific dominated the market with the highest market share in 2023.

- Europe is observed to grow at a significant rate during the forecast period.

- By product type, the temperature sensor segment dominated the market with the largest market share in 2023.

- By propulsion type, the battery electric vehicles segment projected the largest market share in 2023.

Asia Pacific dominated the market in 2023

- Increasing EV Production and Sales: The global push towards reducing carbon emissions and dependence on fossil fuels is driving the production and sales of electric vehicles. This surge directly influences the demand for sensors used in EVs.

- Advancements in Sensor Technology: Sensors play a crucial role in the operation and performance optimization of electric vehicles. There is ongoing development in sensor technology to enhance accuracy, reliability, and efficiency in EVs. This includes sensors for battery management, electric motor control, and vehicle dynamics.

- Rising Demand for Safety and Driver Assistance Systems: Electric vehicles are incorporating advanced driver assistance systems (ADAS) and safety features. Sensors such as LiDAR, radar, ultrasonic sensors, and cameras are essential for functionalities like adaptive cruise control, collision avoidance, and autonomous emergency braking.

- Focus on Energy Efficiency and Range Optimization: Sensors are pivotal in optimizing energy efficiency and extending the range of electric vehicles. This includes sensors for monitoring battery health, temperature, and charging status, as well as aerodynamic sensors for reducing drag.

- Integration of IoT and Connectivity: Electric vehicles are increasingly becoming part of the IoT ecosystem, requiring sensors for data collection and transmission. These sensors enable vehicle-to-grid (V2G) communication, remote diagnostics, and over-the-air (OTA) updates.

Electric Vehicle Sensor Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 53.75 Billion |

| Market Size in 2023 | USD 13.12 Billion |

| Market Size in 2024 | USD 15.11 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 15.14% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product Type, Propulsion, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Type Insights

The Electric Vehicle Sensor Market’s product type segment encompasses a diverse range of sensors critical to the functionality and safety of electric vehicles (EVs). Temperature sensors are pivotal in regulating and monitoring the temperature of components like batteries and motors, ensuring optimal performance and preventing overheating. Position sensors play a crucial role in determining the precise position of pedals, steering wheels, and actuators, providing essential feedback for accurate vehicle control and enhancing safety. Current sensors monitor the flow of electrical current within EVs, facilitating efficient battery management and motor operation. Proximity sensors detect objects in the vehicle’s vicinity, integral for ADAS features such as collision avoidance and parking assistance. Pressure sensors, meanwhile, maintain optimal fluid pressures in systems like brakes and suspensions, contributing to overall vehicle safety and performance.

Propulsion Insights

In the Electric Vehicle Sensor Market, the propulsion segment focuses on sensors tailored for electric propulsion systems. Motor position sensors are vital for monitoring the position and speed of electric motors, essential for precise control and efficient power distribution. Battery State-of-Charge (SOC) sensors gauge the remaining capacity of EV batteries, crucial for estimating driving range and optimizing charging cycles. Sensors embedded within inverters and converters monitor electrical parameters like voltage and current, ensuring efficient energy conversion and powertrain performance. Torque sensors measure the torque generated by motors, facilitating smooth acceleration and enabling regenerative braking. Acceleration and gyroscopic sensors detect vehicle movement, supporting stability control and driver assistance systems, enhancing overall safety and driving experience in electric vehicles.

Read Also: Automotive Lubricants Market Size to Cross USD 84.41 Bn by 2033

Electric Vehicle Sensor Market Companies

- Melexis

- Continental AG

- NXP Semiconductors

- Valeo

- Robert Bosch

- Venture Capital GmbH

- Denso Corporation

- Renesas Electronics

- Panasonic

- Sensate Technologies Inc.

- Amphenol Advanced Sensors

Recent Developments

- In May 2022, Continental is expanding its range of sensor portfolio with the launch of its two latest electric vehicle sensors the Battery Impact Detection (BID), and the Current Sensor Module (CSM) system with the technology for protecting battery or on battery parameter retention.

- In June 2024, Planet Electric, a Delhi-based automobile startup is planning to introduce its first electric vehicle. The company is claiming the integration of industries first weight sensor telematics system which will provide real-time updates on cargo weight, and responds to the vehicle’s driving range.

- In October 2023, NVIDIA comes in the strategic partnership with the Foxconn to launch the next wave of intelligent electric vehicle (EV) platforms for the worldwide automotive market.

- In January 2024, Texas Instruments (TI) is launched the latest semiconductor design the AWR2544 77GHz mm-wave radar sensor chip, the first satellite radar architectures allows increase level of autonomy by enhancing sensor fusion and decision making in ADAS.

- In November 2023, United Safety & Survivability Corporation, a leading player in the advanced safety solutions is launched the new innovation, a Lithium-Ion Battery Failure Detection Sensor for transforming the safety standards of the electric vehicles across industries.

- In April 2023, Volvo, a leading automaker is starts its production of its EX90 electric vehicles with the integration of laser sensors to enhancing safety and self-driving features in the EX90. With enabling the EX90 will become the first consumer vehicle to standardize this technology.

Electric Vehicle Sensor Market Dynamics

Drivers

Several key drivers propel the growth of the electric vehicle sensor market. First and foremost is the global push towards reducing greenhouse gas emissions and dependence on fossil fuels, which has accelerated the adoption of electric vehicles. Government incentives and regulations promoting electric vehicle adoption, coupled with increasing consumer awareness of environmental sustainability, further boost market growth. Additionally, advancements in sensor technology, including improvements in accuracy, reliability, and miniaturization, are enhancing their integration into electric vehicles, thereby driving market expansion.

Opportunities

The electric vehicle sensor market presents numerous opportunities for stakeholders across the value chain. One prominent opportunity lies in the development of sensors optimized for electric vehicle powertrains and battery management systems. As electric vehicle architectures evolve, there is a growing demand for sensors capable of monitoring high-voltage systems and ensuring operational safety and efficiency. Furthermore, the integration of smart sensors with predictive maintenance capabilities offers opportunities for service providers to enhance vehicle lifecycle management and reduce operational costs for electric vehicle owners. The expanding market for autonomous and semi-autonomous electric vehicles also opens avenues for sensor manufacturers to innovate and cater to the unique sensor requirements of autonomous driving technologies.

Challenges

Despite the promising growth prospects, the electric vehicle sensor market faces several challenges. One significant challenge is the cost of sensor technologies, particularly for high-precision sensors required in electric vehicles. Manufacturers must strive to achieve cost efficiency while maintaining high performance standards to meet the price sensitivity of electric vehicle OEMs and consumers. Another challenge is the complexity associated with sensor integration into electric vehicle architectures, especially in terms of compatibility, calibration, and reliability under diverse operating conditions. Additionally, ensuring cybersecurity and data privacy measures for sensors connected to electric vehicle networks presents a critical challenge as the industry transitions towards interconnected and autonomous vehicle ecosystems.