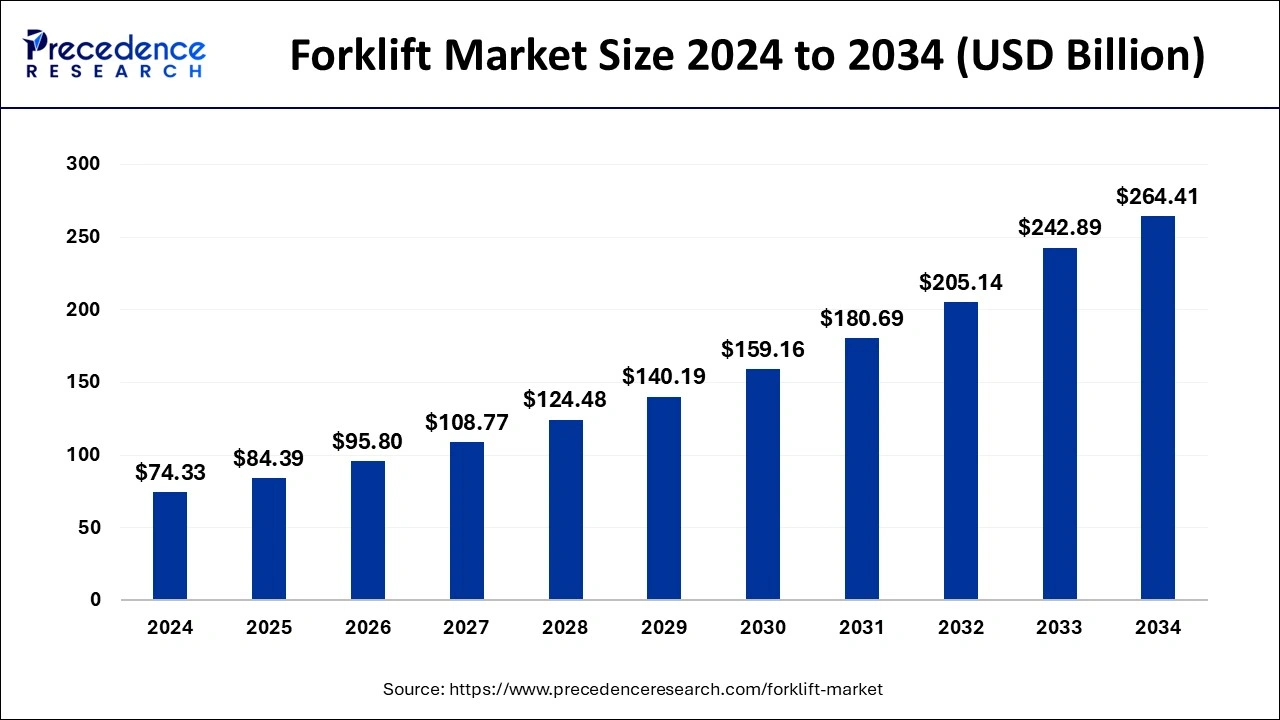

The global forklift market size was accounted at USD 74.33 billion in 2024 and is projected to attain around USD 264.41 billion by 2034 with a CAGR of 13.53%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1032

Key Takeaways

- In 2024, Asia-Pacific held the highest market share at 48%.

- The class 3 category led with a 44% market share in 2024.

- The electric power source segment recorded the largest market share in 2024.

- The 5-15 ton load capacity segment contributed the most to the market in 2024.

- The lead-acid battery type dominated the electric battery segment with a 67% share in 2024.

- The industrial end-use sector captured over 25% of the market share in 2024.

AI Transforming the Forklift Market

Artificial intelligence is revolutionizing the forklift industry by enhancing automation, efficiency, and safety. AI-powered autonomous forklifts are reducing the need for manual operation, improving warehouse logistics, and minimizing human errors. Machine learning algorithms enable forklifts to optimize navigation, detect obstacles, and adapt to changing warehouse environments in real time.

AI-driven predictive maintenance is another game-changer, allowing fleet managers to monitor forklift performance and detect potential failures before they occur. This reduces downtime, lowers maintenance costs, and increases overall productivity. Additionally, AI integration with IoT and data analytics helps optimize fleet management, ensuring better route planning and fuel efficiency.

As AI technology advances, the forklift market is expected to see increased adoption of fully autonomous and semi-autonomous solutions, leading to safer, more efficient, and cost-effective material handling operations.

Market Drivers

The forklift market is driven by the rapid growth of e-commerce, increasing warehouse automation, and rising demand for efficient material handling solutions. The expansion of manufacturing industries and the construction sector further fuels the need for forklifts across various applications.

Opportunities

Advancements in electric forklifts and autonomous technology present significant growth opportunities. The push for sustainability and emission-free operations is leading to higher adoption of battery-powered forklifts, while the integration of IoT and AI enhances operational efficiency.

Challenges

High initial investment costs and maintenance expenses pose challenges for small and medium-sized businesses. Additionally, a shortage of skilled operators and safety concerns related to forklift operations create obstacles in the market’s growth.

Regional Insights

The Asia Pacific region dominates the forklift market due to rapid industrialization and infrastructure development, particularly in China and India. North America and Europe also show strong demand, driven by warehouse automation and stringent workplace safety regulations.

Forklift Market Companies

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha

- Forklift Co., Ltd.

- Toyota Motor Corporation (Toyota Material Handling)

- Hyster-Yale Materials Handling, Inc. (Hyster-Yale Group, Inc.)

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnex

Recent Developments

- In February 2024, ArcBest announced the introduction of remote-operated autonomous reach vehicles and forklifts. Vaux Smart Autonomy is an expansion of the business’s existing warehouse freight management technology.

- In November 2023, the leading innovator in material handling technology, Toyota Material Handling (TMH), is introducing a new range of electric pneumatic forklifts, including 48V and 80V variants. This sturdy line is perfect for retail applications, including landscaping, home centers, lumberyards, and shop support applications, because it is made to resist outside terrain and operate in various weather conditions.

Segments covered in the report

By Class

- Class 1

- Class 2

- Class 3

- Class 4/5

By Power Source

- ICE

- Electric

By Load Capacity

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

By Electric Battery Type

- Li-ion

- Lead Acid

By End Use

- Industrial

- Logistics

- Chemical

- Food & Beverage

- Retail & E-Commerce

- Others

By Regional Outlook

- North America

- U.S.

- Rest of North America

- Europe

- U.K.

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America- Middle East & Africa

- Brazil

- Mexico

- Argentina

- Colombia

- South Africa

- Saudi Arabia

- UAE

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/