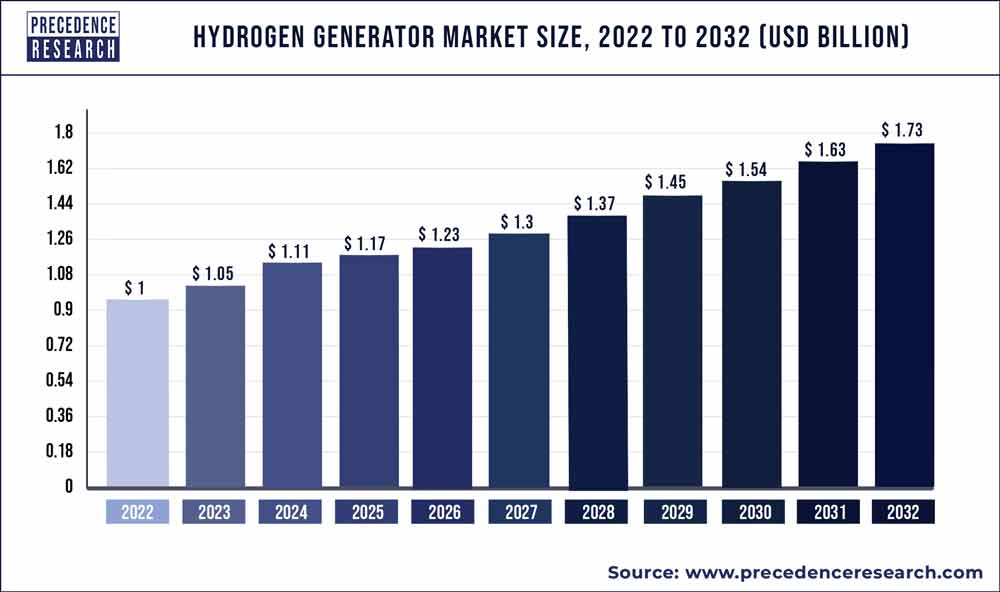

The global hydrogen generator market size was valued at USD 1 billion in 2022 and is expected to hit around USD 1.73 billion by 2032, notable at a CAGR of 5.7% from 2023 to 2032.

A hydrogen generator is a device that creates hydrogen from water and fossil fuels using a number of techniques, including electrolysis and steam reforming. It produces high-grade hydrogen gas from water by using a proton exchange membrane. In the beginning, NASA employed this technique to power spacecraft. Currently, hydrogen generators are used in a wide range of processes, such as chemical synthesis, fuel cells, refinement, and petroleum recovery.

Get the Free Sample Copy of Report@ https://www.precedenceresearch.com/sample/2383

The hydrogen generators market is being driven by growing energy use, increased awareness of the usage of renewable fuel sources, and the quick depletion of fossil resources. Furthermore, it is anticipated that the market for hydrogen generators would be driven by strict emission rules that encourage the use of clean fuels like hydrogen instead of fossil fuels.

There is rising concern about carbon emissions and global warming. Governments from all over the world have put in place a variety of regulations and policies that demand a decrease in carbon emissions from different enterprises. During the electrolysis process, which yields hydrogen, water is split into hydrogen and oxygen using electricity. Energy sources, either renewable or not, are used to produce power. For instance, governments all across the world are setting up electric public transit systems and building public infrastructure. A rise in the need for electrolyzers is also anticipated as the popularity of electric cars increases. Therefore, throughout the foreseeable period, these factors are anticipated to offer profitable chances for industry growth.

Hydrogenics Corporation was purchased by Air Liquide, a French manufacturer of industrial gases, for $20.5 million in January 2019. With this purchase, the Air Liquide business is able to reaffirm its long-term commitment to the hydrogen energy markets and its goal to dominate the supply of carbon-free hydrogen, notably for the industrial and transportation sectors. Based in Canada, Hydrogenics Corporation develops and produces fuel cell and hydrogen generating systems using water electrolysis and proton exchange membrane technology.

Regional Snapshots

Due to the increasing demand for hydrogen for Fuel Cell Electric Vehicles, North America dominated the global market for hydrogen generators in 2019. (FCEVs). Additionally, the growth of auxiliary infrastructure like hydrogen refueling stations is anticipated to propel the regional hydrogen generator market. The cost of renewable energy sources, particularly solar PV and wind turbines, has been declining, which has led to a rise in interest in electrolytic hydrogen throughout the world. Throughout the anticipated period, this is anticipated to boost the North American hydrogen generator market.

Report Scope of the Hydrogen Generator Market

| Report Coverage | Details |

| Market Size in 2023 | USD 1.05 Billion |

| Market Size by 2032 | USD 1.73 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.7% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered |

|

Hydrogen Generator Market dynamics

Drivers

During the projection period, there will be more need for hydrogen generators as clean hydrogen production receives more emphasis. The clean hydrogen manufacturing sector, which is still in its infancy, has a lot of room for expansion and growth. Due to the atmosphere’s expanding carbon footprint, the production of clean hydrogen has lately expanded significantly and will do so in the years to come. While hydrogen is frequently available as atoms inside various compounds, it is only found in small amounts as molecules in the Earth’s atmosphere (e.g., water, biomasses, and methane). Some of the green and sustainable methods now employed for hydrogen production without factoring in the cost of carbon emissions include electrolysis, solar PV, and offshore wind. These technologies are more expensive than the methods of producing hydrogen from coal and natural gas, but they are anticipated to become commercially available for the production of green and clean hydrogen by the year 2030.

Although the relative costs are mostly unknown, a technological breakthrough might completely upend clean hydrogen generation. Fuel substitution for blue and turquoise fuels that are produced using sustainable bio methane may help to reduce greenhouse gas emissions from the environment. This fuel is also often employed in the transportation industry as a different renewable fuel source. So, in the approaching years, the market for hydrogen generation is projected to rise due to the clean hydrogen production technology.

Restraints

High capital cost of storing hydrogen energy is a major threat to the hydrogen generator market. Currently, hydrogen is most frequently used for small-scale mobile and stationary applications when it is kept as a gas or liquid in tanks. Hydrogen storage and transit both require compression and cooling systems. Hydrogen storage tanks need to be able to adsorb and desorb hydrogen quickly, on non-reactive medium, at low temperatures, and without the use of thermal energy.

On the other side, when hydrogen molecules are required, the ammonia that was previously stored must be broken down using heat energy. As a result, the hydrogen storage for the bespoke tanks comes at a high cost. Aside from this, the main technological obstacle to the advancement and broad use of fuel cell technology in fixed, transit, and portable applications is hydrogen storage. This is thus anticipated to further limit market growth throughout the ensuing years.

Opportunities

Accessibility of cheap natural gas feedstock to drive up demand for hydrogen generators. Throughout the forecast period, the availability of inexpensive natural gas feedstock is projected to grow the market for hydrogen generators globally. In an on-site hydrogen generating operation, natural gas represents a substantial operating expense. It costs less than other low-cost feedstocks like coal, biomass, and water nevertheless. Furthermore, natural gas is the most economical feedstock, even when hydrogen is generated in power plants and supplied through pipelines, gas trailers, or liquid tankers. The feedstock for the steam reforming process is natural gas. It is the most affordable way to provide people with hydrogen.

Challenges

The development of their individual communities is a priority for both established and developing nations. As a result, it is anticipated that the market would be dissatisfied with the lack of funding for extensive hydrogen generation. People are more reliant on liquid fuels when implementing lifestyle adjustments, which by the end of the projection might severely impede market growth. In addition, energy sources are now more expensive than hydrogen energy storage. As a result, liquid hydrogen should be kept apart from gaseous hydrogen since it transmits energy more slowly than hydrogen.

Read Also: Automotive OEM Market Size To Worth USD 54.06 Billion By 2032

Recent Developments

- March 7, 2020, Together with Toshiba Energy System, Tohoku Electric Power, and Iwatani Corporation, the New Energy and Industrial Technology Development Organization (NEDO) officially opened the Fukushima Hydrogen Research Field, which was built with a 10 MW class hydrogen production unit powered by renewable energy.

- On January 21, 2021, the Canadian government signed a contract for the installation of an 88-megawatt water electrolysis facility for Hydro-Quebec with ThyssenKrupp Uhde chlorine experts. The capacity of this new facility will be to produce 11,100 metric tonnes of green hydrogen annually.

Key Market Players

- Air Products and Chemicals Inc.

- Athena Technology

- Chromatec SDO JSC

- Chromservis sro

- Cummins Inc.

- EPOCH Energy Technology Corp.

- F-DGSi

- Air Liquide SA

- Linde Plc

- LNI Swissgas SRL

- Matheson TRI Gas Inc.

- McPhy Energy SA

- MVS Engineering Pvt. Ltd.

- Nel ASA

- Nuberg Engineering Ltd.

- Parker Hannifin Corp.

- PCI Analytics Pvt. Ltd.

- PerkinElmer Inc.

- Scientific Repair Inc.

- Teledyne Technologies Inc.

Segment Covered in the Report

By Product Type

- Onsite type

- Portable type

By Process

- Steam reforming

- electrolysis

- others

By Application

- Chemical processing

- Fuel Cells

- Petroleum recovery

- Refining

- others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/