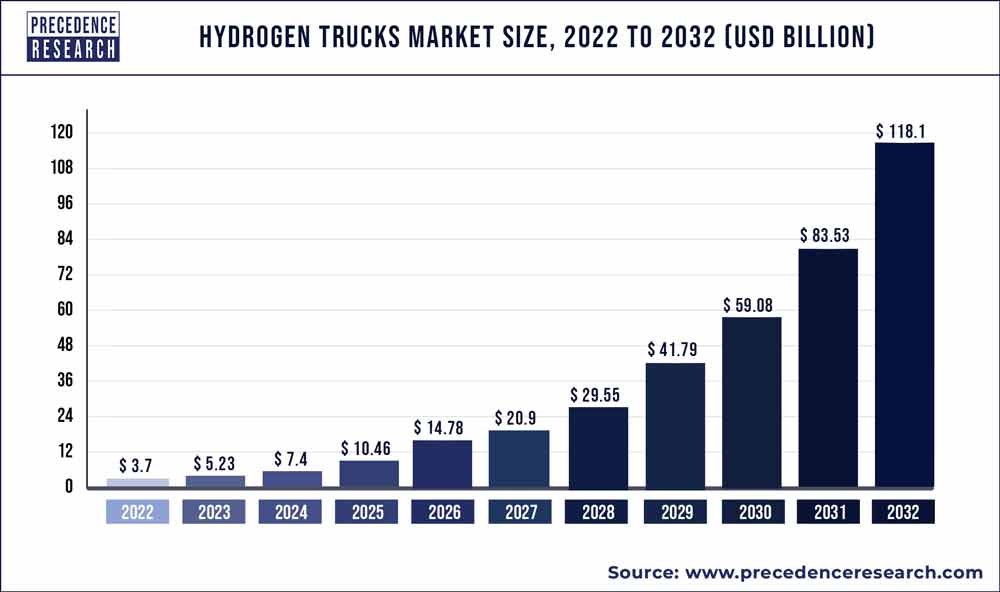

The global hydrogen trucks market size was valued at USD 3.7 billion in 2022 and is estimated to hit around USD 118.1 billion by 2032, registering a CAGR of 41.38% from 2023 to 2032.

The hydrogen trucks market represents a pivotal frontier in the transportation industry’s quest for sustainable solutions. With growing concerns about carbon emissions, air pollution, and the environmental impact of conventional diesel trucks, hydrogen-powered trucks offer a promising alternative. This market analysis delves into the factors shaping the growth of hydrogen trucks globally, exploring key drivers, opportunities, and challenges across different regions.

Get a Sample: https://www.precedenceresearch.com/sample/2482

Growth Factors:

The hydrogen trucks market is propelled by several factors. One of the primary drivers is the increasing focus on decarbonization and the transition to clean energy sources. Hydrogen fuel cells offer a zero-emission alternative to traditional diesel engines, making them attractive for reducing greenhouse gas emissions and combating climate change.

Moreover, advancements in hydrogen fuel cell technology have improved efficiency, performance, and affordability, making hydrogen trucks increasingly competitive with conventional diesel trucks. Innovations in fuel cell materials, storage systems, and infrastructure development have enhanced the feasibility and scalability of hydrogen-powered transportation.

Furthermore, government incentives, regulations, and climate policies aimed at reducing emissions and promoting renewable energy adoption have stimulated investment and market growth in the hydrogen trucks sector. Subsidies, tax incentives, and emissions standards encourage fleet operators and logistics companies to adopt hydrogen-powered trucks, driving market expansion.

Region Insights:

The adoption and growth of hydrogen trucks vary across different regions, influenced by factors such as government policies, infrastructure development, and market dynamics.

In North America, particularly in the United States and Canada, government initiatives, such as tax credits, grants, and funding for hydrogen infrastructure projects, support the deployment of hydrogen trucks. Companies like Nikola Corporation and Toyota are actively developing and commercializing hydrogen fuel cell trucks in the region, with plans for expanding their presence in the coming years.

In Europe, countries like Germany, France, and the United Kingdom are leading the way in hydrogen infrastructure development and deployment of fuel cell trucks. The European Union’s ambitious climate targets and initiatives, such as the European Clean Hydrogen Alliance and the Green Deal, drive investment in hydrogen technologies and promote cross-border collaboration to establish a hydrogen economy.

In Asia-Pacific, countries like Japan and South Korea have long been pioneers in hydrogen fuel cell technology and are accelerating efforts to commercialize hydrogen trucks. Japan’s commitment to hydrogen as a key component of its energy strategy, coupled with South Korea’s ambitious hydrogen roadmap, create significant opportunities for market growth in the region.

Hydrogen Trucks Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 5.23 Billion |

| Market Size by 2032 | USD 118.1 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 41.38% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Largest Market | North America |

| Segments Covered | BY Product, BY Application, By Range |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Hydrogen Trucks Market Dynamics

Drivers:

Several drivers underpin the growth of the hydrogen trucks market. One of the primary drivers is the increasing demand for sustainable transportation solutions driven by environmental concerns and regulatory pressures. Hydrogen fuel cell trucks offer a viable alternative to diesel trucks, enabling fleet operators to reduce carbon emissions and comply with stringent emissions regulations.

Furthermore, advancements in hydrogen infrastructure, including hydrogen production, storage, and refueling stations, are essential drivers of market growth. Investments in infrastructure development by governments, energy companies, and automotive manufacturers are critical to overcoming infrastructure barriers and scaling up hydrogen truck deployment.

Moreover, partnerships and collaborations between industry players, government agencies, and research institutions play a crucial role in driving innovation, reducing costs, and expanding the hydrogen trucks market. Joint ventures, technology-sharing agreements, and pilot projects facilitate knowledge transfer and accelerate the commercialization of hydrogen fuel cell technology.

Opportunities:

The hydrogen trucks market presents significant opportunities for stakeholders across the value chain. One such opportunity lies in addressing last-mile delivery and urban freight challenges with hydrogen-powered trucks. As cities strive to reduce congestion, air pollution, and noise, hydrogen trucks offer a sustainable solution for clean and quiet urban transportation.

Additionally, the decarbonization of heavy-duty transportation, including long-haul trucking and freight transportation, presents a vast opportunity for hydrogen trucks. The scalability, range, and quick refueling times of hydrogen fuel cell trucks make them well-suited for long-distance transportation, providing a zero-emission alternative to diesel trucks.

Furthermore, partnerships between hydrogen producers, energy companies, and fleet operators can unlock synergies and accelerate market adoption. Collaborative efforts to develop hydrogen infrastructure, establish supply chains, and deploy hydrogen trucks can drive economies of scale, reduce costs, and enhance the competitiveness of hydrogen as a transportation fuel.

Challenges:

Despite the promising outlook for hydrogen trucks, several challenges must be addressed to realize their full potential. One of the primary challenges is the high upfront costs associated with hydrogen fuel cell technology, including fuel cell stacks, hydrogen storage tanks, and refueling infrastructure. Cost reduction efforts through technological advancements, economies of scale, and government incentives are essential to improve the competitiveness of hydrogen trucks.

Moreover, the limited availability of hydrogen refueling infrastructure remains a significant barrier to widespread adoption. While progress has been made in establishing hydrogen refueling stations in certain regions, the lack of a comprehensive and interconnected infrastructure network hinders the deployment of hydrogen trucks, particularly for long-haul transportation routes.

Furthermore, concerns about hydrogen safety, including storage, handling, and transportation, pose challenges to market acceptance and regulatory approval. Addressing safety risks through standardized protocols, training programs, and risk assessments is crucial to building confidence among stakeholders and ensuring the safe deployment of hydrogen trucks.

Read Also: E-bike Market Size to Reach USD 44.08 Billion by 2032

Recent Developments

- With this acquisition, Hyzon now has three fully operational manufacturing facilities and over 80 employees. ORTEN’s employees have expertise in body construction, retrofitting, and electrification, which are all essential steps in Hyzon’s FCEV manufacturing process.

- In addition, ORTEN’s management maintains extensive and permanent customer contact throughout Germany.

- Hyzon and ORTEN’s complementary product lines, as well as ORTEN’s body and powertrain kits, offer customers a total solution for converting their fleets into zero-emission vehicles.

- Vehicles up to 26 tons can be upgraded to ORTEN’s current battery electric vehicles, while the functional needs of medium and heavy vehicles can be met with Hyzon’s FCEV.

- In the coming years, Germany is expected to become an important global market for zero-emission commercial vehicles

- The European Union recently announced a total ban on the sale of internal combustion engine vehicles.

- The jr. minister of natural resources, Seamus o Regan, announce a $2.3-million investment in the Alberta Zero-Emissions Truck Electrification Collaboration (AZETEC) project. And this project led by the Alberta motor and transport association with the collaboration of project partners hydrogen technology and energy corporation, Bison Transport, and Canadian Energy Systems Analysis Research.

- According to Wu, China is now the world leader in hydrogen production, accounting for one-third of the world’s production.

Hydrogen Trucks Market Companies

- Nikola

- Daimler trucks

- Cummins

- Hyzonmotors

- Toyota

- Volvo

- Honda motors

- Hyundai motors

- SAIC

- JMCH

Segments Covered in the Report

By Product

- Heavy Duty trucks

- Medium Duty Trucks

- Small Duty Trucks

By Application

- Logistics

- Municipal

By Range

- Above 400 Km

- Below 400 Km

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/