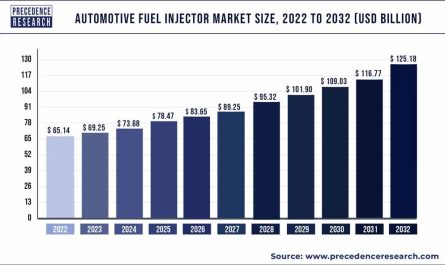

The India electric vehicle market size was valued at USD 6.87 billion in 2023 and it is expected to reach around USD 637.85 billion by 2032, growing at a CAGR of 65.44% from 2023 to 2032.

Key Points

- By Propulsion, the battery-electric vehicle segment is expected to acquire the largest share of the market during the forecast period.

- By Platform, the four-wheeler segment contributed more than 58% of revenue share in 2022.

- By Platform, the two-wheeler is the fastest growing segment of the India electric vehicle market.

- By vehicle type, the passenger vehicle segment held the largest share of the market in 2022, the segment is expected to sustain the growth during the forecast period.

The India Electric Vehicle (EV) Market has experienced remarkable growth in recent years, driven by various factors such as government initiatives, increasing environmental awareness, technological advancements, and changing consumer preferences. Electric vehicles, including battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs), are gaining traction as viable alternatives to traditional internal combustion engine vehicles in India’s automotive landscape. This market overview will delve into the growth factors, region insights, drivers, opportunities, and challenges shaping the India Electric Vehicle Market.

Get a Sample: https://www.precedenceresearch.com/sample/3163

Data and Statistics:

- The Ministry of Heavy Industries, India sanctioned a total of 2,877 electric vehicle charging stations in 2022, among which 50 charging stations were successfully installed on 1st July 2022.

- In June 2023, Tata Group, India invested $1.6 billion in an electric vehicle rechargeable battery production plant in Gujrat. The plan for the new plant is done in collaboration with Gujrat state government that aims to boost the production of electric vehicles to achieve sustainability.

- In India, the total sales of electric two-wheelers reached 7,20,733 in the fiscal year 2023, Ola being the leader of the market held approximately 21% share of the electric vehicle market in the nation.

- In India, the electric three-wheeler is experiencing a surge, the sales for electric 3-wheeler passenger vehicles rose by 23% and sales for 3-wheeler cargo-type rose by 56% in the month of March 2023. Mahindra and Mahindra alone sold 3,538 three-wheeler passenger vehicles in March 2023.

- In 2022, Uttar Pradesh (state) held the highest electric vehicle sales while holding 20.64% share of the nation’s market. The state was followed by Maharashtra which held a 10.15% share of the market.

- India has recently discovered a significant reserve of lithium in the states of Rajasthan and Jammu & Kashmir; the discovery is observed as a game changer for electric vehicle production in the country. These reserves are claimed to fulfill almost 80% of the country’s lithium requirement. The discovery is expected to boost the production of electric vehicles with lithium batteries by declining the country’s dependency on lithium imports.

Indian origin electric vehicle companies and their sales (Fiscal Year 2023: 1st April 2022- 31st March 2023)

| Company | Electric Vehicle Type | Sales by Units (FY2023) |

| Bajaj | Two-wheeler | 36,260 |

| Tata | Four-wheeler | 5,38,640 (+45%) |

| Ola | Two-wheeler | 1,29,866 |

| Mahindra and Mahindra | Three-wheeler | 36,816 |

| TVS | Two-wheeler | 81,290 (excluding March 2023) |

Growth Factors:

Several key growth factors contribute to the expansion of the India Electric Vehicle Market. Government policies and incentives promoting EV adoption, such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, subsidies, and tax benefits, play a crucial role in fostering a conducive environment for EV manufacturers and consumers. Additionally, the growing focus on reducing greenhouse gas emissions and combating air pollution is driving the shift towards cleaner transportation options, further accelerating the demand for electric vehicles in India.

Technological advancements in battery technology, including improvements in energy density, charging infrastructure, and affordability, have significantly enhanced the performance and range of electric vehicles, addressing one of the primary concerns of consumers – range anxiety. Moreover, the increasing investment in research and development by both domestic and international automotive players has led to the introduction of innovative EV models with competitive pricing, appealing designs, and advanced features, bolstering market growth.

Region Insights:

The adoption of electric vehicles varies across different regions in India, influenced by factors such as infrastructure development, economic prosperity, and government support. Metropolitan cities like Delhi, Mumbai, Bangalore, and Chennai exhibit higher EV penetration rates due to better charging infrastructure, higher disposable income levels, and greater awareness about environmental issues among urban residents. However, the EV market penetration in rural and semi-urban areas remains relatively low due to infrastructure limitations and affordability constraints.

Certain states in India, such as Karnataka, Maharashtra, Tamil Nadu, and Telangana, have emerged as key hubs for electric vehicle manufacturing and innovation, attracting investment from domestic and international players. These states offer favorable policies, incentives, and infrastructure support to promote EV manufacturing and adoption, contributing significantly to regional growth in the electric vehicle market.

India Electric Vehicle Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 6.87 Billion |

| Market Size by 2032 | USD 637.85 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 65.44% |

| Base Year | 2022 |

| Forecast Period | 2023 To 2032 |

| Segments Covered | By Propulsion Type, By Platform, and By Vehicle Type |

India Electric Vehicle Market Dynamics:

Drivers:

Several drivers propel the growth of the India Electric Vehicle Market. Rising fuel prices, coupled with volatile crude oil prices, have led consumers to seek alternative, cost-effective transportation solutions, making electric vehicles an attractive option. Additionally, the growing awareness of environmental sustainability and the need to reduce carbon emissions have incentivized consumers, fleet operators, and government agencies to transition towards cleaner mobility options, driving the demand for electric vehicles.

Government initiatives and regulations mandating the adoption of electric vehicles in public transportation fleets, such as buses and taxis, are creating a significant demand pull for EVs in India. Moreover, increasing investments by automotive manufacturers, technology companies, and venture capitalists in electric vehicle infrastructure, including charging stations and battery swapping facilities, are addressing infrastructure bottlenecks and enhancing consumer confidence in electric vehicle adoption.

Opportunities:

The India Electric Vehicle Market presents numerous opportunities for stakeholders across the value chain. The rapidly evolving regulatory landscape, coupled with government incentives and subsidies, creates a conducive environment for investment in electric vehicle manufacturing, component manufacturing, and charging infrastructure development. Collaborations and partnerships between automotive OEMs, technology companies, and government agencies can facilitate knowledge exchange, technology transfer, and skill development, fostering innovation and competitiveness in the electric vehicle ecosystem.

Furthermore, the burgeoning demand for electric two-wheelers and three-wheelers, particularly in urban areas, presents a lucrative opportunity for manufacturers to introduce affordable, high-performance electric vehicles tailored to the needs of urban commuters. Additionally, the electrification of commercial fleets, including e-commerce delivery vehicles, logistics trucks, and shared mobility services, presents a vast market opportunity for electric vehicle manufacturers and fleet operators to capitalize on the growing demand for sustainable transportation solutions.

Challenges:

Despite the promising growth prospects, the India Electric Vehicle Market faces several challenges that need to be addressed for sustained market expansion. High upfront costs associated with electric vehicles, including battery costs, remain a significant barrier to mass adoption, particularly in price-sensitive market segments. Limited charging infrastructure, range anxiety, and inadequate awareness about the benefits of electric vehicles among consumers pose challenges to market penetration, especially in rural and semi-urban areas.

Supply chain constraints, including the availability of critical raw materials for battery manufacturing and dependence on imports for key components, such as lithium-ion cells, pose challenges to domestic electric vehicle manufacturing and could impact the competitiveness of Indian electric vehicle manufacturers in the global market. Moreover, the lack of uniform standards and regulations governing electric vehicle manufacturing, charging infrastructure, and vehicle testing creates regulatory ambiguity and impedes market growth.

Read Also: Automotive V2X Market Size to Reach US$ 66.26 Bn by 2032

Recent Developments:

- In July 2023, Tesla representatives stepped up for its new manufacturing plant for electric vehicles in India, while having a conversation with the commerce minister this month. The world’s leading automotive company aims to create a manufacturing plant to offer electric vehicles at 25% cheaper rate than its current offering. In May 2023, Tesla executives visited India to establish the manufacturing base for cars and batteries in India.

- In July 2023, Maruti Suzuki announced to launch its Maruti Suzuki Brezza EV in Indian market. The electric car is observed to challenge many other manufacturers as it can have an extensive range of 550 kilometers with a 60 kilowatts battery pack. The electric car also aims to have Apple CarPlay and Android Auto touchscreen infotainment system.

- In July 2023, based in Madhya Pradesh, Enigma Automobiles announced the launch of its new Ambier N8 electric scooter at the price of Rs.1,08 Lakh. According to the company, the scooter offers 200 kms of range with a single charge and gets fully charged within 2-4 hours.

India Electric Vehicle Market Companies

- Ather Energy Pvt Limited

- JBM Auto Limited

- Bajaj

- Mahindra Electric Mobility Limited

- Ola

- TVS

- Electrotherm

Segments Covered in the Report:

By Propulsion Type

- Battery electric vehicle

- Hybrid electric vehicle

By Platform

- Two-wheeler

- Three-wheeler

- Four-wheeler

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/