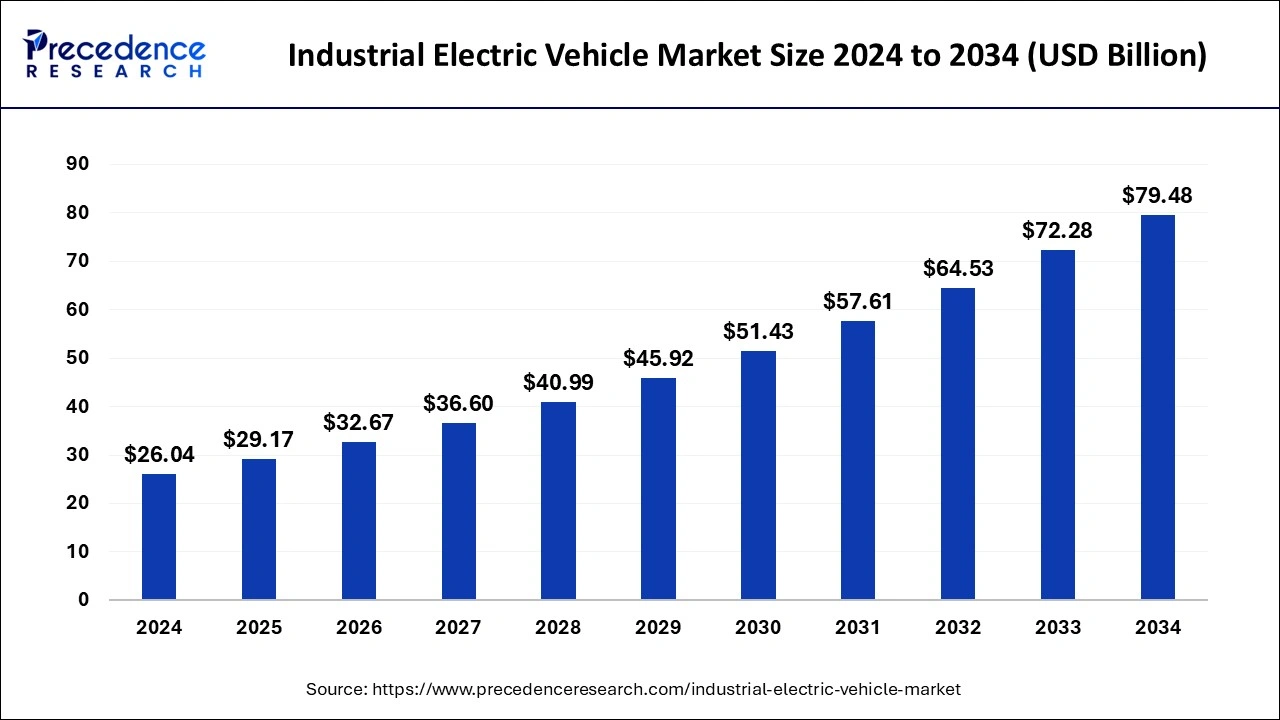

The global industrial electric vehicle market size is calculated at USD 26.04 billion in 2024 and is projected to cross around USD 72.28 billion by 2033 with a solid CAGR of 12.01% from 2024 to 2033.

The Industrial Electric Vehicle market has been witnessing substantial growth driven by increasing adoption of electric vehicles (EVs) across various industrial sectors. These vehicles are favored for their lower operational costs, reduced emissions, and advancements in battery technology, which enhance their efficiency and performance in industrial applications. Key segments include electric forklifts, electric tow tractors, and electric utility vehicles, catering to diverse industrial needs from logistics and warehousing to manufacturing and mining.

Get a Sample: https://www.precedenceresearch.com/sample/4247

Industrial Electric Vehicle Market Highlights

- Asia Pacific led the market with the largest market share of 41% in 2023.

- North America is expected to witness the fastest growth rate during the forecast period.

- By vehicle, the forklift segment has contributed the major market share of 36% in 2023.

- By propulsion type, the hybrid electric vehicle segment dominated the market in 2023.

- By application, the manufacturing segment has held the largest market share of 41% in 2023.

Trends in the Industrial Electric Vehicle Market

- Rise in Demand for Sustainable Solutions: As industries globally aim to reduce carbon footprints and comply with stringent environmental regulations, the demand for electric vehicles in industrial applications is increasing. Electric vehicles offer lower emissions and reduced operational costs over their lifetime compared to traditional fuel-powered vehicles.

- Advancements in Battery Technology: Improvements in battery technology, including higher energy densities, faster charging capabilities, and longer lifespans, are crucial for the adoption of electric vehicles in industrial settings. These advancements are addressing concerns such as range anxiety and downtime for recharging.

- Expansion of Charging Infrastructure: The development of robust charging infrastructure is essential for the widespread adoption of industrial electric vehicles. Governments, businesses, and utility providers are investing in charging stations to support the growing fleet of electric vehicles, enhancing convenience and operational efficiency.

- Cost Competitiveness: The decreasing costs of electric vehicle components, including batteries and electric drivetrains, are making electric vehicles increasingly cost-competitive with conventional vehicles. This cost parity, coupled with lower maintenance expenses, is accelerating adoption across various industrial sectors.

- Diverse Applications Across Industries: Industrial electric vehicles are used across a wide range of sectors, including manufacturing, mining, logistics, and agriculture. Each industry has specific operational needs that electric vehicles can address, such as indoor air quality improvements in manufacturing plants or noise reduction in urban logistics.

Regional Insights

Geographically, North America and Europe lead in the adoption of industrial electric vehicles, driven by stringent emissions regulations and government incentives promoting sustainable transportation solutions. Asia-Pacific, particularly China and Japan, is witnessing rapid growth due to industrial expansion and investments in infrastructure supporting electric mobility. Emerging economies in Latin America and Africa are also increasingly adopting electric vehicles, albeit at a slower pace, influenced by rising awareness of environmental impact and technological advancements.

- The Asia Pacific industrial electric vehicle market size was estimated at USD 9.53 billion in 2023 and is predicted to be worth around USD 30 billion by 2033, at a CAGR of 12.15% from 2024 to 2033.

- The Europe industrial electric vehicle market size was calculated at USD 6.51 billion in 2023 and is projected to expand around USD 20.60 billion by 2033, poised to grow at a CAGR of 12.20% from 2024 to 2033.

Industrial Electric Vehicle Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.01% |

| Industrial Electric Vehicle Market Size in 2023 | USD 23.25 Billion |

| Industrial Electric Vehicle Market Size in 2024 | USD 26.04 Billion |

| Industrial Electric Vehicle Market Size by 2033 | USD 72.28 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Vehicle, By Propulsion, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vehicle Insights

The Industrial Electric Vehicle Market encompasses a wide range of vehicle types tailored for industrial applications. This includes forklifts, trucks, tractors, and automated guided vehicles (AGVs), each designed to optimize efficiency and productivity in various industrial settings.

Propulsion Insights

Electric propulsion systems dominate the Industrial Electric Vehicle Market, driven by their environmental benefits and operational efficiencies. These systems typically include battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), with BEVs particularly favored for their zero-emission capabilities ideal for indoor and enclosed spaces.

Application Insights

Applications of industrial electric vehicles span across diverse sectors such as manufacturing, warehouses, logistics, and mining. In manufacturing, electric forklifts and AGVs streamline material handling, while electric trucks and tractors enhance efficiency in logistics and agricultural operations. Mining industries are increasingly adopting electric vehicles for their reduced emissions and lower operational costs, marking a significant shift towards sustainable mobility solutions.

Industrial Electric Vehicle Market Dynamics

Drivers

The shift towards sustainability and environmental consciousness is a primary driver, compelling industries to switch from traditional fuel-powered vehicles to electric alternatives. Cost savings on fuel and maintenance further incentivize adoption, along with improvements in battery technology that extend vehicle range and operational uptime. Government subsidies and initiatives promoting electric vehicle adoption are also significant drivers, fostering a favorable regulatory environment.

Opportunities

Opportunities abound in expanding applications of electric vehicles across diverse industrial sectors, including construction, agriculture, and waste management. Innovations in battery technology and charging infrastructure present opportunities for market players to develop more efficient and scalable solutions. Collaborations between automotive manufacturers and technology firms are expected to accelerate advancements in electric vehicle capabilities, opening new avenues for growth and market expansion.

Challenges

Despite the promising growth trajectory, challenges persist in the Industrial Electric Vehicle market. High initial costs associated with electric vehicles remain a barrier for widespread adoption, particularly in developing regions where infrastructure for charging and maintenance is still underdeveloped. Concerns over battery disposal and recycling pose environmental challenges, requiring sustainable practices and regulatory frameworks to manage end-of-life components effectively. Additionally, limited awareness and skilled workforce for electric vehicle maintenance and operation present hurdles for market penetration in some regions.

Read Also: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Size, Report 2033

Industrial Electric Vehicle Market Recent Developments

- In March 2024, Hyundai Motor India Limited (HMIL) announced that it is planning to launch solution into the Indian electric vehicle market with the development of five latest manufacturing units across the India by 2030.

- In April 2024, the founder of Tesla, Elon Musk stated that he is planning to launch a range of affordable electric vehicle models by the year 2025. Production will start by the second half of 2025.

- In April 2024, Hyundai Motor Group is announcing the launch of the first hybrid cars in India by 2026. As per the reports, the company is currently assessing the hybrid sport-utility vehicle (SUV) similar in size to the bestselling mid-sized Creta SUV.

- In April 2024, Daimler Truck’s, Rizon, a latest brand is proudly announcing the launch of its battery-electric Class 4-5 trucks in Canada. The brand will showcase in Canada for the first time in Truck World in Toronto from April 18th to 20th and will be in the Canadian market with the preorders starts from June 2024.

- In May 2024, Toyota Motor North America, Inc. (Toyota) and FuelCell Energy, Inc. are celebrating the launch of first-of-its-kind “Tri-gen” system at the Port of Long Beach, California. The latest launch Tri-gen uses biogas to renewable hydrogen, produce renewable electricity, and usable water, and designed to support the vehicle distribution and processing center for Toyota Logistics Services (TLS) at Long Beach.

- In May 2024, BorgWarner, the first to the market for the electric torque Vectoring and Disconnect (eTVD) system for battery electric vehicles (BEVs) introduces the Polestar and an additional major European OEM.

- In April 2024, Daimler India Commercial Vehicles (DICV), the branch of the Daimler Truck AG launched the light duty redesigned eCanter all electric in India. It will used as the light duty commercial truck segment.

- In April 2024, Al Masaood Commercial Vehicles & Equipment (CV&E), the part of the well-known business conglomerate Al Masaood Group, announced that they secure the distributorship rights for Dongfeng Commercial Vehicles with the one of China’s premier automotive manufacturers- Dongfeng Automobile Corporation.

Industrial Electric Vehicle Market Companies

- Toyota Industries Corporation

- Hyster-Yale Materials Handling, Inc.

- Balyo

- John Bean Technologies Corporation (JBT)

- Seegrid Corporation

- Kuka AG

- Jungheinrich AG

- Swisslog Holding AG

- Dematic

- Daifuku Co., Ltd.

- Bastian Solutions, Inc.

- Schaefer Holding International GmbH

Segments Covered in the Report

By Vehicle

- Tow Tractors

- Forklifts

- Container Handlers

- Aisle Trucks

- Others

By Propulsion

- Hybrid Electric Vehicles (HEVs)

- Battery Electric Vehicle (BEVs)

By Application

- Manufacturing

- Warehouses

- Freight and Logistics

- Others

By Regional Outlook

- North America: US, and Rest of North America

- Europe: UK, Germany, France, and Rest of Europe

- Asia Pacific: China, Japan, India, and Rest of Asia Pacific

- Latin America: Brazil, and Rest of Latin America

- Middle East & Africa (MEA): GCC, North Africa, South Africa, and Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/