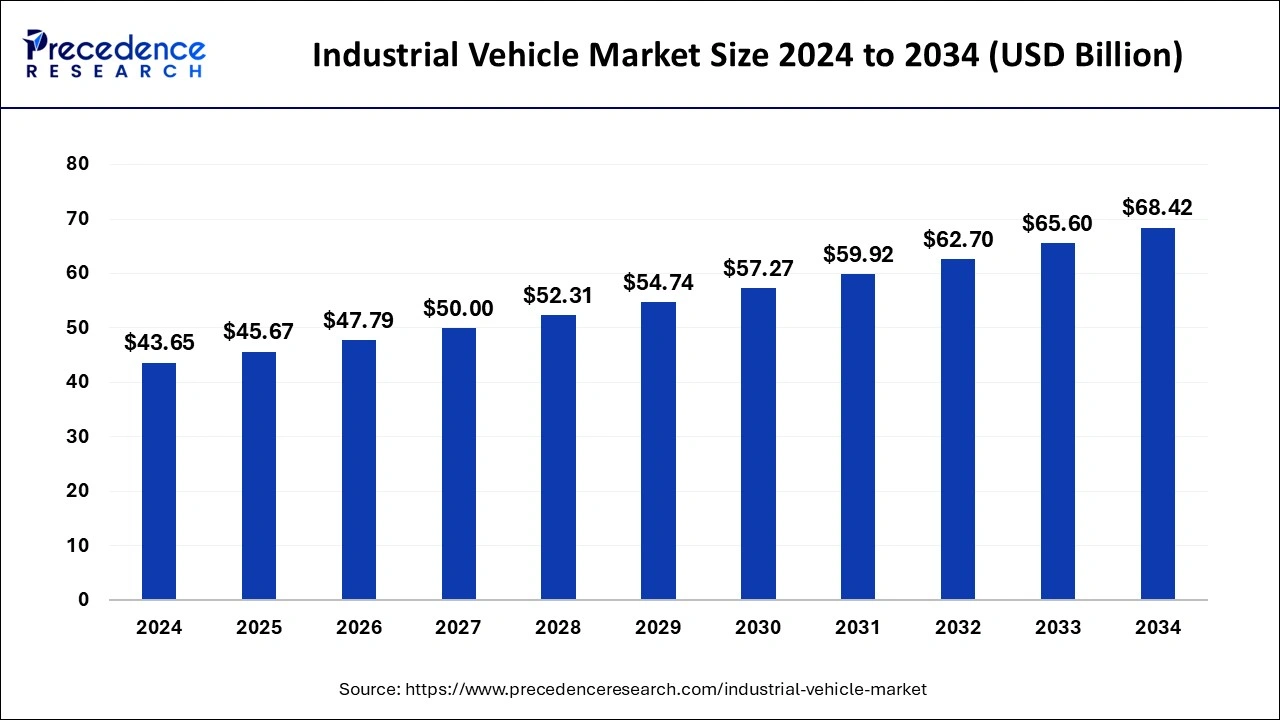

The global industrial vehicle market size reached USD 41.72 billion in 2023 and is projected to cross around USD 65.60 billion by 2033, growing at a CAGR of 4.63% from 2024 to 2033.

The industrial vehicle market encompasses a broad spectrum of vehicles designed primarily for heavy-duty operations in industrial settings. These vehicles are crucial across various industries such as manufacturing, construction, mining, agriculture, logistics, and warehousing. They are designed to withstand rugged environments and carry out specialized tasks that standard passenger or commercial vehicles cannot handle. Key types of industrial vehicles include forklift trucks, excavators, cranes, loaders, dump trucks, and various specialized vehicles used in material handling and heavy equipment operations.

Industrial Vehicle Market Key Points

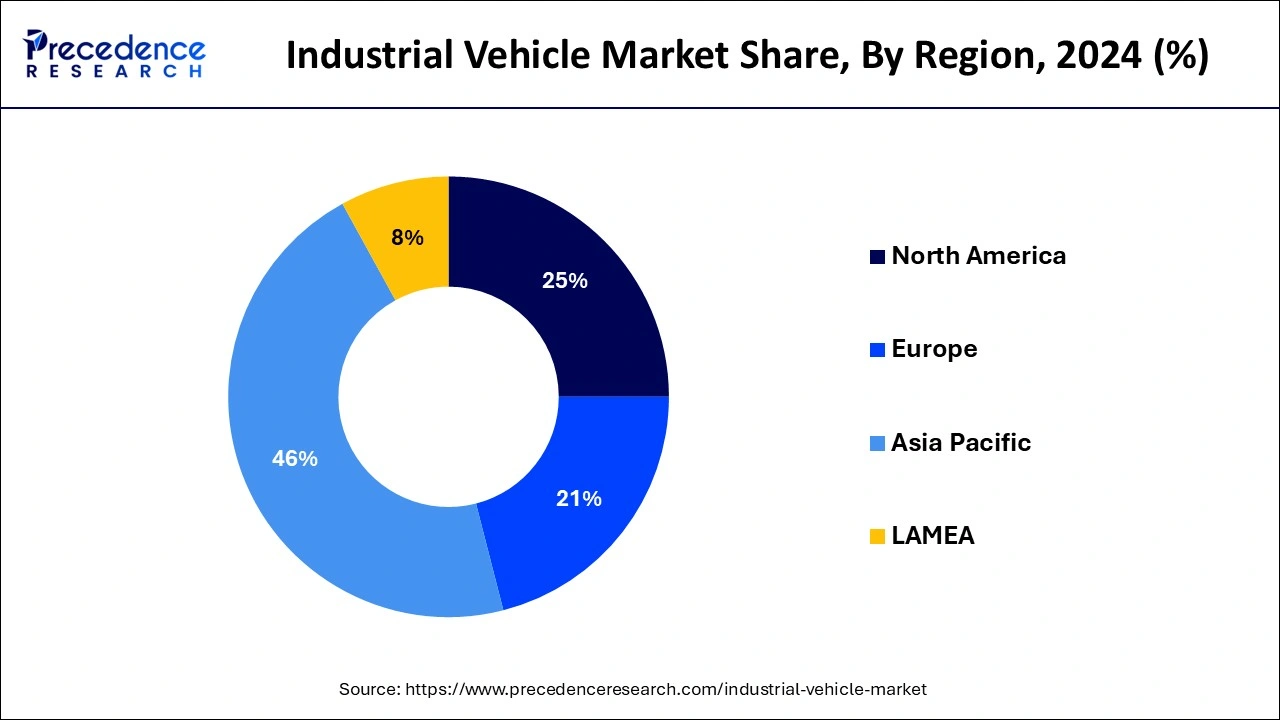

- Asia Pacific led the market with the largest market share of 46% in 2023.

- North America is observed to expand at a rapid pace during the forecast period.

- By drive type, the ICE segment has held the major market share of 49% in 2023.

- By drive type, the battery-operated segment is expected to grow at a significant rate during the predicted timeframe.

- By the level of autonomy, the non/semi-autonomous segment held a significant share of the market in 2023.

- By the level of autonomy, the autonomous segment is observed to grow at a notable rate during the forecast period.

- By application, the manufacturing segment held the largest share of the market in 2023.

- By application, the warehousing segment is expected to grow fastest during the forecast period.

Regional Insights

Asia Pacific led the market with the largest market share of 46% in 2023. Asia Pacific emerges as a dominant force in the global industrial vehicle market, fueled by rapid industrialization, urbanization, and infrastructure development. Countries like China, Japan, and India are significant contributors, with a high demand for construction machinery, forklift trucks, and agricultural equipment. The region also leads in manufacturing, prompting investments in automation and robotics, which influence the demand for industrial vehicles equipped with advanced technologies.

- In September 2023, Hangcha unveiled the 3-Pivot XC Model. The 3-Pivot XC Model is about precision and flexibility. Its three-wheel design provides exceptional maneuverability, permitting users to maneuver around little spaces and tight curves easily. In the powerful universe of material handling, where efficiency reigns supreme, Introducing Lithium E-Trucks is nothing short of a breakthrough. The 3-Pivot XC Model stands apart among these wonders and promises to reshape the material handling sector’s future.

In North America, the industrial vehicle market is robust, driven by the region’s strong industrial base, advanced manufacturing capabilities, and significant investments in infrastructure development. The United States and Canada are major contributors to market growth, with demand stemming from sectors like construction, logistics, and warehousing. The adoption of advanced technologies such as automation and electrification is shaping the market landscape, with a growing emphasis on reducing emissions and enhancing operational efficiency.

Europe’s industrial vehicle market is characterized by stringent regulatory standards, particularly concerning emissions and safety. Countries like Germany, France, and the UK are key players due to their strong manufacturing sectors and extensive use of industrial vehicles in construction and logistics. The shift towards electric and hybrid vehicles is gaining momentum in Europe, driven by environmental regulations and the push towards sustainable practices.

- The Asia Pacific industrial vehicle market size was estimated at USD 19.19 billion in 2023 and is predicted to be worth around USD 30.50 billion by 2033 at a CAGR of 4.74% from 2024 to 2033.

- The North America industrial vehicle market size was calculated at USD 10.43 billion in 2023 and is projected to expand around USD 16.73 billion by 2033, poised to grow at a CAGR of 4.83% from 2024 to 2033.

Trends in the Industrial Vehicle Market

Electrification and Hybridization

One of the prominent trends in the industrial vehicle market is the shift towards electrification and hybridization. Manufacturers are increasingly focusing on developing electric and hybrid vehicles to meet stringent emission regulations and reduce operational costs. Electric forklifts, excavators, and loaders are gaining traction due to their lower environmental impact and operational efficiency benefits.

Autonomous and Semi-Autonomous Vehicles

Automation is reshaping the industrial vehicle landscape with the introduction of autonomous and semi-autonomous vehicles. These vehicles integrate advanced sensors, AI-driven algorithms, and connectivity solutions to enable tasks such as autonomous material handling, navigation, and predictive maintenance. The deployment of autonomous forklifts and AGVs (Automated Guided Vehicles) in warehouses and manufacturing facilities enhances productivity and safety.

Connectivity and IoT Integration

Industrial vehicles are increasingly integrated with IoT (Internet of Things) technology, enabling real-time data monitoring, remote diagnostics, and predictive analytics. IoT-enabled vehicles facilitate fleet management optimization, predictive maintenance scheduling, and operational efficiency improvements. Connectivity solutions also enhance safety features and enable seamless communication between vehicles and control centers.

Sustainable Practices and Green Technologies

Sustainability is a critical focus area for the industrial vehicle market, driven by regulatory pressures and corporate sustainability goals. Manufacturers are investing in green technologies such as zero-emission vehicles, energy-efficient engines, and lightweight materials to minimize carbon footprints and enhance energy efficiency. Sustainable practices not only align with environmental regulations but also appeal to environmentally conscious consumers and businesses.

Digitalization of Supply Chain and Operations

The digital transformation of supply chain and operations is influencing the industrial vehicle market. Integration of digital technologies such as RFID (Radio Frequency Identification), GPS tracking, and cloud-based fleet management systems enhances operational visibility, inventory management, and supply chain efficiency. Digitalization enables real-time monitoring of vehicle performance, driver behavior, and asset utilization, contributing to cost savings and operational agility.

Industrial Vehicle Market Scope

| Report Coverage | Details |

| Industrial Vehicle Market Size in 2023 | USD 41.72 Billion |

| Industrial Vehicle Market Size in 2024 | USD 43.65 Billion |

| Industrial Vehicle Market Size by 2033 | USD 65.60 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.63% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Drive Type, By Level of Autonomy, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drive Type Insights

The Industrial Vehicle Market, categorized by drive type, encompasses a diverse range of vehicles tailored to specific operational requirements. These vehicles are typically classified into electric, hybrid, and internal combustion engine (ICE) types. Electric industrial vehicles, powered solely by batteries, are gaining prominence due to their eco-friendly operation and lower maintenance costs. They are particularly favored in indoor environments where emissions and noise are critical concerns. Hybrid vehicles combine electric and ICE technologies, offering flexibility in operations by combining the benefits of both power sources. ICE vehicles remain prevalent, especially in heavy-duty applications requiring high torque and extended operational ranges.

Level of Autonomy Insights

The evolution of autonomy levels in industrial vehicles is reshaping operational efficiency and safety standards across various industries. These vehicles are categorized into manually operated, semi-autonomous, and fully autonomous systems. Manually operated vehicles rely entirely on human control, offering familiarity and direct oversight but limited automation benefits. Semi-autonomous vehicles integrate automated features like assisted steering or braking, enhancing operator efficiency and safety without fully replacing human oversight. Fully autonomous vehicles represent the pinnacle of automation, leveraging advanced sensors, AI algorithms, and real-time data processing to navigate and perform tasks independently, reducing labor costs and enhancing operational uptime.

Application Insights

Industrial vehicles cater to a broad spectrum of applications, each demanding specialized designs and capabilities. These applications include logistics and warehousing, where vehicles like forklifts, pallet jacks, and AGVs (Automated Guided Vehicles) optimize material handling efficiency within confined spaces. Construction and mining sectors employ rugged industrial vehicles such as excavators, bulldozers, and dump trucks, designed for heavy-duty tasks in challenging terrains. Agriculture utilizes specialized vehicles like tractors and harvesters equipped with precision farming technologies to enhance crop productivity and operational yields. Other applications include airports, where baggage tugs and aircraft tugs streamline ground handling operations, ensuring timely aircraft turnaround and passenger satisfaction.

Industrial Vehicle Market Dynamics

Drivers

Infrastructure Development Projects

Infrastructure development projects worldwide, including road construction, urban development, and industrial parks, drive the demand for industrial vehicles. Heavy equipment such as excavators, bulldozers, and cranes are essential for earthmoving, foundation laying, and building construction, contributing significantly to market growth.

Expansion of E-commerce and Logistics

The rapid growth of e-commerce and logistics sectors necessitates efficient material handling and warehouse operations. Industrial vehicles such as forklifts, reach trucks, and pallet jacks play a crucial role in optimizing storage, picking, and distribution processes. The expansion of global supply chains and distribution networks further fuels the demand for industrial vehicles equipped with advanced handling capabilities.

Technological Advancements in Vehicle Design

Advancements in vehicle design and manufacturing technologies enhance the performance, safety, and efficiency of industrial vehicles. Innovations such as ergonomic cabin designs, telematics systems, and adaptive controls improve operator comfort, productivity, and operational reliability. Manufacturers are also focusing on developing lightweight materials and robust chassis designs to enhance vehicle durability and reduce maintenance costs.

Regulatory Push Towards Emission Standards

Stringent emission regulations imposed by governments worldwide propel the adoption of electric and hybrid industrial vehicles. Regulations aimed at reducing carbon emissions and promoting sustainable practices encourage manufacturers to invest in clean technologies and alternative fuels. Electric forklifts, aerial work platforms, and utility vehicles are increasingly preferred in urban areas and environmentally sensitive zones.

Opportunities in the Industrial Vehicle Market

Emerging Markets and Untapped Potential

Emerging markets in Asia Pacific, Latin America, and Africa present untapped opportunities for market expansion. Rapid urbanization, industrialization, and infrastructure investments create a demand for industrial vehicles across construction, mining, and agriculture sectors. Manufacturers can capitalize on these growth opportunities by offering tailored solutions and localized support services.

Innovation in Autonomous Technologies

The evolution of autonomous technologies offers significant growth prospects in the industrial vehicle market. Continued advancements in AI, machine learning, and sensor technologies enable the development of more sophisticated autonomous and semi-autonomous vehicles. Applications in material handling, mining operations, and agricultural automation unlock new avenues for market penetration and operational efficiency.

Strategic Partnerships and Collaborations

Collaborations between industrial vehicle manufacturers, technology providers, and logistics companies foster innovation and market expansion. Strategic partnerships enable shared expertise in R&D, market insights, and customer engagement, accelerating product development cycles and enhancing competitive advantages. Joint ventures and alliances also facilitate access to new markets and customer segments globally.

Aftermarket Services and Maintenance Solutions

The aftermarket services segment presents lucrative opportunities for revenue generation and customer retention. Offering comprehensive maintenance, repair, and spare parts solutions enhances customer satisfaction and extends the lifecycle of industrial vehicles. Predictive maintenance technologies and remote diagnostics capabilities enable proactive service interventions, minimizing downtime and optimizing fleet performance.

Challenges in the Industrial Vehicle Market

High Initial Investment Costs

The capital-intensive nature of industrial vehicles poses challenges for market entry and expansion. High upfront costs associated with vehicle procurement, customization, and maintenance deter small and medium-sized enterprises (SMEs) from investing in advanced equipment. Manufacturers must explore financing options, leasing arrangements, and flexible payment terms to mitigate financial barriers for potential buyers.

Regulatory Compliance and Safety Standards

Compliance with stringent regulatory requirements and safety standards imposes operational challenges on industrial vehicle manufacturers. Adherence to emission norms, workplace safety regulations, and equipment certification processes necessitates continuous monitoring and investment in compliance management systems. Non-compliance risks penalties, legal liabilities, and reputational damage, prompting manufacturers to prioritize regulatory adherence and safety protocols.

Technological Integration and Skills Gap

The rapid pace of technological advancements in industrial vehicles necessitates continuous workforce training and upskilling. Integrating IoT, AI, and digitalization solutions requires technical expertise in software development, data analytics, and cyber-security. The skills gap in advanced technologies poses challenges in recruiting and retaining qualified professionals, hindering the seamless adoption of digital innovations across operations and service delivery.

Economic Uncertainty and Market Volatility

Global economic fluctuations, geopolitical tensions, and trade disputes impact market dynamics and consumer confidence in industrial vehicle investments. Uncertainties in raw material prices, currency exchange rates, and supply chain disruptions pose risks to manufacturing costs and profit margins. Manufacturers must adopt resilient business strategies, diversify market portfolios, and monitor macroeconomic indicators to mitigate financial risks and sustain long-term growth.

Environmental Impact and Sustainability Concerns

Addressing environmental impact and sustainability concerns remains a persistent challenge for the industrial vehicle market. Heavy-duty equipment emissions contribute to air pollution, greenhouse gas emissions, and ecological footprints, prompting regulatory interventions and societal expectations for cleaner technologies. Manufacturers are investing in R&D for eco-friendly propulsion systems, energy-efficient designs, and circular economy practices to align with sustainability goals and stakeholder expectations.

Read Also: Autonomous Forklift Market Size to Attain USD 13.91 Billion by 2033

Industrial Vehicle Market Recent Developments

- In June 2023, Hangcha announced the launch of the XE series electric forklifts to the global market. This is an adaptable, durable, comfortable, and affordable material handling solution that can go anywhere and do anything. The XE series covers from 1.5-3.8t, with a battery capacity of up to 80V/608Ah.

- In May 2024, Volvo CE secured an order from the Swedish Defense Materiel Administration (FMV) for 81-wheel loaders. The order is the first procurement in a seven-year framework agreement signed earlier this year and valued at USD 110 million that will enhance collaboration and strengthen the security of supply, both in times of peace and crises, thereby safeguarding people, resources, and societies. Volvo CE will be supplying a variety of wheel loaders and attachments and the machines will be produced at its plants in Arvika, Sweden, and Konz in Germany which specialize in the production of wheel loaders.

Industrial Vehicle Market Companies

- Anhui Heli Co. Ltd

- Crown Equipment Corporation

- Hangcha Forklift

- Hyster-Yale Materials Handling

- Jungheinrich

- Konecranes

- Daifuku

- Ross Electric Vehicles

- SSI SCHAEFER

- Taylor-Dunn

- Hyster-Yale Group, Inc.,

- Jungheinrich AG

- Kion Group AG

- Mitsubishi Heavy Industries, Ltd.

- Toyota Industries Corporation

- Doosan Corporation

- Hyundai Construction Equipment

- Polaris Inc.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/