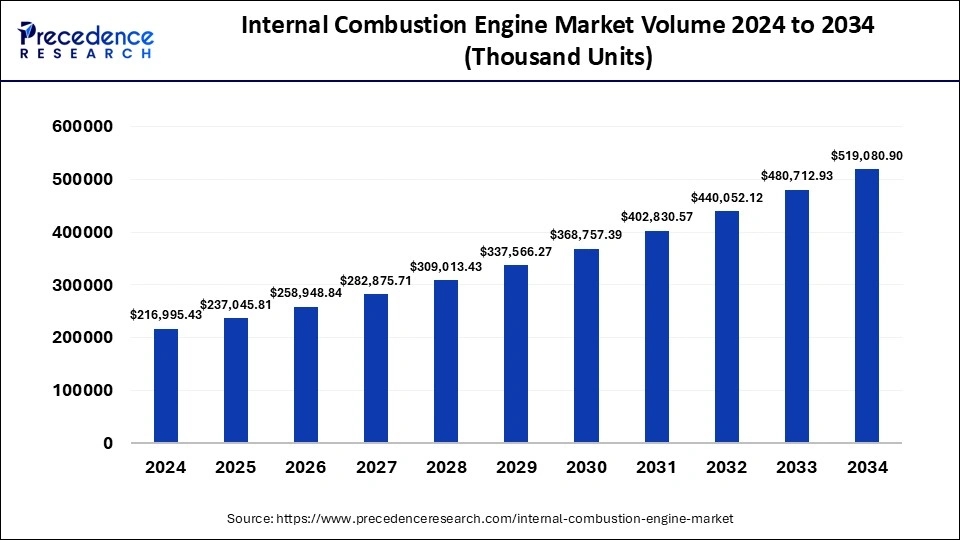

The global internal combustion engine market demand was 1,98,641 thousand units in 2023, estimated at 2,16,995.43 thousand units in 2024 and is projected to hit around 4,80,712.93 thousand units by 2033, at a CAGR of 9.24% from 2024 to 2033.

The Internal Combustion Engine (ICE) market remains a cornerstone of the automotive and industrial sectors globally, driven by its widespread use in vehicles, machinery, and power generation applications. Despite the growing shift towards electric vehicles (EVs), ICEs continue to dominate due to their established infrastructure and cost-effectiveness, especially in emerging economies. The market encompasses various types of ICEs, including gasoline and diesel engines, each catering to distinct end-user requirements across different regions.

Internal Combustion Engine Market Key Points

- Asia Pacific dominated the market with the largest revenue share of 42% in 2023.

- North America is anticipated to grow at a soldi CAGR of 8.92% during the forecast period.

- By fuel type, the petroleum segment accounted for the highest revenue share of 82% in 2023.

- By fuel type, the natural gas segment is expected to grow at a significant CAGR of 9.04% during the forecast period.

- By end-use, the automotive segment has held the largest revenue share of 69% of revenue share in 2023.

- By end-use, the aircraft segment is projected to expand at a remarkable CAGR of 8.52% during the forecast period.

Region Insights

Regionally, North America and Europe lead the market due to a high concentration of automotive manufacturing and stringent emission regulations that drive technological advancements in ICEs. Asia-Pacific follows closely, propelled by the rapid industrialization in countries like China and India, where demand for commercial vehicles and construction machinery remains robust. In contrast, Latin America and the Middle East & Africa regions exhibit steady growth, supported by investments in infrastructure and mining sectors, which rely heavily on ICE-powered equipment.

Trends

- Transition Towards Hybridization and Electrification: With the global push towards reducing carbon emissions and improving fuel efficiency, many ICE manufacturers are investing in hybrid and electric powertrains. This shift is driven by stricter emission norms and consumer demand for cleaner technologies.

- Advancements in Fuel Efficiency: Continuous research and development efforts are focusing on enhancing the fuel efficiency of internal combustion engines. This includes improvements in engine design, fuel injection systems, turbocharging, and lightweight materials to reduce vehicle weight.

- Increased Focus on Alternative Fuels: There is growing interest in alternative fuels such as biofuels, natural gas, and hydrogen as viable options for reducing greenhouse gas emissions from ICE vehicles. This trend is supported by government policies promoting renewable energy sources.

- Integration of Advanced Technologies: ICEs are increasingly incorporating advanced technologies such as variable valve timing, direct injection, cylinder deactivation, and start-stop systems to optimize performance and reduce fuel consumption.

- Market Expansion in Developing Regions: Emerging economies are witnessing a rise in demand for automobiles, which is driving the growth of the ICE market in regions like Asia-Pacific and Latin America. This expansion is fueled by increasing urbanization, rising disposable incomes, and infrastructure development.

Internal Combustion Engine Market Scope

| Report Coverage | Details |

| Market Volume by 2033 | 4,80,712.93 Thousand Units |

| Market Volume in 2023 | 1,98,641 Thousand Units |

| Market Volume in 2024 | 2,16,995.43 Thousand Units |

| Market Growth Rate from 2024 to 2033 | CAGR of 9.24% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Fuel Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fuel Type Segmentation:

The Internal Combustion Engine Market is segmented primarily by fuel type, with gasoline engines holding a significant share in applications such as passenger vehicles, motorcycles, and light-duty commercial vehicles. Gasoline engines are favored for their smooth operation, affordability, and widespread availability of fueling infrastructure, making them ideal for urban commuting and short-distance travel. Despite increasing adoption of electric vehicles, gasoline engines continue to dominate due to their convenience and efficiency in meeting daily transportation needs.

Diesel engines constitute another critical segment in the market, particularly renowned for their robust performance in heavy-duty applications such as trucks, buses, and industrial machinery. Diesel engines are prized for their high torque output and fuel efficiency, which are essential for transporting goods over long distances and powering machinery in construction and agriculture sectors. Despite facing regulatory challenges related to emissions, advancements in diesel engine technology, including improved combustion systems and emission control technologies, continue to sustain their relevance in various industries.

Natural gas engines are gaining traction as an alternative fuel option, offering lower emissions compared to gasoline and diesel counterparts. They find application in fleet vehicles, buses, and stationary power generation units, where environmental regulations favor cleaner-burning fuels. Natural gas engines are particularly valued for their reduced carbon footprint and lower operating costs, driving their adoption in urban transport systems and industries striving for sustainability.

End-use Industry Segmentation:

The Internal Combustion Engine Market is also segmented by end-use industries, with the automotive sector representing the largest consumer base. Internal combustion engines power a wide range of vehicles, including passenger cars, light trucks, and SUVs. Manufacturers continuously innovate to enhance engine efficiency, reduce emissions, and integrate hybrid technologies to meet stringent regulatory standards and consumer demands for fuel economy and performance. The automotive industry’s reliance on internal combustion engines underscores ongoing advancements in engine design and materials to optimize power output and environmental sustainability.

In the aerospace and defense sectors, internal combustion engines play a critical role in powering various aircraft and military vehicles. These engines are engineered to deliver high performance, reliability, and efficiency under extreme conditions, driving continuous advancements in engine technology. Aerospace and defense applications prioritize engine durability, lightweight construction, and compliance with stringent safety and operational standards, contributing to ongoing research and development efforts in engine innovation.

The marine industry also relies heavily on internal combustion engines to power commercial shipping vessels, leisure boats, and fishing fleets. These engines are designed to withstand maritime environments while delivering efficient performance and durability. Engine manufacturers focus on developing marine engines that meet stringent emissions regulations and enhance fuel efficiency to support sustainable maritime transportation and recreational boating activities worldwide.

Internal Combustion Engine Market Dynamics

Drivers

The market’s growth is driven by several factors. First, the expanding transportation and logistics sectors globally necessitate reliable and cost-effective power solutions, wherein ICEs excel. Second, the versatility of ICEs in powering a wide range of applications, from passenger cars to heavy-duty trucks and industrial machinery, sustains demand across diverse industries. Furthermore, ongoing research and development efforts aimed at enhancing engine efficiency and reducing emissions continue to propel market growth amidst environmental concerns.

Opportunities

Opportunities abound in the ICE market, particularly in emerging economies where infrastructural development and urbanization fuel demand for construction and transportation equipment. Moreover, the ongoing transition towards hybridization and alternative fuels presents opportunities for ICE manufacturers to innovate and adapt their technologies to meet evolving regulatory standards and consumer preferences. Furthermore, collaborations between automotive OEMs and technology providers offer avenues for integrating advanced features like hybrid powertrains and autonomous capabilities into ICE-driven vehicles.

Challenges

Despite its resilience, the ICE market faces challenges, primarily stemming from stringent emission norms and regulatory pressures worldwide. The shift towards electrification poses a long-term challenge, as governments and consumers increasingly favor cleaner, sustainable technologies. Additionally, fluctuations in raw material prices and the need for continuous technological innovation to meet future emissions targets present operational and strategic challenges for manufacturers. Moreover, geopolitical uncertainties and trade tensions can impact supply chains and market dynamics, necessitating agile strategies to navigate global uncertainties effectively.

Read Also: Minivans Market Size to Hit USD 141.38 Billion By 2033

Internal Combustion Engine Market Companies

- Volkswagen AG

- Toyota Industries Corporation

- Robert Bosch GmbH

- Shanghai Diesel Engine Co., Ltd.

- BMW

- Rolls-Royce

- Navistar International Corporation

- MAN SE

- Kirloskar Oil Engines Ltd.

- Detroit Diesel

- Cummins

- Caterpillar Incorporated

- Ashok Leyland Ltd

- AB Volvo

- Mahindra & Mahindra Ltd.

- Renault Group

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- General Motors

- Ford Motor Company

- AGCO Corporation

Recent Developments

- In June 2023, Rolls-Royce opened an MTU combustion engine assembly plant for its MTU Series 2000 engines in Kluftern. The new structure features a 1.2MW solar photovoltaic system, e-charging columns to promote greener mobility, and smart building control to maximize energy efficiency.

- In June 2023, General Motors Co. announced its plan to invest USD 632 million in Fort Wayne Assembly to prepare the plant for production of the next-generation internal combustion engine (ICE) full-volume light-duty trucks. This investment will enable the company to strengthen its industry-leading full-volume truck business. Product details and timing related to GM’s future trucks are not being released at this time.

- In February 2023, RIL announced India’s first hydrogen combustion engine technology for heavy-duty vehicles. Reliance claims that it is a “unique and affordable” domestically developed technology solution that could change the course of green mobility in the future.

- In May 2024, Swedish auto manufacturer Volvo announced that it would start customer trials for trucks with hydrogen internal combustion engines in 2026, with a wider market launch planned for the end of the decade.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/