Light Duty Vehicles Market Size and Growth

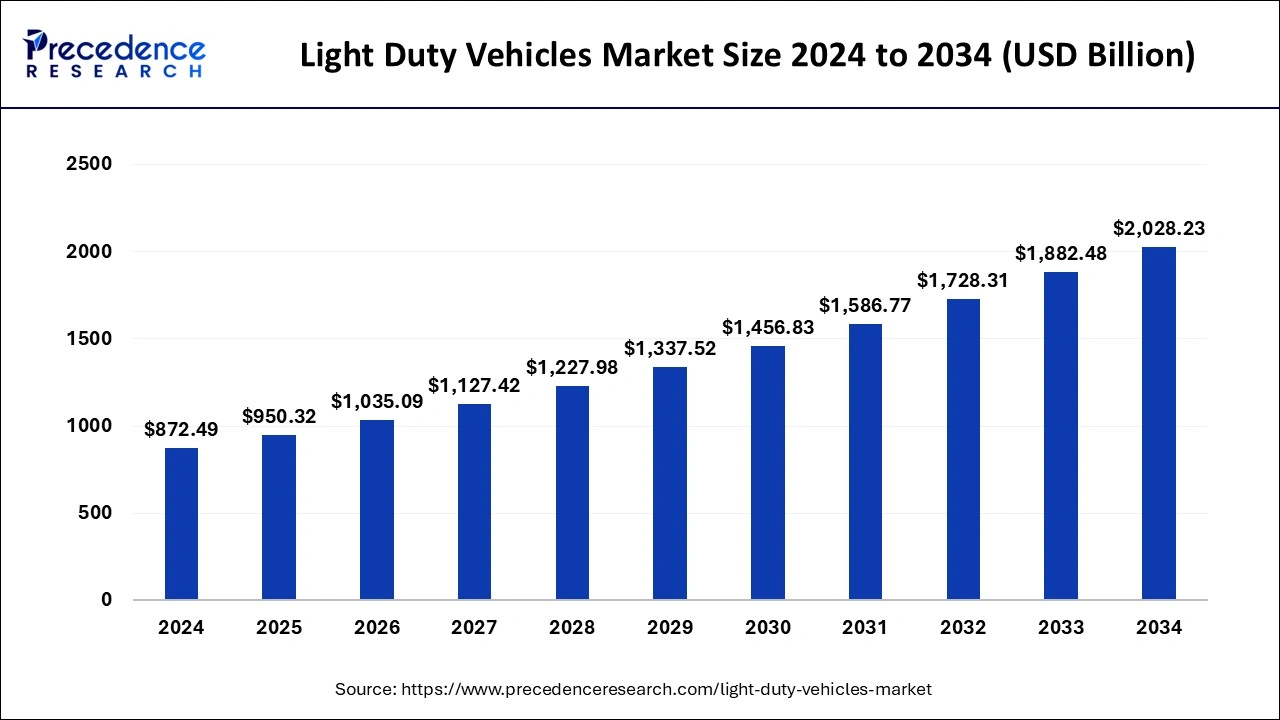

The global light duty vehicles market size reached USD 801.04 billion in 2023 and is projected to cross around USD 1,882.48 billion by 2033 with a notable CAGR of 8.92% from 2024 to 2033.

The Light Duty Vehicles (LDV) market encompasses a wide range of vehicles including cars, SUVs, vans, and light trucks designed primarily for personal and commercial use. These vehicles are characterized by their gross vehicle weight rating (GVWR) of up to 8,500 pounds, making them more fuel-efficient and versatile for everyday transportation needs. The LDV market is a vital segment of the global automotive industry, significantly contributing to economic growth, employment, and technological advancements. With increasing urbanization, rising disposable incomes, and growing consumer preference for personal mobility, the demand for LDVs has been steadily rising. Additionally, advancements in vehicle technology, including the integration of advanced driver assistance systems (ADAS) and electric powertrains, are further propelling the market forward.

Get a Sample: https://www.precedenceresearch.com/sample/4448

Light Duty Vehicles Market Key Takeaways

- The North America light duty vehicles market size reached USD 272.35 billion in 2023 and is projected to grow around USD 649.46 billion by 2033, at a CAGR of 9.07% from 2024 to 2033.

- North America dominated the market with the largest revenue share of 34% in 2023.

- By vehicle type, the passenger car segment has contributed more than 43% in 2023.

- By vehicle type, the pickup truck segment is expected to grow at the fastest rate during the forecast period.

- By fuel type, the gasoline segment has held a major revenue share of 72% in 2023.

- By fuel type, the electric segment is estimated to register the highest CAGR during the forecast period.

- By drivetrain, the rear wheel drive (RWD) segment dominated the market during the forecast period.

- By drivetrain, the all-wheel drive (AWD) segment is expected to grow at the fastest rate during the forecast period.

- By transmission type, the manual segment has recorded more than 61% of revenue share in 2023.

- By transmission type, the automatic segment is expected to grow at the fastest CAGR during the forecast period.

Regional Insights

North America, particularly the United States and Canada, represents one of the largest markets for light-duty vehicles. The region’s demand is driven by a strong preference for SUVs and trucks, supported by a robust automotive manufacturing base. Government initiatives promoting electric vehicles (EVs) and stringent emission regulations are pushing automakers to innovate and introduce more eco-friendly models. Europe is another significant market for LDVs, with countries like Germany, France, and the UK leading in vehicle production and consumption. The region is at the forefront of adopting electric and hybrid vehicles, driven by stringent emission norms and government incentives. The European Union’s Green Deal aims to make the continent carbon-neutral by 2050, further accelerating the shift towards sustainable mobility solutions.

- For instance, in January 2024, Tesla launched the all-new Model 3 in North America. This vehicle supports level 2 autonomy and comes with an electric drivetrain that provides a driving range of up to 341 miles on a single charge.

- In January 2024, Texas Instruments launched a new automotive chip named ‘AWR2544’. This is a satellite-based single-chip radar sensor that enables a high autonomy level and improves sensor fusion and decision-making capabilities in ADAS.

- In May 2024, the U.S. government announced that it would invest around 1.3 billion USD in developing EV infrastructure across the country.

The Asia-Pacific region, led by China, Japan, and India, is experiencing rapid growth in the LDV market. China, the world’s largest automotive market, is witnessing a surge in demand for electric vehicles, supported by government subsidies and a robust manufacturing ecosystem. Japan’s focus on hybrid technology and India’s growing middle class and urbanization are also contributing to the market’s expansion. These regions are gradually emerging as significant markets for LDVs, driven by improving economic conditions and increasing urbanization. Brazil, Mexico, South Africa, and the UAE are key markets where rising disposable incomes and expanding infrastructure are boosting vehicle sales.

- For instance, in January 2024, Bosch announced a partnership with Here Technologies and Daimler Trucks. This partnership was done to develop a new advanced driver assistance system (ADAS) for commercial vehicles in Europe.

- For instance, in June 2023, Volkswagen launched a new SUV named ‘Tiguan’ in Europe. This SUV comes with several superior features, such as a modern cockpit design, a Car2X warning system, side assist (lane change assist), front assist (emergency braking system), and others, along with eight different mild hybrids (eTSI), turbocharged petrol (TSI), plug-in hybrid (eHybrid), and turbocharged diesel (TDI) drives.

- For instance, in April 2024, the government of the Netherlands announced that fully electric vehicles are exempted from any taxes, and plug-in hybrid vehicles will get a 50% reduction in taxes till the end of 2024.

Light Duty Vehicles Market Trends

Electrification: The shift towards electric vehicles (EVs) is one of the most prominent trends in the LDV market. Governments worldwide are setting ambitious targets for reducing carbon emissions, driving automakers to invest heavily in EV technology. The development of more efficient battery technologies and the expansion of charging infrastructure are making EVs more accessible and appealing to consumers.

Connectivity and Autonomous Driving: Advances in vehicle connectivity and autonomous driving technologies are transforming the LDV landscape. Features such as real-time traffic updates, remote diagnostics, and over-the-air software updates are becoming standard. Additionally, the development of autonomous vehicles is progressing rapidly, promising to revolutionize transportation by enhancing safety and efficiency.

Sustainability and Green Technologies: Environmental sustainability is becoming a key focus for the automotive industry. Manufacturers are exploring alternative materials, lightweight designs, and renewable energy sources to reduce the environmental impact of vehicles. The adoption of green technologies such as hydrogen fuel cells and biofuels is also gaining traction.

Consumer Preferences: Changing consumer preferences towards SUVs and crossover vehicles are influencing market dynamics. These vehicles offer a blend of comfort, space, and versatility, making them popular choices among families and outdoor enthusiasts. The trend towards personalization and customization of vehicles is also on the rise, with consumers seeking unique features and designs.

Light Duty Vehicles Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 801.04 Billion |

| Market Size in 2024 | USD 872.49 Billion |

| Market Size by 2033 | USD 1,882.48 Billion |

| Market Growth Rate | CAGR of 8.92% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Vehicle Type, Fuel Type, Drivetrain, Transmission Type and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vehicle Type

The Light Duty Vehicles (LDV) market encompasses a variety of vehicle types, each catering to different consumer needs and preferences. The primary categories include passenger cars, light commercial vehicles (LCVs), and sports utility vehicles (SUVs). Passenger cars dominate the LDV market due to their widespread use for personal transportation and commuting. LCVs, including vans and small trucks, are essential for businesses requiring efficient logistics and transportation of goods within urban and suburban areas. SUVs have seen a significant rise in popularity, combining the benefits of higher seating positions, increased cargo space, and off-road capabilities. The growing consumer demand for versatility, comfort, and advanced features continues to drive the expansion of these vehicle types within the LDV market.

Fuel Type Insights

Fuel type is a crucial segment in the LDV market, significantly influenced by the global push towards sustainability and reducing carbon emissions. Traditionally, gasoline and diesel-powered vehicles have dominated the market. However, the shift towards greener alternatives has led to a surge in the adoption of electric vehicles (EVs) and hybrid vehicles. EVs, powered solely by electricity, are gaining traction due to advancements in battery technology, increased range, and expanding charging infrastructure. Hybrid vehicles, which combine internal combustion engines with electric propulsion, offer a transitional solution, providing improved fuel efficiency and lower emissions. Additionally, alternative fuels such as compressed natural gas (CNG) and hydrogen fuel cells are emerging, though their market share remains relatively small compared to conventional fuels and EVs.

Drivetrain Insights

The drivetrain segment of the LDV market includes various configurations such as front-wheel drive (FWD), rear-wheel drive (RWD), and all-wheel drive (AWD). FWD vehicles are prevalent due to their cost-effectiveness, lighter weight, and better fuel efficiency, making them suitable for most passenger cars and urban driving conditions. RWD vehicles, often found in performance and luxury cars, provide superior handling and weight distribution, enhancing driving dynamics. AWD vehicles offer enhanced traction and stability, particularly in adverse weather conditions and off-road scenarios. This drivetrain configuration is increasingly popular in SUVs and crossover vehicles, appealing to consumers seeking versatility and safety. The choice of drivetrain significantly impacts vehicle performance, handling, and suitability for different driving conditions, influencing consumer preferences and market trends.

Transmission Type Insights

Transmission type is another vital segment in the LDV market, affecting vehicle performance, fuel efficiency, and driving experience. The two main types are manual transmissions and automatic transmissions. Manual transmissions, while becoming less common, are preferred by some enthusiasts for the direct control they offer over gear changes and the engaging driving experience. Automatic transmissions, including traditional torque-converter automatics, continuously variable transmissions (CVTs), and dual-clutch transmissions (DCTs), have gained widespread popularity due to their convenience, ease of use, and improving fuel efficiency. CVTs are known for their smooth and seamless acceleration, while DCTs offer rapid gear shifts and are often found in performance-oriented vehicles. The trend towards automatic transmissions is driven by technological advancements, changing consumer preferences, and the increasing complexity of modern vehicles.

Light Duty Vehicles Market Size Dynamics

Drivers

Several factors are driving the growth of the light-duty vehicles market:

Economic Growth and Urbanization: Rapid economic growth, particularly in emerging markets, is boosting disposable incomes and urbanization, leading to increased demand for personal and commercial vehicles. Urbanization drives the need for efficient and versatile transportation solutions, further fueling LDV sales.

Technological Advancements: Continuous advancements in automotive technology, including the development of more fuel-efficient engines, advanced safety features, and connectivity solutions, are enhancing the appeal of light-duty vehicles. Innovations such as hybrid and electric powertrains are also contributing to market growth.

Government Policies and Incentives: Governments worldwide are implementing policies and incentives to promote the adoption of electric and low-emission vehicles. Subsidies, tax benefits, and stringent emission regulations are encouraging consumers and manufacturers to shift towards more sustainable transportation solutions.

Rising Consumer Awareness: Increasing awareness about environmental issues and the benefits of green mobility solutions is influencing consumer preferences. Consumers are becoming more conscious of their carbon footprint and are opting for vehicles that offer better fuel efficiency and lower emissions.

Opportunities

The light-duty vehicles market presents several growth opportunities:

Expansion of Electric Vehicle Infrastructure: The expansion of EV charging infrastructure is a significant opportunity for the LDV market. Governments and private enterprises are investing in building a comprehensive network of charging stations, making electric vehicles more convenient and accessible for consumers.

Emerging Markets: Emerging markets such as India, Southeast Asia, and Africa offer significant growth potential for the LDV market. Rapid economic development, increasing urbanization, and a growing middle class are driving demand for affordable and efficient transportation solutions.

Innovation in Battery Technology: Advancements in battery technology, including the development of solid-state batteries and improved energy density, are expected to drive the growth of electric vehicles. These innovations will enhance the range, performance, and affordability of EVs, making them more attractive to consumers.

Collaborations and Partnerships: Collaborations and partnerships between automakers, technology companies, and government agencies can drive innovation and accelerate the adoption of new technologies. Joint ventures and strategic alliances can help companies leverage each other’s strengths and resources to develop advanced mobility solutions.

Challenges

Despite the growth prospects, the light-duty vehicles market faces several challenges:

High Cost of Electric Vehicles: The high initial cost of electric vehicles remains a significant barrier to widespread adoption. Although the cost of batteries is decreasing, EVs are still more expensive than traditional internal combustion engine vehicles. Overcoming this cost barrier is crucial for increasing EV penetration in the market.

Infrastructure Development: The lack of adequate charging infrastructure in many regions poses a challenge to the growth of electric vehicles. Developing a reliable and widespread charging network is essential to address range anxiety and make EVs a viable option for consumers.

Supply Chain Disruptions: The global automotive industry has been facing supply chain disruptions due to factors such as the COVID-19 pandemic, semiconductor shortages, and geopolitical tensions. These disruptions can impact vehicle production and delivery timelines, affecting market growth.

Regulatory and Policy Uncertainty: The automotive industry is subject to a complex and evolving regulatory environment. Changes in government policies, emission standards, and trade agreements can create uncertainties for manufacturers and impact market dynamics. Navigating these regulatory challenges requires strategic planning and adaptability.

Consumer Acceptance and Education: Consumer acceptance and education about new technologies, such as electric and autonomous vehicles, are critical for market growth. Misconceptions, lack of awareness, and resistance to change can hinder the adoption of advanced mobility solutions. Educating consumers about the benefits and capabilities of these technologies is essential for driving market acceptance.

Read Also: High-Voltage Hybrid Vehicle Market Size, Growth, Report By 2033

Light Duty Vehicles Market Companies

- Ford Motor Company

- Nissan Motor Company

- Subaru Corporation

- General Motors Company

- Honda Motor Company, Ltd.,

- BMW AG

- Daimler AG

- Fiat Chrysler Automobiles N.V.

- Hyundai Motor Company

- Toyota Motor Corporation

Recent Developments

- In March 2024, BMW launched the all-electric‘ iX xDrive50’ in India. This car provides superior features to ensure a smooth driving experience. It comes with standard adaptive 2-axle air suspension for a comfortable ride and a driving range of up to 635 km.

- In March 2024, Nissan launched a Kicks SUV. This SUV comes with ADAS and ProPILOT assist system for maximum safety along with touch-sensitive controls for the HVAC, a wireless charging pad, four USB-C ports, wireless Apple CarPlay and Android Auto connectivity, a headrest-mounted BOSE speakers, and a panoramic sunroof.

- In February 2024, Daimler AG launched a new light truck named ‘Canter’ in Japan. This truck offers a high level of comfort and advanced safety features, such as active sideguard assist and active brake assist 5, to ensure safe driving.

- In February 2024, Honda Motors launched a plug-in hydrogen fuel cell electric vehicle. This car is named the ‘Honda CR-V,’ and it bundles a 17.7-kwh battery that provides a range of around 270 miles along with a 9-inch HD touchscreen, wireless phone charging, wireless Apple CarPlay, and Android Auto compatibility, a 12-speaker Bose premium audio system, heated steering wheel, dual-zone climate control, power-adjustable heated front seats, parking sensors, and bio-based leather seat.

- In November 2023, Mitsubishi Motors Corporation launched a new Minicab EV. This vehicle has enhanced safety features, a powerful driving experience, and a range of around 180 km.

- In September 2023, Switch Mobility launched two light commercial electric vehicles in India, the Switch IeV3 and Switch IeV4. The Switch IeV3 has a 25.6 kWh LFP battery that produces a peak power of 40 kW and provides a payload capacity of 1200 kgs. The Switch IeV4 has a 32.2 kWh LFP battery that produces a peak power of 60 kW and provides a payload capacity of 1700 kgs.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/