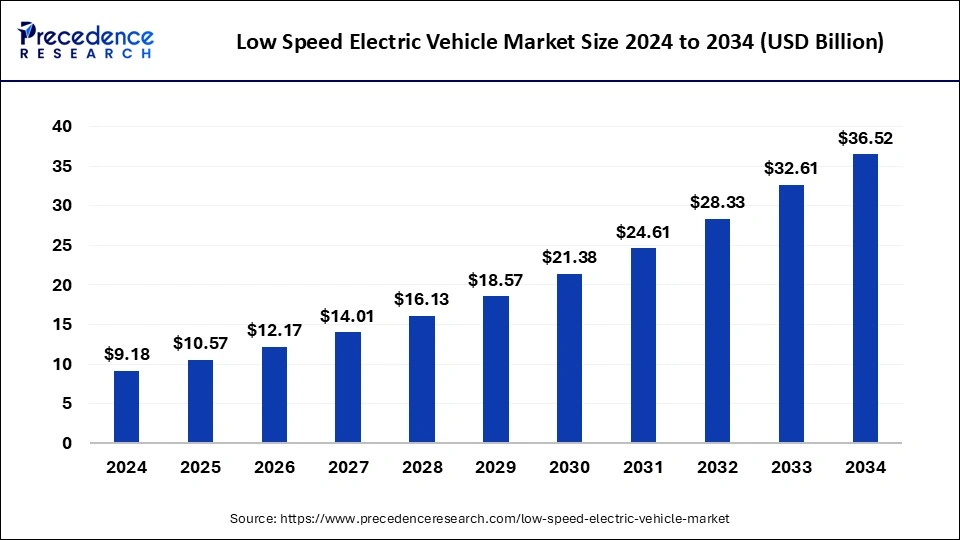

The global low-speed electric vehicle market size is estimated at USD 9.18 billion in 2024 and is projected to surpass around USD 32.61 billion by 2033. at a solid CAGR of 15.12% from 2024 to 2033.

The low speed electric vehicle (LSEV) market has witnessed substantial growth in recent years, driven by increasing environmental concerns, rising fuel costs, and advancements in electric vehicle (EV) technology. LSEVs are typically designed for short-range urban commuting and are characterized by their lower speeds and compact size compared to traditional vehicles. They are popular in densely populated areas, campuses, and gated communities where short-distance travel is predominant.

Get a Sample: https://www.precedenceresearch.com/sample/4547

Low Speed Electric Vehicle Market Key Points

- Asia Pacific led the market with the largest share of the market in 2023.

- By vehicle type, the passenger segment projected the largest revenue in the market in 2023.

- By end-user, the golf courses segment dominated the market with the largest share in 2023.

Region Insights

Regionally, Asia-Pacific dominates the low speed electric vehicle market, accounting for a significant share of global production and consumption. Countries like China and India have seen rapid adoption due to supportive government policies promoting electric mobility, coupled with dense urban populations seeking cost-effective and eco-friendly transportation solutions. North America and Europe also show growing interest, driven by environmental regulations and increasing consumer preference for sustainable transportation options.

- In May 2024, In the US, EV manufacturer Eli releases its $11,900 electric mini “car.” This morning, reservations for the well-liked Eli ZERO electric microcar were available in the United States, according to a statement released by Eli Electric. Microcars are a specialized class of vehicles primarily intended for use in cities. They are also known as quadricycles in Europe and Low-Speed Vehicles (LSVs) or Neighborhood Electric Vehicles (NEVs) in the US. Selling only dozens of vehicles, several new automakers in the category have struggled to achieve momentum.

- For instance, in May 2024, Odysse Electric Vehicles, based in Mumbai, launched two electric scooters in India. Out of the two scooters, the Odysse E2 is a low-speed electric scooter that costs Rs 69,999.

Trends in the Low Speed Electric Vehicle Market

- Rising Demand in Urban Areas: LSEVs are gaining popularity in urban settings due to their compact size, ease of maneuverability in traffic, and low operating costs. They are increasingly seen as convenient options for short-distance commuting and local deliveries.

- Government Incentives and Policies: Many governments worldwide are offering incentives such as subsidies, tax rebates, and free parking for LSEVs. This is driving adoption among consumers and businesses alike, promoting cleaner and more sustainable transportation options.

- Technological Advancements: Advances in battery technology, particularly in terms of energy density and cost reduction, are enhancing the performance and affordability of LSEVs. Improved charging infrastructure is also supporting their broader adoption.

- Expansion of Vehicle Types: The LSEV market is diversifying beyond traditional golf carts and neighborhood electric vehicles (NEVs). Newer models include microcars, electric scooters, and utility vehicles, catering to various consumer needs and applications.

- Environmental Awareness: Growing environmental concerns and the need to reduce greenhouse gas emissions are prompting individuals and organizations to switch to electric vehicles (EVs), including LSEVs, as part of their sustainability efforts.

Low Speed Electric Vehicle Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 32.61 Billion |

| Market Size in 2023 | USD 7.98 Billion |

| Market Size in 2024 | USD 9.18 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 15.12% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Vehicle Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vehicle Types

Low Speed Electric Vehicles (LSEVs) encompass a variety of vehicle types designed primarily for short-distance travel and urban mobility. Neighborhood Electric Vehicles (NEVs) are a prominent category within this market, characterized by their compliance with regulations that limit their speed typically to 25 mph (40 km/h). NEVs are popular in gated communities, industrial campuses, and university settings where they provide convenient, zero-emission transportation for residents, employees, and students alike.

Golf carts are another significant segment of LSEVs, widely used in golf courses, resorts, and recreational areas. These electric vehicles offer quiet operation and low environmental impact, making them ideal for leisurely travel over short distances. They have become essential in facilities where noise and emissions restrictions are crucial, enhancing the overall experience for users without compromising on efficiency.

Electric quadricycles round out the vehicle types in the LSEV market, serving as compact, four-wheeled options for urban transportation. These vehicles are designed for city commuting and short trips, providing a practical and eco-friendly alternative to conventional cars. Electric quadricycles are gaining popularity in densely populated areas where traffic congestion and environmental concerns drive the demand for sustainable mobility solutions.

End-User Segments

LSEVs cater to diverse end-user segments across residential, commercial, recreational, and public sectors. In residential and gated communities, these vehicles are utilized for local commuting, errands, and leisure activities within the community grounds. Their quiet operation and emission-free performance contribute to a peaceful living environment and align with sustainability goals embraced by many homeowners’ associations and property developers.

Commercial and industrial applications of LSEVs focus on intra-site transportation within warehouses, manufacturing plants, and large facilities. These electric vehicles are deployed to streamline logistics operations, reduce operational costs, and enhance workplace efficiency. By minimizing the use of conventional vehicles, businesses can achieve significant savings in fuel and maintenance expenses while promoting a cleaner working environment.

In tourism and recreational facilities, LSEVs play a crucial role in providing visitors with convenient transportation options around resorts, amusement parks, and tourist attractions. Their maneuverability, ease of use, and eco-friendly attributes make them preferred choices for enhancing visitor experiences while reducing the ecological footprint of these leisure destinations.

Public sector and municipal use of LSEVs extends to various applications such as park management, security patrols, and maintenance services within urban settings. Municipalities employ these vehicles to support local mobility initiatives, improve public services, and achieve sustainability targets outlined in urban mobility plans. LSEVs contribute to reducing traffic congestion and air pollution in city centers while offering cost-effective transportation solutions for municipal operations.

Low Speed Electric Vehicle Market Dynamics

Drivers

Several factors drive the growth of the low speed electric vehicle market. Environmental concerns and stringent emission regulations worldwide push consumers and businesses towards cleaner transportation options. Rising urbanization leads to increased traffic congestion, making compact electric vehicles more attractive for short-distance commuting. Moreover, declining battery costs and government incentives further encourage adoption, making LSEVs a viable economic choice compared to conventional vehicles.

Opportunities

The market presents numerous opportunities for growth, especially in emerging economies where urbanization rates are high and infrastructure development is ongoing. Technological advancements, such as improvements in battery efficiency and autonomous driving features, open doors for enhanced functionality and safety in LSEVs. Moreover, partnerships between automakers and technology firms are likely to foster innovation and expand market reach, creating new avenues for growth.

Challenges

Despite its growth prospects, the LSEV market faces several challenges. Limited range and speed capabilities restrict their appeal for long-distance travel and highway use, positioning them primarily as urban commuting solutions. Infrastructure challenges, including the availability of charging stations in less-developed regions, pose logistical hurdles. Moreover, consumer perception and awareness regarding the capabilities and benefits of LSEVs compared to conventional vehicles remain a barrier in some markets. Regulatory uncertainties and evolving standards also impact market dynamics, requiring continuous adaptation from industry stakeholders.

Read Also: Self-Driving Cars and Trucks Market Volume to Hit 7112.07 Thousand Units by 2033

Low Speed Electric Vehicle Market Companies

- Textron Inc. (Textron Specialized Vehicles Inc.)

- HDK Electric Vehicle

- Star EV Corporation

- Polaris Inc.

- Yamaha Motor Co., Ltd.

- Bradshaw Electric Vehicles, Inc

- GARIA

- AGT Electric Cars

- Columbia Vehicle Group Inc.

- SpeedwaysElectric

Recent Developments

- In June 2024, Kandi America, a leading manufacturer of eUTVs and electric golf carts, launched three new electric go-karts specifically designed for off-roading fun.

- In June 2024, Motovolt Mobility Pvt. Ltd., a leading e-mobility brand in India, collaborated with Zevo, a technology-powered logistics solutions provider that uses efficiency and environmental sustainability in operations for the launch of 5,000 M7 electric scooters for urban mobility and last-mile delivery services.

- In January 2024, ICON EV and WiTricity announced the launch of 2024 ICON Low-Speed Vehicles (LSVs) with the feature of wireless charging. The launch will be unveiled at WiTricity’s display at the Las Vegas Consumer Electronics Show (CES) and will be available in the market in the summer of 2024.

- In June 2024, Zelio Ebikes, a trailblazing company in the EV two-wheeler space, revealed the introduction of the X Men low-speed electric scooter series, which is its newest product line. With five unique X Men scooter variations that are sure to appeal to a broad spectrum of customers, this reveal marks a considerable extension of Zelio Ebikes’ product line.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/