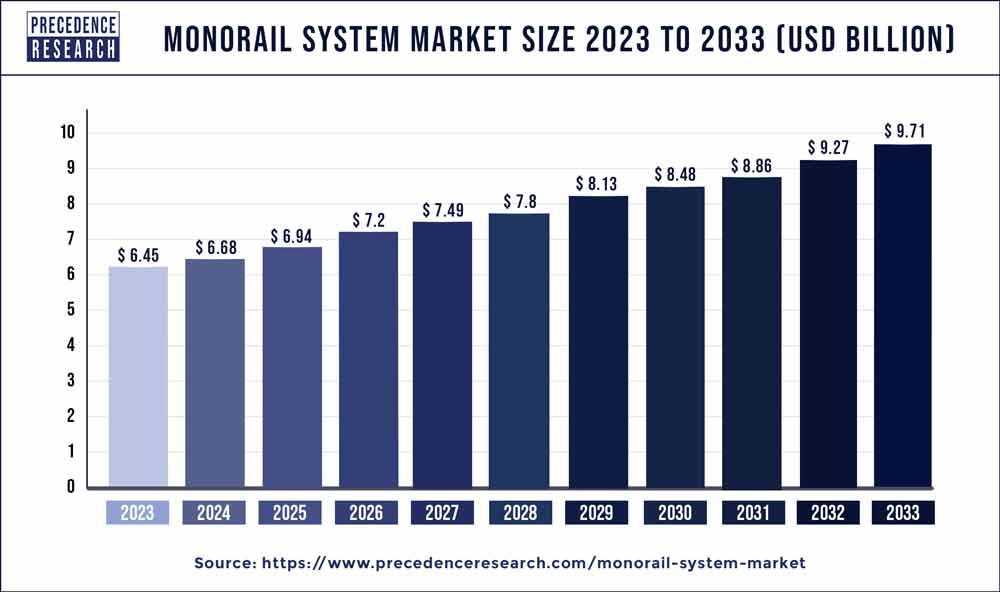

The global monorail system market size was valued at USD 6.45 billion in 2023 and it is projected to reach around USD 9.71 billion by 2033 and grow at a CAGR of 4.25% from 2024 to 2033.

Key Points

- Asia Pacific led the global market with the highest market share of 40.11% in 2023.

- By Type, the straddle monorail segment has held the largest revenue share in 2023.

- By Autonomy, the completely autonomous segment had the biggest market share in 2023.

- By Propulsion Type, the electric monorail segment is estimated to hold the highest market share in 2023.

The Monorail System Market refers to the industry involved in the design, manufacturing, and deployment of monorail transportation solutions. Monorail systems are characterized by trains running on a single rail, either elevated or at ground level, offering efficient and sustainable mass transit options in urban areas. These systems are known for their ability to alleviate traffic congestion, reduce pollution, and provide a reliable mode of transportation in densely populated regions.

Get a Sample: https://www.precedenceresearch.com/sample/1004

Table of Contents

ToggleGrowth Factors:

The Monorail System Market is experiencing significant growth due to several key factors. Firstly, rapid urbanization and population growth in cities worldwide have heightened the demand for efficient public transportation systems. Monorails offer a solution by providing high-capacity transit with minimal land requirements. Additionally, increasing government investments in infrastructure development projects, coupled with growing environmental concerns, are driving the adoption of monorail systems as sustainable alternatives to traditional modes of transportation.

Asia Pacific Monorail System Market 2024 To 2033

The Asia Pacific monorail system market size was valued at USD 2.59 billion in 2023 and is expected to hit around USD 4 billion by 2033, registering a CAGR of 4.53% from 2024 to 2033.

The Monorail System Market exhibits a global presence, with regions such as Asia-Pacific, particularly countries like China, Japan, and India, leading in terms of market share. These regions are witnessing extensive urbanization and are actively investing in modernizing their transportation infrastructure to accommodate the growing population and ease congestion. North America and Europe also contribute significantly to the market, with ongoing projects and initiatives aimed at enhancing public transit systems.

Monorail System Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 6.45 Billion |

| Market Size by 2033 | USD 9.71 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.25% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Autonomy, Propulsion Type, Autonomous, Size, Geography |

| Companies Mentioned | Bombardier Corporation, CRRC Corporation Limited, Hitachi Rail, Ansaldo STS, BYD Company ltd, General Electric, Alstom S.A., Thales Group, SIEMENS AG, Mitsubishi Electric, ABB |

Monorail System Market Dynamics

Drivers:

Several drivers propel the growth of the Monorail System Market. These include the need for efficient and reliable transportation solutions in urban areas, government initiatives promoting sustainable infrastructure development, advancements in monorail technology enhancing operational efficiency and safety, and the rising preference for mass transit options among commuters seeking to reduce travel time and environmental impact.

Restraints: Despite its growth prospects, the Monorail System Market faces certain restraints. These may include high initial investment costs associated with infrastructure development and system installation, regulatory hurdles and bureaucratic processes delaying project implementation, challenges related to land acquisition and right-of-way issues, and potential public resistance to changes in transportation systems.

Opportunities:

The Monorail System Market presents various opportunities for growth and expansion. These include untapped markets in emerging economies with burgeoning urban populations, collaborations between public and private sectors to fund and execute monorail projects, technological innovations enhancing system efficiency and passenger experience, and the integration of monorail systems with other modes of transportation to create seamless multimodal networks.

Challenges:

Challenges facing the Monorail System Market include competition from alternative transportation modes such as buses, metros, and emerging technologies like autonomous vehicles, ensuring financial viability and profitability of monorail projects amidst fluctuating economic conditions, addressing concerns regarding safety and security, and overcoming public skepticism or opposition towards new transportation initiatives.

Competitive Landscape:

The Monorail System Market is characterized by intense competition among key players striving to innovate and capture market share. Major companies involved in the market include manufacturers of monorail vehicles and infrastructure components, engineering firms specializing in system design and integration, and operators providing maintenance and operational services. Competition often revolves around factors such as technology capabilities, project execution expertise, pricing strategies, and customer service quality

Read Also: Electric Vehicle Charging Station Market Size to hit USD 344.61 Bn by 2032

Recent Developments

- In February 2023, the first medium-capacity monorail train manufactured by CRRC Changchun was introduced in Chongqing, China, on February 10th. This multi-adaptive straddle-type monorail offers excellent climbing ability, a small turning radius, and high environmental adaptability. With a maximum speed of 80km/h, each car can accommodate 136 passengers. The flexible configuration meets different passenger traffic demands, and its lightweight construction and low running noise have a minimal environmental impact.

- Alstom delivered monorail in September 2021 at its own plant in Derby, UK. The first 2Innovia 300 monorail trains for the Cairo Monorail plan have already inwards in Cairo, with Alstom’s Trapaga, Spain plant leading the propulsion systems application.

- Egypt debuted the world’s largest monorail east and west of Cairo in May 2022. Bombardier Transportation, a company based in Canada, has successfully completed monorail projects.

- Hitachi stated in December 2021 that it will purchase Bombardier Transportation’s business interests, which includes the V300 ZEFIRO extremely high-speed train from Alstom.

- Siemens, a German corporation, was awarded a project in January 2021 to build a high-speed electric monorail network that would be tested by the middle of 2024. According to Kamel EL-Wazir of the Ministry of Transport Egypt, the monorail project’s initial construction began in early 2021. The project is estimated to be worth $3 billion.

Monorail System Market Companies

- Bombardier Corporation

- CRRC Corporation Limited

- Hitachi Rail

- Ansaldo STS

- BYD Company ltd

- General Electric

- Alstom S.A.

- Thales Group

- SIEMENS AG

- Mitsubishi Electric

- ABB

Segments Covered in the Report

By Type

- Straddle Monorail

- Suspended Monorail

By Autonomy

- Semi-autonomous

- Completely Autonomous

- Manual

By Propulsion Type

- Electric Monorail

- Maglev Monorail

By Size

- Large

- Medium

- Compact

By Autonomous

- GoA0

- GoA1

- GoA2

- GoA3

- GoA4

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/