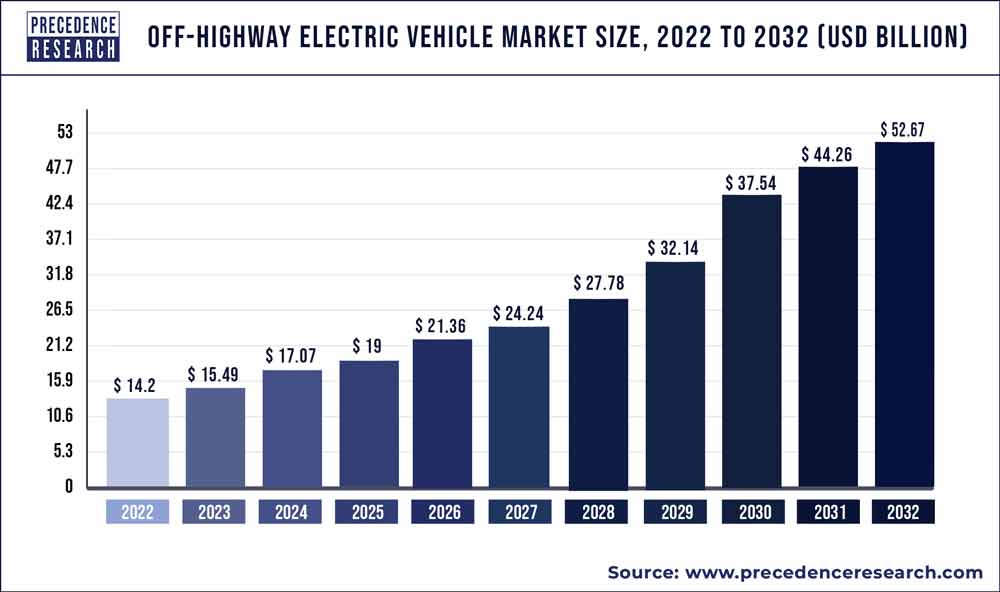

The global Off-highway Electric Vehicle market reached USD 14.2 billion in 2022 and is predicted to touch USD 52.67 billion by 2032, with a CAGR of 14.6% during the forecast period 2023 to 2032.

Electrically powered machinery offers a range of benefits, including enhanced maneuverability, overall performance, and operational precision. The adoption of electric technology in off-highway vehicles brings numerous advantages, yet its integration into the industry faces challenges due to factors such as battery capacity limitations and inadequate charging infrastructure, which are expected to impede rapid acceptance.

Get a Sample: https://www.precedenceresearch.com/sample/1161

Off-highway Electric Vehicle Market Growth

The expansion of infrastructure in developing markets and redevelopment initiatives in developed nations are propelling the sales of electric off-highway vehicles. Government-imposed stringent emission standards, exemplified by regulations on greenhouse gas emissions set by entities like the U.S. Environmental Protection Agency (EPA) and the European Commission, significantly impact the global market for off-road electric vehicles (EVs). The electrification trend in heavy-duty off-highway vehicles is on the upswing, as businesses explore how this emerging trend aligns with their existing business models. The merits of electric systems in heavy-duty vehicles are considerable, yet elements like battery technology, charging infrastructure, and production costs are pivotal considerations in research and implementation of electric solutions.

Moreover, the market for off-highway electric vehicles benefits from factors like heightened electrical machinery performance, reduced noise and vibration levels, lower maintenance expenses, and others. Governments worldwide have enacted increasingly strict emission standards for off-highway vehicles, exemplified by India’s and China’s BS-VI and the U.S. EPA’s greenhouse gas (GHG) emission regulations. This emphasis on emissions has pushed Original Equipment Manufacturers (OEMs) to explore alternative powertrain options like hybrid and fully electric off-highway vehicles to cater to global demand.

Report Highlights

- The global off-highway electric vehicles market accounted USD 5.5 billion in 2019, and is expected to rise at a CAGR of 21.2 percent over the forecast period.

- The global off-highway electric vehicles market accounted USD 5.5 billion in 2019, and is expected to rise at a CAGR of 21.2 percent over the forecast period.

- The BEV segment is expected to grow over the forecast period at the fastest CAGR of 30.5 percent. The slowdown in the adoption of internal combustion engine vehicles and the limitation of CO2 targets are expected to encourage segmental expansion.

- The construction sector emerged as the largest sector in 2019 and by the end of the forecast period it is projected to produce revenues of over USD 6.68 billion

Read More: Automotive Braking System Market to See Booming CAGR Growth By 2032

Regional Insights

The North American market holds the largest share in sales and is projected to maintain its dominance. Key players like Caterpillar, Deere & Company, and CNH Industrial N.V. contribute to this region’s strong position. The growth of the construction sector in North America fuels demand for off-highway electric equipment.

In the Asia Pacific region, the off-highway EV market is expected to experience the highest Compound Annual Growth Rate (CAGR) of 34.4 percent from 2020 to 2027. Countries such as China and India exhibited robust performance in 2019 due to increased investment in infrastructure. China, with its numerous OEMs, cost-effective production, low labor expenses, and top-tier manufacturers, stands out as a significant contributor to construction equipment manufacturing.

Opportunities:

- Environmental Benefits: Off-highway EVs contribute to reduced greenhouse gas emissions and local air pollution compared to their internal combustion engine counterparts. This aligns with global efforts to mitigate climate change and improve air quality.

- Cost Savings: Over the long term, off-highway EVs can potentially provide cost savings through reduced fuel and maintenance expenses. Electricity is generally cheaper than diesel fuel, and electric drivetrains have fewer moving parts, leading to lower maintenance costs.

- Regulatory Support: Many regions are implementing stricter emissions regulations for off-highway machinery. The transition to electric vehicles can help industries comply with these regulations and avoid penalties.

- Innovation and Technological Advancement: The development of off-highway EVs fosters innovation in battery technology, energy storage, and electric drivetrain systems, which can lead to advancements benefiting various sectors.

- Noise Reduction: Electric vehicles operate quietly, making them suitable for applications in noise-sensitive areas or during nighttime operations.

Challenges:

- Battery Technology: Off-highway applications often require large and heavy machinery, which demand substantial battery capacity and energy density. Developing high-capacity batteries that can handle the rigors of heavy-duty use is a significant challenge.

- Range and Charging Infrastructure: Off-highway vehicles may need to operate in remote or expansive areas, requiring a reliable charging infrastructure. Ensuring sufficient range and charging options can be difficult in certain environments.

- Initial Cost: The upfront cost of off-highway EVs, including batteries and specialized components, can be higher than traditional vehicles. This can deter adoption, particularly for small businesses or in regions with limited financial incentives.

- Weight and Performance: Electric drivetrains, including batteries, can add considerable weight to the vehicles. This can impact performance, mobility, and overall efficiency, especially for heavy machinery that relies on power and torque.

- Adaptation and Infrastructure: Retrofitting existing off-highway equipment with electric drivetrains may require design and engineering changes. Additionally, adapting existing maintenance and repair infrastructure for EVs can pose challenges.

- Harsh Environments: Off-highway equipment often operates in rugged and harsh environments, subjecting vehicles to extreme temperatures, vibrations, dust, and moisture. Developing EVs that can withstand these conditions is a complex task.

- Limited Market Awareness: Awareness and understanding of off-highway EVs may be limited in certain sectors, leading to resistance or reluctance to transition from conventional vehicles.

- Transition Period: Transitioning from conventional vehicles to off-highway EVs requires planning, training, and adjustments to operational practices, which can create a period of uncertainty and adjustment.

Key Players & Strategies

The Off-highway Electric Vehicle industry thrives on opportunities and competition, driven by ongoing advancements to meet evolving consumer demands. Technological progressions reshape consumer electronics rapidly, intensifying competition among market participants. Presently, consumers favor battery-powered vehicles, prompting industry players to innovate flexible technologies. Accordingly, these players invest substantially in research and development to create novel and advanced products that cater to changing consumer preferences.

Some of the key players operating in the market are Caterpillar, Volvo Construction Equipment AB, Komatsu Ltd, Deere & Company, Sandvik AB, Hitachi Construction Machinery Co., Ltd, Epiroc AB, Doosan Corporation, J C Bamford Excavators Ltd, and CNH Industrial N.V.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333