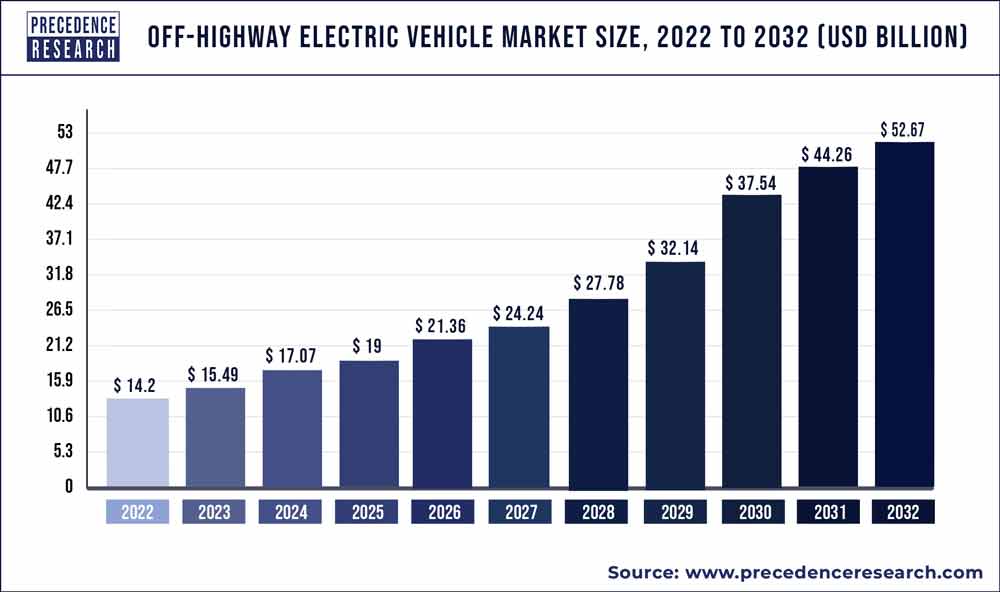

The global Off-highway electric vehicle market size reached USD 14.2 billion in 2022 and is expected to reach USD 52.67 billion by 2032, with a CAGR of 14.6% from 2023 to 2032.

The off-highway electric vehicle market has witnessed significant growth in recent years, driven by various factors such as increasing environmental concerns, stringent emission regulations, and advancements in battery technology. Off-highway electric vehicles are primarily used in industries such as agriculture, construction, mining, and forestry, where they offer benefits such as reduced emissions, lower operating costs, and improved efficiency compared to traditional fossil fuel-powered vehicles.

One of the key drivers of the off-highway electric vehicle market is the growing focus on reducing carbon emissions and mitigating the impact of climate change. Governments worldwide are implementing strict emission norms and offering incentives to promote the adoption of electric vehicles across different sectors. This has led to a surge in demand for off-highway electric vehicles, as businesses seek to comply with regulations and reduce their carbon footprint.

Additionally, advancements in battery technology have played a crucial role in the growth of the off-highway electric vehicle market. Lithium-ion batteries, in particular, have become more affordable and efficient, enabling longer operating ranges and faster charging times for electric vehicles. This has addressed one of the key limitations of electric vehicles in the past and has made them more viable for off-highway applications where long operating hours are common.

Get a Sample: https://www.precedenceresearch.com/sample/1161

Growth Factors

Several factors are driving the growth of the off-highway electric vehicle market. One of the primary factors is the increasing demand for cleaner and more sustainable transportation solutions. Off-highway electric vehicles offer significant environmental benefits compared to their diesel-powered counterparts, including lower emissions of greenhouse gases and pollutants such as particulate matter and nitrogen oxides.

Furthermore, off-highway electric vehicles are often quieter and produce less vibration than traditional diesel-powered vehicles, making them well-suited for use in urban areas or noise-sensitive environments such as residential neighborhoods or construction sites near hospitals or schools. This has led to increased adoption of electric vehicles in industries where noise pollution is a concern, such as construction, mining, and forestry.

Another factor driving the growth of the off-highway electric vehicle market is the availability of government incentives and subsidies for electric vehicle adoption. Many governments around the world are offering tax credits, rebates, and grants to encourage businesses to switch to electric vehicles and invest in charging infrastructure. These incentives help reduce the upfront costs of purchasing electric vehicles and make them more competitive with traditional diesel-powered vehicles in terms of total cost of ownership.

Additionally, advancements in battery technology have improved the performance and affordability of off-highway electric vehicles, making them more attractive to fleet operators and businesses. Lithium-ion batteries, in particular, have become increasingly popular due to their high energy density, fast charging capabilities, and declining costs. As a result, the range and operating capabilities of off-highway electric vehicles have improved significantly in recent years, making them a viable alternative to diesel-powered vehicles in many applications.

Trends

Several trends are shaping the off-highway electric vehicle market, including the development of new electric vehicle technologies, the expansion of charging infrastructure, and the integration of digitalization and connectivity solutions.

One notable trend is the development of new electric vehicle technologies tailored specifically for off-highway applications. Manufacturers are investing in research and development to design electric vehicles that can withstand the rugged operating conditions typical of industries such as construction, mining, and agriculture. This includes designing vehicles with robust chassis and suspension systems, as well as implementing advanced cooling and thermal management systems to ensure optimal performance in extreme temperatures and environments.

Another trend is the expansion of charging infrastructure to support the growing fleet of off-highway electric vehicles. As the number of electric vehicles in operation increases, there is a growing need for charging stations at job sites, warehouses, and other locations where off-highway vehicles are deployed. Manufacturers and infrastructure providers are working together to develop fast-charging solutions that can recharge electric vehicles quickly and efficiently, minimizing downtime and maximizing productivity for businesses.

Furthermore, the integration of digitalization and connectivity solutions is transforming the off-highway electric vehicle market. Manufacturers are equipping electric vehicles with telematics systems and onboard sensors that collect data on vehicle performance, operating conditions, and energy consumption in real-time. This data can be used to optimize vehicle performance, predict maintenance needs, and improve overall efficiency, helping businesses reduce operating costs and maximize the return on investment for their electric vehicle fleets.

Report Scope of the Off-highway Electric Vehicle Market

| Report Highlights | Details |

| Market Size in 2023 | USD 15.49 Billion |

| Market Size by 2032 | USD 52.67 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.6% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Electric Vehicle, Application, Region |

Regional Insights

The off-highway electric vehicle market is experiencing rapid growth across various regions, driven by factors such as government policies, infrastructure development, and market demand. While North America and Europe currently lead the market in terms of adoption and infrastructure development, emerging economies in Asia-Pacific and Latin America are expected to witness significant growth in the coming years.

North America and Europe have been at the forefront of off-highway electric vehicle adoption, driven by stringent emission regulations, government incentives, and a growing awareness of environmental issues. In North America, countries such as the United States and Canada have implemented…

Read Also: E-bike Drive Unit Market Size, Share, Trends, Report By 2033

Competitive Landscape of the Off-highway Electric Vehicle Market

The off-highway electric vehicle market is highly competitive, with numerous players ranging from established OEMs to startups and specialized manufacturers. Key players in the market include major automotive manufacturers, such as Caterpillar Inc., Komatsu Ltd., and Volvo Construction Equipment, as well as specialized electric vehicle manufacturers, such as Tesla Inc. and BYD Company Limited.

These companies are investing heavily in research and development to develop innovative electric vehicle technologies and gain a competitive edge in the market. They are also expanding their product portfolios to include a wide range of off-highway electric vehicles, including excavators, loaders, dump trucks, and agricultural machinery, to cater to diverse customer needs and applications.

In addition to product innovation, companies in the off-highway electric vehicle market are also focusing on strategic partnerships, acquisitions, and collaborations to strengthen their market position and expand their presence globally. For example, many OEMs are partnering with battery manufacturers, charging infrastructure providers, and technology companies to develop integrated solutions that offer seamless.

Some of the prominent players in the Off-highway Electric Vehicle market include:

- Caterpillar

- Komatsu Ltd

- Volvo Construction Equipment AB

- Deere & Company

- Sandvik AB

- Hitachi Construction Machinery Co., Ltd

- Epiroc AB

- Doosan Corporation

- CNH Industrial N.V

- J C Bamford Excavators Ltd.

Segments Covered in the Report

By Application

- Construction

- Agriculture

- Mining

By Electric Vehicle

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/