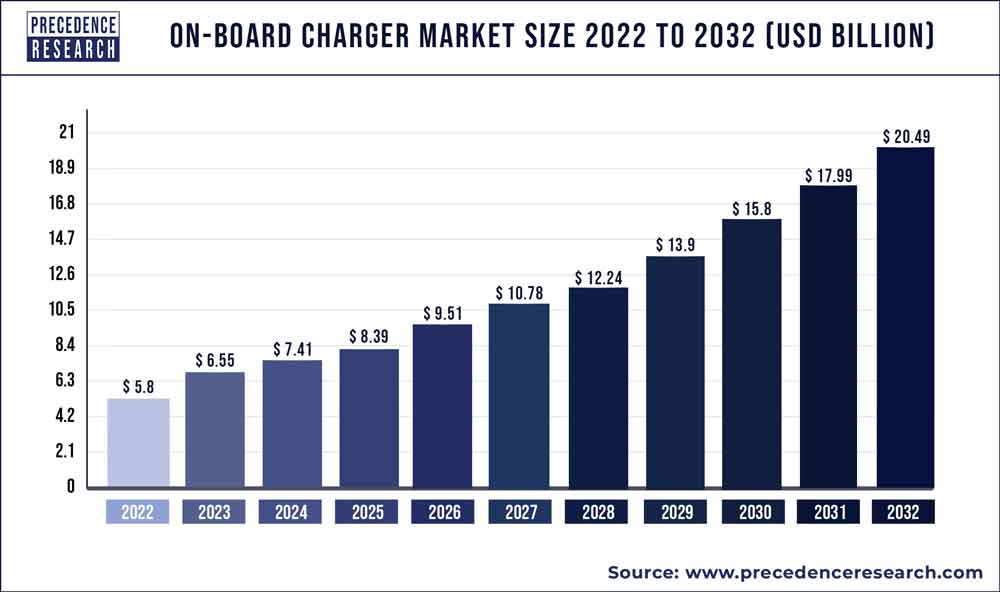

The global onboard charger market size is projected to grow around USD 20.49 billion by 2032 and is poised to grow at a registered CAGR of 13.50% from 2023 to 2032.

Key Takeaways:

- By power output, the U.S. on-board charger market was valued at USD 458 million in 2022.

- By power output, the 11 kW to 22 kW segment accounted market share of around 43% in 2022

- By vehicle type, the passenger cars segment garnered 37% market share in 2022 and bus segment is projected to grow at a remarkable CAGR from 2023 to 2032.

- By propulsion type, the BEV segment hit 69% market share in 2022 and PHEV segment will register notable growth from 2023 to 2032.

- In 2022, the Asia Pacific region representing in excess of 40% of overall income

- Europe is projected to witness significant growth from 2023 to 2032.

- European plug-in passenger car sales registered at 8% in 2022 in contrast to 4% in 2021.

The developing worldwide interest for electric vehicles is the essential driver driving expanded interest for on-board chargers all through the anticipated period. To charge a vehicle battery, an on-board charger changes over alternating current (AC) contribution from charging stations to Direct Current. The expanded number of AC charging stations being laid out in developing business sectors is additionally adding to the development of the on-board charger industry.

Get the Free Sample Copy of Report@ https://www.precedenceresearch.com/sample/1870

Due to its powerful thickness and 98% proficiency rate, silicon carbide semiconductor innovation is rapidly being utilized to create on-board chargers. Accordingly, a few firms are zeroing in more on giving silicon carbide on board charger that are more powerful and productive, offering new possibilities for market development.

- Key Takeaways:

- By power output, the U.S. on-board charger market was valued at USD 458 million in 2022.

- By power output, the 11 kW to 22 kW segment accounted market share of around 43% in 2022

- By vehicle type, the passenger cars segment garnered 37% market share in 2022 and bus segment is projected to grow at a remarkable CAGR from 2023 to 2032.

- By propulsion type, the BEV segment hit 69% market share in 2022 and PHEV segment will register notable growth from 2023 to 2032.

- In 2022, the Asia Pacific region representing in excess of 40% of overall income

- Europe is projected to witness significant growth from 2023 to 2032.

- European plug-in passenger car sales registered at 8% in 2022 in contrast to 4% in 2021.

Report highlights

- On the basis of vehicle type, the passenger vehicle section will overwhelm the whole market in 2022. Fast urbanization, which raises request in money related transportation mediums like electric vehicles, is a central point influencing market development. Electric vehicles are more reasonable than IC cars and have a lower normal impact.

- On the basis of power output, the market is divided into two segments: 20kilowatt and >20. Vehicle on-board chargers transfer electricity from alternating current to alternating current and then store it in the vehicle’s battery. Because electricity from the framework is always AC, AC is the best continuous charging option for electric cars.

Report Scope of the On-Board Charger Market

| Report Coverage | Details |

| Market Size by 2032 | USD 20.49 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.50% |

| Asia Pacific Market Share in 2022 | 40% |

| BEV Segment Market Share in 2022 | 69% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Vehicle Type, Power Type, Propulsion Type, Sales Channel, Geography |

| Companies Mentioned | Tonhe Technology, Anghua, Wanma, Kongsberg, Lear, Delphi, Infineon |

Regional Snapshots

During the figure time frame, the Asia Pacific on-board charger market is assessed to represent the most noteworthy income divide between every single provincial market. China is the essential driver of market development in Asia Pacific. China has become one of the main business sectors for on-board chargers. In China, electric vehicles with on-board chargers incorporate the Tesla Model 3, and BYD Qin Pro EV. Besides, more prominent government drives to advance electric vehicle deals in countries, for example, China and India are supporting local market development.

During the projection time frame, the European market is probably going to see extensive income development. Severe contamination limitations, ideal government arrangements, developing vehicle zap, and the accessibility of essential charging foundation are immensely significant elements supporting EV reception in Europe. Denmark, Norway, Germany, Sweden, and the United Kingdom are in the front of the European electric vehicle unrest. The presence of significant EV producers in the area makes a much seriously engaging learning experience for EV on-board chargers. As per their objective, BMW plans to zap its vehicles, Mini vehicles and SUVs all through Europe by 2032.

Market dynamics

Drivers

The headway of electric vehicle charging frameworks moves the on-board charger industry forward. This is because of decreased power misfortune and upgraded influence reserve funds, which brings about better influence thickness and further developed in general battery execution. All around the world, expanding mechanical necessities because of natural worries have provoked R&D interest in electric vehicle advancements. A few automakers are putting resources into electric vehicle improvement. For instance, Fiat Chrysler Automobiles N.V. reported expectations in July 2019 to put USD788 million in the development of a creation line for the new electric rendition of its Fiat 500 minicar. The gathering plant will deliver right around eighty thousand units every year. Expanded speculation prompts lower all out expenses and more sensible accessibility, which helps with the extension of the on-board charger industry.

Restraints

The rising interest from state run administrations for the establishment of DC quick chargers is one of the essential variables obliging the development of the worldwide on-board charger market. The on-board charger reception rate changes by brand yet is restricted inferable from weight, space, and cost. Contingent upon the vehicle, charging time could go from four to five hours to over twelve hours using Level 2 AC chargers. DC quick chargers keep away from each of the constraints of an on-board charger as well as the requirement for power change. These give direct DC power supply to the vehicle battery, possibly speeding up essentially. West Coast Electric Highway is one such illustration of DC fast charger rollout. It is an immense organization of DC quick charging stations for electric vehicles separated each 25 to 50 miles along Highway 99, Interstate 5, and other significant roadways in British Columbia, California, and Washington. Subsequently, the expanded interest for DC quick chargers is a boundary to the on-board charger industry.

Opportunities

A spike in electric vehicle deals will speed up market development. Electric vehicle deals moved by 160% in the main portion of 2021 contrasted with a similar period in 2020. It represented 26% of new vehicle deals in the car area. China arose as the world’s driving EV community, representing 13% of the market. One more impact of the EV business blast is that lithium costs have gone up by around 165%. Subsequently, these factors lead to higher buyer spending. Shoppers overall spent around $12 billion USD on EV products in 2020. Besides, as per a Power Technology research, EV deals in the primary portion of 2021 were 2.6 million units, with 5 million units anticipated before the year’s over.

Challenges

A spike in electric vehicle deals will speed up market development

Electric vehicle deals moved by 160% in the main portion of 2021 contrasted with a similar period in 2020. It represented 27% of new vehicle deals in the car area. China arose as the world’s driving EV community, representing 14% of the market. One more impact of the EV business blast is that lithium costs have gone up by around 165%. Subsequently, these factors lead to higher buyer spending. Shoppers overall spent around $12 billion USD on EV products in 2020. Besides, as per a Power Technology research, EV deals in the primary portion of 2021 were 2.6 million units, with 5 million units anticipated before the year’s over. Subsequently, these impediments, along with the fluctuating charging station estimating, may obstruct the overall electric vehicle on-board charger market’s development.

Recent Developments

- STMicroelectronics will team up with Arrival, a British electric vehicle maker, in July 2021. STMicroelectronics’ auto microcontrollers, power and battery-the executives gadgets would be added to Arrival’s vehicle portfolio as a feature of the collaboration, permitting Arrival to supply zero-outflow business vehicles as a component of a coordinated versatility environment.

- Eaton reported the procurement of Green Motion SA, a maker and designer of electric vehicle charging programming and innovation, in March 2021. Eaton’s electric charging capacities were expanded because of this buy.

Market Segmentation

By Vehicle Type

- Boats

- Vans

- Passenger Cars

- Buses

- Medium and Heavy Duty Vehicles

- Others

By Power Type

- 11 kW to 22 kW

- Less than 11 kW

- More than 22 kW

By Propulsion Type

- Plug-in Hybrid Electric Vehicle

- Battery Electric Vehicle

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on On-Board Charger Market

5.1. COVID-19 Landscape: On-Board Charger Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global On-Board Charger Market, By Vehicle Type

8.1. On-Board Charger Market, by Vehicle Type, 2023-2032

8.1.1. Boats

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Vans

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Passenger Cars

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Buses

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Medium and Heavy Duty Vehicles

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global On-Board Charger Market, By Power Type

9.1. On-Board Charger Market, by Power Type e, 2023-2032

9.1.1. 11 kW to 22 kW

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Less than 11 kW

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. More than 22 kW

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global On-Board Charger Market, By Propulsion Type

10.1. On-Board Charger Market, by Propulsion Type, 2023-2032

10.1.1. Plug-in Hybrid Electric Vehicle

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Battery Electric Vehicle

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global On-Board Charger Market, By Sales Channel

11.1. On-Board Charger Market, by Sales Channel, 2023-2032

11.1.1. Original Equipment Manufacturer (OEM)

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Aftermarket

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global On-Board Charger Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.1.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.2.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.3.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.4.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.5.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Power Type (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

Chapter 13. Company Profiles

13.1. Tonhe Technology

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Anghua

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Wanma

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Kongsberg

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Lear

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Delphi

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Infineon

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/