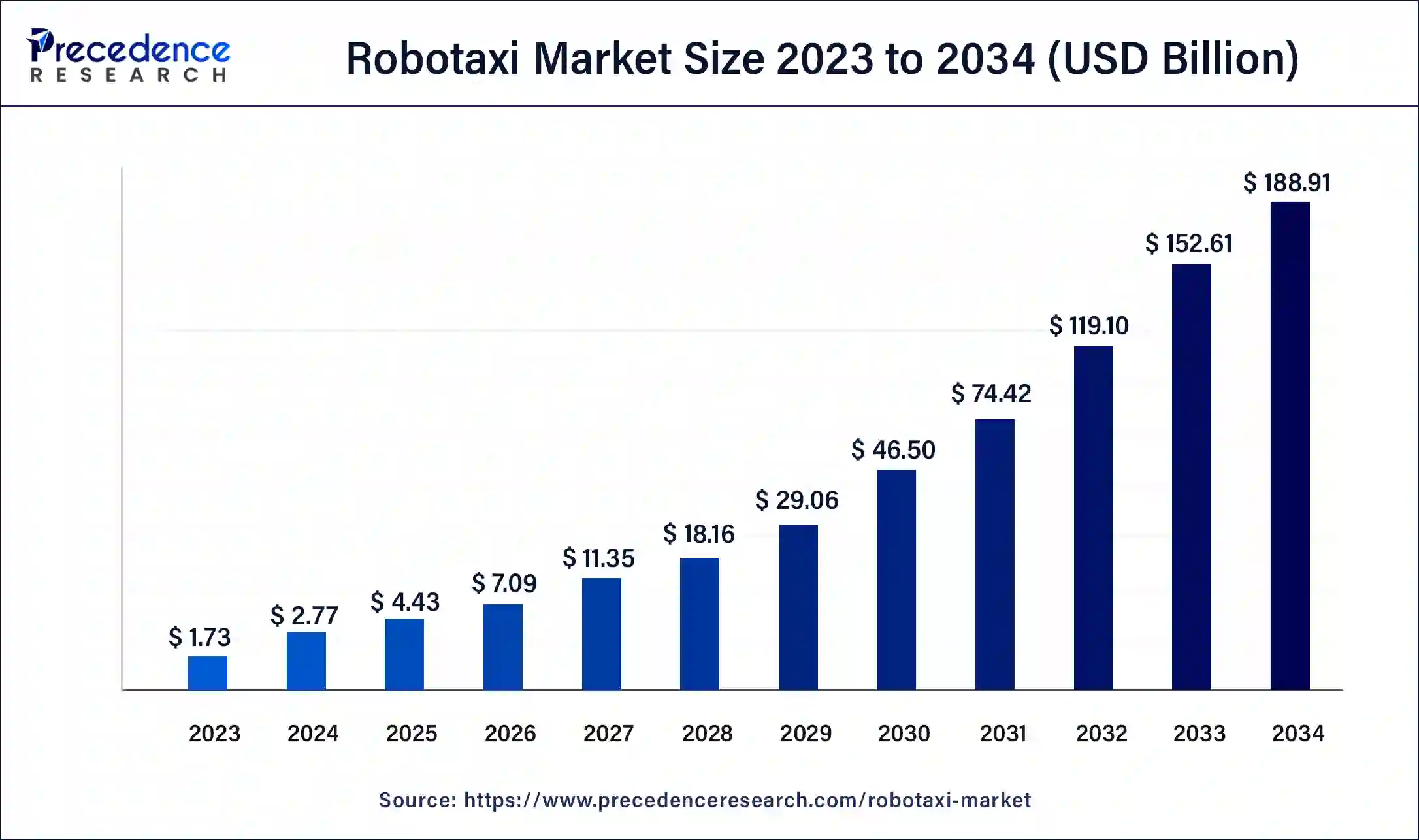

The global robotaxi market size is estimated at USD 2.77 billion in 2024 and is projected to reach around USD 188.91 billion by 2034, growing at a CAGR of 60.03% over the forecast period 2024 to 2034.

The robotaxi market is characterized by the deployment of self-driving vehicles that provide ride-hailing services without human drivers. This market is fueled by the increasing demand for autonomous and shared mobility solutions, driven by urbanization and the shift towards sustainable transportation. The global push to reduce traffic congestion and emissions aligns with technological advancements in artificial intelligence (AI), machine learning, and sensor technologies, paving the way for safer and more efficient autonomous driving systems. Major investments from automotive manufacturers, technology firms, and startups underscore the potential of this transformative market.

Robotaxi Market Key Takeaways

- Asia Pacific dominated the global robotaxi market with the largest market share of 32% in 2023.

- Europe is expected to grow significantly in the market during the forecast period of 2024 to 2034.

- By propulsion type, the electric vehicle segment stood the dominant in the market in 2023 and is expected to maintain its dominance during the forecast period.

- By component type, the LiDAR segment held the largest market share of 41% in 2023.

- By component type, the RADAR segment is anticipated to register rapid growth in the market during the forecast period of 2024 to 2034.

- By application, the passenger segment accounted for the largest share of the market in 2023.

- By application, the goods segment is expected to grow at the highest CAGR in the market from 2024 to 2034.

Download the Sample Report ( Including Full TOC, List of Table & Figures, Chart): https://www.precedenceresearch.com/sample/5030

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 188.91 Billion |

| Market Size in 2024 | USD 2.77 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 60.03% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Propulsion Type, Application, Component Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Robotaxi Market Dynamics

Market Drivers

Several factors are propelling the growth of the robotaxi market. Rapid developments in autonomous vehicle technology, including enhanced sensors, AI, and vehicle-to-everything (V2X) communication, are making robotaxis more feasible and reliable. Furthermore, the increasing urban population leads to heightened traffic congestion, making robotaxis an efficient, flexible transportation alternative that can reduce the number of vehicles on the road. Environmental concerns are also a significant factor; the transition towards electric and autonomous vehicles aligns with global sustainability goals. Additionally, a growing preference for on-demand transportation solutions, especially among younger generations, drives the demand for robotaxi services that offer convenience and cost-effectiveness. Finally, many governments are developing regulations and frameworks to support the testing and deployment of autonomous vehicles, creating a conducive environment for market growth.

Restraints

Despite its promising outlook, the robotaxi market faces several challenges. The regulatory landscape for autonomous vehicles is still evolving, with inconsistencies across jurisdictions creating barriers to market entry and expansion. Safety and liability concerns also persist, as high-profile accidents involving autonomous vehicles raise questions about technology reliability and the legal implications of accidents. Technological limitations remain an issue; current autonomous driving technologies still encounter challenges related to complex driving environments, adverse weather conditions, and unexpected obstacles. Furthermore, public acceptance is not guaranteed, with consumers expressing concerns about safety, privacy, and the overall user experience, which could hinder widespread adoption.

Opportunities

The robotaxi market presents several opportunities for stakeholders. Companies in the automotive and technology sectors can benefit from partnerships to enhance capabilities, share resources, and accelerate the development of robotaxi services. Additionally, rapid urbanization in emerging markets presents significant growth potential, with the opportunity to tailor services to meet local needs. Robotaxis can also be integrated into smart city plans, enhancing public transportation systems and improving urban mobility. Investments in charging stations, vehicle maintenance facilities, and dedicated lanes for autonomous vehicles can facilitate market growth. Finally, new business models, such as subscription services or partnerships with public transportation systems, can enhance the viability of robotaxi services.

Regional Insights

The robotaxi market shows varying growth trends across regions. In North America, the United States leads robotaxi development, with numerous companies conducting trials in urban areas. The supportive regulatory environment and significant investments position North America as a market leader. In Europe, countries like Germany and the UK are actively investing in autonomous vehicle technologies, exploring pilot programs for robotaxis, and fostering strong collaborations between government and industry stakeholders. The Asia-Pacific region is expected to witness rapid growth due to urbanization, a rising middle class, and technological advancements, with countries like China making significant strides in deploying autonomous vehicles, supported by government initiatives. Although still nascent, the robotaxi market in the Middle East and Africa is poised for growth, driven by urban development projects and a keen interest in innovative transportation solutions.

Read Also: Cybertruck Manufacturing Market Size, Share, Report by 2034

Trade Data: Import and Export Statistics

The robotaxi market’s economic impact is significant, with key statistics highlighting the global trade landscape for autonomous vehicles and related technologies. Below is an overview of estimated import and export values for 2022. The United States reported imports of approximately $12 billion and exports of $15 billion, positioning it as a leading player in the market. Germany followed closely with $8.5 billion in imports and $10 billion in exports. China, Japan, and the United Kingdom also contributed significantly, with imports of $5 billion, $4 billion, and $3.5 billion, respectively, while their exports stood at $7.5 billion, $6 billion, and $4.5 billion.

| Country | Imports (in USD Billion) | Exports (in USD Billion) |

|---|---|---|

| United States | 12.0 | 15.0 |

| Germany | 8.5 | 10.0 |

| China | 5.0 | 7.5 |

| Japan | 4.0 | 6.0 |

| United Kingdom | 3.5 | 4.5 |

| South Korea | 3.0 | 3.5 |

| France | 2.5 | 4.0 |

| Canada | 2.0 | 2.5 |

| India | 1.5 | 2.0 |

| Australia | 1.0 | 1.5 |

| Brazil | 0.8 | 1.2 |

| Russia | 0.6 | 1.0 |

| Mexico | 0.5 | 0.9 |

| Netherlands | 0.4 | 0.7 |

| Sweden | 0.3 | 0.5 |

Robotaxi Market Companies

- Tesla Inc. (U.S.)

- Uber Technologies Inc. (U.S.)

- Baidu (China)

- Waymo LLC (U.S.)

- Aptiv (Ireland)

- Didi Chuxing Technology Co (China)

- Zoox, Inc (U.S.)

- AutoX, Inc (U.S.)

- Cruise LLC (U.S.)

- Lyft, Inc (U.S.)

Recent Developments

- In September 2024, Foster City-based Zoox announced that they are entering the Bay Area robotaxi market with uniquely designed autonomous vehicles, featuring inward-facing seats and dual-side doors, aiming to differentiate itself from traditional robotaxi models.

- In July 2024, Waymo secured a USD 5 billion investment from Alphabet, accelerating its lead in the self-driving taxi industry.

- In November 2023, Hyundai Motor Group and Motional announced the manufacture of the all-electric IONIQ 5 robotaxi at the new Hyundai Motor Group Innovation Center Singapore, with initial models set for U.S. deployment in 2024.